How to participate in a Binance Fan Token launchpad

Binance fan tokens are initially offered Binance Launchpad.

Binance Launchpad is Binance’s exclusive token launch platform, which aims to support the crypto ecosystem by offering privileged access to the most promising projects for all Binance users.

How does the Binance Fan Token launchpad work?

Once a new team or brand becomes a Binance fan token partner on the Binance Fan Token platform, the tokens are listed on the Binance launchpad – becoming available to all Binance users interested in participating in the team’s token offering.

The launchpad subscription module allows BNB holders to invest a quantity of their BNB in a sale of Binance Fan Token. The final allocation of the new token is determined by the ratio of their BNB invested to the total BNB invested by all participating users.

A maximum token allocation limit is established for each user, to ensure an equal distribution of fan tokens among all participants. Once the subscription process is complete, the token allocation for each user will be calculated approximately as follows:

Go to Binance Official Website

How to get Binance fan tokens on Binance launchpad?

Visit the Binance fan token platform, sign up for an account and complete the identity verification process.

Explore the new Binance fan token listings in the “Team Partner” area. Select the token of the team you are interested in: in this way you will be redirected directly to the launchpad page of the corresponding Binance fan token.

Calculate your participation limit. This is determined by your average BNB balance over a given period of days. During this time, it is not necessary to perform any further operations with your BNB.

Commits BNB. Once the participation limit is determined, you will be able to commit and block any amount of BNB up to the participation limit to receive Binance fan tokens.

Calculation phase. Once the commitment period for BNB is over, Binance will calculate the token allocation for each user in about 1 hour.

Finally, BNBs are deducted in exchange for Binance fan tokens. Once each user’s final allocation is determined, a portion of the blocked BNB will be deducted in exchange for tokens. Both your BNB and Binance fan tokens will be automatically transferred to your Spot wallet.

What is an ICO?

ICO is an abbreviation of Initial Coin Offering, which is interpreted as the meaning of the first coin offering, which is commonly used as an important concept for all Bitcoin and other cryptocurrency investors. Similar to an initial public offering (IPO), this is an opportunity to invest in a new company to generate future returns. However, unlike an IPO, if you participate in an ICO, you will not actually receive any shares of the company.

Advantages and disadvantages of ICOs

To better understand the concept of ICO, let’s take a look at the following example.

Let’s say you are an entrepreneur who doesn’t currently own any cryptocurrencies but has a new alternative or improvement (idea) for an existing industry. You want to implement this new idea, but you are short on funds.

At this time, rather than looking for VC venture capital or borrowing funds from a bank, you can ask Bitcoin and other cryptocurrencies investors to invest their money. In return for the investment, you pay them the cryptocurrency of your project.

Even if this project becomes popular, you will still own 100% of the project, but those who received those coins will also benefit from the increase in the coin’s value.

The best aspects and advantages of ICOs are that they are easy to get started, anyone can participate, and there are few restrictive rules. However, this last point is also probably the biggest drawback. Unfortunately, if you look at the history of ICOs, there have been a number of frequent scams, which are causing a headache.

Once a company or project team receives money from investors, there is no guarantee that they will actually deliver on their promises. It may even disappear the very next day the team receives investment from investors. That is why it is very important for investors to always do sufficient research and due diligence before participating in such projects.

Go to Binance Official Website

Process of ICO

Anyone in the world can start an ICO. Typically, your only requirement is to write a white paper describing your idea or project and develop a website to showcase your content. The next step is to convince potential investors.

Because of all the cheating that has happened in the past, new projects often ask popular crypto influencers and independent reviewers to validate the project.

In addition, project representatives and stakeholders actively use social media to answer any doubts or questions. Finally, once you have decided on your token’s pricing and distribution plan, you are ready to go.

The important thing to understand once again is that, like all cryptocurrency investments, ICOs are a high-risk, high-reward investment method (high risk and high return).

