Huobi Global will launch a strategy on how to arbitrage from funding fees.

Launch of Funding Fee Arbitrage

Huobi Global will launch the funding rate arbitrage strategy at 18:00 (GMT+8) on April 25, 2022, and we sincerely invite you to participate in the experience.

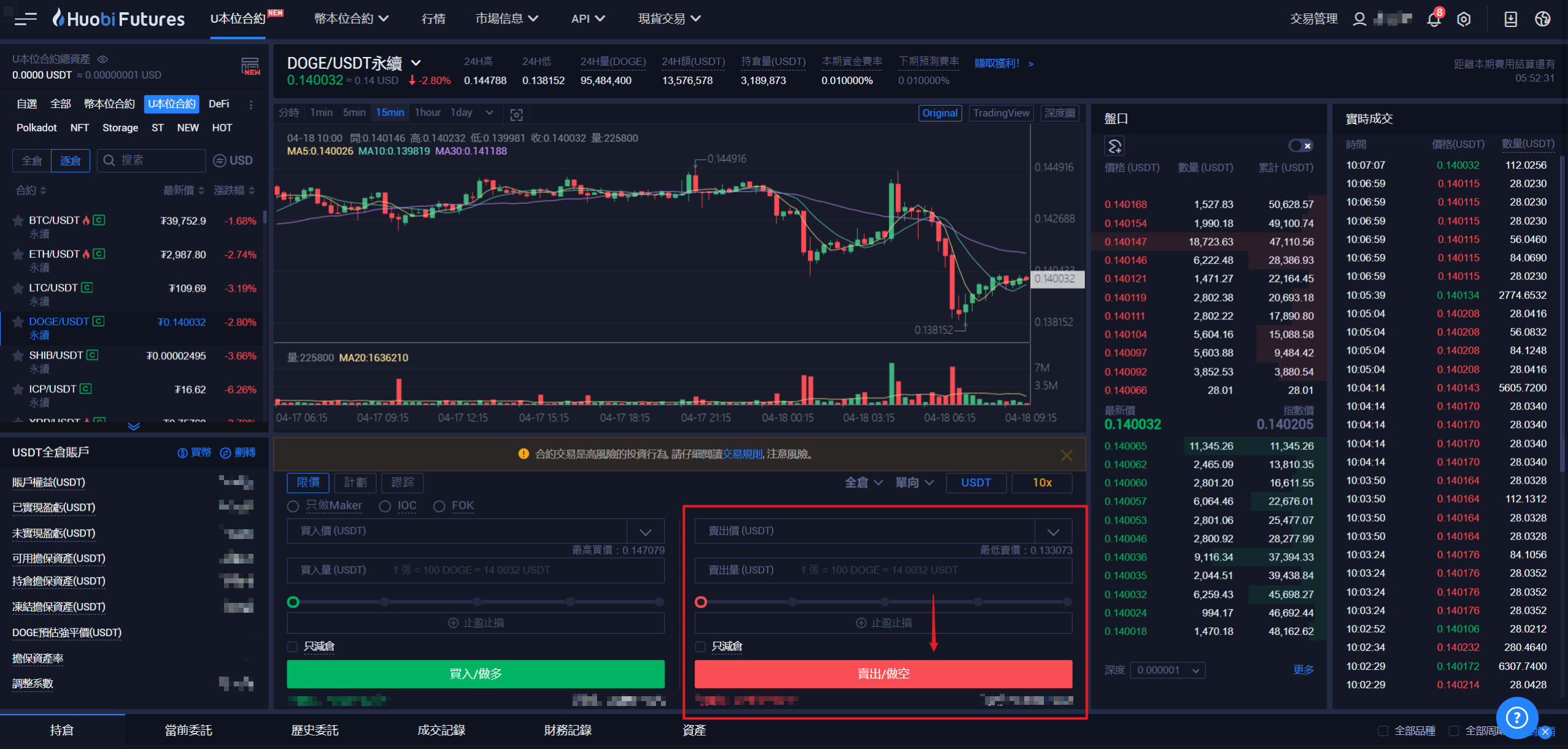

1. What is the funding rate arbitrage strategy

Simply put, it is to hold positions in the “spot” and “contract” markets in opposite directions but with the same position value, to hedge the risks caused by price fluctuations, and then continue to earn funding costs.

2. How to get profit

USDT-margined perpetual contracts are settled every 8 hours. At the time of settlement, whether the user should charge or pay the funding fee is determined by the current funding rate and the user’s position. When the funding rate is positive, the long position will pay the funding fee and the short position will receive the funding fee; when the funding rate is negative, the long position will be charged the funding fee and the short position will pay the funding fee.

