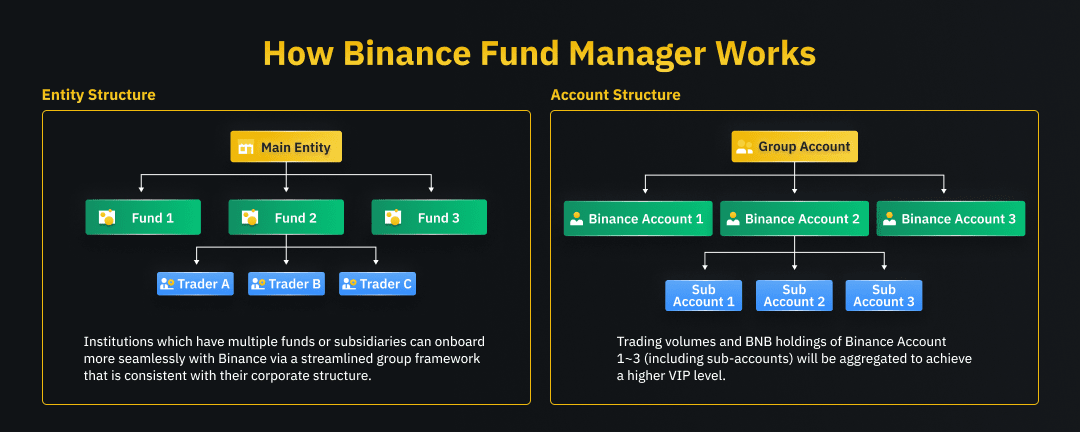

Binance Fund Manager will allow institutional clients who manage multiple funds or subsidiaries to aggregate their trading volume and BNB holding balance across multiple accounts for additional privileges.

New feature – Binance Fund Manager

Binance Institution officially launched the fund management function to provide management services for institutional clients with multiple funds/subsidiaries.

This function aggregates the trading volume and BNB holdings of funds/subsidiaries under a single group, so as to share the corresponding VIP level and VIP privileges.

At the same time, the fund/company parent account of a single group can maintain the independent attributes of its account.

After completing the corporate identity verification and compliance approval, if the overall account of a group meets a higher VIP level, the fund/subsidiary parent account of the group will enjoy the same VIP privileges, including but not limited to:

- Lower transaction fees and loan interest;

- More trading orders and sub-accounts and higher withdrawal limits;

- Get exclusive customer service and data services.

Main applicable institutions:

- New clients with multiple funds/subsidiaries;

- Add new funds/subsidiaries to existing clients;

- Existing customers who need to consolidate accounts.

After successful binding, the VIP level of all accounts will be updated on the next day after binding, and the corresponding VIP level will be shared.

If one of the subsidiary accounts is a liquidity provider, the transaction fee will be adjusted according to the corresponding liquidity provider item.

In addition, the sharing of BNB positions of funds/company under the same group is only regarded as meeting the VIP level BNB position requirements.

The BNB holdings of the respective accounts of a single fund/subsidiary determine the account rebate and Launchpad qualification.

Binance reserves all rights to modify, adjust, cancel and optimize fund management functions.

The final interpretation right belongs to Binance.

Go to Binance Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...