ICO projects should always be approached with caution.

Why Bitcoin is not a Ponzi Scam

When we encounter something new or something we don’t understand, we usually try to find a connection with something we don’t trust or are already familiar with. Bitcoin is no exception. Bitcoin is often mistaken for a Ponzi scheme that we are already familiar with.

What is Ponzi Scam?

So first, let’s take a look at what exactly a Ponzi scheme is and why Bitcoin can’t be a Ponzi scheme.

In general, a Ponzi scheme is when someone impersonating a portfolio manager takes an investor’s money and repays it to former investors with revenue or income. Of course, portfolio managers allocate a significant portion of their investments to themselves. This investment scam is when portfolio managers manipulate entire settings for their own benefit. The Ponzi scheme can only happen when new investors’ funds are deposited, which is used to make existing investors feel profitable.

In order for new investors to keep deposits, Ponzi schemes must meet certain criteria.

First, it must be confidential. Investors think that portfolio managers will invest their own money in a variety of revenue-generating activities, but in reality nothing is going on, so where the money goes and where the ‘return’ comes from remains a secret.

Why Bitcoin is not a Ponzi Scam

The Ponzi scheme and Bitcoin are simply incompatible. Blockchain is completely transparent. Anyone can see how much and where Bitcoin is moving by looking at the public ledger at any time.

Second, the Ponzi scheme requires complexity to obfuscate transactions for regulators as well as investors. In other words, these projects hide behind complex financial procedures and accounts. Bitcoin, on the other hand, requires minimal computer skills and is generally accessible by anyone. Bitcoin can be easily bought with fiat currency or traded with other cryptocurrencies. Once the order is placed, the buyer is now an investor in Bitcoin. Users will trade at a price set by the cryptocurrency market, not a random number created by a criminal expert.

Go to Binance Official Website

Market volatility

Finally, the Ponzi scheme gives early investors a questionable lump sum return. Since the profits from your investments are steadily coming in, you fall victim to these scams, but in fact, no one asks why the money keeps coming in. But Bitcoin is different. Market volatility means that any day trader can gain or lose at any time. Bitcoin history shows that consistent returns can only be achieved after 4 years or more. This is a much more sensible sign of a solid investment, and not the way to go crazy.

However, just because Bitcoin itself is not a Ponzi scheme does not mean that there are no people trying to abuse those who want to try Bitcoin. To avoid being scammed, it is best to only trade on trusted platforms like Binance.

Difference Between IEO and ICO

As is common in the world of technology, the cryptocurrency field has a lot of abbreviations, jargon, and slang. In the past, we looked at slang terms such as Fud and FOMO, along with some jargon related to spot trading and futures. In time, we would like to explore two key acronyms in the cryptocurrency space: ICO and IEO.

ICO is a similar concept to crowdfunding and is an abbreviation for “initial offering of coins”.

This usually includes companies or projects that publish white papers detailing ideas for emerging coins.

Investors then sponsor projects that allow for the issuance of coins and the infrastructure needed to operate them.

In return for this investment, they receive a certain number of tokens corresponding to their contribution to the project.

If this business succeeds, investors are quite likely to become wealthy, as did the early Bitcoin investors.

If the project fails, they lose their initial investment.

This method is the most common way new cryptocurrency projects are born, and given the very indefinite nature of the cryptocurrency industry in its infancy, the probability of success and failure is the same.

When looking at an ICO, it is essential to review the team behind the project and their motives, background, technologies used, and ultimate goals.

What is IEO ?

IEO is an acronym for initially offering coins on an exchange.

The big difference between ICOs and IEOs is where exactly the investment takes place.

IEO is similar to crowdfunding.

An ICO is where people invest money in a new coin or token in exchange for the coin or token itself. However, with IEO, only users of that exchange can participate, as it is distributed only through a specific exchange. Theoretically, these particular exchanges are more secure if you trust them.

