Ethereum 2.0, Ethereum 1.0 and the Defi craze. Let’s know deeper about the market.

Ethereum 2.0 – Everything You Need to Know

Ethereum 2.0 is generating tremendous excitement in the world of blockchain and cryptocurrencies. It is the first time that Ethereum’s main platform upgrade is in progress since its first appearance in 2015. What will happen in Ethereum 2.0? And what does this change mean for users who own Ether or Ethereum-based assets? Here’s a compilation of what’s going to happen to Ethereum over the next few months or years.

Ethereum 1.0 – A Brief Summary

The first appearance of Ethereum in 2015 symbolized an innovative movement in the development of blockchain technology. Thanks to Ethereum, existing blockchain features such as Bitcoin have experienced significant upgrades. If Bitcoin is a digital currency that symbolizes a new way to exchange value between peers, then Ethereum has provided a way for the world to use smart contracts. Smart contracts provide a means to enforce certain conditions using code. This is how a variant of the logic of “if-this-situation-if-this-then-that” (IFTTT, it-this-then-that) works. It can be easily explained by analogy to a beverage vending machine. If you insert a coin into the beverage vending machine, a can of beverage is dispensed immediately without the need for a broker or third party to intervene. In this way, a smart contract based on Ether is programmed into the blockchain, and it can be used to manage Ether-based digital assets. For example, the Maker smart contract will automatically mint DAI when the user deposits enough collateral in the Maker Collateralized Debt Position. Although many other smart contract platforms have appeared, Ethereum is still the most popular. State of the Dapps, a website for tracking decentralized apps (dApps), says that there are only about 330 EOS dApps, while Ethereum dApps have close to 3,000.

Open Bybit’s Crypto Wallet for free

Disadvantages of Ethereum 1.0

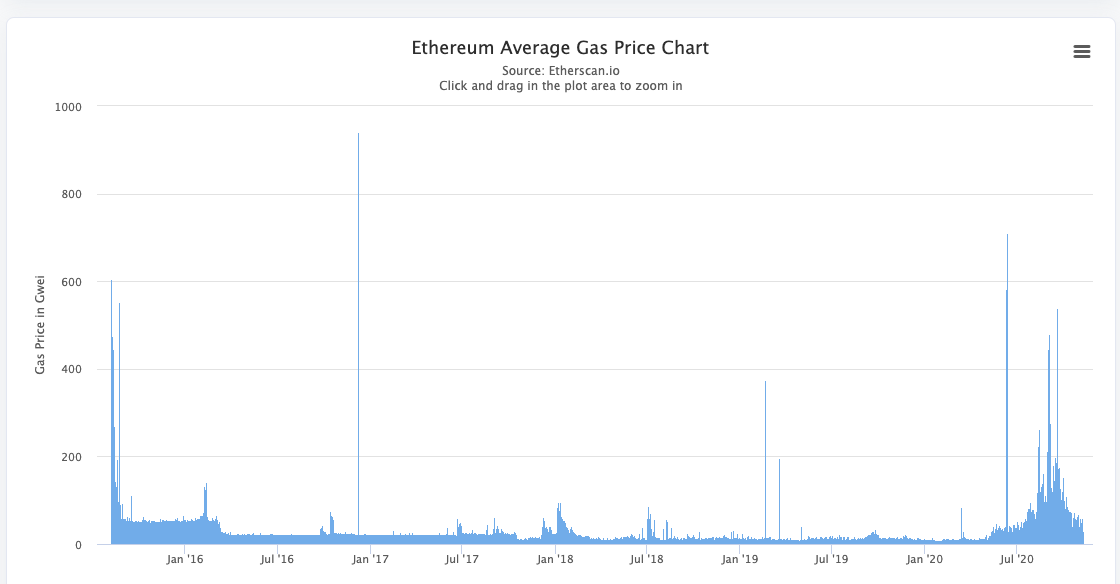

However, as Ethereum’s popularity persisted over the years, it ran into its biggest problem. It was the lack of scalability, that is, the lack of ability to quickly process high trading volumes. High transaction volume was a problem as Ethereum could only process 15 transactions per second. So, in a situation with high transaction volume and limited throughput, a backlog of delayed and delayed transactions occurs. Not only that, if the network transaction volume is high, users will pay more for their transaction. This problem became evident when the Cryptokitties craze in 2017 caused the network to slow down due to high traffic. Most recently, the DeFi segment, a decentralized financial system, has grown, resulting in a surge in Ethereum traffic. The gas price chart below illustrates this trend well.

