The controversy around Three Arrows Capital’s escalating financial woes is now in the hands of the court.

3AC (Three Arrows Capital) files for bankruptcy

The controversy surrounding Three Arrows Capital’s worsening financial woes is now on the judge’s table, as a court in the British Virgin Islands has ordered the cryptocurrency hedge fund to be liquidated. Following the filing of the case, 3AC has filed for Chapter 15 bankruptcy protection under the U.S. Bankruptcy Code, a move aimed at protecting its U.S. assets during liquidation. The collapse of one of the biggest lending platforms in the cryptocurrency space has unleashed a risk contagion crisis that has affected several of the top companies linked to the troubled hedge fund. Voyager Digital, a cryptocurrency trading platform, announced that it has suspended all withdrawals, deposits and transactions due to market conditions.

Although there is less optimistic news such as Three Arrows Capital’s unfortunate bankruptcy, the main cryptocurrency market is still in a relatively range-bound state. On the bright side, after the $20,000 support level fell, BTC successfully defended the psychological $19,000 mark and turned it into a new support level. At the time of writing, BTC is up slightly over the past 24 hours and is now just above $19,000. The $17,000 range is the next key position for BTC and will be the next line of defense if the market falls further in the bear quagmire.

On the other hand, ETH and most of the major non-major coins had a smooth weekend. The second-largest cryptocurrency by market cap is now sitting below the $1,100 mark after a slight decline in market cap over the same period. The performance of most major altcoins was mixed, with TRX and AVAX leading the pack with a 4% gain over the same period.