Additionally, exchanges would have researched and due diligence IEOs in advance to minimize risk as much as possible.

With that in mind, in the past exchanges received coins or received incentives instead of listing them, so the reliability of coins was not guaranteed. However, now it is easier to purchase with IEO than with ICO, as all you need to do is go through the formal procedure of purchasing coins/tokens through an exchange.

| ICO- Initial coin offering | IEO- Initial Exchange Offer |

|---|---|

| You need to do some research on the project and the team to determine if the project is a scam or not. | Exchanges may have already done due diligence to protect themselves and their customers. |

| Tokens must be purchased or obtained on the project’s separate, own platform. | You buy tokens through an exchange in the same way as any other token. |

| To trade, you have to wait for the token to be registered on the exchange. | Tokens can be traded immediately after the IEO is over. |

Go to Binance Official Website

How diverse are cryptocurrencies?

There are thousands of cryptocurrencies, and more than half of them first appeared last year. Because cryptocurrencies have so many different functions and use cases, it is difficult to classify them and rank them for importance, or to distinguish whether they are a true breakthrough technology or a scam depending on the application area.

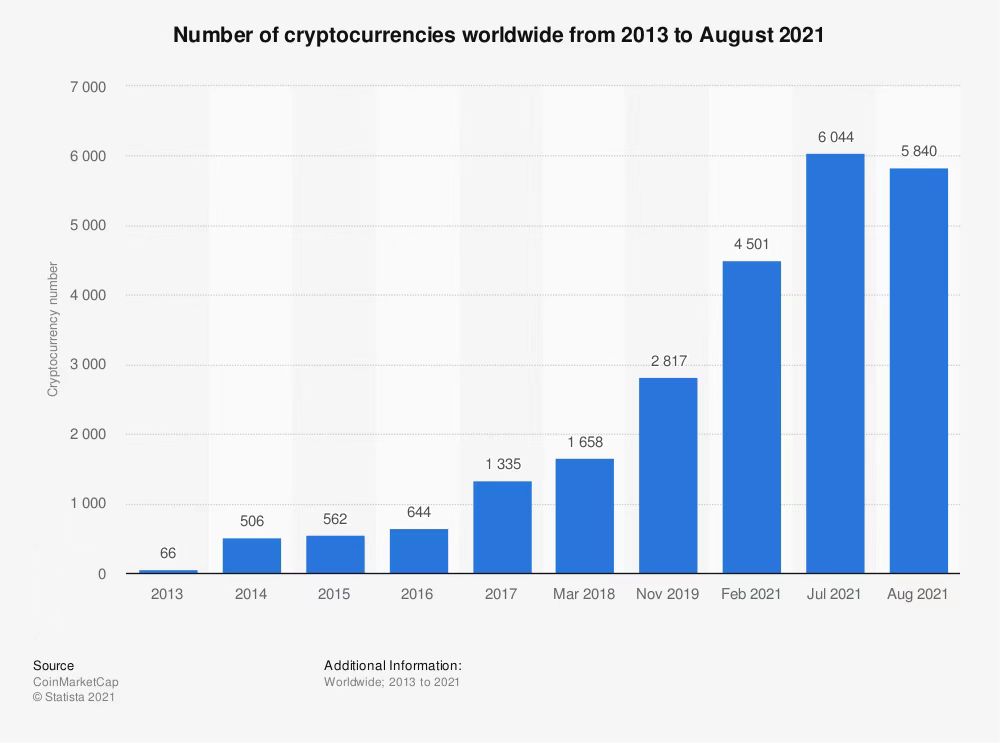

How many cryptocurrencies are there in total?

As of 2021, there are about 6,000 cryptocurrencies. Some even speculate that there are up to ten thousand cryptocurrencies. Cryptocurrency is relatively easy to develop because its creation process is open to the public. In addition, although it is true that there are many types of virtual currencies, the top 20 cryptocurrencies account for nearly 90% of the total market.

