A notice of default to Three Arrows Capital, the embattled crypto hedge fund that has been struggling with liquidity issues.

On Monday, cryptocurrency brokerage Voyager Digital said it had issued a loan default notice to Three Arrows Capital, a cryptocurrency hedge fund struggling with liquidity issues.

According to Voyager, the loan that Three Arrows failed to repay as required consists of 15,250 BTC and $350 million in USDC, which is a whopping $675 million based on the recent price of BTC.

The company said it plans to recover money from Three Arrows and is currently discussing legal remedies with its advisers to meet clients’ needs.

Stocks and cryptocurrency markets both tumbled late Monday as investors looked to rebalance their portfolios in the final days of the quarter. Despite a 2% drop over the past 24 hours, BTC has managed to hold a key support level at $20,000. A key bearish trend line is forming on the hourly chart of BTC with a ceiling near $21,000. If it can break through this level in one fell swoop, BTC is likely to usher in another rally. Conversely, if attempts to clear key resistance levels fail, BTC could retest support near $20,500.

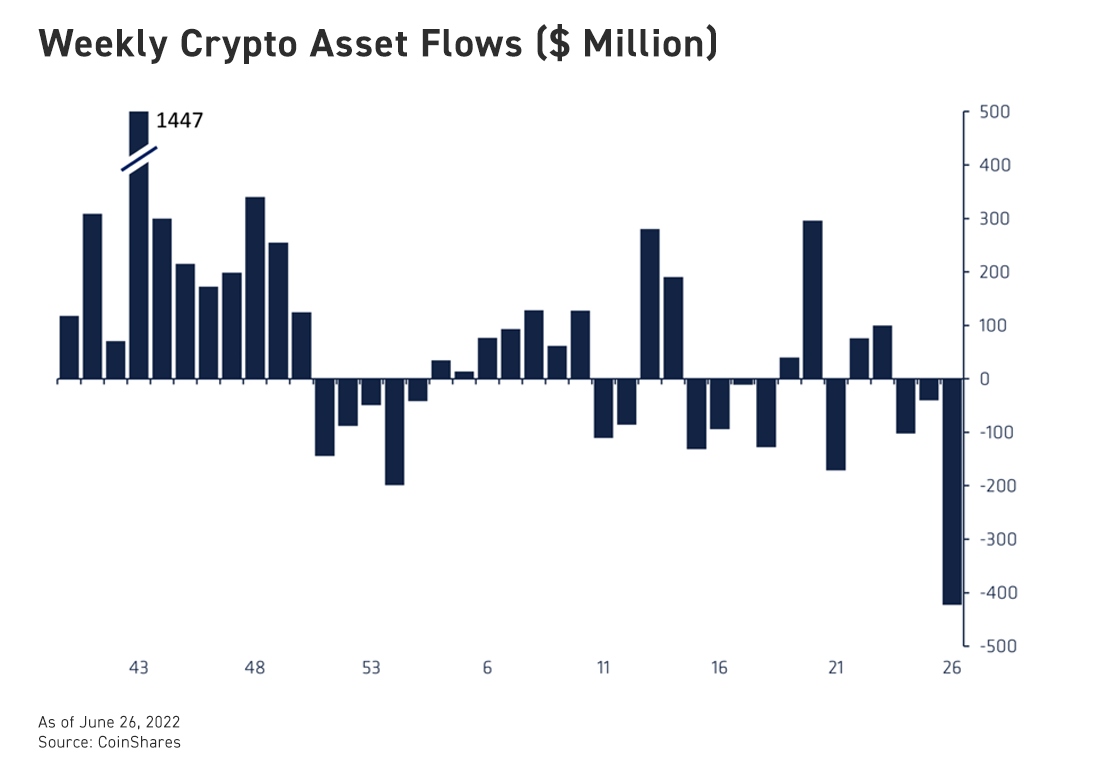

Several on-chain metrics consistently indicate that the market has reached cyclical lows and demand has fallen to historically low levels. Last week, a staggering $453 million was withdrawn from the market from multiple digital asset investments focused solely on BTC, wiping out all capital inflows so far this year and reducing total BTC assets under management to less than $24.5 billion The dollar hit its lowest point since 2021. Additionally, BTC has entered the oversold zone, which represents an unprecedented buying opportunity for traders. Similar to BTC, ETH’s market cap is now just below the $1,200 mark after losing 2.3% in the same period. After the second-largest cryptocurrency by market cap hit an all-time high in November 2021, ethereum usage and network demand have been sliding since then. Movements in daily volume and average miner fees have trended in sync with a macro downtrend that has lasted more than six months, reflecting weakening demand in the Ethereum ecosystem. At the same time, major non-mainstream coins turned from rising to falling, with Dogecoin and MATIC leading the decline with a 7% decline in the same period.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...