Binance Futures Quarterly Report: Q2 2022

Binance Futures introduced a series of trading system updates in the second quarter of this year to improve performance and stability.

Binance promotes the launch of a variety of USDT-M, COIN-M, BUSD-M perpetual contracts, and strive to create a more diverse investment portfolio for trading users and investment users.

Binance also enhances the user experience by releasing new products and services designed to help cryptocurrency traders profit.

The second quarter of the year saw a sharp rise in volatility in the cryptocurrency market. The general economic environment has led investors to seek conservative and safe investments and divest into riskier assets such as cryptocurrencies.

Binance Futures has made significant improvements in Q2 2022, allowing traders to use the right tools to help users profit even in the toughest market conditions. Binance upgraded the system to an institutional-level trading platform, added new trading pairs in response to user demand growth, and incorporated new features, such as time-weighted average price (TWAP) trading algorithms, to improve user experience.

All the efforts are for the benefit of users and the global community of cryptocurrency traders. Binance is proud of the milestones Binance Futures reached in the second quarter of this year, and invite you to follow the results and see how Binance continues to improve the world’s largest cryptocurrency derivatives exchange through trading volume.

Go to Binance’s Official Website

Better, faster, stronger

Binance Futures implemented a series of trading system upgrades in the second quarter of this year to improve performance and stability. Binance has also made major updates, including various margin levels and leverages for U-margined and coin-margined perpetual contracts to meet market demand. More importantly, Binance has extended the trading fee discount for BUSD-M perpetual contracts to help new and existing users maximize their trading strategies.