For years, the Ethereum core development team has been trying to solve the scalability problem by combining various solutions. Ethereum 2.0 was born by reflecting only the essence of that effort.

One thing to note is that although Ethereum 2.0 is often referred to as an upgrade, it is actually a new blockchain. Therefore, Ethereum 2.0 will be released in stages. At each stage, significant changes are made to the consensus method and architecture of Ethereum, and the migration from Ethereum 1.0 to 2.0 also takes place.

Migrating from Ethereum 1.0 to 2.0

Step 0. Proof of Stake

Phase 0 is the first phase of the Ethereum 2.0 upgrade, which will take place at the end of 2020. At this stage, the new Ethereum blockchain is first iterated, which is called the Beacon chain. This will be the starting point for Ethereum to move from proof-of-work ( PoW) consensus to proof-of-stake (PoS). In Proof of Work (PoW), the miner competitively expands enormous computing power using special hardware and can mine virtual currency as a reward. In Proof of Stake (PoS), the miner turns into a validator. In Ethereum 2.0, validators stake a minimum of 32 Ether and have block proof rights, and can receive Ether as a reward for this. On November 4, 2020, the Ethereum Foundation announced that if at least 16,384 validators are staking at least 32 ETH by November 24, the first block of the beacon chain (genesis block) will be triggered on December 1. announced that it will be. If the target number of validators is not reached by November 24, the first block will be triggered 7 days after the number of validators is filled. In stage 0, the Ethereum 1.0 mainnet operates as before, and the beacon chain exists in an unconnected, parallel state. Therefore, even if you become a validator of the beacon chain by staking 32 Ether, you cannot withdraw the margin until step 1.5 is reached and the Ethereum 1.0 and Ethereum 2.0 architectures are connected.

Step 1. Sharding

The next phase, Phase 1, is scheduled to take place in 2021, and the key is to introduce sharding to the beacon chain. A shard chain is a sub-chain connected to the beacon chain. If the beacon chain is the body of a tree, the shard chain is a single long branch attached to the body. Blocks are created through proof-of-stake consensus. Although 64 shards will be launched in Phase 1, this next phase must be completed to fully utilize its features and smart contract support.

Open Bybit’s Crypto Wallet for free

Step 1.5. Ethereum 1.0 joins Ethereum 2.0

When the shard chain is activated, the Ethereum 1.0 mainnet joins the beacon chain in the form of a shard. Until then, Ethereum 1.0 will remain as proof-of-work (PoW), but after joining the beacon chain, it will switch to proof-of-stake (PoW). The Ethereum Foundation has stated that the end-user experience and dApps will not be interrupted during the transition process. This means that users who own Ether or Ethereum-based assets do not need to prepare for a transition.

Step 2. Ethereum 2.0 – Fully functional shard

At the final stage, shards will become subchains with the ability to support all types of transactions and smart contracts. Inter-shard communication is also possible. Since 64 shards can process transactions simultaneously, it could significantly improve Ethereum’s throughput. Vitalik Buterin estimated that the Ethereum 2.0 upgrade would allow the network to scale enough to process 10,000 transactions per second at the time of phase 1 implementation. So, how will all of this affect the price of Ethereum? It’s not easy to say yet, but we could see the value of Ether skyrocketing along with the DeFi market value this summer. Looking at these movements alone, if the demand for Ethereum dAPPs increases as much as the platform scalability, it can be assumed that the long-term outlook for Ethereum is very positive. Not only that, as soon as news broke that the Ethereum Foundation was recruiting for a staking deposit contract, the price of Ethereum rose by about 18% in just a few days. It is true that it remains to be seen whether the price of Ether will continue to rise during the Ethereum 2.0 implementation process. However, it is clear that the long-term prospects for the entire Ethereum ecosystem will become brighter as the platform adds scalability.

Open Bybit’s Crypto Wallet for free

DeFi craze for ETH

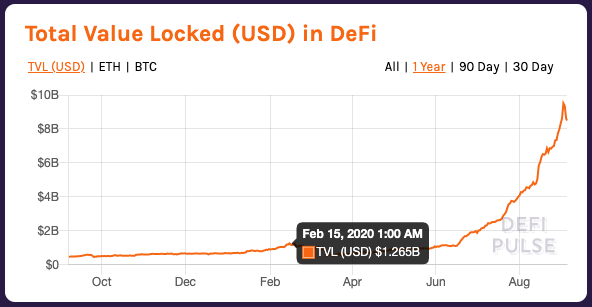

This craze, where everything goes with DeFi, is reminiscent of the ICO booms of 2017 and early 2018. Last year alone, deposits in decentralized financial applications were less than $500 million, but DeFi Pulse data showed that total deposits surged to over $9.5 billion in early September.

