BTC took a plunge to the $38k handle, wiping out all the gains it made on the back of the bullish news.

While the week was off to a promising start, the main cryptocurrency market took a hit on Wednesday as investors began adopting increasingly safe-haven and defensive strategies to deal with growing macroeconomic uncertainty.

Against this backdrop, BTC plummeted to $38,000, erasing all the gains made on the positive news that BTC was listed as a viable investment option in retirement plans.

At the time of writing, the largest cryptocurrency by market capitalization has plunged 5.3% in the past 24 hours, retreating to its lowest level since early March of this year, and is now recovering losses above $38,000.

Currently, BTC’s upside is likely to be limited to $39,200, while further corrections to the $36,200-$37,500 range are also possible.

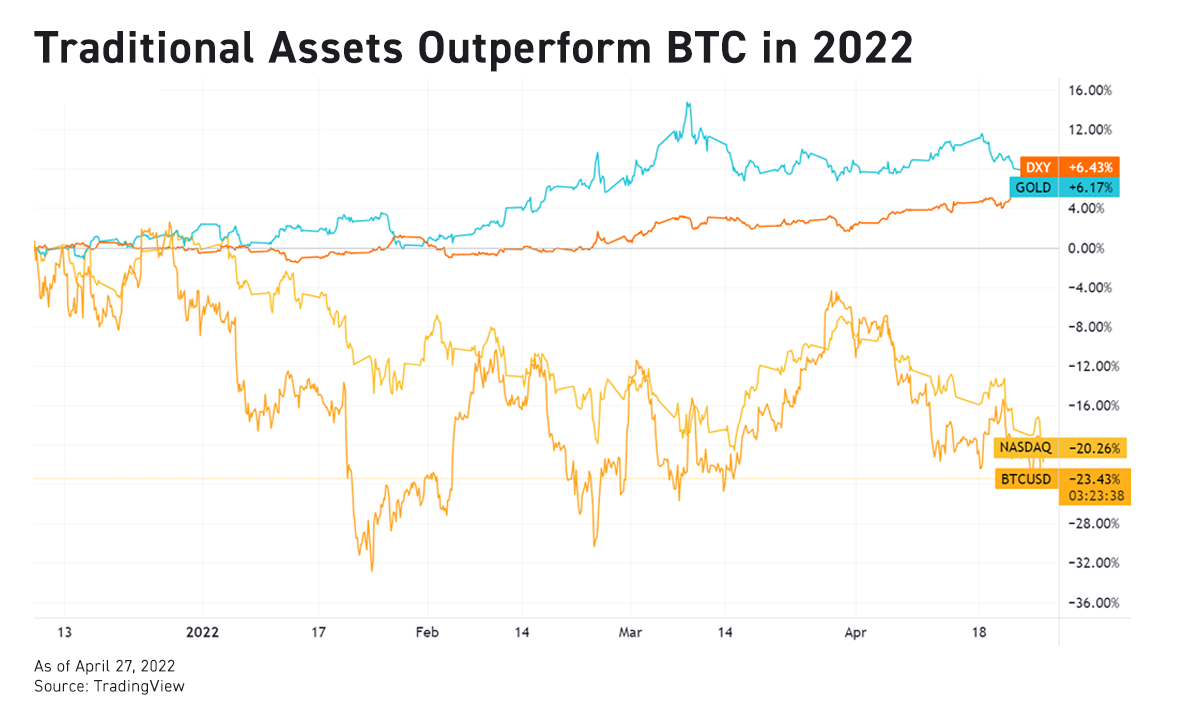

From a broader perspective, most traditional assets, like tech stocks and gold, have outperformed BTC.

During this time frame, the Nasdaq is down 19% (as of this writing), but has managed to maintain a slight edge over BTC.

At the same time, both the U.S. dollar index and gold are thriving in an environment where the public is seeking safe-haven at this time, and in the context of increasing geopolitical uncertainty, they have lived up to their reputation as safe-haven assets.

Similar to BTC, ETH once again failed to hold the $3,000 mark.

ETH is now holding steady above $2,800 after losing 5.5% of its market cap in a single day.

Most major altcoins are also in deep losses.

Dogecoin, the top gainer on Monday, is now leading this wave of downside corrections for altcoins after suffering double-digit percentage losses in 24 hours.

The good news is that capital is flowing into the cryptocurrency space at an unprecedented rate.

Asymmetric, a new investment firm founded by former Microsoft strategist Joe McCann, has announced that they aim to raise $1 billion and then use Wall Street tools to fund crypto-token trades.

McCann described the new investment firm as a company with a “very technical view on cryptocurrencies” and as a tech company with a “fund mandate.” McCann managed to persuade some of the biggest names in the crypto industry to back him, including a16z’s Marc Andreessen and Solana’s Anatoly Yakovenko.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...