The most popular cryptocurrencies include Bitcoin ( BTC ), Ethereum ( ETH ), Cardano ( ADA ), Tether ( USDT ), Ripple ( XRP ), Solana ( SOL ), Polkadot ( DOT ), Dogecoin ( DOGE ) are there. What is interesting is that all of these cryptocurrencies have different characteristics and functions and are unique.

Classification criteria used to define cryptocurrency

In order to better understand and properly understand cryptocurrencies, professional analysts, writers, exchanges, news sites, and journalists have tried to divide the various types of cryptocurrencies into simpler categories. However, as a result, it can be said that the number of types of virtual currency depends on the classification criteria.

Examples of Cryptocurrency Types

For example, we can say that there are two types of cryptocurrencies: coins and tokens. However, someone will say that cryptocurrencies are divided into three categories. There are three types: Bitcoin, Altcoin, and Token. In addition, others will want to divide cryptocurrencies into Proof-of-Work (PoW, Proof-of-Work), Proof-of-Stake (PoS), and stablecoins. In addition, exchanges are dividing them according to to use cases. For example, for payment/infrastructure/finance/services/media and entertainment cryptocurrencies. So, in the end, there is no right or wrong in these classifications. The important thing is to define broad classification criteria that can include as many cryptocurrencies as possible.

Go to Binance Official Website

13 Most Popular Cryptocurrency Types

1. Coin

A cryptocurrency coin can be traded as a native asset of the blockchain network and can be used as a medium for transaction as well as a means of storing its value. Examples of cryptocurrency coins are Bitcoin (BTC) and Ethereum (ETH).

2. Token

Tokens share compatibility with cryptocurrencies but are effectively a different class of digital assets. In addition, tokens are different from virtual currencies in that they are built on the basis of an existing blockchain network. There are various classification criteria for tokens, including utility tokens, stock tokens, exchange tokens, and NFTs. Tokens are created through token standards, many of which are built on Ethereum. The most widely used token standard is ERC20. With ERC20, you can create interoperable tokens in the Ethereum ecosystem, dApps. However, various standards such as ERC721 and TRC20 for NFT also exist.

3. Bitcoin (BTC)

As the first virtual currency, Bitcoin still maintains its position as the No.1 coin by market cap worldwide. Bitcoin is a peer-to-peer electronic payment system that allows participants to transfer directly to each other without intermediaries. But beyond these basic features, BTC has become one of the best-performing investment assets on the market. This is because many people consider Bitcoin as a reliable value option, and some even consider it to be worth more than gold.

