Long-Term BTC Holders Capitulating at Unprecedented Rate; MicroStrategy Discloses Balance Sheet.

The main cryptocurrency market continued its downward spiral on Wednesday as investors anxiously awaited the Federal Reserve’s decision to raise interest rates by another half a percentage point this month. At the time of writing, BTC has lost 1.15% of its market cap in the past 24 hours before hovering around support at $38,000. The largest cryptocurrency by market cap has failed to show any bullishness on its multi-time chart and is likely to pull back further due to rising volatility.

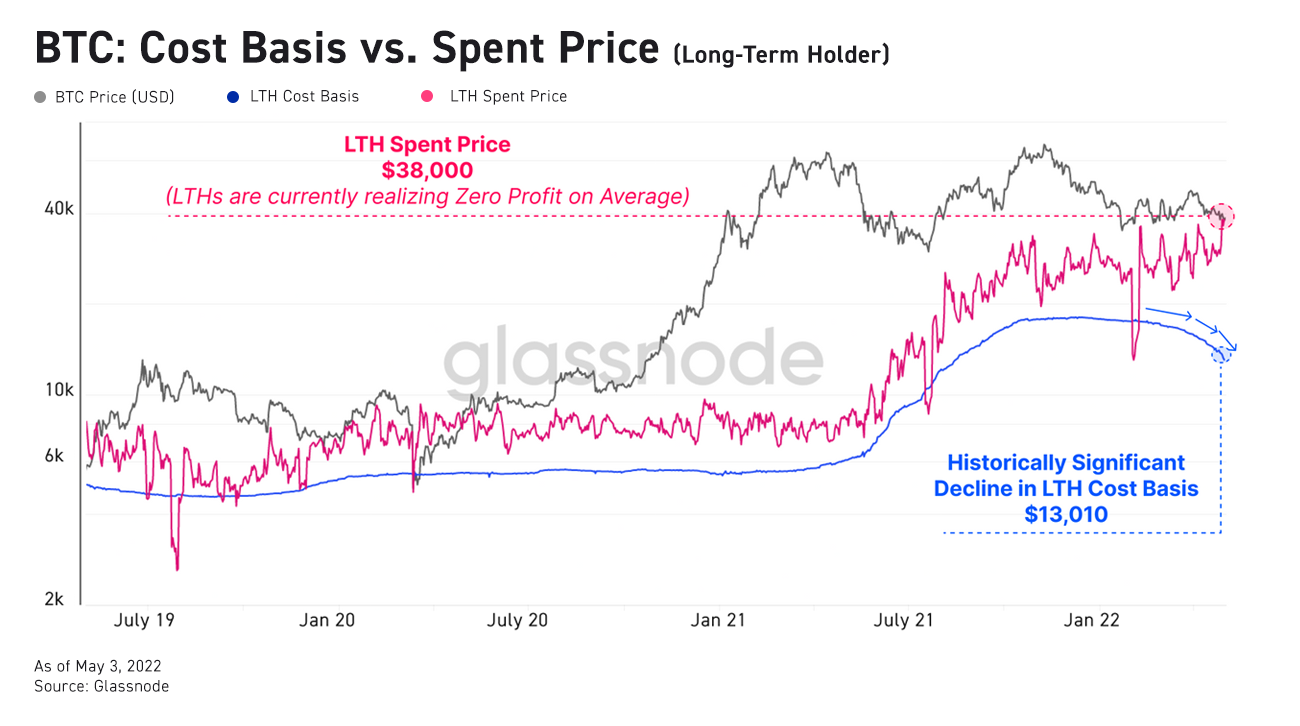

On-chain, several key on-chain metrics show that many short- and long-term BTC holders are now locked in for significant unrealized losses. Long-term BTC holders in particular are capitulating at an unprecedented rate. At the same time, long-term holders are also trading rapidly close to spot prices, as new members of the long-term holder group are now increasingly concerned that prices will fall further.

Similar to BTC, a bearish pattern appears to be forming on the hourly chart of ETH. The second-largest cryptocurrency by market capitalization finally fell below $2,800 after losing 1.7% in 24 hours. Most of the non-major coins are also in decline, with the exception of NEAR and CRO, both of which are up 2% over the past 24 hours.

MicroStrategy quarterly loss widens on Bitcoin

Software company MicroStrategy, which holds more than 129,000 BTC, recently disclosed its balance sheet for the first quarter of 2022. The company is facing a $170 million impairment of non-cash digital assets, up from $146.6 million in the fourth quarter of last year, financial data showed. This impairment reflects weakening BTC spot prices against the backdrop of deteriorating global macroeconomic conditions. In the released earnings report, the company highlighted a BTC-backed loan deal with Silvergate, and hinted that it may pursue yield-generating deals of a similar nature in the future.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...