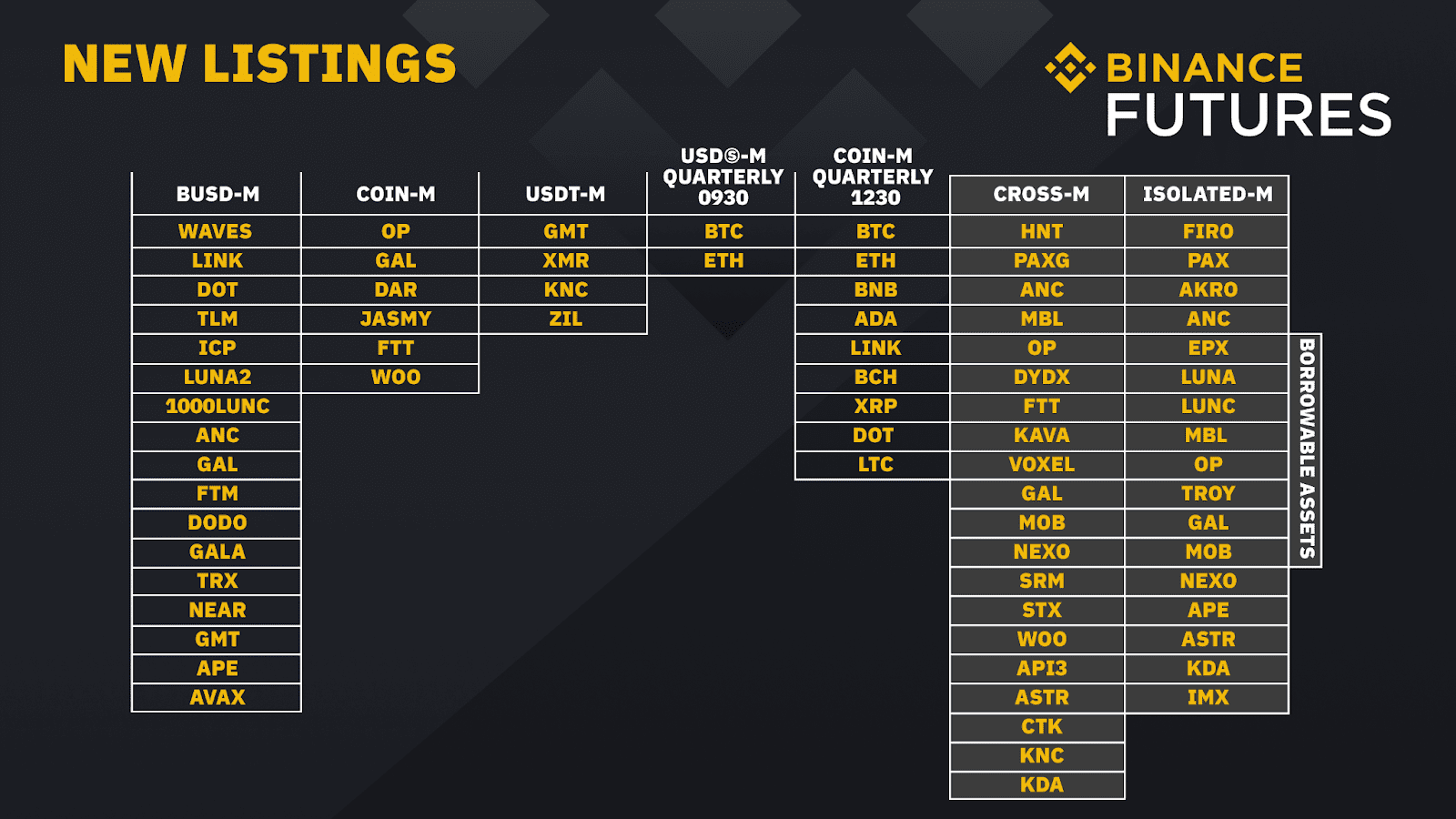

In Q2 2022, Binance will release six new USDT-M perpetual contracts, four new COIN-M perpetual contracts, and 17 new BUSD-M perpetual contracts on Binance Futures, dedicated to creating new opportunities for traders and investors. A more diverse portfolio. Binance will also launch a number of products, including two new quarterly 0930 U-margined perpetual contracts and nine new second-quarter 1230 coin-margined perpetual contracts. In addition, Binance has added 20 new leveraged assets to cross-margin accounts and 17 new leveraged assets to isolated accounts to accommodate the rapidly growing ecosystem.

Binance is committed to helping cryptocurrency traders profitably by launching not only new products, but also new features and services to improve the user experience. The goal is to provide enterprise-grade tools that allow users to gain greater insights and market timing.

The range of new functions added to Binance Futures covers trading algorithms, sub-account functions, liquidity analysis tools, and more:

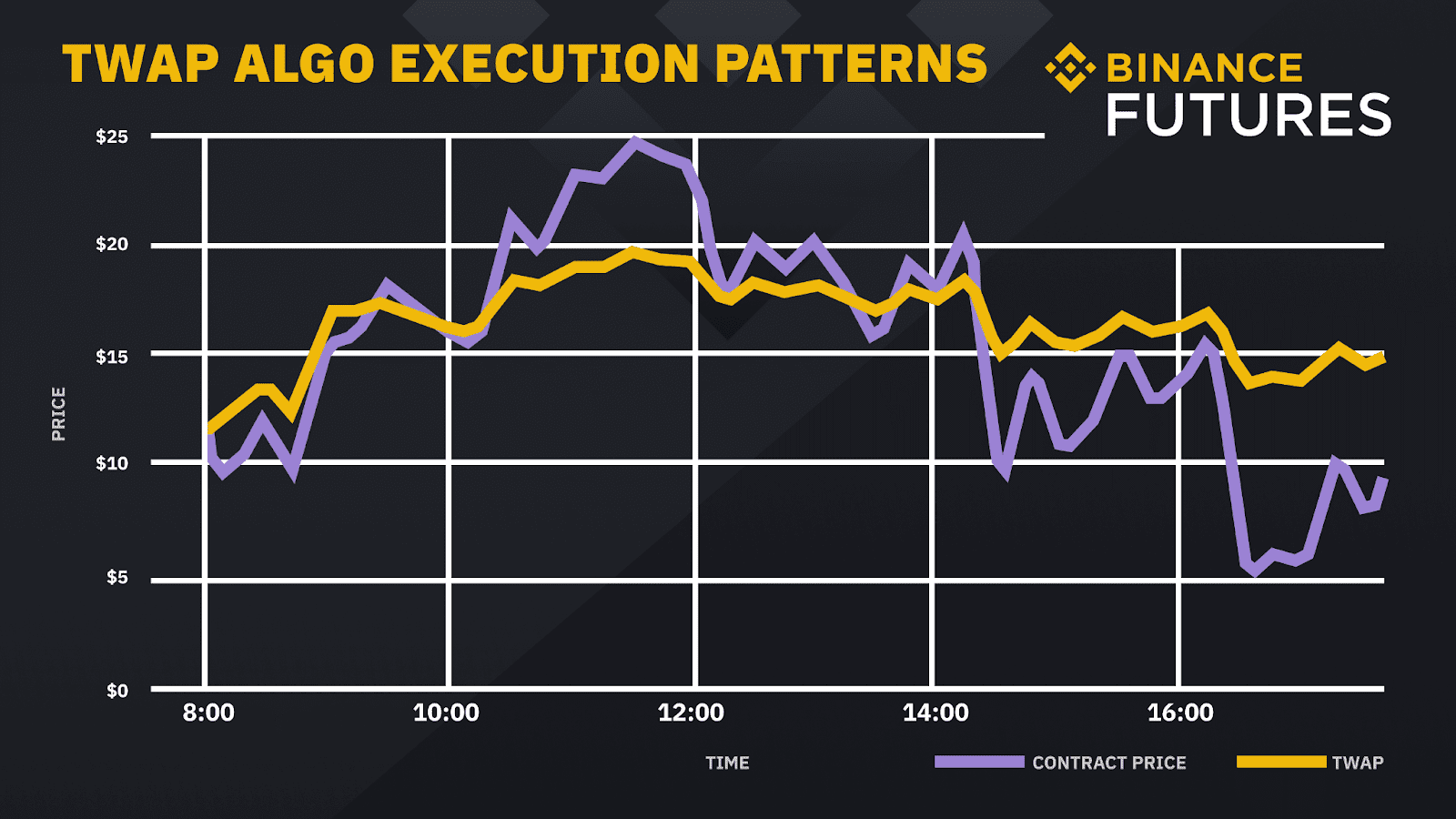

Time weighted average price

The so-called time-weighted average price, or TWAP for short, is a trading algorithm designed to keep the average strike price as close as possible to the time-weighted average price over a specific period. By splitting orders into regular intervals, it allows traders to execute large orders while mitigating the impact of the market.