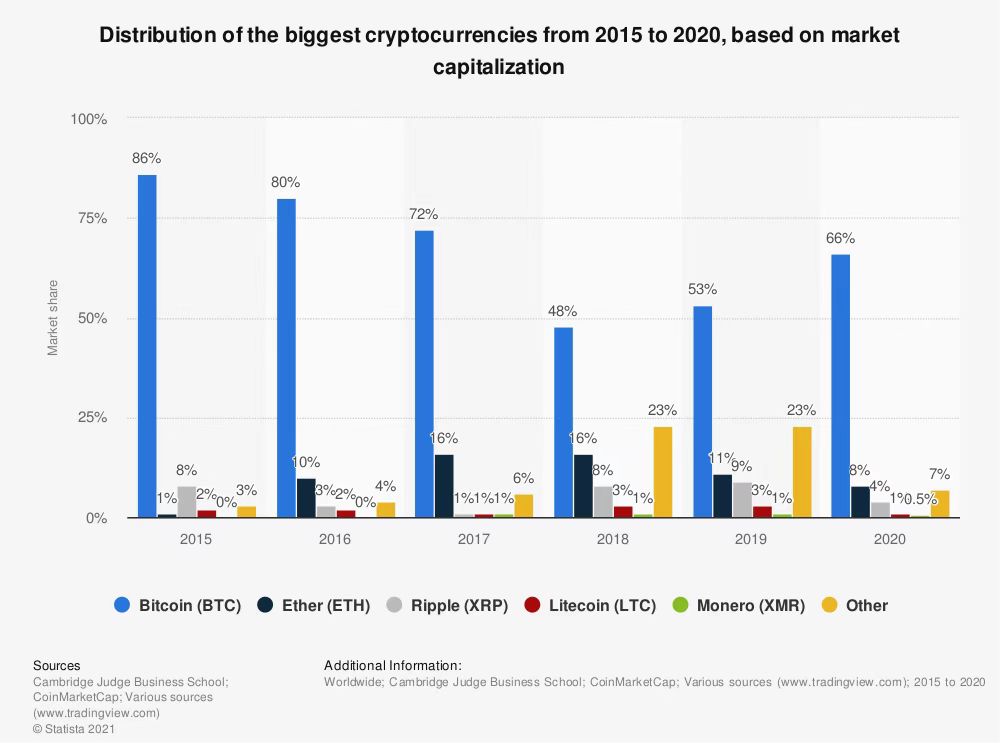

The chart below shows how dominant Bitcoin is. It accounts for more than half of the total crypto market. It is for this reason that people believe that Bitcoin will continue to maintain its dominance and favor it as a risk-free asset. Despite the considerable volatility, Bitcoin is still one of the most trusted cryptocurrencies and is gaining worldwide attention and popularity. This is why people think Bitcoin is now promoted to another class.

4. Altcoin

Bitcoin has become the precedent and standard for the creation of other cryptocurrencies and coins. Therefore, other non-Bitcoin coins are referred to as “alternative coins” or abbreviated as “altcoins. Bitcoin has its own purpose and function, but altcoins are very versatile. For example, Ethereum is the most popular “altcoin” and has different functions and different capabilities compared to Bitcoin.

5. Proof-of-work coin

Proof-of-Work (PoW) coins are another classification type of cryptocurrency. Proof-of-Work coins, as their name suggests, are created through a Proof-of-Work (PoW) consensus mechanism. PoW is a kind of cryptographic zero-knowledge proof that proves to others the degree of expansion of intrinsic computational effort. PoW cryptocurrencies include Bitcoin (BTC), Ethereum ( ETH ), Dogecoin ( DOGE ), Litecoin ( LTC ), Bitcoin Cash ( BCH ), and Ethereum Classic ( ETC ), and Zcash ( ZEC ).

6. Proof of Stake (PoS) Coins

Proof of Stake cryptocurrency refers to a cryptocurrency created based on the Proof of Stake (PoS) protocol. Proof of Stake is one of the consensus mechanisms that select validators in proportion to their holdings (crypto) and proceeds with the work. Similar to PoW, PoS is a consensus mechanism using a blockchain network to reach decentralized consensus. For example, users need to stake their stake in Ether (ETH) to become a validator. Ethereum is currently looking to move to this type of consensus mechanism with an Ether 2 upgrade. So, upon completion of this process, Ether (ETH) will be a PoS Crypto, not a PoW. PoS coins include Cardano ( ADA ), Algorand (ALGO), Cosmos ( ATOM ), Tron ( TRX ), Tezos ( XTZ ), EOS (EOS), and more.

7. Stablecoin

Stablecoins were developed with the goal of providing a trusted form of storage of value and cryptocurrencies linked to assets. Stablecoins are slightly different from other coins and tokens. In particular, although it is built on the existing blockchain, it can be said that it is different in that it can be transacted with fiat currency at a 1:1 ratio in most cases. USDT and USDC are representative examples of stablecoins, but there are countless other stablecoins.

The market capitalization of stablecoins will double in 2021, surpassing the $100 billion mark this summer. In January 2021, the market capitalization was estimated at about $30 billion, and now, about five months after that, it is estimated that the market capitalization has more than tripled based on the top 10 stablecoins.

