Why Binance Futures Stands Out

Binance Futures is one of the most liquid derivatives trading platforms in the market, with a rich selection of cryptocurrency trading pairs, providing investors with unlimited profit opportunities.

When using built-in strategies such as TWAP and grid trading on Binance Futures, traders can benefit from minor price fluctuations even if the market deviates.

Binance Futures follows a user-centric design concept, allowing traders to plan their own strategies in advance, improve transaction consistency, properly manage risks, and avoid emotional and impulsive trading.

Cryptocurrency derivatives are gaining increasing attention from traders as an emerging way to invest in digital assets.

In fact, cryptocurrency derivatives such as futures contracts are rapidly gaining popularity as traders seek to seize money-making opportunities in various ways in the ever-expanding financial markets.

Cryptocurrency derivatives play a pivotal role in the cryptocurrency market, and Binance Futures offers investors an excellent opportunity to tap into the fast-growing derivatives market, which has a monthly trading volume in the trillions of dollars.

To get the most out of the market, let’s take a deep dive into how contract trading can benefit traders.

Go to Binance Official Website

Why senior traders have a soft spot for futures contracts

Traders can buy cryptocurrencies at any time through the spot market, but there are certain limitations.

Investors are not only limited to buying cryptocurrencies with the funds on hand, they often have to hold the assets for a period of time to generate returns.

On the one hand, traders can diversify their portfolios through futures contracts.

And, access to multiple cryptocurrency options without holding the underlying asset.

The use of leverage by traders means that they do not have to lock up all their funds to buy cryptocurrencies, thus increasing the utilization of funds.

Additionally, when the value of cryptocurrencies falls, traders have the opportunity to profit by short selling.

Spot trading is more suitable for investors looking for a safe haven, while traders who want to take advantage of the volatility of the cryptocurrency market can opt for futures contracts.

