Miami has always been at the forefront of cryptocurrency adoption and technological innovation, and this time is no exception, becoming a pioneer city for minting NFTs. On Thursday, Miami Mayor Francis X.

Suarez said that 5,000 NFTs will be released later this year in partnership with prominent institutions in different industries.

The specific plan is that the NFT project will be helmed by Time magazine to determine the strategy and drive the project execution, Mastercard will provide exclusive offers, and Salesforce will control the minting and main sales process.

The Miami NFT Collection is designed to reflect “the vast diversity of the city” and unlock unique experiences for holders.

The rally in the main cryptocurrency market drew more attention, with traders reducing bets on rate hikes amid a gloomy economy.

Major digital assets rose for three straight days, BTC breached real prices for the second time in two weeks, and ETH surged toward the $1,800 mark, despite a growing number of data indicators signaling an imminent recession.

At the time of writing, BTC is consolidating above the $23,500 mark after gaining 2.4% over the past 24 hours.

A short-term converging triangle is forming with resistance near $24,000 on the hourly chart of BTC.

A smooth break above this level could spark stronger bullish sentiment, propelling BTC toward $25,000.

Similar to BTC, ETH briefly touched a multi-week high near $1,780 before a muted downside correction.

The second-largest cryptocurrency by market cap is gaining a foothold above the $1,700 mark after gaining 3.6% over the same period.

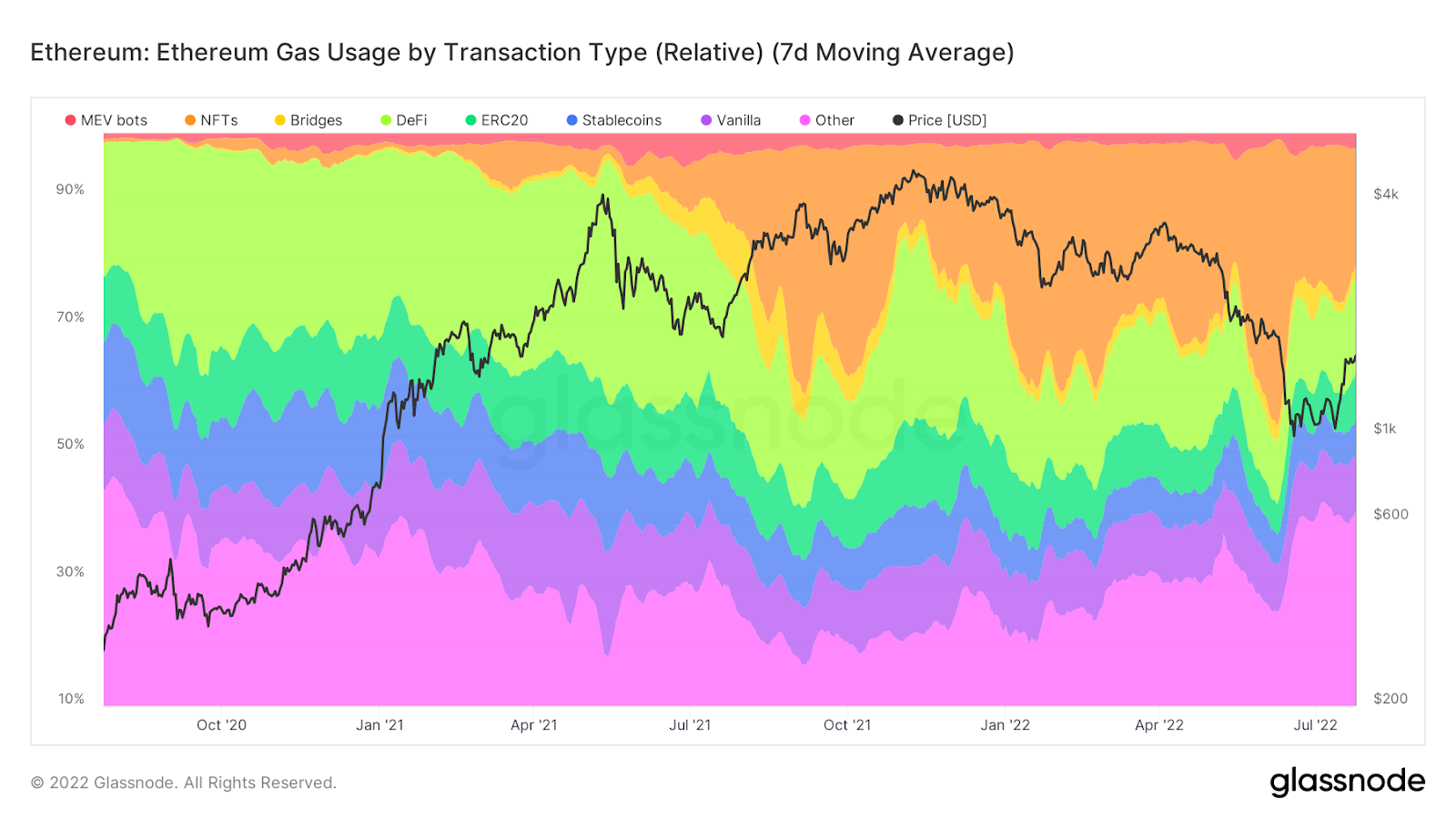

A breakdown of ETH gas fees by transaction type shows that the relative gas consumption of NFT activity has increased by 6.2% since November, indicating undiminished interest from traders in the NFT space.

On the other hand, the implosion in the cryptocurrency space meets the turbulent macroeconomic environment, which has almost halved the share of fuel consumption of DeFi applications.

This data is in line with the plummeting market capitalization of DeFi protocols, which have shrunk by 60% in the last quarter.

Fortunately, the relative strength of DEXs and the growth in synthetic asset adoption suggest that there is always hope for recovery.

Most of the major non-mainstream coins remained on the rise, with the exception of ADA and DOT, both of which fell slightly over the same period.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...