Crypto assets equal money laundering? Reject stigma and justify the name of crypto assets!

There are generally two reasons why people oppose cryptoassets. First, encrypted assets have no practical use; second, encrypted assets are used for money laundering. Clearly, it is untenable to say that cryptoassets have no practical use; but are cryptoassets really as extrajudicial for money laundering as TV pundits and naysayers claim?

the answer is negative.

Those who intend to call crypto assets a “money laundering haven” will find the following “unpleasant facts.”

According to data from Chainalysis, a data analysis company specializing in the field of encrypted assets and blockchain , only 0.15% of transactions completed through encrypted assets in 2021 will be related to illegal activities.

According to United Nations estimates , 2-5% of transactions done through traditional fiat currency (cash) (approximately $800 billion to $2 trillion in U.S. dollars) are associated with illicit acts, that is, nearly $1 trillion of transactions per year Funds are used for illegal purposes.

Opponents of cryptoassets are trying hard to create a narrative that major exchanges, including Binance, have never taken anti-money laundering and transparency protocols seriously. However, this allegation is seriously inconsistent with the facts.

Recently, a reporter claimed to have evidence that Binance facilitated money laundering between 2017 and 2022, involving up to $2.5 billion. After verification with Chainalysis related personnel, the reporter obviously did not understand the data nor the operation principle of the blockchain.

Crypto assets are not really suitable for money laundering. First, the KYC process is very strict, and it is not as good as opening an account with a fake identity at a small local or regional bank; second, the large flow of crypto assets is difficult not to be noticed; third, the flow of crypto assets is traceable. Even so-called “privacy coins” are more transparent and traceable than traditional cash.

Blockchain is proving to be one of the most powerful law enforcement tools compared to nearly untraceable cash. Due to the immutability and public nature of the blockchain, law enforcement can investigate and trace the laundering of encrypted assets much easier than investigating cash laundering.

Take the Bitfinex attack as an example. In theory, criminals could successfully steal $3.6 billion worth of bitcoins, but once the coins were used, they would be discovered and caught .

In addition, assuming that a total of $1 trillion in funds was involved in money laundering last year, the proportion of encrypted assets is estimated to be only 0.86%, once again indicating that encrypted assets are not suitable means of money laundering.

However, even though the traditional financial system is more vulnerable to money laundering and sanctions-busting illegals than crypto assets, Binance, as a crypto asset trading platform, is actively involved in the fight against global money laundering.

Combating organized and state-sponsored crime

Binance has the most advanced anti-money laundering system in the world, employs the most experienced anti-money laundering investigation agencies inside and outside the industry, and regularly provides clues and other information to law enforcement to help identify and deter criminal acts.

Because transactions on the blockchain are immutable and fully public, money laundering through crypto assets is quickly detected and prevented. If someone accuses money laundering on Binance, just check the transaction records to find out the truth.

Detractors also deliberately confuse “direct” and “indirect” associations and present top-up data. What does it mean?

For example, let’s say a drug dealer stuffed a package of drugs into your letterbox at home. Obviously you can’t prevent this behavior in advance, but once you find the package, it’s your responsibility to contact law enforcement and give them what they need to find the dealer. information.

Therefore, Binance has invested tens of millions of dollars to build the world’s top network forensics team, including more than 120 security and industry experts from around the world, including those who have worked in the US IRS, FBI, Special Intelligence Agency, Europol, the Netherlands and UK police agencies, as well as former senior law enforcement investigators at national level agencies in Asia and Latin America.

However, the media rarely reported on this. The Binance team not only works closely with law enforcement, but has also made indelible contributions to the fight against cybercriminal organizations such as Hydra and Lazarus.

