The organization will consider discussions about de-pegging DAI, its native, decentralized stablecoin, from Circle’s USDC.

MakerDAO Founder Calls To Ditch U.S. Dollar Peg

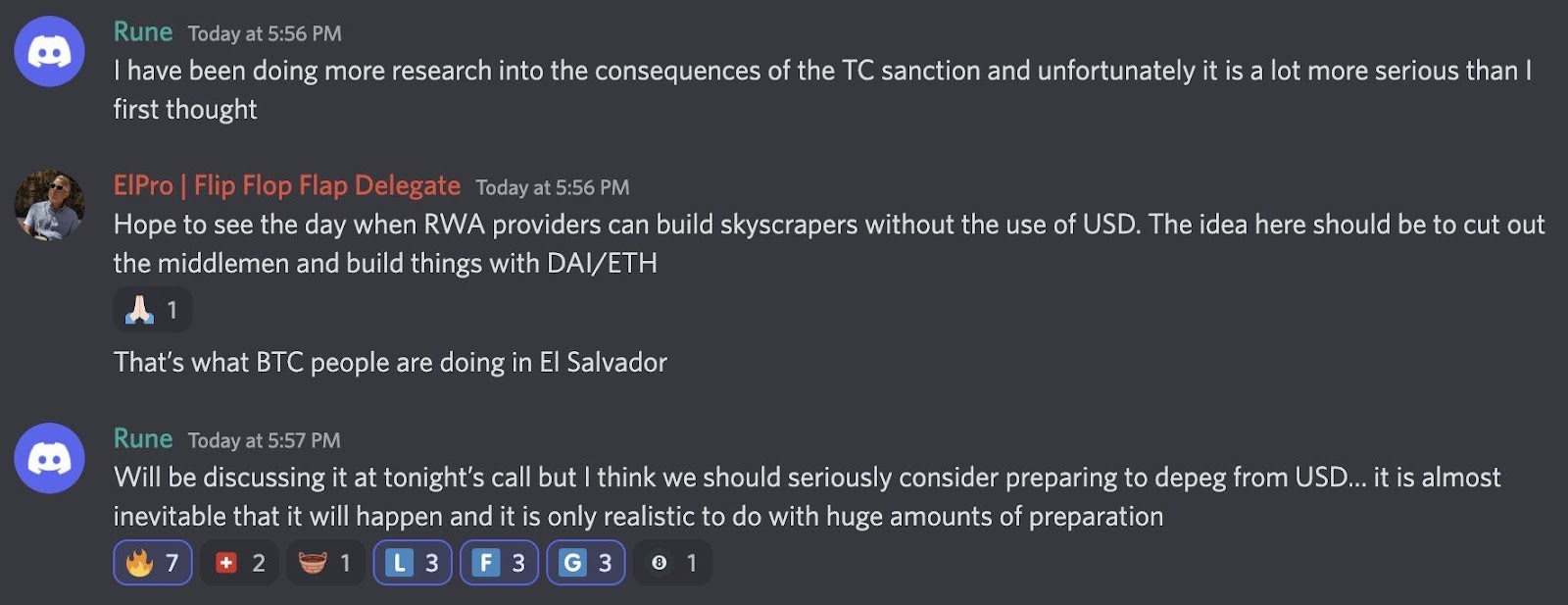

The U.S. Treasury Department’s ban on Tornado Cash, the cryptocurrency industry’s leading privacy solution, is a jaw-dropping move that has prompted many market participants to reconsider their investments in centralized products under the purview of regulators. The growing list includes DeFi protocol MakerDAO, whose founder Rune Christensen revealed via Discord that the organization will consider discussing whether to decouple its native decentralized stablecoin DAI from the USDC issued by Circle. The move comes in response to Circle’s decision to blacklist 38 wallets linked to the Tornado Cash ban. The founders of MakerDAO believe that this process is inevitable and will require “a lot of preparation work” because USDC accounts for a considerable share of the current collateral assets of DAI.

