Want to started leverage margin trading on Binance? Open a futures account and get started.

The Ultimate Guide to Binance Futures Trading

With Binance, you can open the following 4 types of Futures accounts to invest in Cryptocurrencies in a new way.

- USDⓈ-M Futures

- Perpetual or Quarterly Contracts settled in USDT or BUSD.

- COIN-M Futures

- Perpetual or Quarterly Contracts settled in Cryptocurrency.

- Binance Leveraged Tokens

- Enjoy increased leverage without risk of liquidation.

- Binance Options

- Crypto Options made simple. Limited risk and unlimited profits.

Binance is connecting you to crypto – Anytime, anywhere and on any device!

How to Open a Binance Futures Account?

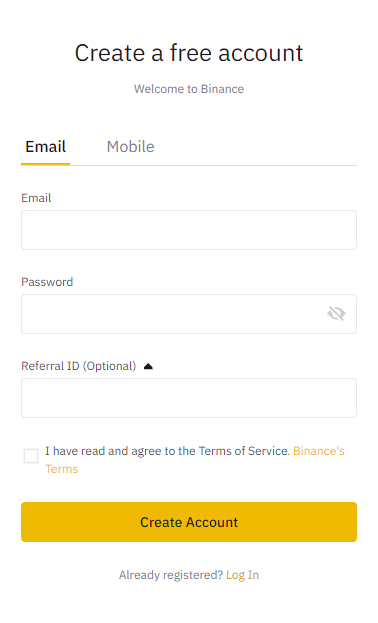

Before opening a Binance Futures account, you first need to register for a regular Binance account.

If you haven’t registered a regular account yet, visit Binance’s official website and click “Sign Up” in the upper right corner of the screen.

Then follow these steps:

Enter your email address and create a secure password.

When everything is ready, click “Create Account”.

You will receive a verification email shortly.

Please follow the email instructions to complete the registration.

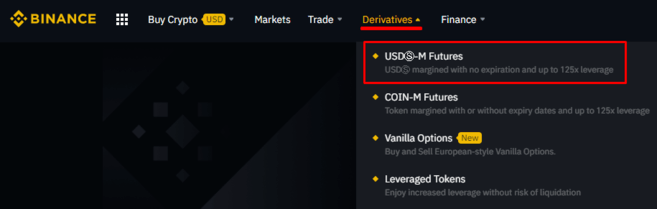

Next, log into your Binance account, move your mouse to the top bar of the page, and click on “USDⓈ-M Futures”.

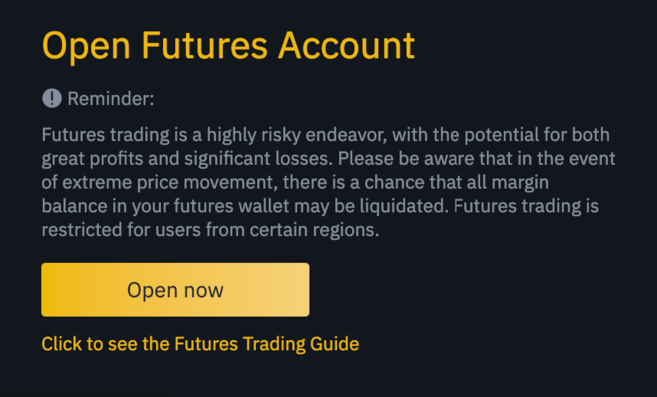

Click “Activate Now” to activate the futures account.

Now you are ready to start trading.

Open Binance’s Futures Account

How to deposit funds to the Futures account?

You can move funds flexibly between the exchange wallet (the one used on Binance) and the futures wallet (the one used in Binance Futures).