Go to Binance’s Official Website

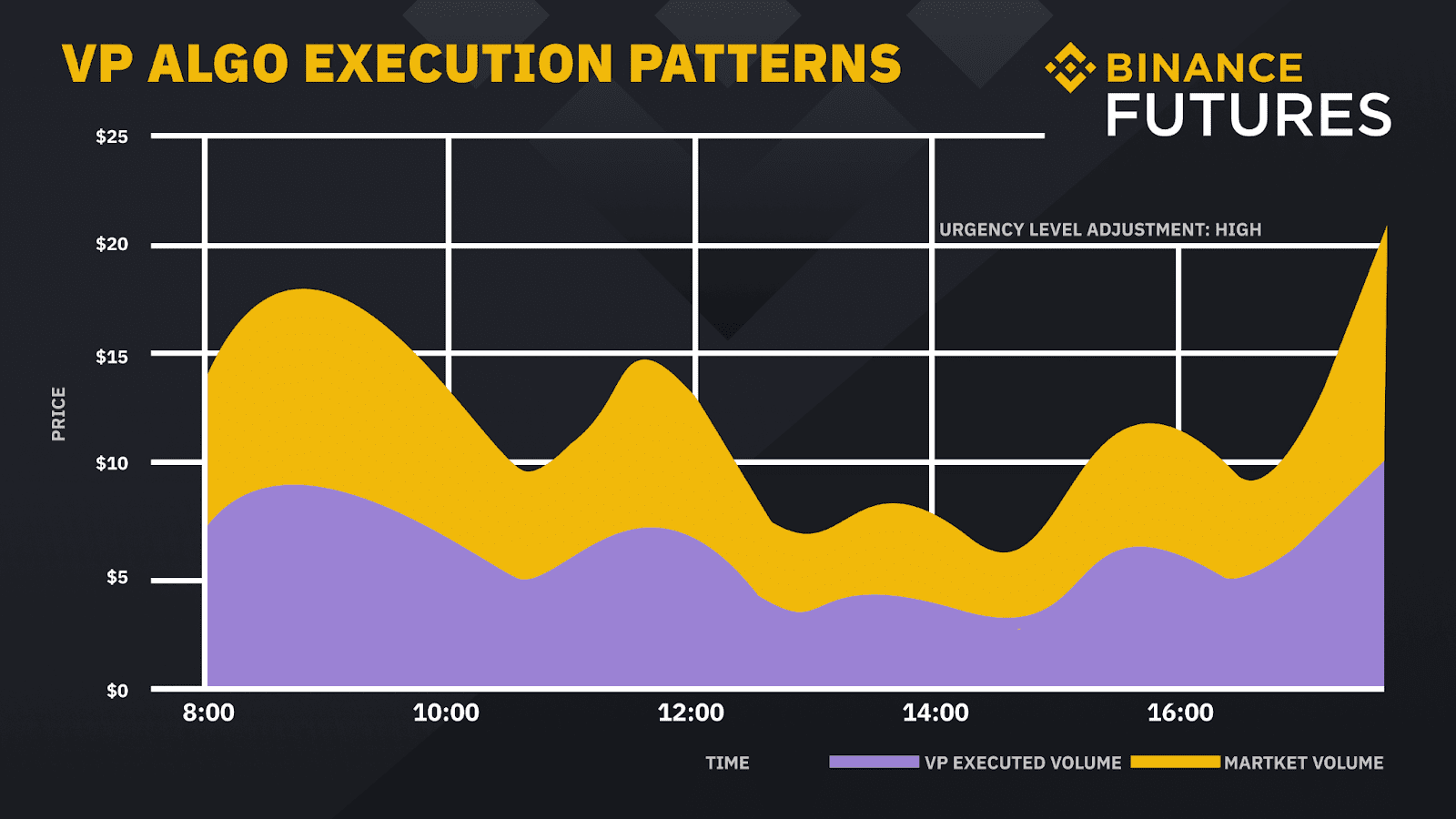

Volume share participation

The so-called volume share participation method, also referred to as VP, is an algorithm that uses the probability of opportunity to execute a large number of orders in a specific order and proportion, aiming to participate in the target transaction volume level by segments to be close to the real-time market transaction volume ratio.

