The Limit, Take Profit, and Stop Loss order combines the Take Profit and Stop Loss trigger mechanism with a limit order. Traders use such orders to set the minimum profit target they expect to accept, or the maximum cost or loss they are willing to bear on a trade. After you set a limit, take profit and stop loss order and reach the trigger price, the limit order will be automatically issued even if you log out or offline. Traders can strategically issue limit, take profit and stop loss orders based on resistance levels, support levels and asset volatility.

In a limit, take profit and stop loss order, the take profit and stop loss price is the trigger price for the trading platform to issue a limit order. The limit price is the price point at which the order is placed. The limit price can be set by yourself – the limit price for buy orders is usually set higher than the take profit and stop loss price, and the limit price for sell orders is lower than the take profit and stop loss price. This difference takes into account that the market price will change within the time difference between triggering the take profit and stop loss price and issuing the limit order.

Introduction

Knowing a market order is not enough to actively trade rather than hold for the long term . Limit, Take Profit and Stop Loss orders are more controllable and customizable. Beginners may be confused by this concept, so let’s first understand the key differences between limit orders, stop-loss orders, and stop-limit orders.

Comparison of pending orders

Comparison of Limit Orders, Stop Loss Orders and Limit Take Profit and Stop Loss Orders.

Limit orders, stop-loss orders, and take-profit and stop-loss orders are all common order types. The limit order allows traders to set the target price range, the stop order sets the take profit and stop loss price that triggers the market order, and the limit take profit and stop loss order is a combination of the former two. Let’s dig a little deeper:

Limit order

When setting a limit order, you can choose the highest bid price or the lowest ask price. When the market price reaches or exceeds the limit price, the trading platform will automatically push the limit order to be filled. These orders are useful if the target opening or selling price is clear and you are willing to wait for the market to meet the set conditions.

Traders typically place sell limit orders at points above the current market price and buy limit orders at points below the current market price. If a limit order is posted at the current market price, it is likely to be executed within seconds (except in illiquid markets).

For example, assuming the market price of Bitcoin is $32,000 (BUSD), a buy limit order can be set at $31,000. Buy Bitcoin as soon as the price drops to $31,000 and below. In addition, a sell limit order can be placed at the $33,000 level. If the price rises to $33,000 and above, exchanges will sell bitcoin.

Limit take profit stop loss order

As mentioned earlier, a stop-limit order is a combination of a take-profit and stop-loss mechanism and a limit order. A stop loss order adds the trigger price for posting a limit order in the trading platform. Let us understand the specific principle.

How do Take Profit Stop Loss orders work?

The best way to understand stop-limit and stop-loss orders is to disassemble them. The Take Profit and Stop Loss price acts as the trigger price for placing a limit order. When the market price reaches the take profit and stop loss price, the system will automatically create a limit order with a custom price (limit price).

Although the Take Profit, Stop Loss and Limit prices can be the same, they do not have to be. In fact, it is safer to set the take profit and stop loss price (trigger price) slightly higher than the limit price if it is a sell order and slightly lower than the limit price if it is a buy order Some. This increases the chance of a limit order being filled.

Examples of Stop-Limit Buy and Sell Orders

Buy Limit, Take Profit, Stop Loss

Say Binance Coin is trading at $300 (BUSD) and you want to buy it when it is trending bullish. However, if Binance Coin rises too fast and you don’t want to pay too much for it, you need to limit the price you pay.

Assuming that according to technical analysis, if the market breaks through $310, it may start an uptrend. The trader decides to use the take profit stop limit buy order to open a position in response to the rising market. Take profit, stop loss and limit prices are set at $310 and $315, respectively. When the BNB price reached $310, the system immediately issued a limit order to buy at $315. Orders may fill at $315 or less. Note that $315 is the limit price. If the market rapidly exceeds this value, the order may not be filled at all.

Sell Limit, Take Profit, Stop Loss

Let’s say BNB, which was bought at $285 (BUSD), has now risen to $300. To avoid losses, traders decide to sell BNB using a stop-limit order when the price falls back to the opening price. The stop price for a sell limit stop loss order is set at $289 and the limit price is $285 (BNB’s buy price). If the price reaches $289, the system will immediately issue a limit order to sell BNB at $285. Orders may fill at $285 or higher.

Go to Binance Official Website

How to issue a Take Profit and Stop Loss order on Binance?