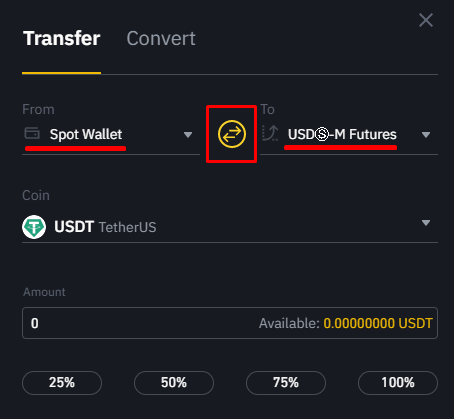

To transfer funds to your personal futures wallet, click “Transfer” on the right side of the Binance Futures page.

Set the amount you want to transfer, then click “Confirm” to complete the transfer.

The corresponding balance will soon be transferred to the futures wallet.

The transfer direction can be reversed via the double arrow icon shown below.

This is not the only way to deposit funds into a futures wallet.

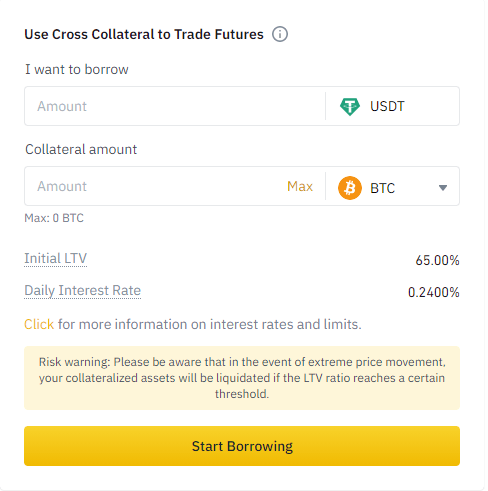

You can also use funds in your trading platform wallet as collateral and invest USDT for futures trading through the futures wallet balance page.

In this way, there is no need to transfer funds directly into a futures wallet.

Open Binance’s Futures Account

What is a futures contract?

A futures contract is an agreement to buy or sell a commodity, currency or other financial asset at a predetermined price at a specific time in the future.

Unlike traditional spot markets, trades in futures markets are not immediately settled.

Buyers and sellers trade futures that are set to settle at a definite time in the future.

In addition, users cannot directly buy and sell physical commodities or digital assets in the futures market.

Instead, they trade contracts representing those assets, and the actual transaction of the asset (or cash) will take place in the future when the contract executes.

Let’s take futures contracts for physical commodities such as wheat and gold as an example.

In some traditional futures markets, delivering these contracts means delivering the physical commodity.

Therefore, gold or wheat must be properly stored and transported, incurring additional costs (called “stocking costs”).

However, many futures markets now support cash settlement, which means that only the equivalent cash value is settled (no barter exchange).

In addition, the price of gold or wheat in the futures market may vary depending on how far or near the contract settlement date is.

The further the expiry date, the higher the corresponding storage cost, the higher the price uncertainty, the larger the potential spread between the futures market and the spot market.

Open Binance’s Futures Account

Why trade futures contracts?

There are various merits to invest in futures market.

- Hedging and Risk Management:

- This is the main reason for the birth of futures contracts.

- Short-term exposure:

- A trader can bet on the performance of an asset even if he does not own it.

- Leverage:

- Traders can open positions larger than their account balance.

Go to Binance’s Official Website

What is a perpetual futures contract?

A perpetual futures is a special type of futures contract.

Unlike traditional futures, perpetual futures have no expiration date, and users can choose to hold positions forever.

In addition, perpetual futures transactions are based on the underlying index price.

It consists of the average price of an asset, influenced by the main spot market and relative volume.

Unlike traditional future, perpetual futures usually trade at or very close to the spot market.

However, the biggest difference between traditional futures and perpetual futures is that the former stipulates a “settlement date”.

Trade Perpetual Futures on Binance

What is initial margin?

The initial margin is the minimum margin required to open a leveraged position.

For example, if the initial deposit is 10 BNB, the user can buy 1,000 BNB with 100x leverage.

Therefore, the initial margin is 1% of the total order amount.

Initial margin is a strong support for leveraged positions and plays the role of collateral.

Go to Binance’s Official Website

What is Maintenance Margin?

