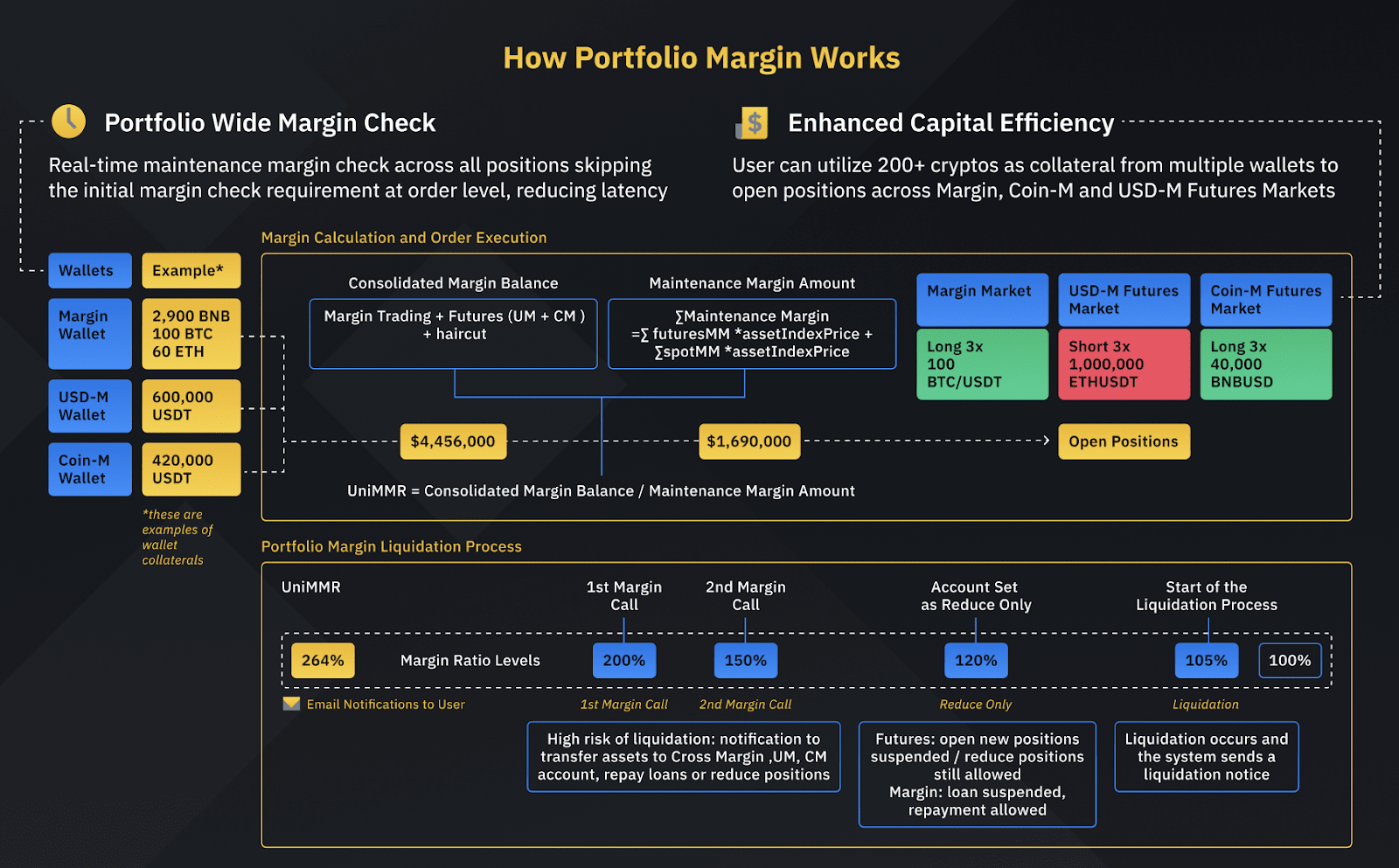

Binance is launching the Portfolio Margin Program, which consolidates the margin balances of USDⓈ-M Futures, COIN-M Futures and Margin accounts.

Binance Portfolio Margin Program

In order to provide Binance users with better services and improve user capital utilization, Binance will launch a Portfolio Margin Program.

The plan will be calculated based on the total assets of contract wallets and spot leveraged wallets as margin.

The Binance Portfolio Margin Program is a cross-asset margining program that supports over 200 active cryptoassets.

USDⓈ-M contracts, coin-margined contracts, and crypto assets and positions supported in leveraged wallets will serve as valid joint collateral to determine equity, margin balances and maintenance margin requirements for the Portfolio Margin accounts.

Through this program, high-frequency traders can obtain potentially higher limits and a lower-latency contract trading experience.

How the Portfolio Margin Program works?

Go to Binance Official Website

How to get involved?

Users who meet one or more of the following requirements will be eligible to participate in the program:

- Binance VIP 7 – VIP 9;

- The trading volume of USDⓈ-M contracts is equivalent to VIP 7 – VIP 9;

- The total balance of USDⓈ-M contracts and margin wallets exceeds 10M BUSD.

If you would like to participate in the Portfolio Margin Program, please email futures-business@binance.com or contact your Key Account Manager.

Go to Binance Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...