Stability is very important in the cryptocurrency market. Therefore, stablecoins will play a very central role in the world of decentralized finance or centralized decentralized finance. Stablecoins are also said to have been a major catalyst for the development of CBDCs.

8. Central Bank Digital Currencies (CBDCs)

CBDCs are cryptocurrencies developed by central banks. CBDCs are digital currencies, but they are not cryptocurrencies. This is because it is not decentralized and is not linked to fiat money, and it can be said to be fiat money itself. So it’s no different than being a digital version of cash issued by the same central bank.

9. Privacy coin

Privacy Coins are privacy-focused digital assets and cryptocurrencies. Binance provides enhanced security features that can help keep users’ identities and activities private. In a private coin transaction, only the parties to the transaction know the details of the transaction (such as the number of coins being traded). Not only that, the public will not be able to see the balance held in the privacy coin wallet address. Examples of privacy coins are Zcash ( ZEC ), Monero ( XMR ), Dash and Horizon.

10. Meme coin

Memecoin is a cryptocurrency that was created based on memes. It appears like a joke and grows into popularity and fun. Examples are Dogecoin ( DOGE ) and Shiba Inu ( SHIB ).

11. Cryptocurrency for payment

Cryptocurrency for payment refers to a cryptocurrency that was created to replace payment systems such as Visa and MasterCard that people use today. Sometimes the developers of these cryptocurrencies use smart contracts in their implementation process. In effect, crypto for payments opens up yet another avenue for the execution and completion of transactions and transfers. Examples of cryptocurrencies for payment include Bitcoin (BTC), Bitcoin Cash (BCH), Dai (DAI), Dash, Terra (LUNA), Dogecoin (DOGE), Litecoin (LTC), Monero (XMR), These include NANO, Ripple ( XRP ), Stellar (XLM), Tether (USDT), Zcash (ZEC), and Telcoin ( TEL ).

12. Cryptocurrency for storage of value

Store-of-value cryptocurrencies are cryptocurrencies designed to store purchasing power and value or to increase it over time. Store-of-value cryptocurrencies also never lose their value or depreciate. The most basic cryptocurrency we can define as a store of value crypto is Bitcoin (and possibly Litecoin). Unlike other common currencies that have an infinite supply and can lose their value through inflation, Bitcoin only has a maximum supply of 21 million BTC. Store-of-value cryptocurrencies are particularly positive in that they are a much safer investment than other cryptocurrencies and that their value increases over time.

13. Smart contract cryptocurrency

Smart contract cryptocurrencies are cryptos designed to be programmable. So the store-of-value feature is not a key focus. Smart contracts allow the development of several different types of cryptocurrency tokens, which may or may not be interchangeable. The basic smart contract cryptocurrency blockchains are Ethereum and BSC. Unlike virtual currencies that store value, smart contracts are recognized for their utility value as a means of payment for smart contracts and dApp transactions. Examples of smart contract cryptocurrencies include Ether (ETH) and BNB.

Just like the number of virtual currencies, there are various types and forms such as coins, tokens, altcoins, and stablecoins. The best way to better understand and understand these different types of cryptocurrencies is to identify their function, purpose, and the blockchain or platform on which they are based and classify them accordingly. This can help you discover coins or tokens worth investing in, understand the nuances of different functions, and even guess the added value that different coins and tokens can bring.

The difference between IDO, IEO, and ICO

IDO (DEX Exchange Listing) is a new crowdfunding technique in which cryptocurrency projects launch tokens or coins through DEX, or Decentralized Exchange (DEX). IDO, which was created following the notorious Initial Coin Offering (ICO), allows cryptocurrency projects to easily attract funds needed for self-management or project development.

What is an IDO (DEX Exchange Listing)?

IDO means listing coins on DEX, a decentralized exchange. Unlike ICOs, where tokens are sold before listing on an exchange, IDOs are first sold tokens by listing on a DEX exchange. Therefore, the project devs do not have to raise assets for the pool, instead, the pool is created in DEX after IDO.