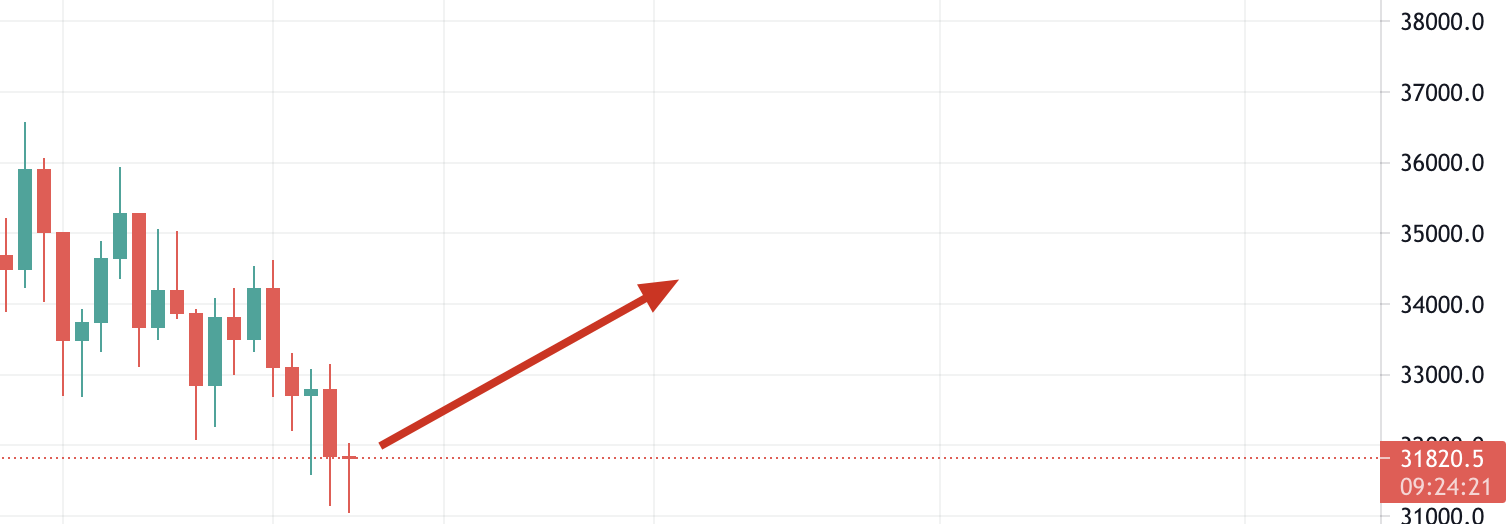

Suppose you just bought five bitcoins at $31,820.50 (BUSD) and predict that the price is about to rise.

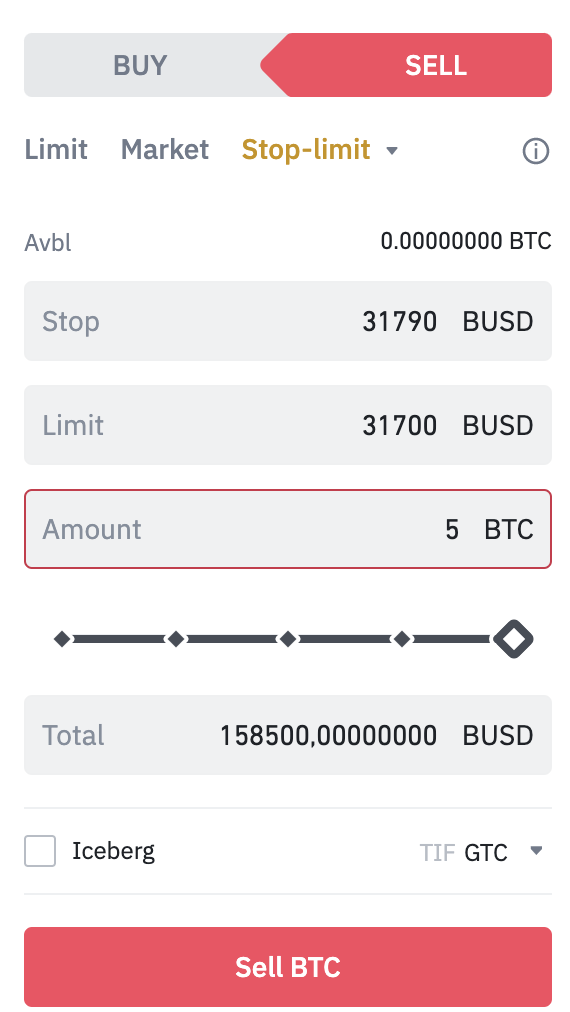

If the forecast is wrong and the price starts to fall, you may cut your losses by placing a sell limit order. To do this, log into your personal Binance account and enter the BTC/BUSD market. Then click the [Limit, Take Profit and Stop Loss] tab to set the Take Profit, Stop Loss and Limit prices and the amount of Bitcoin to be sold.

