What is Bybit Leveraged Tokens? Table of Contents

- Trading Tokens with Bybit leverage

- Fees to be paid in leveraged token trading

- Rebalancing Mechanism

- About Bybit leverage

- Differences between trading tokens and derivatives

- Differences in returns on unilateral and volatile markets between trading tokens and derivatives

- Unilateral market comparison

- Volatile Market Comparison

- Final Thoughts

Use financial leverage on tokens offered by Bybit. Here is a complete guide on the use of leverage.

Token with Bybit leverage

A leveraged token is a financial derivative that offers the ability to trade by opening a leveraged position in cryptocurrencies without having to worry about complex trading margin management.

In principle, traders using this tool will be able to open both long and short positions in a crypto asset.

One of the main characteristics of cryptocurrency tokens comes from the opportunity to open any leveraged position without taking into account any collateral, funding rate, margin management and liquidation.

This simple and straightforward approach to trading is the main reason why many traders opt for this type of investment.

In Bybit, each Leveraged Token is a basket of perpetual contract positions.

In practice, when a trader trades a leveraged token he consequently opts for an investment in a basket of contracts for the underlying asset.

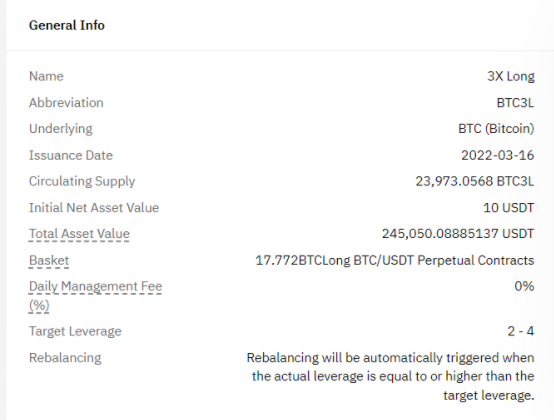

In the next table we will show a basket of BTC3L consisting of 17,772 BTC of long positions of BTCUSDT Perpetual Contracts.

Visit the official website of Bybit

As previously mentioned, leveraged tokens allow you to open both long and short positions.

The next example will give you a way to understand the concept more clearly.

Assuming Bitcoin (BTC) leveraged token investments, we can distinguish BTC3L and BTC3S.

- BTC3L refers to a 3x leveraged token on long positions of BTCUSDT perpetual contracts.

- BTC3S is based on a leveraged token with short positions of BTCUSDT Perpetual Contracts with 3x leverage.

In the acronym we can see the “3” which refers to the target leverage ratio after rebalancing and the letter “L” and “s” which reflect the type of position (long and short).

The Net Asset Value (NAV) varies with changes in the market fluctuations of perpetual contracts and refers to the price of a Leveraged Token.

Using the previous example we could see that:

- BTC3L:

- With a 1% increase in the BTCUSDT price, the BTC3L NAV will increase by 3%.

- BTC3S:

- Any 1% drop in the BTCUSDT price will result in a 3% increase in the BTC3S NAV.

Open a real account with Bybit

Commissions to be incurred in leveraged token trading

Traders who opt for investments with the use of this financial instrument with Bybit will have to pay the following commissions:

- Trading Fee.

- Purchase commission.

- Redemption fee.

- Management fee.

- Financing Commission.

The rates for each of these will be calculated as follows:

| Commission | Rate calculation |

|---|---|

| Trading Fee | Total Order Fulfilled × Spot Trading Fee Rate (Spot Trading Fee Rate: 0.1%) |

| Purchase Fee | Purchase Quantity × Purchase Price x Purchase Fee Rate (Purchase Fee: 0.1%) |

| Redemption fee | Total refund × Redemption Price × Redemption Fee Rate (Redemption Fee Rate: 0.1%) |

| Management Fee | Net Asset Value × Position Quantity × Daily Management Fee Rate (Management Fee: 0.02%) |

| Financing fee | Position value × financing rate |

Visit the official website of Bybit

Rebalancing mechanism

The rebalancing mechanism is a process that observes very precise rules, which by making certain changes, allows traders to stabilize the structure of their investment portfolio following sudden market fluctuations or changes in the objectives set by the trader.

This instrument ensures that the positions of the perpetual contracts of the underlying asset have a strong adjustment aimed at achieving the right financial leverage.

The mechanism will activate automatically when the actual leverage ratio falls outside the required leverage range.

By investing with Bybit, traders will notice that the leverage range has a specific purpose and the rebalancing mechanism will only activate when the effective leverage is above the target range.

For example: BTC3L has a target leverage range [2,4].

The rebalancing mechanism will start in complete autonomy when the effective leverage ratio is greater than or equal to 4 or less than or equal to 2, making changes to arrive at the target leverage of 3x.

But traders should not take for granted a positive or profitable result, as the NAV of a Leveraged Token may drop to zero and the rebalancing mechanism may not be able to keep up with the extremely volatile swings in the market.

All of this would result in no adjustment by the system of the perpetual contract positions of the underlying asset when the effective leverage crosses the expected range of extreme market fluctuations.

The Leveraged Token with rebalancing mechanism offered by Bybit is mainly suitable for short-term investments made in a unilateral market.

In a market characterized by high volatility, effective leverage can in many cases exceed the target leverage range.

And it is in this case that the rebalancing mechanism plays a decisive role with its activation and the aim of keeping the leverage within the target range.

Trading tokens with Bybit leverage

Bybit offers the possibility to trade leveraged tokens in two ways:

- Sale

- Purchase and redemption

Any leveraged token operation will be done directly through a Bybit Spot account .

- Trade.

