Digital asset custody firm BitGo has partnered with the NEAR Foundation to support the latter’s foray into institutional investment to expand the ecosystem. In a statement released Tuesday, the institutional custody company announced that it will support NEAR Foundation’s protocols and assets through qualified custody services. Institutional investors will be able to escrow and stake NEAR tokens through hot and escrow wallets on BitGo. BitGo will also be the custodian of the NEAR vault, but its holdings have not yet been disclosed.

U.S. stocks rallied across the board and cryptocurrency markets rallied on Tuesday as speculation grew that the market was about to bottom after investors assessed the outlook for earnings. BTC broke the $23,000 mark and corrected downwards after reaching a local peak near $23,800. At the time of writing, the largest cryptocurrency by market cap is trying to regain lost ground at $23,500 after gaining 6% in the past 24 hours. A bullish trend line is forming with support near $22,700 on the hourly chart of BTC. And BTC’s technical indicators have turned up, suggesting that the bulls are picking up the pace, at least in the short term.

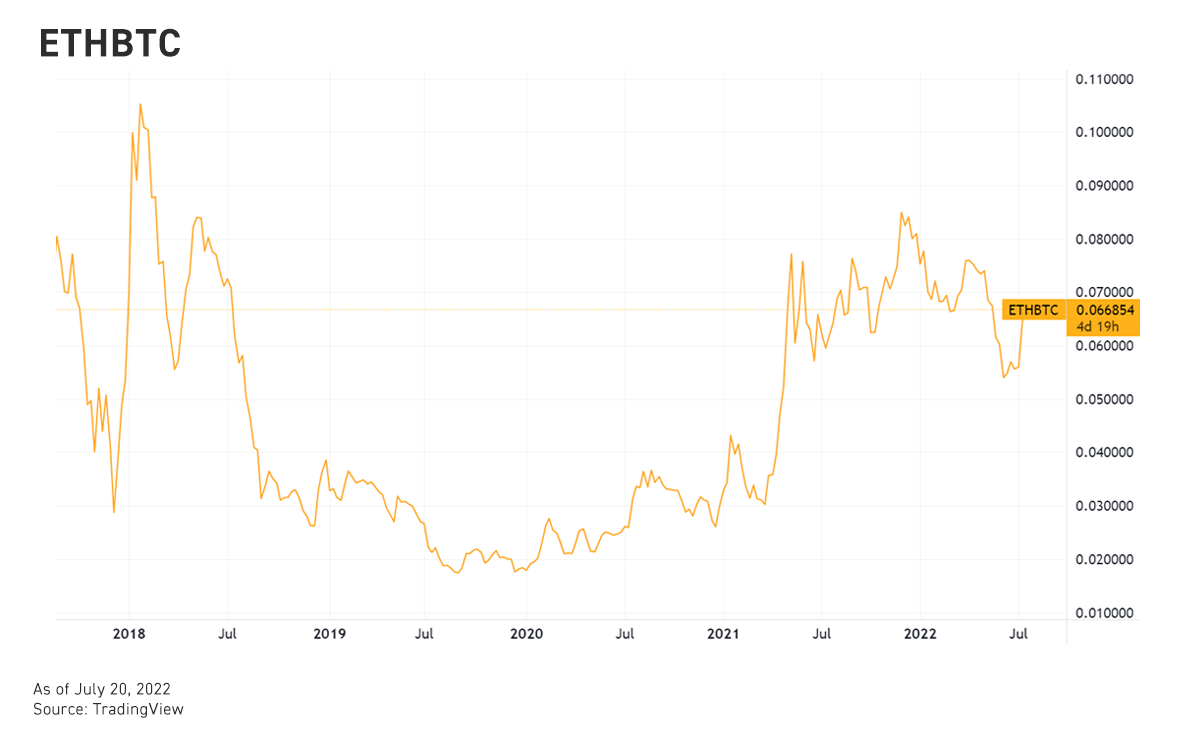

While BTC has surged 20% over the past week, it still underperforms ETH, which surged nearly 50% over the same period, successfully breaking the $1,600 mark. If the current momentum continues, ETH bulls may even look towards the $1,800 mark in the near future. Meanwhile, the ETH/BTC pair surged 40% to 0.07, soaring to levels seen in mid-May before several major crypto companies thundered. If history is anything to go by, we need to be wary of optimism, as during the 2018 bear cycle, the price of ETH unexpectedly plummeted to a quarter of its peak after the ETH/BTC pair rebounded by 75%.

Driven by the renewed investor confidence and the bullish momentum brought about by the upcoming Ethereum Merge upgrade, most of the major non-mainstream currencies have turned for the better, and most of them are on the rise. mainstream currency.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...