The background to the proliferation of IDOs is the advantage of being able to raise funds through a liquidity pool without an intermediary and, for investors, the ability to profit from instant token trading. Especially in the latter case, it is a win-win strategy that is beneficial to everyone.

Go to Binance Official Website

History of IDO Emergence

The IDO model was born after IPOs, ICOs, and IEOs. Let’s learn more about the pioneering model.

- What is an Initial Public Offering (IPO)?

- For a long time, businesses have struggled to get the funds they need to achieve their business goals. The main ways to raise funds include angel investors, venture capitalists, and initial public offerings (IPOs) in which a portion of the stake is sold.

- What is ICO (Initial Coin Offering)?

- Around 2017, as the cryptocurrency industry went mainstream, several projects sold a portion of their token supply to the public through ICOs. ICOs have had a huge impact on the cryptocurrency industry as investors flock to them for investment opportunities. Raised funds are estimated at $4.9 billion at the end of 2017 . However , due to a surge in scams and Ponzi scams, ICOs have plummeted in popularity. To replace this, in 2018, a new form of attracting funds, Initial Exchange Open (IEO), appeared.

- What is IEO (Initial Exchange Public Offering)?

- IEO is similar to ICO . However, the coins are consigned to a centralized exchange and the listed tokens are guaranteed not to be fraudulent. In addition, IEO listing screening is very strict, and there are relatively many conditions that cryptocurrency projects must satisfy. Thus, it has been trusted by investors and the cryptocurrency community. Among the projects using IEO are Polygon and Elrond , which are very popular today.

Birth of DEX Listing (IDO)

However, with the advent of DEX in 2019, many cryptocurrency projects began to be drawn to the essence of DEX as decentralization. This enabled us to launch tokens and raise funds without the problems of centralized exchanges.

As DEX became a hit, the concept of IDO was born, and Raven Protocol succeeded in listing as IDO for the first time in history. Later, IDO Launchpad was born, which provides customized services for projects planning IDO. Based on this, the popularity of IDOs as a means of attracting funds in the cryptocurrency industry has increased.

DEX listing, what are the advantages of IDO?

Both ICOs and IEOs have spawned popular cryptocurrency projects, but each has its own shortcomings. In the case of ICO, there is a risk of investment due to weak screening, and investors may suffer large losses. In the case of IEO, centralized exchanges are vulnerable to theft and hacking, so there is an intrinsic disadvantage to centralization.

From this point of view, IDO overcomes the shortcomings of ICOs and IEOs and is becoming increasingly popular in the cryptocurrency market.

- IDOs do not require any rights and there are no or minimal fees for DEX listings.

- Since DEX does not store user funds, there is no need to worry about security incidents and investors can access their tokens through individual secure wallets.

- Tokens can be traded immediately with no waiting time.

- Most DEX launchpads are based on community governance. This means that listings are decided by the community, not by a central authority.

Go to Binance Official Website

What challenges do IDOs face?

From mid-2019 to now, IDOs have become the most popular means of financing in the cryptocurrency industry. However, DEX listing has its challenges as well as its advantages.

- Pump-and-dump: Pump-and-dump is a very common problem when listing on a DEX. Since tokens can be traded immediately upon listing on the DEX, when people buy a large amount of tokens, the market price surges, and then the tokens are sold at the sharply high price, resulting in a big price difference.

- Unstable market prices: Another problem that arises from being able to trade immediately. Token swapping starts so quickly that very few investors will be able to buy tokens at the listed price.

The problems with DEX listing cannot be ignored, but the advantages are far greater. And the IDO Launchpad is working to address these issues in the near future. Considering that DeFi and DEX have grown significantly in recent years, it is safe to say that the future of IDO is bright and the DeFi project is in a position to benefit from IDO compared to ICO or IEO.

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...