The bill aims to create tax exemptions for transactions that are either under $50 or have a capital gain of less than $50.

On Tuesday, the U.S. Senate introduced a bipartisan bill aimed at simplifying the use of cryptocurrencies in everyday payment scenarios by relaxing disclosure requirements for small transactions. The bill, called the Virtual Currency Tax Fairness Act, proposes applying tax exemptions to transactions under $50 or capital gains of less than $50. One of the bill’s sponsors, Sen. Pat Toomey (R-PA), noted that “digital currency is expected to become a part of everyday life in the United States,” but “current tax laws impede that progress.” Virtual Currency Tax Fairness Act The bill also has bipartisan support in the House of Representatives, following a similar bill introduced in the House in February to exempt individuals from crypto transactions with earnings below $200.

The main cryptocurrency market managed to reverse some of its losses on Wednesday as investors anticipated a surge in macro uncertainty and began to prepare for the fallout from an expected 75 basis point rate hike by the Federal Reserve.

Against this backdrop, BTC has recovered after a local low near $20,500. At the time of writing, the largest cryptocurrency by market capitalization is now sitting above support at $21,000 after a modest gain over the past 24 hours. However, BTC’s upside gains are likely to be capped by overhead resistance in the $21,500-$21,700 range. Additionally, if key technical indicators are capped in bearish territory, BTC could turn down and retest support at $20,500.

Compared to BTC, ETH has seen an even bigger intraday gain, up 1.9% over the same period, and is currently trading above $1,450. Ethereum’s MVRV Z-score has dropped below 0, indicating that a large portion of the ETH supply has been locked up with significant unrealized losses. With a market bottom imminent, a Z-score in negative territory usually represents a good buying opportunity. Most major altcoins have turned losses into gains, with ETC leading the recovery with double-digit percentage gains.

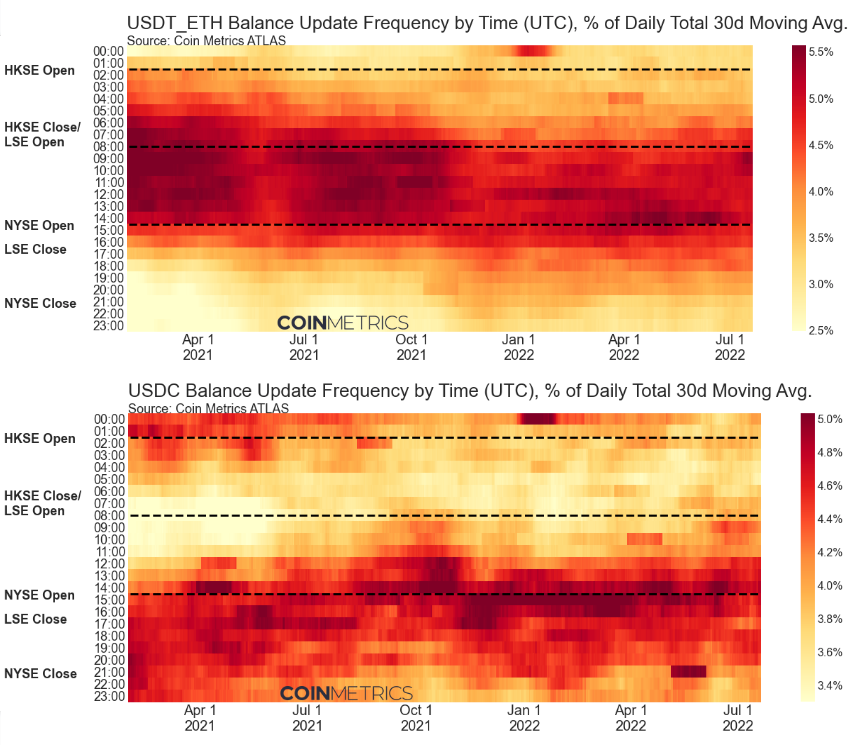

Meanwhile, new research from CoinMetrics reveals differences in the active periods of stablecoin activity around the world. USDC activity is more concentrated during U.S. trading hours, while USDT trades tend to occur during Asian and European trading hours. Other stablecoin trading activity tends to be more active during U.S. trading hours.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...