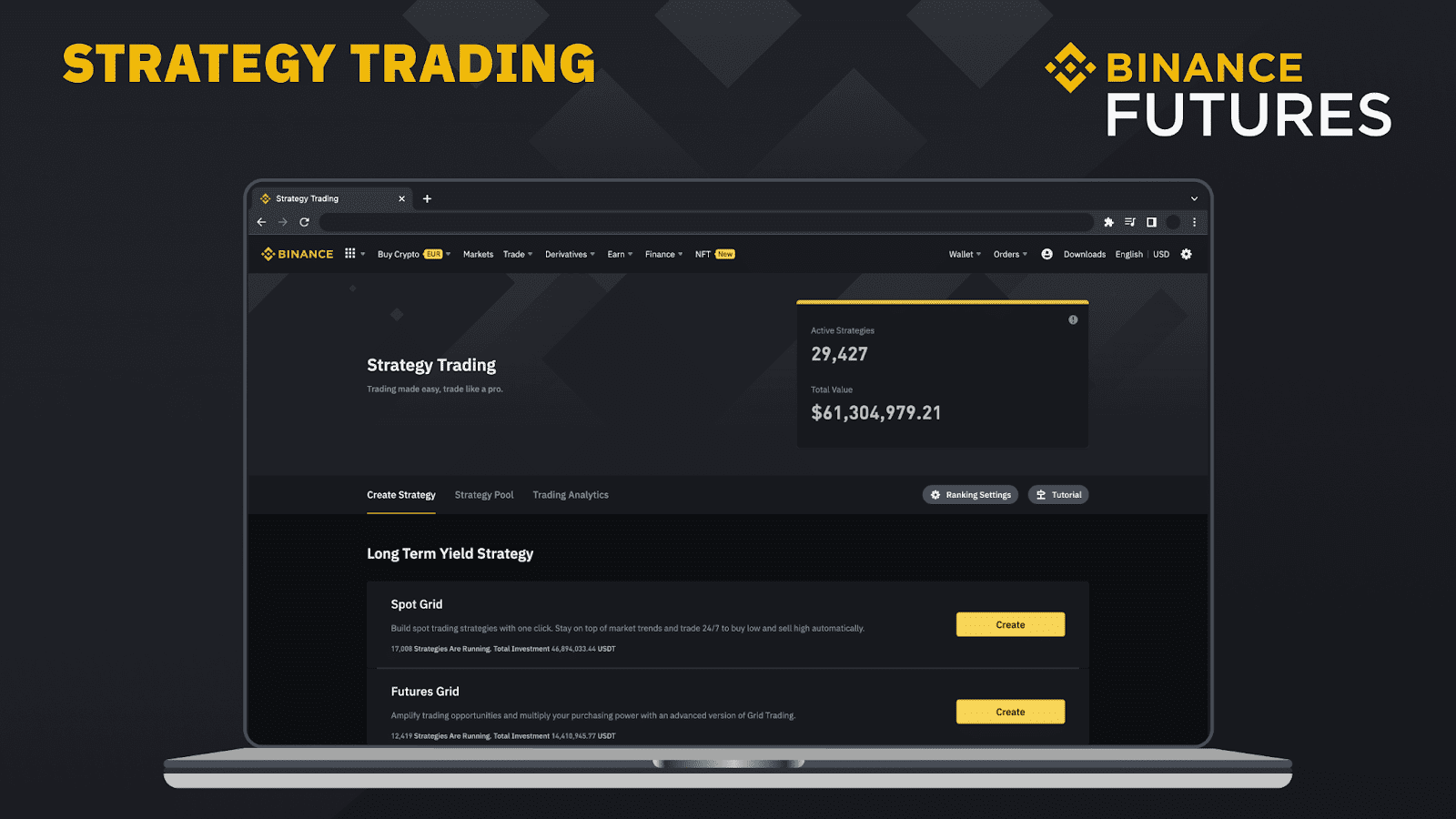

Strategic Trading

The Strategy Trading landing page summarizes grid trading, TWAP, VP, and other automated algorithmic trading capabilities. It can display the contract grid trading strategy for users in an all-round way, and at the same time allow users to copy different parameters to use according to the performance and adoption of the trading method.