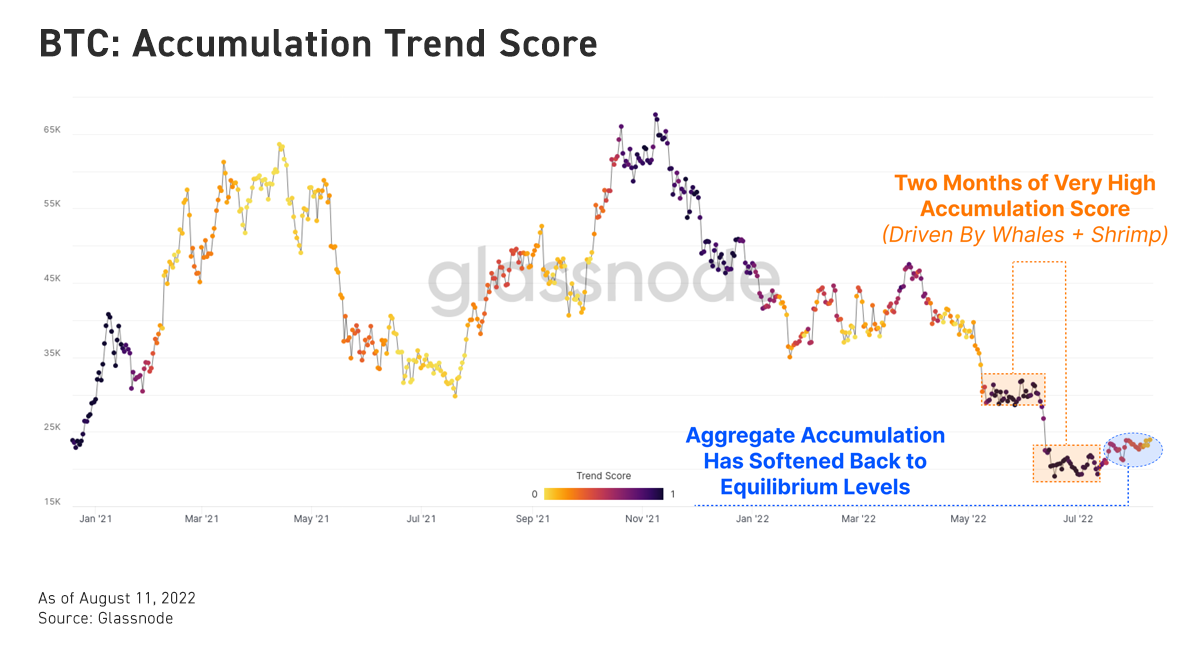

The notable drop in the US producer price index in July confirms that inflation may have peaked. However, the possibility of another 75bps rate hike in September has not been completely ruled out. Nonetheless, optimism has prevailed in the cryptocurrency market, with major digital assets hitting local new highs amid the overall market rally sparked by Merge. In the past 24 hours, BTC once approached the $25,000 mark, and then retreated 1.5%. At the time of writing, BTC is consolidating just below the $24,000 mark. The largest cryptocurrency by market cap must stabilize above the $23,500 support level to challenge major resistance in the $24,200-$24,500 range. Conversely, BTC could test support near the $23,000 mark. The on-chain accumulation trend score shows that after two months of active hoarding, the accumulation behavior of whales and individual investors has decreased significantly.

On the other hand, Ethereum successfully completed its third and final testnet merger before the mainnet merger, a positive news that injected strong momentum into the price action of ETH, which broke the $1,900 cap for the first time since late May. The second-largest cryptocurrency by market cap is trying to establish a stronger foothold above the $1,900 mark, setting the stage for a move towards the psychological $2,000 mark. The broader market of non-major coins pulled back across the board, with the exception of ETC, which rose 7%, thanks in part to traders speculating on a potential Ethereum PoW fork.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...