Lazarus

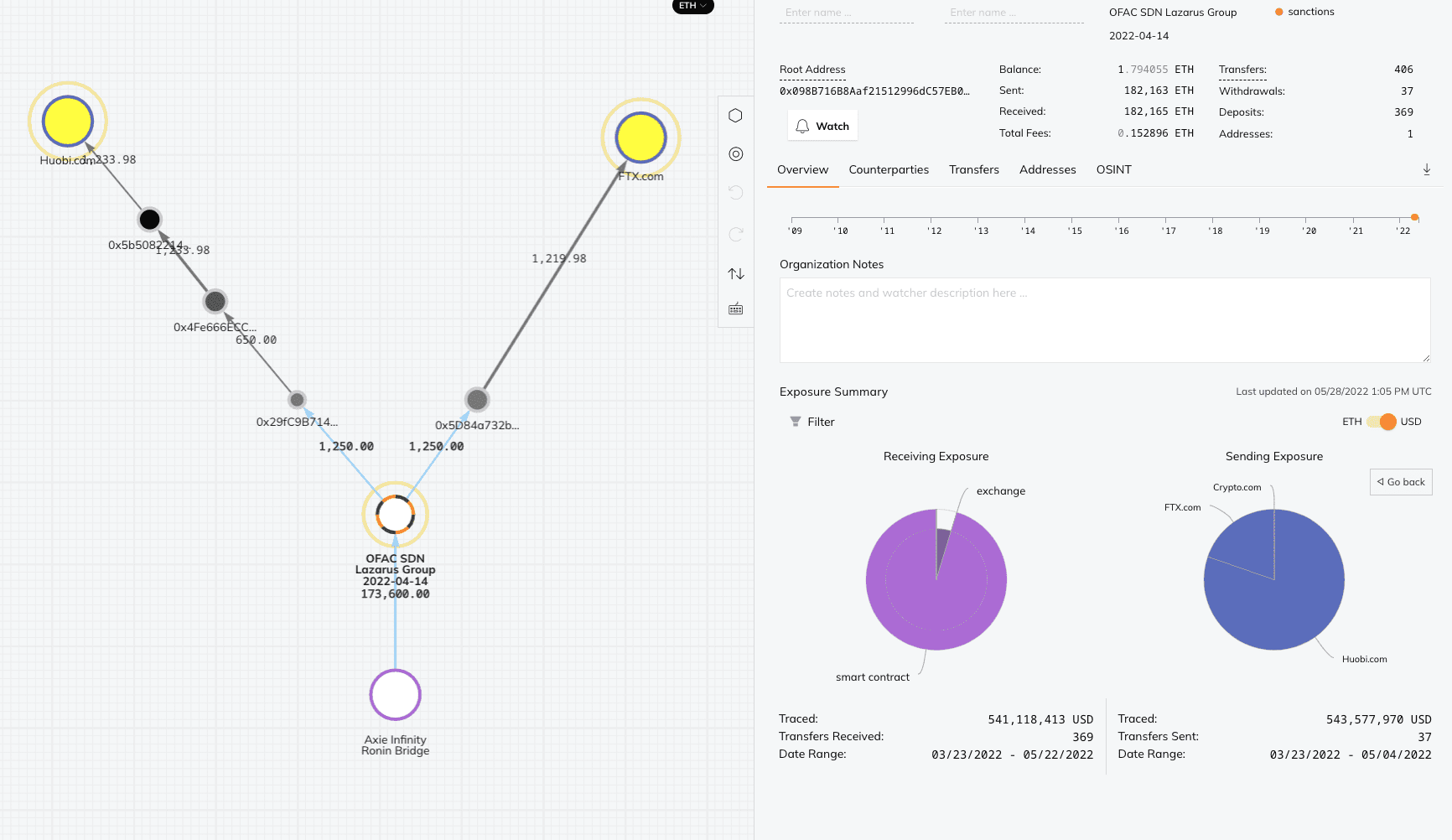

Below, we decipher the recent allegations against the North Korean government-controlled cybercriminal group Lazarus.

Binance actively shared intelligence, helped law enforcement sort out the global network of North Korean criminal groups, and blocked the flow of funds from North Korea to the platform through internal investigations. Binance is certainly not the only trading platform the North Korean government is trying to use, but we don’t think any trading platform has adopted such a severe crackdown as Binance.

For example, many members of the Binance team were involved in the initial investigation, which identified the criminal group and traced the theft of $250 million from the platform, most of which went to other exchanges.

In addition, in the recent theft of Ronin/Axie Infinity by Lazarus , a large part of the funds flowed directly to other large exchanges, and the other part went to Tornado Cash’s currency mixing service. After Binance and Chainalysis worked together to de-mix coins and cooperate with law enforcement, approximately $5.8 million worth of crypto assets were finally frozen.

Lazurus also attacked a Slovakia-based trading platform, Eterbase. At present, Binance cannot disclose any information related to the contact with the Slovak National Police, but what can be revealed is that Binance has received a request from the Slovak government regarding the claim that Lazarus had opened multiple anonymous accounts on multiple crypto asset exchanges. And fully cooperate to find Lazurus related accounts on Binance and other exchanges.