- Leveraged tokens can be on the Spot market. Note that the price of the Leveraged Token varies according to the trades in the Spot market and this will cause a slight difference between the price of the Leveraged Token and its NAV. The purchase and sale of tokens involves a 0.1% commission charged directly to the account.

- Purchase and refund

- Both purchases and redemptions in trading tokens with the use of leverage can be made in correspondence with positions taken on perpetual contracts of the underlying assets in the basket. Trades are related to the token nav. A fee of 0.1% will be charged for each transaction.

For more detailed information on the aforementioned topic visit the official website

Open a real account with Bybit

Differences between trading tokens and derivatives

While both are valid tools for trading with Bybit, they have many structural differences.

In the following table you will be able to know its main characteristics.

| Features | Leveraged tokens | Derivatives trading |

|---|---|---|

| Margin requirement | No | Yes |

| Leverage range | Targeted | No fixed range |

| Settlement | No | Yes |

| Type of trading | Trade – Purchase and redemption | Long and short |

| Investment scenario | Unilateral market | Volatile market |

Visit the official website of Bybit

Differences in returns on unilateral and volatile markets between trading tokens and derivatives

Market returns between Leverage tokens and derivatives for long and short positions show inequalities in both unilateral and volatile markets.

Unilateral market comparison

Below are the main differences for long positions

| Days | Price of the perpetual contract BTCUSDT | ROI of the perpetual contract BTCUSDT with 3x leverage on 4-day period | Changes in the net asset value of BTC3L | ROI of BTC3L over the 4-day period |

|---|---|---|---|---|

| Day 1 | $ 40,000 | 111.51% | 0% | 117.28% |

| Day 2 | 44.444 $ | 111.51% | 33.33% | 117.28% |

| Day 3 | 49.381 $ | 111.51% | 70.36% | 117.28% |

| Day 4 | 54.868 | 111.51% | 117.28% | 117.28% |

It is clearly visible that the returns of Leverage tokens are much more advantageous than the more common perpetual contracts.

By opening a hypothetical long position, the trader who has invested in Token leverage will receive a return of 117.28%.

Same goes for short positions, where the ROI for investments through Token leverage without liquidation or loss of margin will be more advantageous.

| Days | Price of the perpetual contract BTCUSDT | ROI of the perpetual contract BTCUSDT with 3x leverage on 4-day period | Changes in the net asset value of BTC3L | ROI of BTC3L over the 4-day period |

|---|---|---|---|---|

| Day 1 | $ 40,000 | -111.51% | -0% | – 70.37% |

| Day 2 | 44.444 $ | -111.51% | -33.33% | – 70.37% |

| Day 3 | 49.381 $ | -111.51% | -70.36% | – 70.37% |

| Day 4 | 54.868 | -111.51% | -117.28% | -70.37 % |

The returns for perpetual contracts amount to $ 54,868 or -37.17%, for tokens the ROI would be limited to -70.37%.

Visit the official website of Bybit

Comparison of volatile markets

In volatile markets, the situation changes, investments on perpetual contracts prove to be more advantageous than leverage tokens.

For both long and short positions there will be noticeable differences in market returns.

| Days | Price of the perpetual contract BTCUSDT | ROI of the perpetual contract BTCUSDT with 3x leverage on 4-day period | Changes in the net asset value of BTC3L | ROI of BTC3L over the 4-day period |

|---|---|---|---|---|

| Day 1 | $ 40,000 | 0% | -0% | -8.33 % |

| Day 2 | 44.444 $ | 0% | -33.33% | -8.33 % |

| Day 3 | $ 40,000 | 0% | 0% | -8.33% |

| Day 4 | 35.556 $ | 0% | -33.33% | -8.33 % |

| Day 5 | $ 40,000 | 0% | -8.33% | -8.33 % |

The numbers speak for themselves, as regards a possible long position, with a net increase of 0% at the end of the five-day period, perpetual contracts are better than tokens with an ROI of -8.33%.

The same result can be seen for short positions, where perpetual contracts will show higher returns in the volatile market.

| Days | Price of the perpetual contract BTCUSDT | ROI of the perpetual contract BTCUSDT with 3x leverage on 4-day period | Changes in the net asset value of BTC3L | ROI of BTC3L over the 4-day period |

|---|---|---|---|---|

| Day 1 | $ 40,000 | 0% | -0% | -13.33 % |

| Day 2 | 44.444 $ | 0% | -33.33% | -13.33 % |

| Day 3 | $ 40,000 | 0% | -13.33% | -13.33 % |

| Day 4 | 35,556 $ | 0% | 6.67% | -13.33% |

| Day 5 | $ 40,000 | 0% | -13.33% | -13.33 % |

An ROI of 0% of perpetual contracts is certainly more advantageous than -13.33% of tokens.

Visit the official website of Bybit

Final thoughts

Ultimately, investing in leveraged tokens is considered by many traders to be an excellent, relatively low-risk investment. The absence of margin requirements and a targeted maximum leverage allow excellent management of both the position taken and the risks. As for the unilateral market, if in the event the latter moves towards the position taken by the trader, it will be possible to maximize profit thanks to financial leverage. Otherwise, tokens allow you to significantly reduce losses. But as we have just seen, this financial instrument is suitable only for short-term investments and in markets that are not too volatile. Any trader wishing to invest in leveraged tokens should carefully consider whether and how to invest by carefully analyzing every detail and characteristics of both the markets and the financial instrument.

Leveraged crypto tokens have built-in decay.

This means that in an extremely volatile market this characteristic can be extremely detrimental to total returns.

In order to minimize the risks of loss, Bybit leverage tokens offer a transparent rebalancing mechanism that is activated when the effective leverage is lower than the targeted leverage range.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...