Go to Binance Official Website

How Binance Futures Builds an Enterprise-Grade Platform

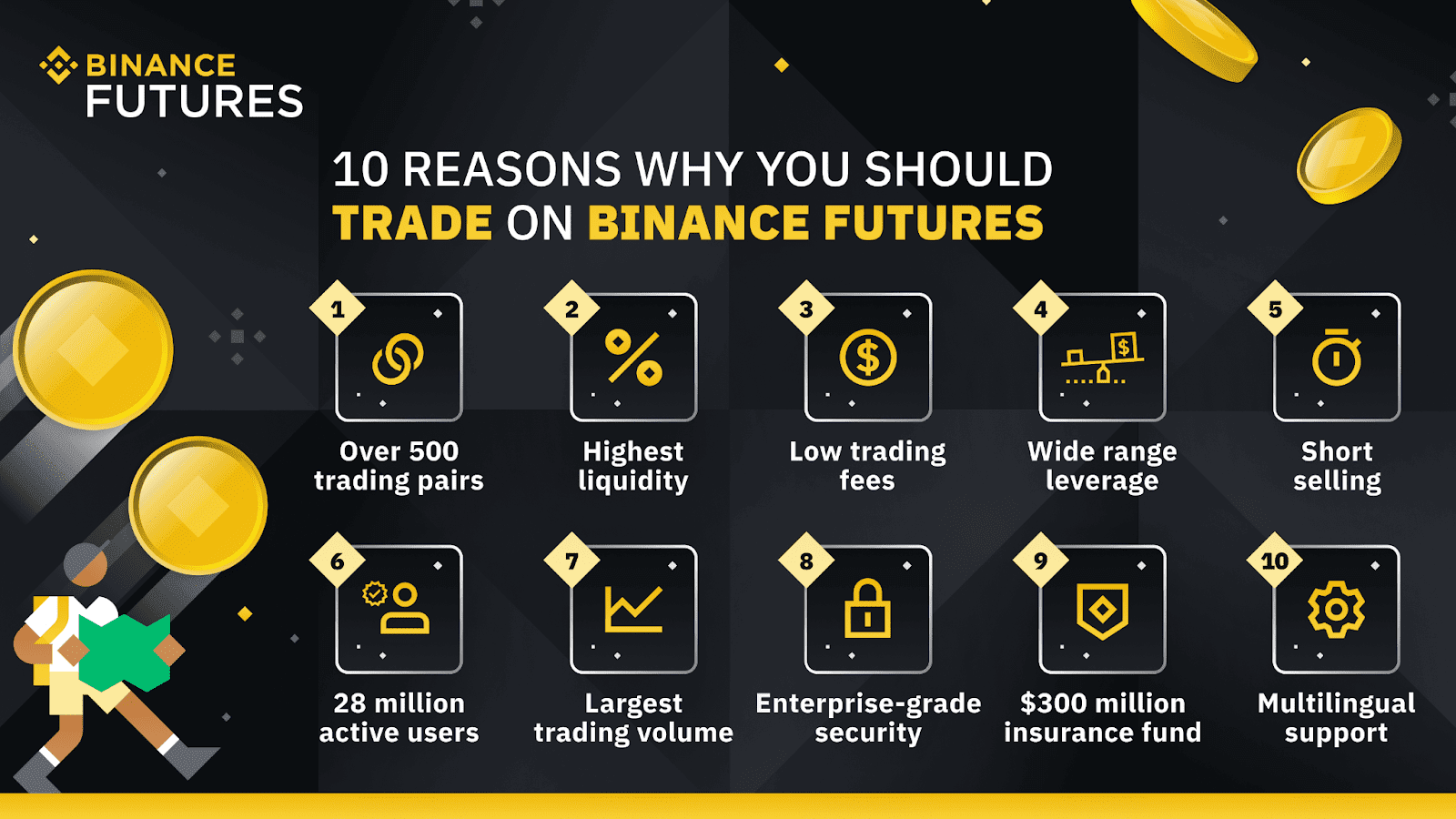

Binance Futures builds an enterprise-level platform with hundreds of currency-to-currency trading pairs, giving traders an unprecedented trading experience.

Users can fully utilize the crypto assets in their portfolios and manage their risk in the well-established ecosystem of Binance Futures.

By implementing various strategies such as TWAP and grid trading provided by Binance Futures, traders can profit by going long or short regardless of the market direction.

Go to Binance Official Website

Preferred Cryptocurrency Derivatives Trading Platform

Binance Futures offers a wide variety of digital asset options, including the most popular cryptocurrencies in the market, allowing users to have the best trading experience.

The platform is equipped with multiple security features to provide users with year-round protection, including a 300 million insurance fund against asset loss due to hacker attacks or technical failures.

Binance Futures users can also take advantage of the platform to expand their portfolio with multiple leverages without worrying about account balances.

The platform follows a user-centric design philosophy and even introduces a low-cost taker fee plan to further benefit traders.

The trading volume of Binance Futures has reached trillions of dollars, with more than 28 million active users participating in cryptocurrency futures trading.

The leading cryptocurrency derivatives trading platform has several features that users love:

Go to Binance Official Website

Advanced Trading Technology

Binance Futures provides users with comprehensive and rich functions, including advanced order type algorithmic trading, and both novice traders and experienced traders can enjoy a smooth trading experience.

After placing a limit order, a trader can also set a take profit order and a stop-loss order (TP/SL) at the same time.

In this way, the user sets two orders at the same time, namely the main order and the secondary order, the former is a limit or market order, and the latter is a take profit and stop-loss order.

This enterprise-grade technology enables traders to plan their own strategies ahead of time, improve trading consistency, and properly manage risk.

Investors who make good use of trading strategies can relieve anxiety, protect funds, and avoid emotional and impulsive trading.

Go to Binance Official Website

Time Weighted Average Price Algorithm, referred to as “TWAP”

Binance Futures users can also adopt an algorithmic trade execution strategy, namely time-weighted average price, which divides the order into several small orders and executes them at fixed intervals within a specific time period, which can minimize the impact of large orders on the market.

The TWAP trading strategy provides more cost-effective execution prices, provided that the order size is larger than the available liquidity of the trading platform’s order book.