But, as you can see, it’s not a gradual increase. When Compound launched the COMP governance token in June of this year, the DeFi bubble quickly inflated, and after that, everyone shouted about interest farming thanks to the craze. Among them, yEarn Finance in particular drew attention, which at the time provided interest farmers with a return of more than 1,000% at a time. The YFI Governance Token is currently in the TOP 30 cryptocurrencies and at one point has risen in value to over $30,000. So, let’s take a look at what this craze means for the price of ETH and how far to believe the numbers.

Doubt everything

If you dig deeper, there are some figures that are enough to call into question. For example, it is a direct function of DeFi’s total deposit ETH price. On the surface, DeFi’s total dollar deposits have increased sixfold since early June. However, the price of ETH has also doubled since then, and people have no choice but to notice. At the end of August, dApp data aggregator DappRadar announced on its blog that it would be launching a new metric to track DeFi growth. This so-called “adjusted total deposit” method uses ETH prices from 90 days ago as a more objective measure of DeFi expansion. The 90-day measurement is rather arbitrary, but it paints a less volatile growth picture than the current ETH price alone.

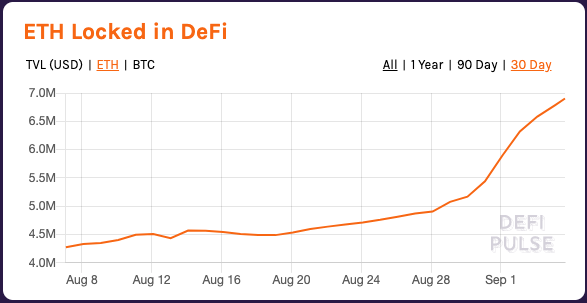

Is limited supply driving ETH prices? Is the bull market for ETH easily explained by the popularity of DeFi? The substantial earnings prospects are undoubtedly driving some demand. Also, depositing ETH into DeFi creates a supply squeeze. However, looking at the numbers, it is questionable whether this supply squeeze is actually a significant factor in ETH prices. According to DeFi Pulse, there are only 7 million ETH on DeFi. This equates to about 6% of the total circulating supply. Moreover, during the week leading up to September 4th, the number of ETH deposited on DeFi increased dramatically.

In the same week, the ETH price followed a path that followed the downward movement of the BTC price.

Therefore, it is unlikely that pure DeFi’s supply squeeze has a direct bearing on the price increase before ETH. Even considering that it is very difficult to determine the exact number of ETH deposited in DeFi. In essence, interest farming requires sequential transactions through multiple applications. For example, deposit ETH to a maker to mint DAI, put that DAI as collateral in a compound, and put cUSD in return into the liquidity pool of Curve Finance. Essentially, the same ETH is effectively recycled across multiple applications. In light of this, even the pure number of ETH deposited in DeFi appears to be questionable. Because I doubt that any data aggregator can account for the potential impact on Proof of Stake.

It is quite interesting to consider the impact these absurd DeFi returns will have on Ethereum’s proof-of-stake consensus in the future. If you currently become an ETH 2.0 staker, you can earn an estimated 4-10% return. If you participate in DeFi, you can earn up to 1,000%, who would want to pay 32 ETH to become a validator? The surge in Ethereum gas prices is also a factor, except for the fact that investing 32 ETH and becoming a validator is much less risky. The DeFi craze is driving transaction fees to all- time highs. Given that Ethereum’s scalability issues won’t be resolved until the later stages of the ETH 2.0 implementation, which we’ll probably face in a year or more, transaction fees aren’t going to drop anytime soon unless traffic drops. Thus, the fee itself could boost node validation returns above the original estimate of 10%, making the offer more attractive to potential stakers. A final and important question is how far regulators will tolerate a persistent DeFi bubble. If DeFi follows the same pattern as the ICO craze, just a few negative verdicts from the SEC could burst the bubble forever. There’s already speculation that this will happen, but I’m currently paddling hard when the DeFi water comes in. With the 2.0 upgrade approaching and the price of ETH hitting new annual highs, one thing is certain. It is the perfect weather to live as an Ethereum fan.

