What is a CFD?

As previously mentioned, when you trade cryptocurrencies with Deriv, you don’t take ownership of an asset. Instead, you will use a CFD, which will track the price of the underlying cryptocurrency.

A CFD is an agreement between you and the counterparty, in this case, Deriv.

That’s why it’s important to choose an established and strong trading firm, as your CFD is only as good as the company that underwrites it.

Let’s assume that after some research, I have decided that BNB is a good cryptocurrency to trade and I believe its price will go higher.

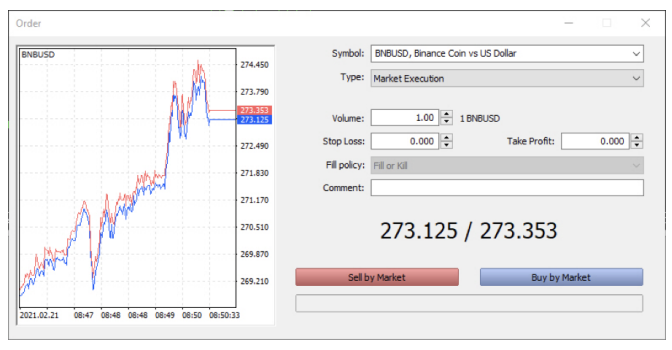

The quote I am given online is $273.125 (sell) and 273.353 ask (buy).

As I want to buy BNB/USD, I will select the ask (buy) price, so I am buying at $273.35. If I were selling, I would be selling at the bid price of $273.12.

We are trading on the number second to the decimal, so it is .12 or .35 in this case.

The 23-cent difference is the spread or profit margin.

Whenever we are trading, we are always looking for the tightest spread because it will be easier to break even, as the following example shows: if I buy at $273.35, I will need to sell the contract at least 23 cents higher to break even, i.e. at $273.58.

I decide to go long (buy) at $0.10 a point. It would be the same as owning 10 Binance coins or $2,735.80 worth of BNB.

Deriv CFDs are leveraged, which means you will only need to put up a margin (deposit).

Deriv will show you the margin requirement when you open the trade. It could be as little as 5%, so you would only need $136.79 (5% of $2,735.80).

A leveraged trade allows you to enter the market with a margin instead of the real worth of the asset.

Therefore, your capital will go further than just a traditional buy and hold approach.

How to profit from falling cryptocurrency markets? Sell short If you have ever followed the cryptocurrency market, you probably know that it is far from being smooth and doesn’t always move upward; however, with Deriv, you can profit from falling markets as well.

A CFD also allows you to profit from downward movements, known as going short.

It means if you believe Bitcoin or any other cryptocurrency is overvalued, you can sell first (even without owning it) and then buy it back.

Of course, if the price goes higher, you will have to buy back at a higher price, covering your short position.

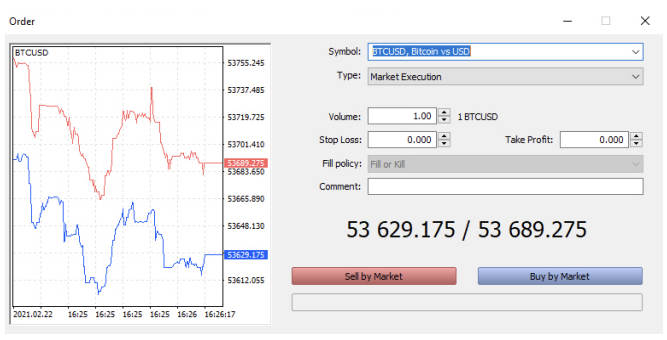

Using Bitcoin as an example, you can see that Deriv quotes a 2-way price, so you can always close out an existing trade or go short.

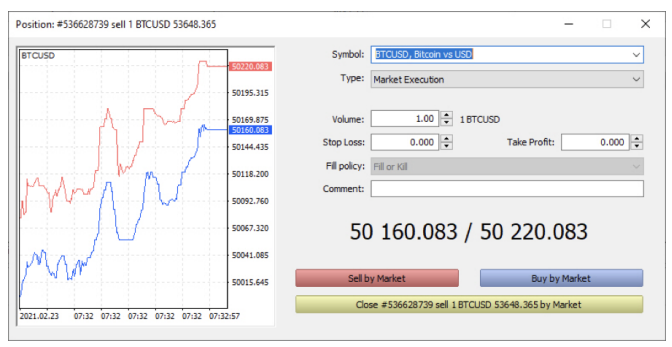

I sold Bitcoin (went short) at $53,648.365.

I need to buy it back to close the trade.

The current price to buy it back is $50,220.083. If I close now, my profit would be $3,428.

We can calculate it by taking the trade size, in this case, $1, and multiplying it by the number of points difference, in this case, 3,428, which equals $3,428.

If I go short, and the price moves up, I would have to pay more than what I sold at, and this would incur a loss.

Go to Deriv’s Official Website

Deriv’s risk mitigation tools for CFDs

We can use the stop loss feature to limit our risks or the take profit feature to close a trade at the desired level.

For example, if I want to close a trade at 50,000.00, I can place a take profit order, and I won’t need to keep watching the market.

Let’s say I’m willing to risk a maximum of $500 when I place the trade. I can place a stop loss 500 points away.

I can also lock in some of my profit and still keep the trade open.

For example, if I set a stop loss at $51,220, $2,428 will be locked in.

It’s also worth mentioning that Deriv offers negative balance protection.

If a trade goes completely against you, you will not be asked for additional funds, and your account cannot end up having a negative balance.

If you act on money management tips, trade mindfully, and use the tools that Deriv provides for risk mitigation, you will have a better chance at protecting your funds.

However, please be aware that trading CFDs always comes with a high risk of losing money.

Swap charges

Whilst the cryptocurrency market is open for trading round the clock, a CFD will need an expiry time.

Deriv’s rollover time is 23:59 GMT.

It means if you are going long on a CFD on Bitcoin, and you do not close it out before that time, it will roll over to the next day, and you will be charged a fee, namely, a swap charge, which will be deducted from the profit and loss.

Open Deriv’s Crypto Trading Account

Please check Deriv official website or contact the customer support with regard to the latest information and more accurate details.

Deriv official website is here.

Please click "Introduction of Deriv", if you want to know the details and the company information of Deriv.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...