The TWAP trading strategy also helps when predicting sharp price swings and unclear market directional tendencies.

In addition, using TWAP on Binance Futures requires no coding at all and is free for all users.

Go to Binance Official Website

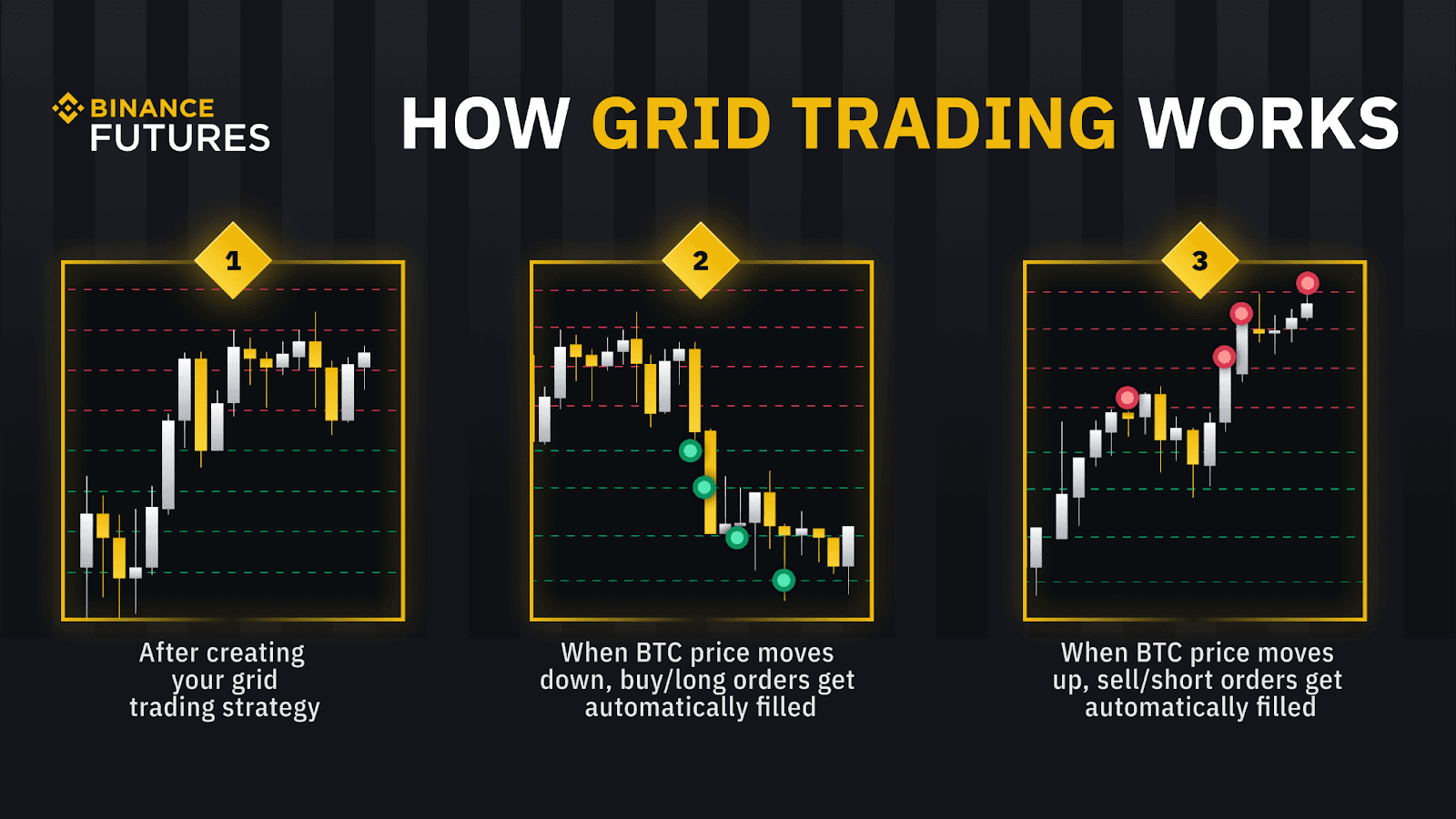

Grid trading

Binance Futures also offers grid trading.