North Korean agents use extremely sophisticated means to circumvent all financial restrictions, including setting up front companies, falsifying highly realistic documents, using third-party IP addresses, and using VPNs. However, Binance managed to identify and close multiple accounts associated with it.

For years, North Korea has attempted to launder money through multiple crypto asset exchanges and traditional banks, and Binance has assumed the role of industry leader in identifying and combating these money laundering practices. We actively work with law enforcement agencies to help combat North Korea’s illegal activities by sharing intelligence, freezing accounts, and shutting down networks before stolen funds flow out of the platform.

Hydra

Hydra is a dark web platform in Russia, which has finally come to an end thanks to a detailed investigation by law enforcement and the collaboration of crypto asset trading platforms. Many of those responsible for this enforcement process are now Binance employees. Some media claims that Binance is the key platform behind Hydra is simply ridiculous.

From Binance’s perspective, the initial investigation request from law enforcement regarding the Hydra incident was sent not only to Binance, but to all large exchanges as well. And Binance was the first platform to respond and provide assistance. According to retrospective data from tool platforms such as Chainalysis , every major trading platform is indirectly linked to Hydra. And what’s interesting is that there are more institutions in the traditional banking industry (non-crypto assets) that provide funds or even host for Hydra’s operations.

Without the crypto asset, the Hydra incident may never be closed. It was because crypto assets were able to track the flow of money and find the source of the dark web that the case was closed.

Sadly, a multinational media outlet not only failed to report on Binance’s industry-leading role in fighting crime, but also claimed that Binance was directly linked to Hydra’s $780 million in funds. This allegation is completely untrue, and we believe that Binance has taken more actions than any other cryptocurrency exchange in the fight against Russian money laundering, including delisting Suex, Chatex, Garantex, etc.

User safety comes first

We’ll also see pundits on TV claiming that the crypto-asset industry agrees that the KYC process is “burdensome,” which is of course wrong. Binance believes that strict KYC practices are very important for both the security of Binance and the safety of users. The only way for crypto assets to achieve popularity is to provide better protection for new users, and KYC is a crucial part of this.

One thing rarely mentioned in the “crypto asset fraud” reports is that most victims’ initial transaction is done through a traditional bank. Usually, scammers find their targets through social media, email, cell phone messages, etc., and then guide victims to make large transfers from bank accounts on the grounds that computers are locked, loved ones save lives, and fines are paid to avoid jail time.

Binance is currently working with law enforcement, the judiciary, and banks to consolidate its “defense” systems against the aforementioned scams to protect users. For example, we recently launched a campaign in Australia to encourage users to learn how to prevent common scams.

In addition, we are constantly building new partnerships with the world’s leading experts in the crypto-asset field. Just last week, Binance formed a partnership with data analytics firm Kharon and cloud-native background provider Neterium to further strengthen its KYC capabilities and ability to identify illegal activities related to crypto assets on the platform.

“Unpleasant fact”

So, what is the final conclusion? The fact that most money laundering is through the traditional banking system rather than crypto assets may be an “unpleasant fact” to crypto asset opponents.

There’s also the unpleasant fact that Binance has taken on an important leadership role in assisting law enforcement in dealing with cyber and financial crime. For example, over the past few weeks, we have assisted the U.S. Drug Enforcement Administration in identifying more than 100 accounts linked to drug money laundering in Mexico. This is Binance’s daily work and a key pillar of Binance’s effective collaboration with law enforcement.

In fact, it was Binance’s expert investigative team that used blockchain’s retrospective capabilities to identify and successfully target the worst actors in the crypto-asset space, including Hydra Market. Experts will continue to put their skills to good use to provide users with better security protections and assist law enforcement in fighting and destroying any organization that seeks to use blockchain for criminal activity.

Also, we need to recognize that the media attacks on crypto assets and Binance will not stop. Some large news organizations will continue to be influenced by actors looking to curb the growth of crypto assets and Binance.

If you want to wear a crown, you must bear its weight. Binance, as an industry leader, will definitely shoulder the responsibility of being a leader. At the same time, Binance believes that a healthy media ecosystem should be strong, fair, and independent, and Binance hopes that the content published by the media can comply with the highest standards of news integrity, and not be misled by people with ulterior motives.

What about Binance itself? Binance will continue to do two things well – protect users and build ecology.

Go to Binance Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...