3. Why use the funding rate arbitrage strategy:

- Stable income:

- Under normal market conditions, the funding rate is positive. If you hold a short position for a long time, you can charge the funding fee for a long time. As long as the number of short positions in the contract and the number of current currency holdings are the same, funds can be continuously and stably earned from the contract. It is suitable for traders looking for long-term solid growth to diversify their funds.

- Low risk:

- Buying in the spot market and shorting the equivalent asset in the contract, the holding value will not change with the fluctuation of the currency price, thereby hedging the risk caused by the price fluctuation.

- Simple operation:

- Only need three steps to wait for the settlement of capital costs and carry out arbitrage closing.

4. Operation steps

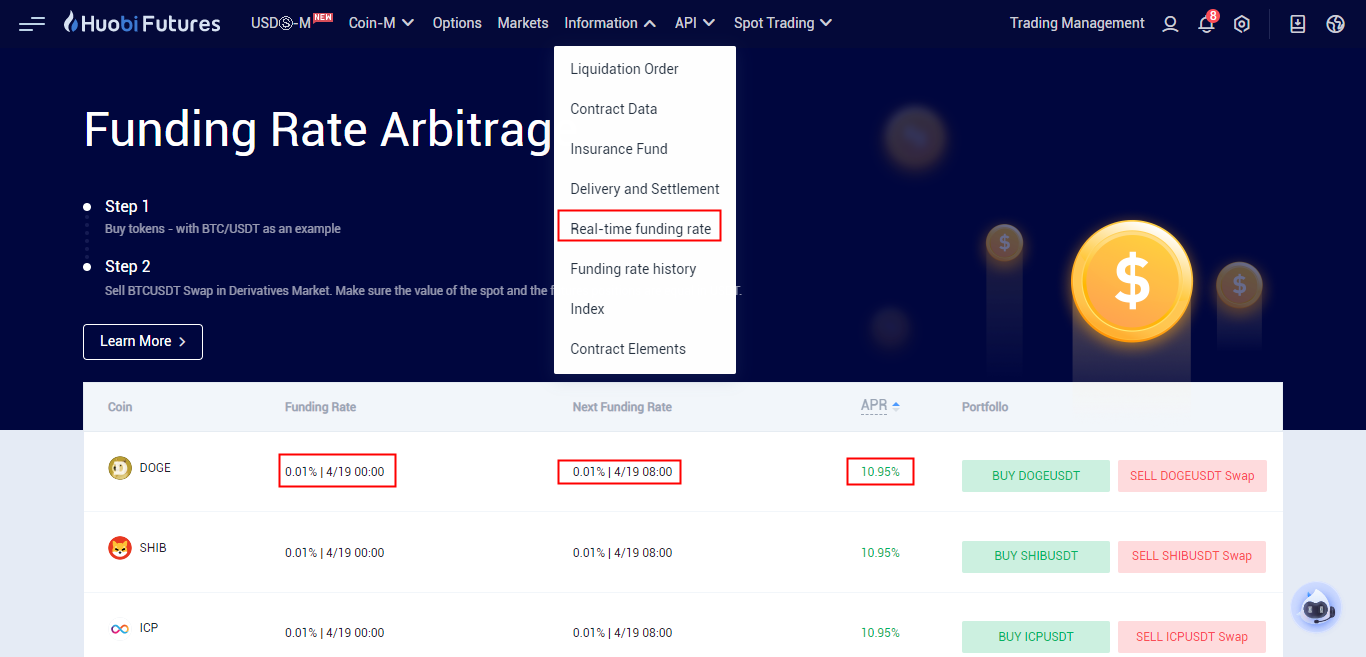

1. Choose an arbitrage portfolio with a higher annualized return

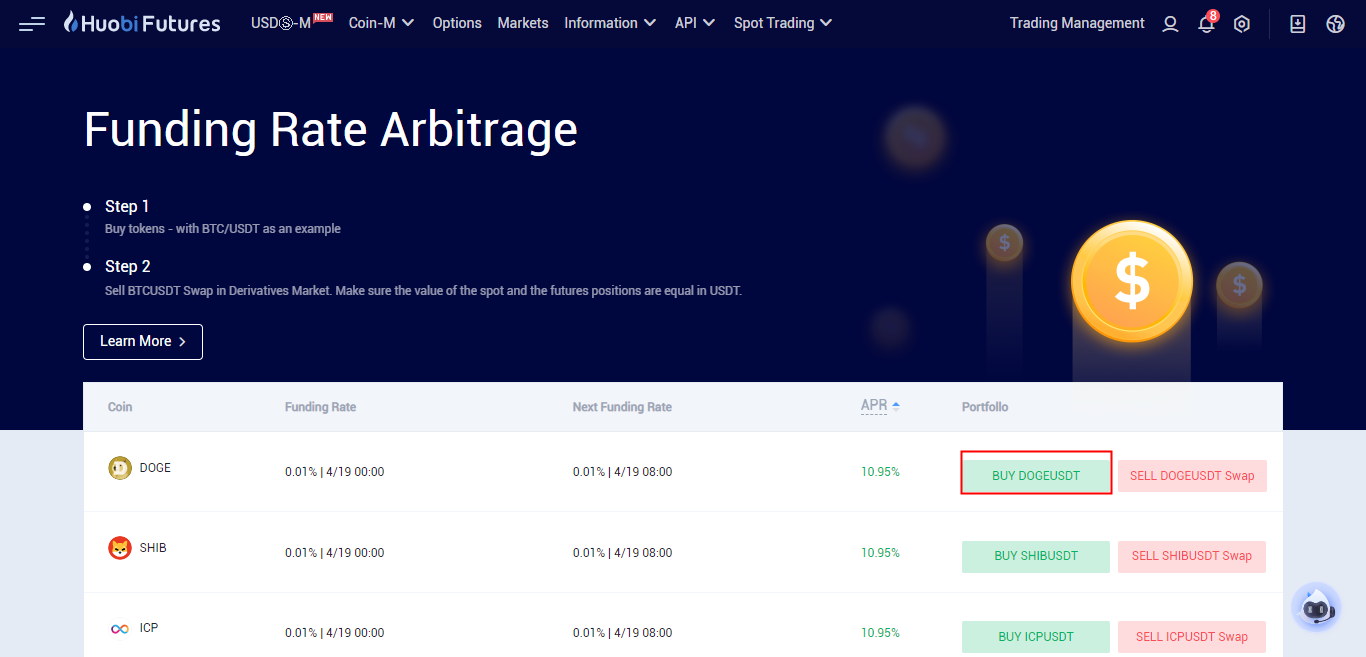

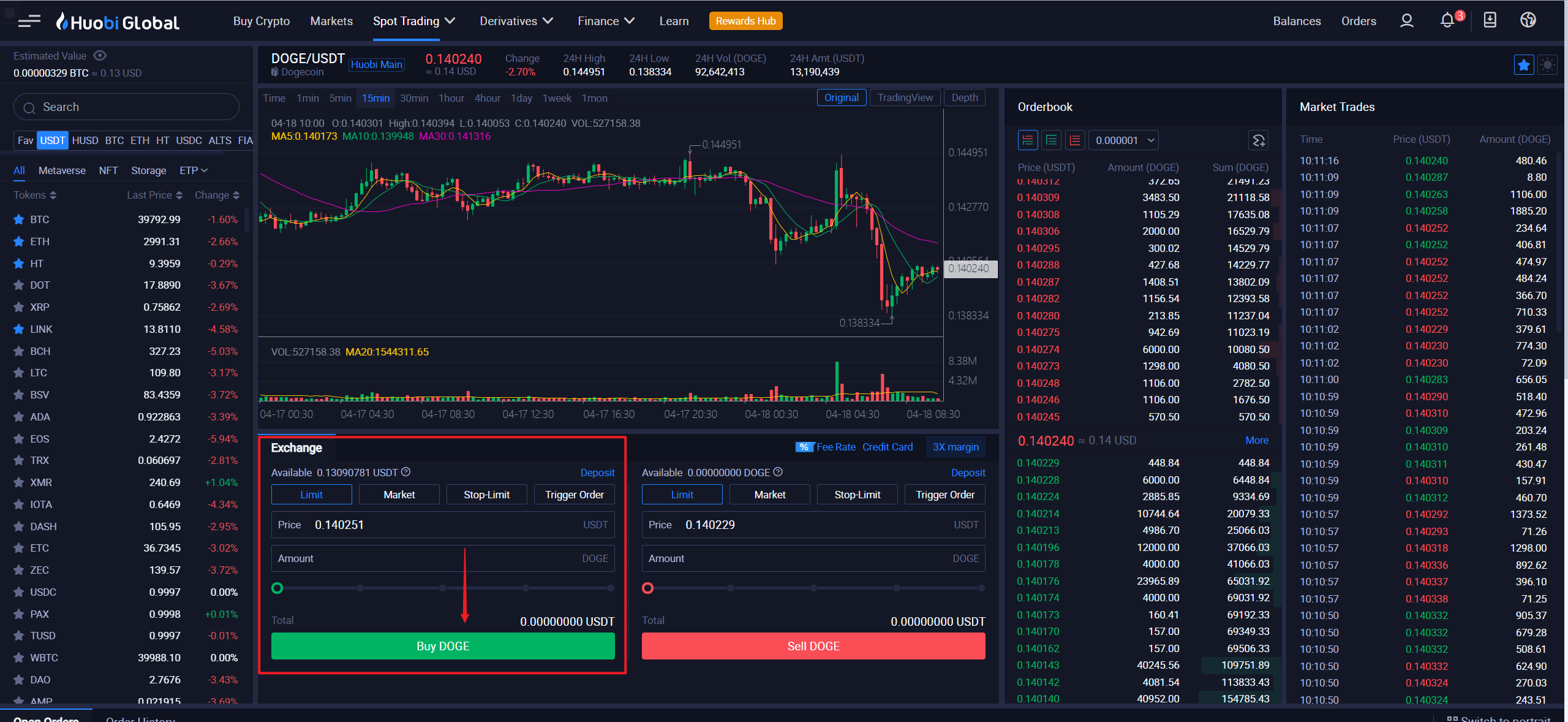

2. Currency purchase corresponding currency

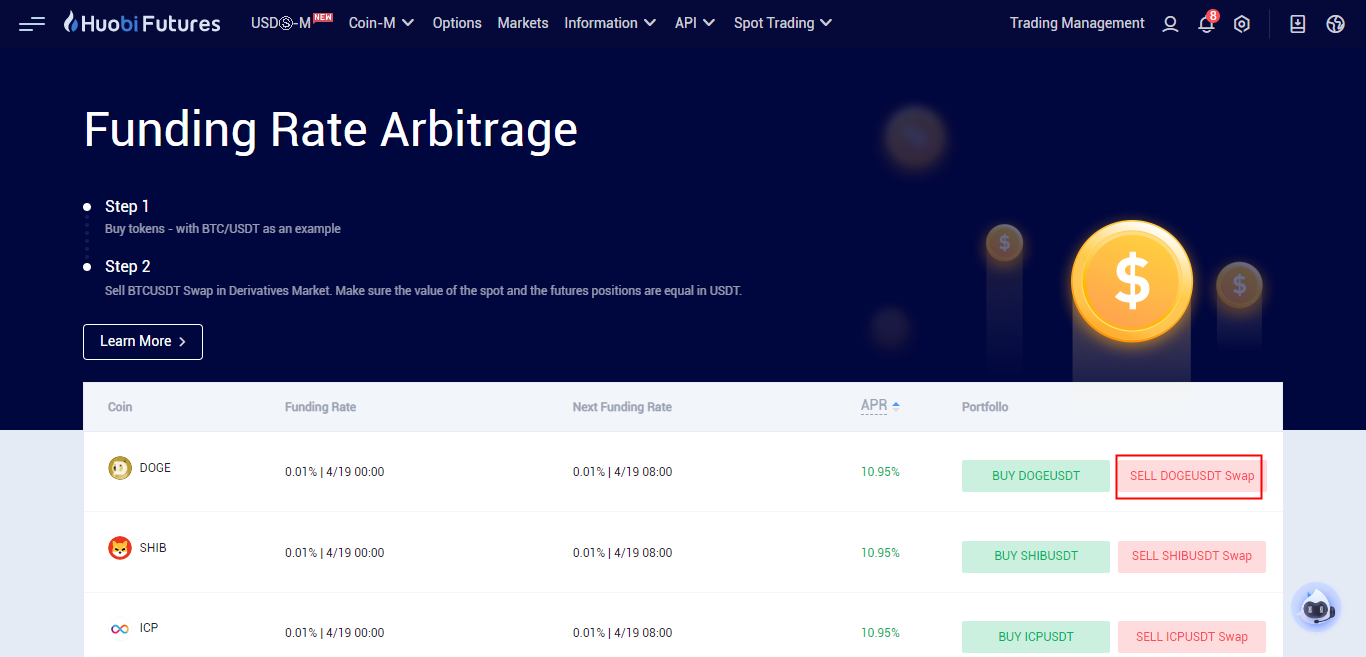

3. The amount of currency equivalent to the short position of the contract

Pay attention to the risk of forced liquidation: It is recommended to open a position with 1x leverage.

If you use multiple leverage to open a position, it is recommended to set take profit and stop loss in advance

Pay attention to changes in the funding rate: The funding rate will change with the actual supply and demand in the market.

It is recommended to pay attention to the history of changes in the funding rate, and close the position in time after reaching the psychologically expected income to lock in the income.

Please check Huobi official website or contact the customer support with regard to the latest information and more accurate details.

Huobi official website is here.

Please click "Introduction of Huobi", if you want to know the details and the company information of Huobi.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...