What is blockchain technology?

As we have seen in previous posts, money is taking more and more new digital forms these days. Cryptocurrency has emerged as a powerful alternative to fiat money. However, before exploring the strengths and weaknesses of cryptocurrencies like Bitcoin, it is important to understand the key technologies that have driven these currency innovations.

History of Blockchain

The first mention of a blockchain-like technology dates back to the 1982 paper ‘Building and Maintaining Trusted Computer Systems Between Mutually Untrusted Groups’. Additional updates and improvements to the concept were described by several people in 1991 and 1992. However, the modern definition of blockchain has been conceptualized by a group or figure under the pseudonym of Satoshi Nakamoto. It all started when Nakamoto, widely known as the father of blockchain, cryptocurrency, and bitcoin, published his white paper ‘Bitcoin: A Peer-to-Peer Electronic Money System’. In January 2009, Nakamoto released the first version of the Bitcoin software, mined the first blocks, and officially launched blockchain technology. gave birth By mid-2010, he himself improved and updated the source code. It has since transferred control and ownership of all aspects of the project to an active and well-known developer in the Bitcoin community before disappearing. His last move was in an email in 2011, where he stated that Bitcoin was “trusted to the right people.”

Function of Blockchain

At its most basic, the blockchain acts as a digital ledger. A ledger is simply a record of transactions. In Digital Payments and Currencies, we discussed the underlying methods or mechanisms that banks use to prove ownership of their customers’ funds. When you deposit money in a bank, you no longer have physical possession of the funds and the only proof that the funds are mine are records maintained by the bank. Each time you deposit and withdraw money into your account, a different record is automatically applied to it. However, while the basic functionality is the same as any standard ledger (primarily recording data or transactions in chronological order), several key elements set it apart from traditional blockchains.

While the digital ledger of a bank or the physical ledger of a small business can be stored centrally under the control of a business or business owner, blockchain is decentralized and decentralized. This means that there are multiple copies in multiple locations and no single entity has full control or ownership of the blockchain. This digital ledger is maintained as a joint venture of individuals around the world and transactions are recorded in batches called blocks. Blocks contain information such as the date and amount used and record the parties involved in the transaction. However, instead of using real names like banks do, blockchains use digital signatures that basically function as usernames. These blocks of data are called blockchains because they are linked together to form an ever-growing chain of verified transactions.

Security of Blockchain

You may have a question here. Wouldn’t it be easy to create a fake block full of transfers? Say it. There is no bank or central institution that can prevent this from happening. This is a very valid concern, but one that is perfectly addressed by the design of the system. In fact, anyone can create fake blocks, but certain requirements must be met before they can be added to a chain of verified and confirmed transactions. A single transaction must first be forged before a forged block can be added to the chain. The public key infrastructure system, the concept introduced above, prevents this from happening. Each user has a private key and a public key. Every transaction initiated by an individual is signed with a unique private key that only you can access. Other users on the network can verify that the signature is authenticated with a matching public (publicly available) key. In other words, the malicious user does not have the private key to sign the transaction, so it is impossible to authenticate the transaction. Invalid or repeating transactions are simply rejected by the system. Since it is impossible to attack the system by forging blocks or transactions, the only alternative would be to modify blocks that are already part of the blockchain. Fortunately, the system also has a way to prevent this from happening. A block not only contains the aforementioned transaction data, but also contains a unique code to distinguish it from other blocks. This code is generated by a cryptographic hash function, which is basically a mathematical process that converts all the data in a block into a string known as a hash value. However, not only the data in a block is used to generate the final hash value of that block. The final hash value is generated from the combination of the block’s data and the hash value of the previously verified block in the chain. In essence, each block is perfectly connected to the before and after blocks. Modifying a single value in a block immediately breaks the logic of the entire chain as the hash value is not correct. For this attack to work, not only would the entire chain need to be modified, but most copies of the blockchain present on the network would have to be altered. Given the time and resources required to do this, an attack is virtually impossible.

Purpose of Blockchain

Perhaps the most well-known use of blockchain technology is cryptocurrency. Bitcoin will be covered in the next article to further explain the value and usefulness of blockchain. Given that the core of this technology is a way to reliably store data in an open and secure way, there are many other applications. Smart contracts, financial services, commodity trading, video games, domain names and even insurance systems are all powered by blockchain technology. It is being redefined. It’s a complex idea that keeps evolving.

Open Bybit’s Crypto Wallet for free

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...