Celsius Prepares for Potential Bankruptcy

Cryptocurrency lending company Celsius is hiring more advisers to deal with its bankruptcy due to extreme market volatility. Celsius has hired restructuring advisors from Alvarez & Marsal to advise on a possible bankruptcy filing, The Wall Street Journal reported. Meanwhile, investment banking giant Goldman Sachs is said to be raising money from various sources in order to buy up the distressed assets it sells at the lowest possible price when the troubled cryptocurrency lending firm files for bankruptcy.

The main cryptocurrency market successfully defended its gains over the past week in a volatile weekend, with BTC finding solid support above $21,000. The largest cryptocurrency by market cap briefly dipped below psychological support at $20,000 on Sunday, but then gradually recovered in early Asian trading Monday. At the time of writing, BTC is currently trading around $21,200 after losing 1.21% in the past 24 hours. BTC managed to enter positive territory thanks to its steady movement above $21,000 and the 100 hourly moving average. If it can successfully break through $21,700, BTC may usher in another wave of upward momentum. Conversely, if BTC’s attempt to break above $22,000 fails, a downside test of support in the $20,700-$21,000 area is likely.

Similar to BTC, although ETH’s market cap has shrunk by 1.1% over the same period, it has also stabilized above $1,200. Most major altcoins are also largely in the red, with the exception of TRX, which bucked the trend and gained 4.6% over the same period.

At the same time, BTC remains highly correlated with the stock market. After a three-week losing streak, major European and American stock indexes recovered significantly last week. As a result, investors continued to take solace in a cooling global economy and faint signs that the Federal Reserve was easing aggressive measures in the second half of the year.

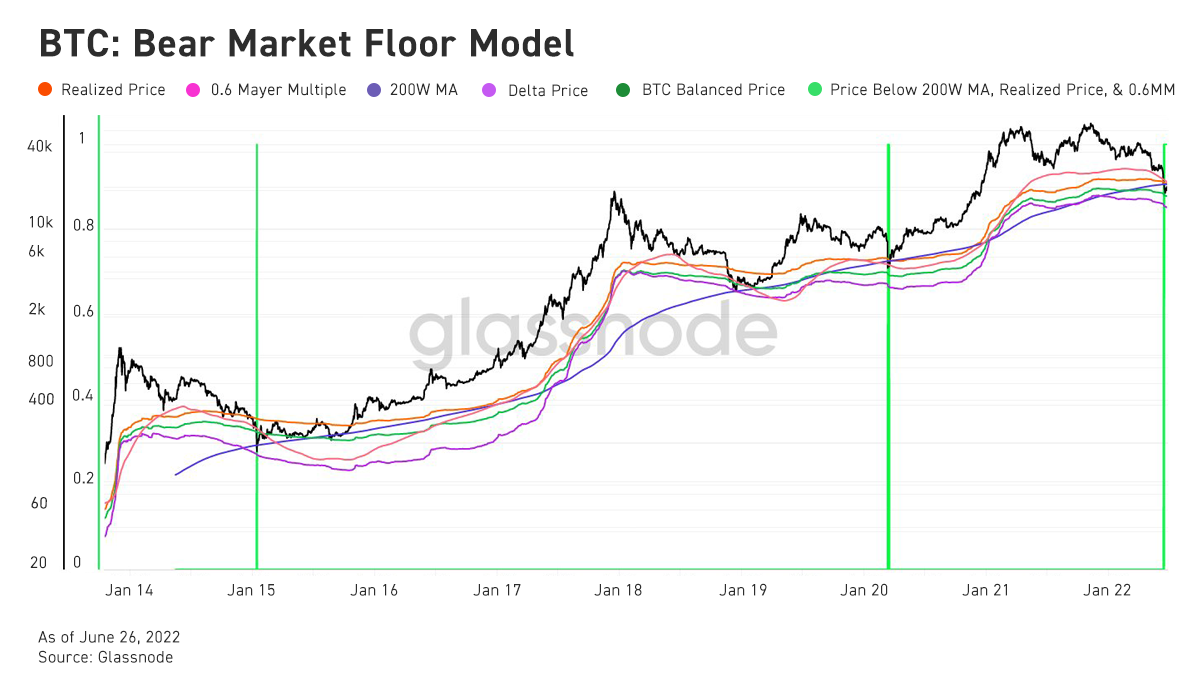

Some analysts believe the market is nearing a bottom. The reason for this speculation is that the price of BTC has fallen below several specific price models, which combine to basically arrive at the bottom price of past bear markets, including the 200-week moving average, the actual price of Bitcoin, and the Mayer Multiple. Bitcoin prices below these price models are very rare, accounting for only 0.2% of all trading days since BTC went live.

Derivatives market leverage showed signs of stabilization. Traders’ fears of a liquidity risk contagion crisis have eased recently with news of a possible bailout for the cryptocurrency industry, which has further impacted the main cryptocurrency market. The perpetual contract funding rates of major centralized exchanges have returned to the middle zone. Options with a notional value of more than $3.2 billion expired on Friday, and so far the event has not caused major waves in the options market, but it does not rule out the possibility of delays in trader activity. For the remaining seven trading days in June, we expect volatility to continue to rise.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...