If you think $31,820 is a solid support level, you can place a stop-limit order below that price (in case the support falls below). In this example, we will issue a Take Profit and Stop Loss order for 5 BTC with a Take Profit and Stop Loss price of $31,790 and a Limit price of $31,700. Below we demonstrate the specific operation step by step.

Stop limit order example on Binance

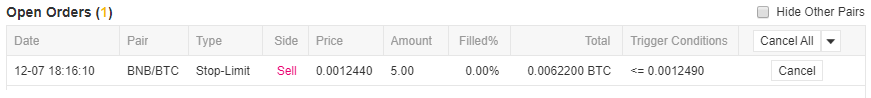

After clicking [Sell BTC], a confirmation window will appear. Make sure everything is correct, then press [Place order] to confirm. You will receive a confirmation message once the Take Profit Stop Loss order is posted. You can also scroll down to view and manage open orders.

Note that a Stop-Limit Order will only execute when the Stop-Loss price is reached. That is, a limit order will only be filled when the market price reaches or exceeds the limit price set by the trader. If the limit order is triggered by the take profit and stop loss price, but the market price does not reach or exceed the set price, the limit order will remain open.

Occasionally, you will also face the situation that the price falls too fast and the limit, take profit and stop loss order fails to be filled. In this case, it may be necessary to use a market order for a quick exit.

Advantages of using stop-limit orders

Limit, Take Profit and Stop Loss orders allow traders to customize and plan trades. We can’t keep an eye on the price, and it’s even more unrealistic to keep an eye on the cryptocurrency market that operates 24/7. Another big advantage is that a stop-limit and take-profit order allows traders to set a reasonable profit limit. If there is no limit, your order will be filled at any market price. Some traders prefer to hold for the long term rather than sell assets at any cost.

Disadvantages of using stop-limit orders

Take-profit and stop-loss orders have the same disadvantages as limit orders in that they are not guaranteed to be filled. A limit order will only be filled when the price reaches or exceeds a certain value . However, this price may never be reached. Even if you leave a spread between the limit price and the take profit and stop loss price, there is a chance that the difference is not enough. For a highly volatile asset, the price change may directly exceed the spread set in the order.

Liquidity can also become an issue if there are not enough takers to push orders to fill. If you are concerned that your order will only be partially filled, consider using a “full or cancel” order. The plan stipulates that the order can only be executed after the full closing conditions are met. However, please note that the more conditions are added to the order, the lower the probability of execution.

Publishing Strategy of Limit, Take Profit and Stop Loss Orders

Having studied the limit take profit stop loss order, how can we make the most use of such orders? The following basic trading strategies can improve the effectiveness of limit, take profit and stop loss orders, and avoid weaknesses.

- Study the volatility of the asset corresponding to the limit, take profit and stop loss order. Previously, we suggested setting a small spread between the take profit, stop loss order and the limit order to increase the probability of the limit order being filled. However, if the traded asset fluctuates wildly, the spread may need to increase.

- Consider the liquidity of trading assets. Stop-Limit orders are very effective when trading assets with wide bid-ask spreads or low liquidity (to avoid unwanted prices due to slippage spreads).

- Use technical analysis to determine price points. It is reasonable to place the take profit and stop loss price at the support or resistance level of the asset. Technical analysis is one means of identifying these points. For example, you can use a Buy Take Profit and Stop Loss order to set the Take Profit and Stop Loss price just above an important resistance level and take advantage of the price breakout to profit. Alternatively, you can use a Sell Take Profit and Stop Loss order to set the Take Profit and Stop Loss price just below the support level to ensure that you exit the market before the market continues to fall.

A Limit Take Profit and Stop Loss order is a powerful tool whose trading capabilities are superior to ordinary market orders. This type of order has the added advantage that the trader does not need to be actively involved in the trade in order for the order to be filled. By combining multiple limit, take profit and stop loss orders, you can manage your assets with peace of mind regardless of whether the price rises or falls.

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...