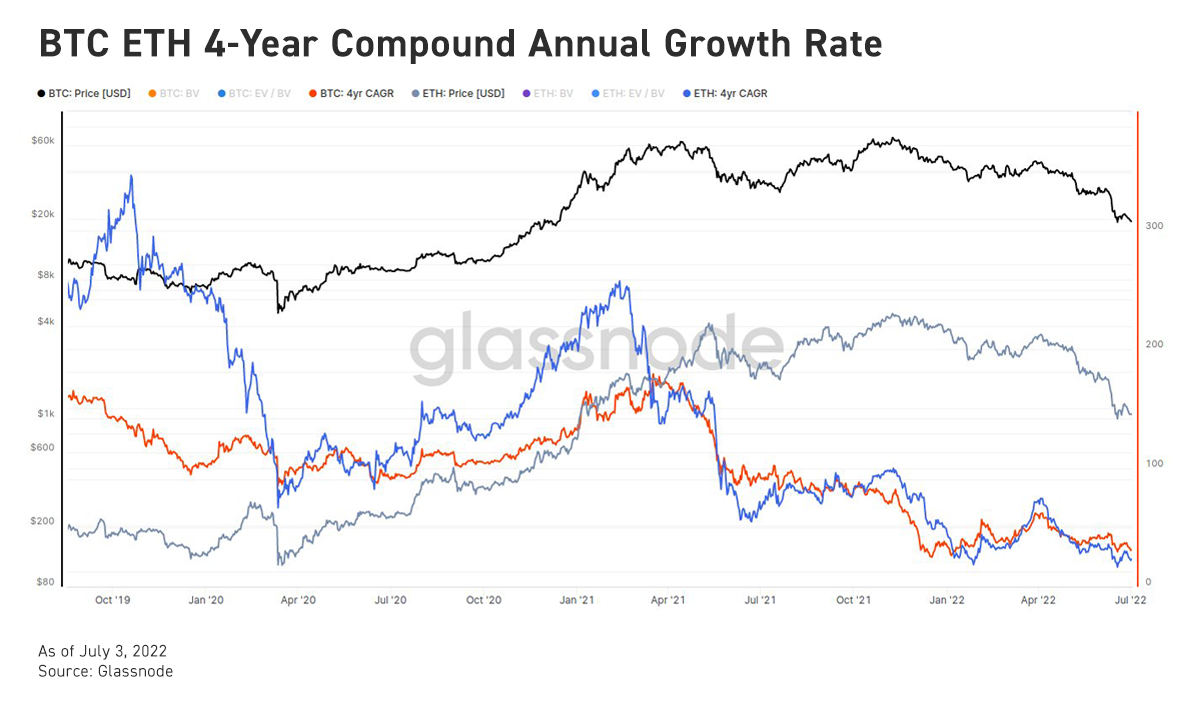

The cryptocurrency market has been mired in illiquidity for some time. A whopping $163.21 billion has flowed out of the BTC market from anxious investors over the past 30 days, causing the price to weaken. The loss of liquidity, combined with the return of volatility on both the bulls and the short sides, suggests that the downtrend may continue for a long time until there are signs that selling momentum is waning. The compound annual growth rate (CAGR) shows that the time is not ripe for capital to rotate into the non-major currency sector, as ETH’s 4-year CAGR has been underperforming.

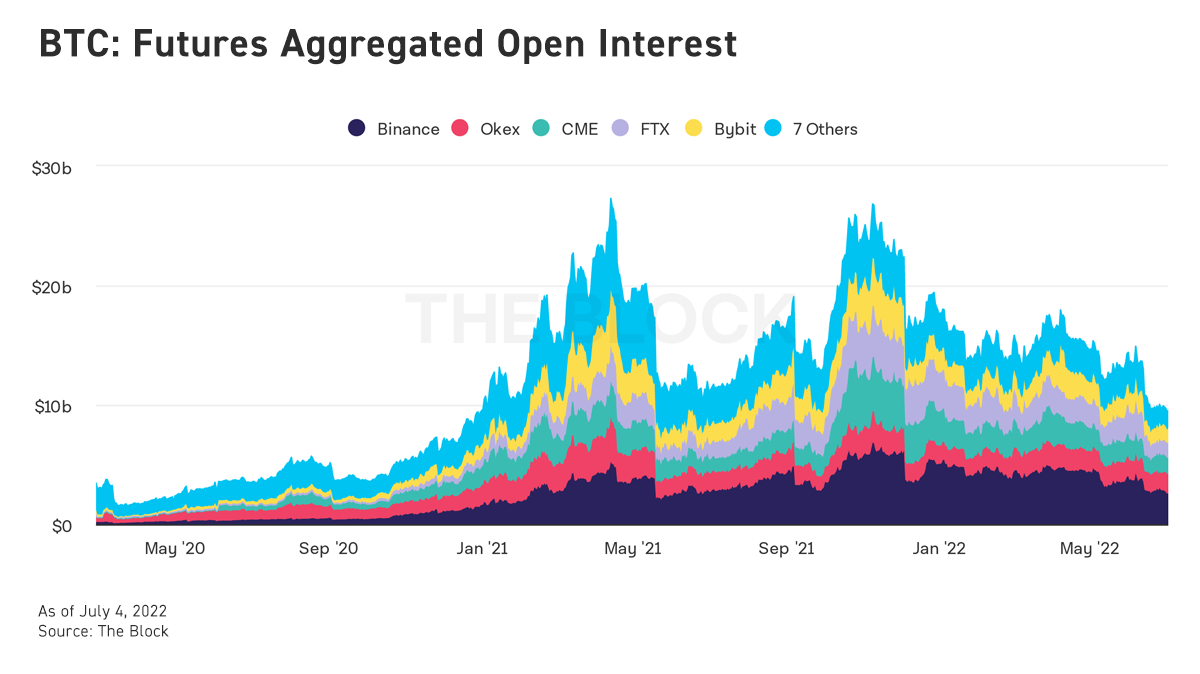

Last week, the BTC perpetual contract funding rate experienced huge fluctuations. Fortunately, there are continuous signs that the funding rate tends to return to the middle area. The total open interest of BTC futures has dropped significantly, and trading volume has also plunged by 11% in a week. Panic selling caused by fears of risk contagion was temporarily halted, but the failure to recover from the $20,000 range suggests that the short-term outlook remains bearish.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...