Go to Binance’s Official Website

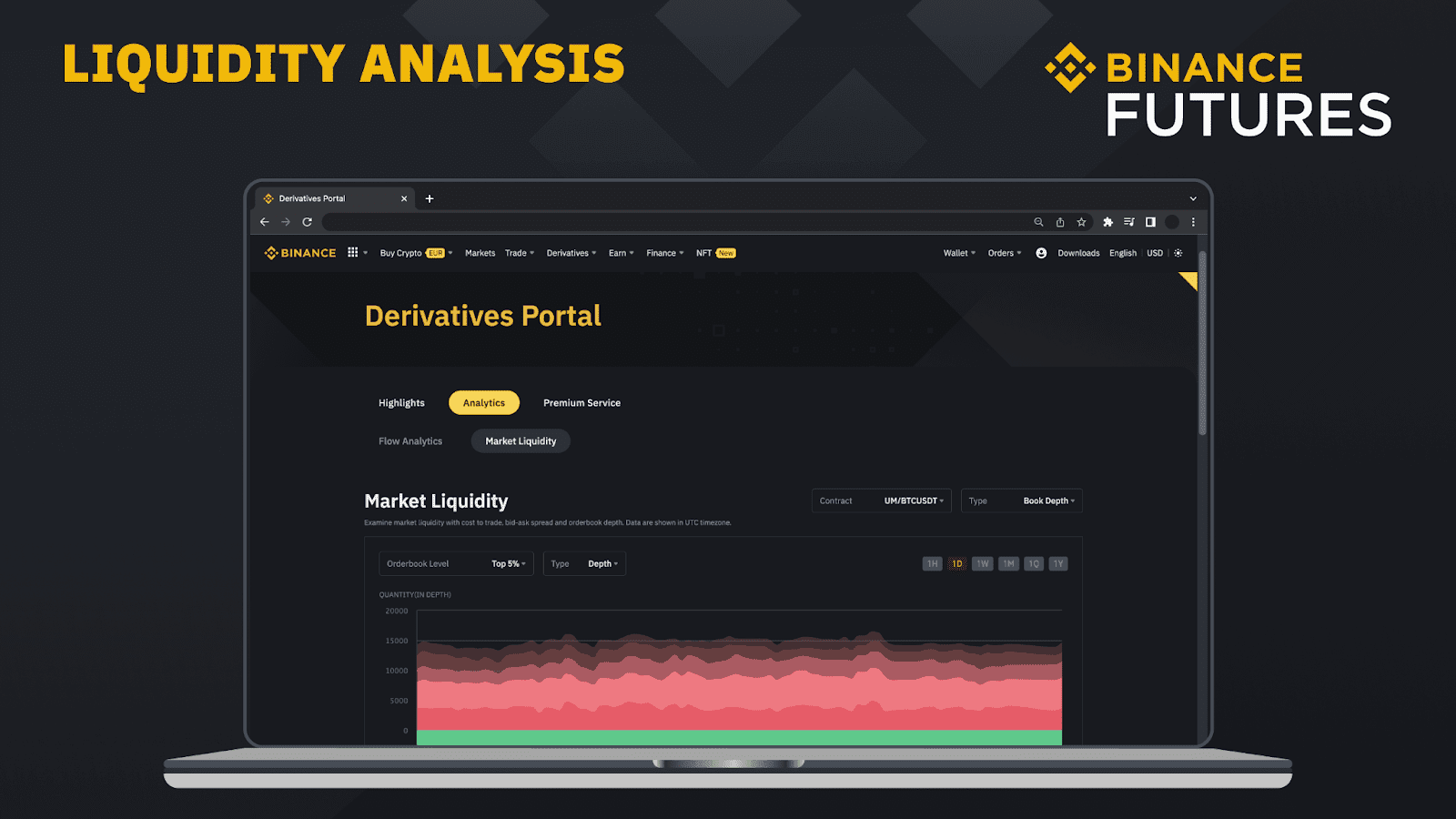

Liquidity Analysis

Liquidity analysis shows you custom transaction costs, bid-ask spreads, and a depth map of the order book for U-margined contracts and currency-margined contracts selected on Binance Futures, which helps frequent traders visualize and find the highest liquidity trading pairs to support higher market orders.

