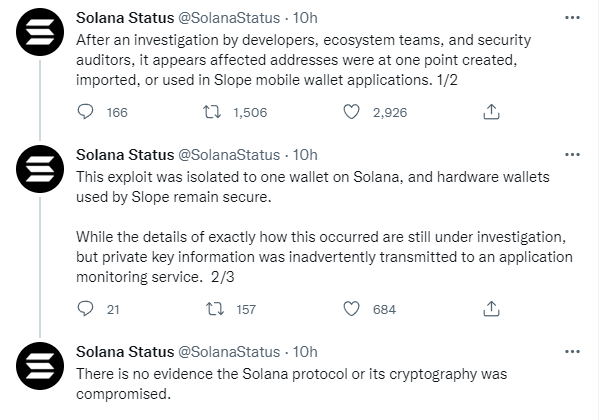

An investigation into the hacking of the Solana network revealed that the affected addresses were “created, imported or used in the Slope mobile app.” The investigation, led by a group of Solana developers, confirmed that the information breach did not stem from a bug in Solana’s core code. Instead, there is evidence that the seed phrases generated in Slope’s hot wallet were compromised by insecure storage methods. Shortly after, Slope Finance released a statement confirming that some wallets on the platform were indeed compromised during the attack. Slope claims that the team has some speculation about the root cause of the leak, but has yet to come to a definitive conclusion.

U.S. stocks snapped a two-day losing streak as better-than-expected corporate earnings and economic data tempered regional tensions. Since this geopolitical provocation did not escalate into a military conflict, major digital assets remained in a range-bound state. Part of the reason for the lack of volatility may be the lack of market-changing macro events in August. At the time of writing, BTC is consolidating near the $23,000 mark after dipping slightly over the past 24 hours. The key resistance level around $23,500 remains, and the largest cryptocurrency by market cap will not have much upside if it continues to seesaw below the $24,000 mark.

Similar to BTC, ETH remained stable above the $1,600 mark despite a slight dip over the same period. The second-largest cryptocurrency by market cap is eyeing immediate resistance at $1,650 in an attempt to extend gains on the upside. In the short term, however, liquidity pressures within the cryptocurrency market are likely to persist. In the derivatives market, the basis of far-month ETH futures has been flat with the spot price, suggesting that ETH’s current implied yield is likely to fall into negative territory. In the non-mainstream currency market, the performance of most major non-mainstream coins was mixed, with NEAR and APE topping the gainer list with nearly double-digit growth rates. The decline of SOL has converged due to the recent key leak investigation results showing that Solana has no problems.

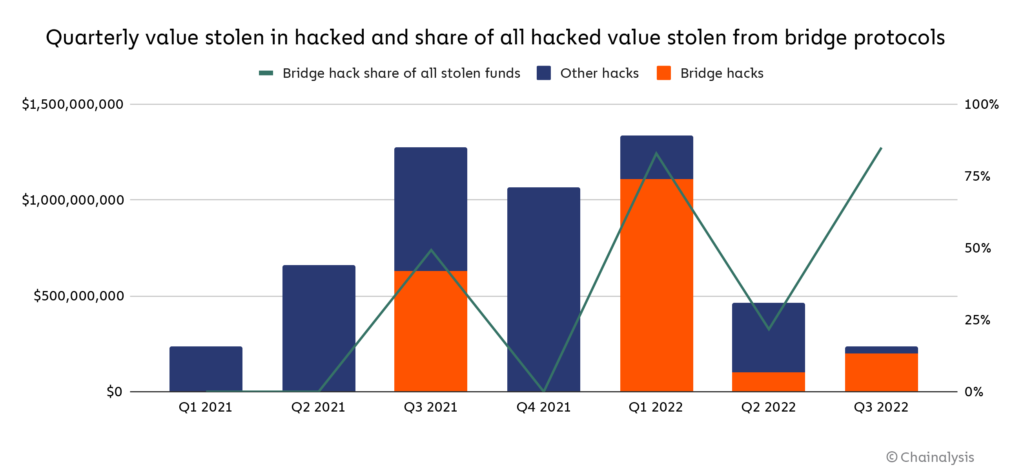

There have been 13 separate hacks targeting cross-chain bridges so far this year, following Monday’s breach on the Nomad bridge. The total value of the various stolen cryptocurrencies is about $2 billion, accounting for about 70% of the funds stolen in various hacks and information breaches this year.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...