Securities regulators in five U.S. states are investigating Celsius’ suspension of all withdrawals, transfers and asset exchanges on the platform.

Securities regulators in five U.S. states are investigating Celsius’ suspension of all withdrawals, transfers and asset exchanges on the platform last Sunday, Reuters reported. Affected by the collapse of LUNC and the recent decoupling of stETH, the crypto lending platform is facing severe liquidity problems due to its high-risk operations in the pursuit of yield.

Celsius CEO Alex Mashinsky issued a statement on Twitter after three days of silence, saying the team was “focused on addressing customer concerns” and was seeking help from Citigroup in dealing with the current situation. difficult situation. However, a recent Wall Street Journal report suggested that Celsius’ lead investor is “unlikely” to provide it with additional financial support.

On Thursday, the main cryptocurrency market recovered strongly after the Federal Reserve decided to raise interest rates by 75 basis points to fight inflation, recovering some lost ground in one fell swoop. However, fears of a further spread of liquidity issues remain shrouded in the market as major lenders and borrowers in the space grapple with liquidity issues. At the same time, the remarks about the successive liquidation of government bonds continued to dampen market sentiment. In addition, investors’ risk aversion has put digital asset prices under enormous pressure.

At the time of writing, BTC has lost 5% of its value in the past 24 hours and has fallen below its 200-week moving average, which is now below $21,000. A new connected bearish trend line has begun to form on the hourly chart of BTC, indicating that the immediate resistance zone at $2.08-2.15 million limits BTC’s upside. If the bear market persists, once the key support level at $20,000 is broken, BTC could see a steeper decline and trigger a new round of liquidations.

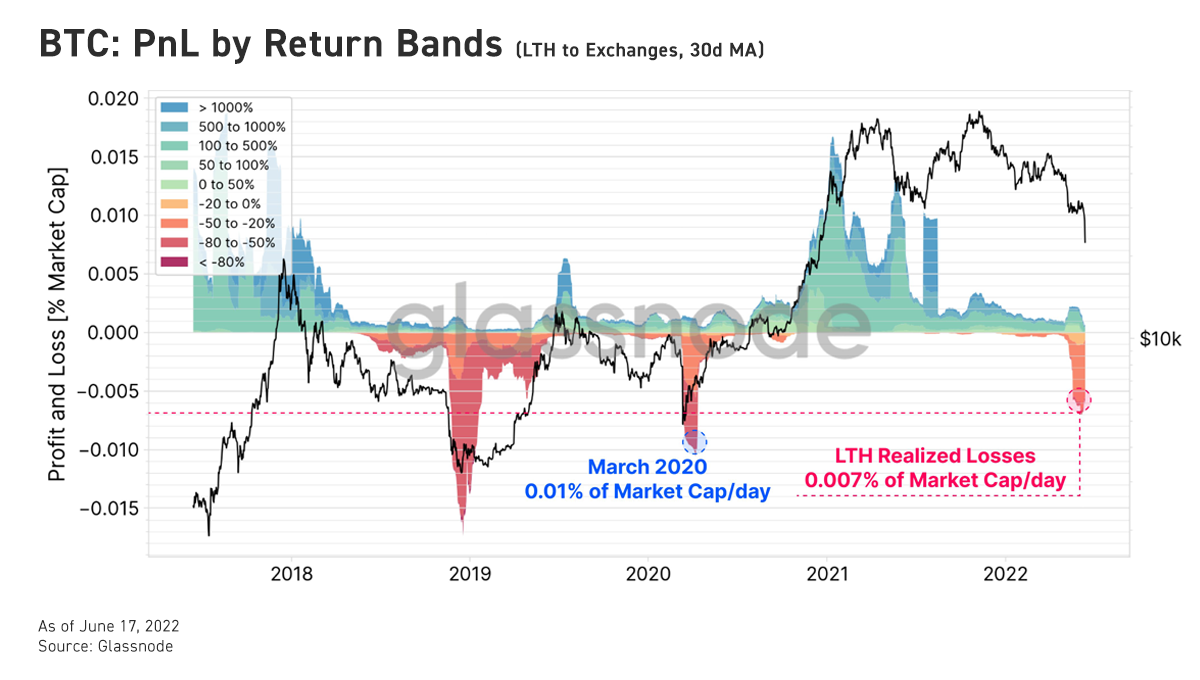

On-chain metrics show that Bitcoin investors have locked in their largest ever real dollar-denominated losses to date, and none of the massive sell-offs in 2021 can compare to it. Looking at P&L for different return segments shows that long-term holders took a hit as their actual losses were close to levels seen during the March 2020 liquidity crunch.

ETH saw an even bigger drop over the same period. The second-largest cryptocurrency by market cap is now struggling to defend the $1,100 mark after falling 7% in the past 24 hours. Most major non-mainstream coins have suffered more or less losses, and DOT led the decline of non-mainstream coins with a 9% decline in the same period.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...