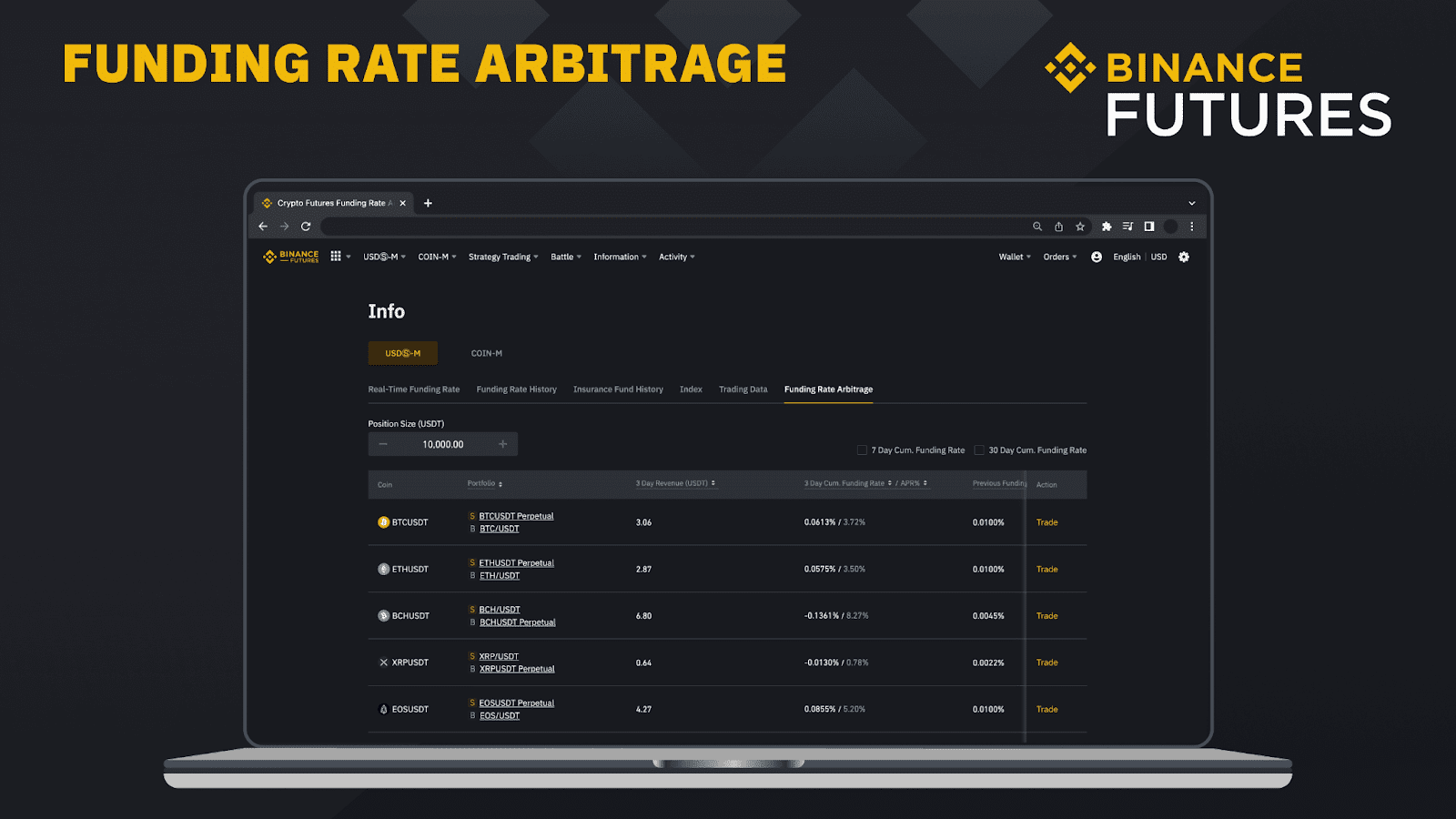

Funding rate arbitrage

Funding rate arbitrage will display updated information, including the accumulated funding rate, APR, spread rate and open interest of the past 3 days, 7 days and 30 days, for you to deploy arbitrage strategies. It can provide users with arbitrage information on perpetual futures contracts, as well as market spot equivalents.

Go to Binance’s Official Website

Historical Market Data

The historical market data page allows you to find K-line charts, aggregate transactions, transactions and contract order book data in the past two years, allowing users to directly access the page or download historical market data through API requests.

Binance API

The Binance API page provides Binance API users with an overview of all available services, enabling fast and smooth access to API files for different products and services. At the same time, the quick API function allows users to create API shortcuts, automatically connect to third-party API agent platforms, and assign specific account permissions to API agents.

Go to Binance’s Official Website

Portfolio Margin

Binance Portfolio Margin Program integrates contract and leveraged margin balances, as well as more than 200 valid cryptocurrency collaterals. It is designed to allow traders to combine supported crypto assets with U-margined, coin-margined contract accounts, and margin accounts as a single joint collateral to determine account equity, margin balances, and maintain margin requirements for cross hedging and risk Management optimization.

Sub account

The sub-account function is now available in the Binance app, allowing master account holders to view the asset settlement and balance of selected sub-accounts or all sub-accounts anytime, anywhere.

