Universal Music Group Partners with LimeWire

The good news is that veteran music label Universal Music Group (UMG) has announced an official partnership with LimeWire.

LimeWire is an emerging music platform that only launched its Algorand-based marketplace in March.

The deal will allow UMP-affiliated artists to publish tokenized digital collectibles on the LimeWire marketplace platform.

However, this is not Universal’s first foray into the web3 space.

Universal was already experimenting with this burgeoning track back in November 2021, when Universal launched Kingship, a virtual band inspired by the NFT series Bored Ape Yacht Club.

Invest in Cryptocurrencies on Bybit

U.S. markets climbed on Tuesday after Federal Reserve Chairman Jerome Powell’s reiterated the Fed’s firm determination to curb inflation.

However, the main cryptocurrency market stalled as sentiment remained bearish.

BTC has lost 1.38% in the past 24 hours and is currently struggling to hold the psychological support level of $30,000.

At the time of writing, key overhead resistance for the largest cryptocurrency by market cap lies in the $31,500 area, which, if successfully broken, could give BTC upward momentum rather than just a temporary easing of losses.

Similar to BTC, ETH managed to defend the $2,000 mark despite a 1.36% drop over the same period. Most major altcoins are in decline, with the exception of LTC and TRX, both of which are up 2% over the same period.

The fallout from Terra’s brutal debacle has been reverberating across the cryptocurrency market over the past few days.

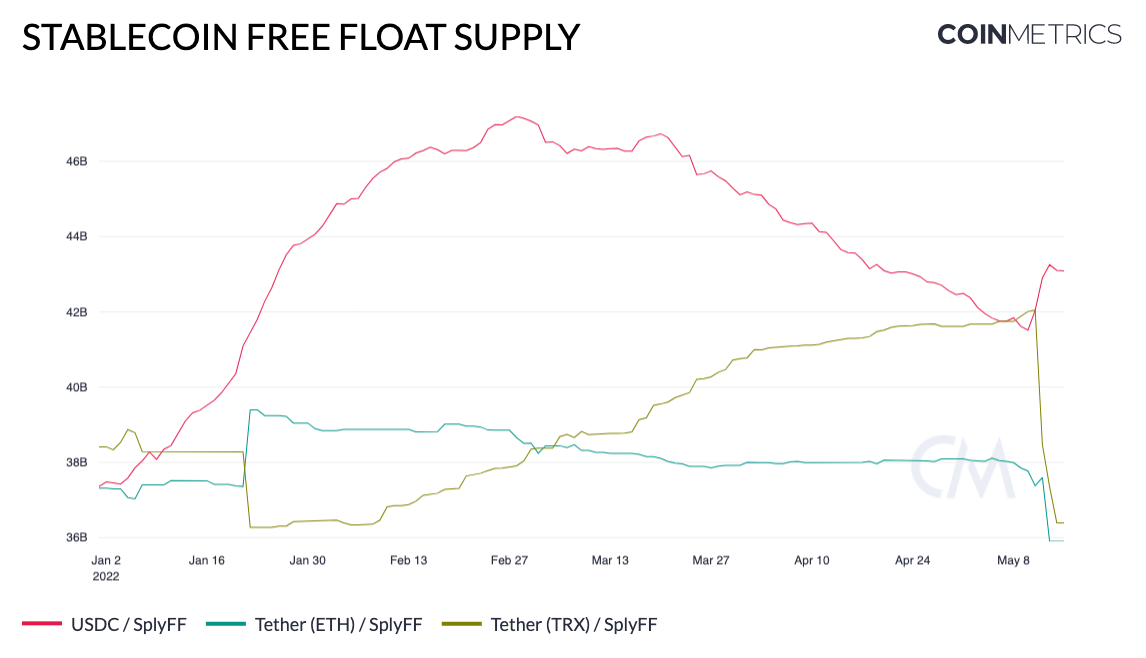

Multiple indicators show that the main means of exchange in the cryptocurrency market, stablecoins, currently has a crisis of confidence.

The largest stablecoin by market capitalization, Tether, set its all-time record for redemptions of more than $3.3 billion on May 12.

In addition, USDT free float was also reduced by $2.8 billion the next day, followed by another $961 million decrease over the weekend.

Likewise, stablecoin liquidity in DeFi contracts has fallen sharply.

Since peaking in March, the amount of USDC in smart contracts has fallen by $5 billion, while the supply of DAI has fallen by $2 billion.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.