This is a trading robot that automatically places orders to buy and sell futures contracts at preset time intervals within a configured price range.

Grid trading takes advantage of range-bound conditions, allowing traders to make the most out of market trend consolidation and high market volatility.

One of the key benefits of using this trading robot is that traders can profit from even small spreads.

The more grid settings, the more frequently trades are executed, albeit at a very thin profit margin per trade.

Binance Futures believes that novice traders may encounter parameter setting difficulties when building their own grid trading strategies.

Therefore, the platform provides suggested parameters to improve the user experience and reduce the learning curve.

Recommended parameters include price floor, price ceiling, and a number of grids.

Anyone, with or without trading experience, can create grid trading strategies with just one click.

Go to Binance Official Website

Abundant selection of trading pairs, strong liquidity and high trading volume

Binance Futures strives to be different from other cryptocurrency trading platforms, providing users with massive and diversified token trading options of more than 530 currency-to-currency trading pairs.

Due to the wide selection of altcoins, Binance Futures has become the most liquid and leading cryptocurrency derivatives trading platform in the market.

Therefore, traders can always fill orders in a timely manner without worrying about sliding spreads.

With a rich selection of cryptocurrency trading pairs, Binance Futures has a significant volume.

A record $7.7 trillion in cryptocurrency volume was set in 2021, with a cumulative 24-hour peak volume of $76 billion.

Go to Binance Official Website

Responsible Trading Environment

In mid-2021, Binance Futures will launch a “ cooling-off period ” option so that users can disable futures trading and avoid emotional and impulsive trading.

Traders can turn on this function on a daily or weekly basis according to their own needs.

One of Binance’s top security priorities is to encourage users to trade responsibly.

Additionally, Binance Futures sets price protection by default for new users to protect their trading strategies from extreme market volatility, including unusual trading activity.

When the market fluctuates wildly, such as when the last price and mark price of a futures contract exceeds a preset threshold, price protection will protect traders from triggering stop-loss or take-profit orders.

Go to Binance Official Website

Talk to experienced traders

Having a community where market trends, project fundamentals or technical analysis can be discussed is crucial so that traders can continue to improve their trading skills. Therefore, Binance Futures has launched a chat room, which is open to futures and derivatives traders. Live Trading Now, everyone can share market news, strategies and insights here.

Binance Futures users can easily access chat rooms through desktop and mobile apps. The chat room is free for all traders to use. Never miss any important announcements in the Binance Futures chat room and keep up to date with the latest news in the cryptocurrency space!

Go to Binance Official Website

Two financial instruments for different markets

To meet the flexibility needs of users, Binance Futures has launched two financial instruments, namely U-margined contracts and coin-margined contracts.

Currency-backed contracts are denominated and settled in the underlying cryptocurrency, so traders do not need to hold stablecoins as collateral. This allows long-term investors or miners to hold the underlying cryptocurrency and all profits can be invested in the long-term holding asset.

In contrast, the U-margin contract is a linear contract product that is quoted and settled in USDT or BUSD, and traders can easily calculate the fiat currency returns. Investors can use the same settlement currency for various futures contracts, so it is more flexible to use stablecoins as the settlement currency.

When the market fluctuates violently, the U-standard contract can also effectively reduce the risk of large price fluctuations. Therefore, there is no need to worry about hedging exposure to the underlying collateral of the contract.

Go to Binance Official Website

Join Binance Futures now!

With a wide variety of derivatives and cryptocurrency trading pairs, Binance Futures has become the premier cryptocurrency derivatives trading platform and is favored by many contract traders.

Both beginners and experienced cryptocurrency traders can easily complete account setup in minutes.

Before formal trading, beginners can use the simulated trading function of Binance Futures to practice and improve their trading skills. Everything works at your own pace, without taking any risks. Users can also continue to comprehensively learn about cryptocurrencies and blockchain through Binance Academy.

Join over 28 million traders and start your futures trading journey on Binance Futures today!

Go to Binance Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...