Open order modification

Turning on the order modification function is available for COIN-M perpetual contracts, allowing users to adjust the price or quantity through open orders, candlestick charts or Binance API to further modify unfilled orders.

Go to Binance’s Official Website

Bringing together the cryptocurrency community

Binance Futures has 29 million active users and will launch a number of trading competitions in Q2 2022 to unite the global cryptocurrency trading community.

The most iconic and most anticipated trading event is the Contract Tournament. With more than 90,000 participants and nearly 1,200 participating teams, the prize pool is as high as $300,000 and 1,400 NFT assets, and one team has set a new transaction volume record.

Binance also congratulates USDT perpetual contracts such as JASMYUSDT, WOOUSDT, and BNXUSDT for joining Binance Futures, and to celebrate, Binance is giving away 50,000 BUSD for every promotion. General and VIP 1-2 users are eligible for bonus pool distribution as long as they trade the designated contract through the tournament.

Even though the market outlook for the second quarter of the year was not optimistic, the overall participation rate for the contract tournaments still greatly exceeded the expectations. Binance would like to express the sincere thanks to all the users, as your huge trading volume solidifies Binance Futures’ position and reputation as the world’s largest cryptocurrency derivatives exchange.

Binance Futures Insights

Binance Futures Watch found that public interest in the BUSD-M perpetual contract increased significantly in the second quarter of the year. BUSD has become the third largest stablecoin in the cryptocurrency market, and the addition of 17 new BUSD-M trading pairs appears to be the main reason for the surge in trading volume.

Total BUSD-M perpetual contract transactions in Q2 2022 averaged $3.8 billion per day, starting April 1 at $2.58 billion and closing June 30 at $6.62 billion.

Despite the increasing popularity of BUSD-M perpetual contracts, USDT-M perpetual contracts in Q2 2022 still account for 91.97% of the total trading volume. The average daily trading volume of USDT-M perpetual contracts in the second quarter of this year was $43.52 billion, with a record high of $121.41 billion on May 11.

The perpetual contract with the largest trading volume on Binance Futures in Q2 2022 is BTCUSDT, with a record trading volume of over $1.28 trillion. In second place was the ETHUSDT contract with a trading volume of $549.75 billion, followed by the GMTUSDT contract with a total quarterly trading volume of $232.28 billion.

Relatively speaking, the perpetual contract 1000BTTCUSDT with the lowest trading volume is only $8.791 million, and YFIIUSDT is $154.62 million.

Although the total trading volume of Binance Futures has exceeded $5.09 trillion, the open interest has still declined significantly. This indicator helps to understand the quantitative performance of long and short positions in U-margin perpetual contracts. The Q2 2022 initial market totaled $11.68 billion and ended with only $5.29 billion, a 54.70% decrease, related to the market momentum seen during this period.

Interestingly, most traders remain optimistic about their investment confidence in the MEME, infrastructure and metaverse market sectors.

The combined long/short ratio of 1000SHIBUSDT and DOGEUSDT is as high as 3.75. The long/short ratio is 3.50 for the infrastructure sector, which includes ANKRUSDT, TKUSDT, CVCUSDT, DENTUSDT, GALUSDT, GTCUSDT, HNTUSDT, JASMYUSDT, LPTUSDT, and NKNUSDT. Meanwhile, the long/short ratio of trading pairs in the Metaverse sector such as ALICEUSDT, AXSUSDT, GALAUSDT, GMTUSDT, MANAUSDT, SANDUSDT and TLMUSDT remained at 3.26 on average.

Go to Binance’s Official Website

Step forward, progress upward

As the cryptocurrency industry continues to expand, Binance Futures plans to provide traders with the most comprehensive set of financial tools to help investors position themselves in the market. Binance is committed to improving the trading system to meet the continuous growth of retail and institutional needs, and to be at the forefront of the trend to respond to the trend of financial product demand as soon as possible.

The team also strives to create educational content for all of the products and services so that new traders gain the knowledge they need to trade responsibly and succeed in the industry.

If you are passionate about cryptocurrencies and the mission, go to the Career Opportunities page to find out how to join Binance, or check out the latest vacancies.

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...