The maintenance margin is the minimum amount of collateral required to maintain a corresponding trading position.

If the margin balance falls below the maintenance margin, the user will receive a margin call (requiring them to fund the account) or be directly liquidated.

Most digital currency trading platforms choose the latter approach.

In other words, the initial margin is the committed amount when opening a position, while the maintenance margin is the minimum balance required to maintain a position.

The maintenance margin is dynamic and depends on market price and account balance (collateral).

Open Binance’s Futures Account

What is forced liquidation?

If the collateral is lower than the maintenance margin, your futures account will be liquidated.

Binance liquidates positions differently based on each user’s risk and leverage (collateralization and net exposure).

The larger the total position, the higher the percentage of the required margin.

This mechanism varies by market and trading platform, but Binance charges a notional fee of 0.5% for first-level liquidation (net exposure below 500,000 USDT).

After the forced liquidation and payment of the nominal fee, the remaining funds in the account will be returned to the user.

If the balance is less than 0.5%, the account will be returned to zero directly.

Please note that after forced liquidation, users need to pay additional fees.

In order to avoid this situation, you can close the position yourself before reaching the liquidation price, or deposit funds into the account to widen the gap between the liquidation price and the current market price.

Go to Binance’s Official Website

What is the funding rate?

Funding consists of periodic payments between buyers and sellers, based on current funding rates.

If the funding rate is greater than zero (positive value), longs (contract buyers) pay shorts (contract sellers) the funding rate.

Conversely, shorts pay longs a funding rate.

The funding rate consists of two components: the interest rate and the premium.

The interest rate on Binance Futures is fixed at 0.03%, while the premium index changes according to the spread between the futures market and the spot market.

Funding rate transfers are done directly between users and Binance does not charge any fees.

When a perpetual futures contract trades at a premium (price is higher than the spot market), the funding rate is positive and longs pay shorts the funding rate.

The above is expected to drive prices lower as longs are closed and new shorts are opened.

Open Binance’s Futures Account

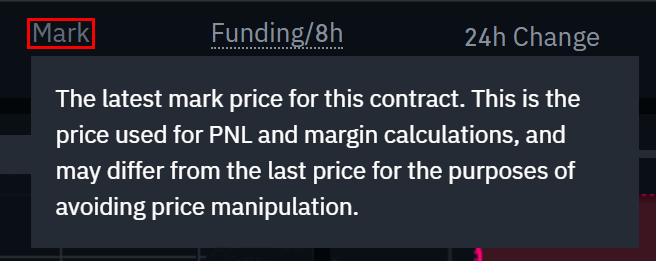

What is the mark price?

The mark price is an estimate of the contract’s true value (fair price) compared to the actual transaction price (last price).

Calculating the mark price can effectively avoid unfair liquidation when the market fluctuates wildly.

Therefore, while the index price is related to the spot market price, the mark price represents the fair value of the perpetual futures contract.

For Binance, the mark price is based on the index price and funding rate and is an important factor in calculating “unrealized profit and loss”.

Go to Binance’s Official Website

How to calculate Profit and Loss (PnL)?

PnL stands for profit and loss, which can be divided into realized profit and loss and unrealized profit and loss.

If you hold an open position in the perpetual futures market, the profit or loss has not been realized and will change as the market develops.

After the position is closed, the unrealized profit and loss will be converted into realized profit and loss.

Realized profit and loss is the profit or loss from the closed position, which is not directly related to the mark price, but only related to the execution price of the order.

On the other hand, unrealized profit and loss are constantly changing and are the main driver of forced liquidation.

Therefore, the mark price is used to ensure that the calculated unrealized profit and loss is accurate, credible and fair.

Open Binance’s Futures Account

What is a protection fund?

In a nutshell, a protection fund effectively prevents losing traders’ balances from falling into negative territory, while ensuring that winning traders get their money’s worth.

For example, suppose Alice has $2,000 in her Binance Futures account.

With this funding, she established a 10x long position in BNB at $20 each.

Note that the contract purchased by Alice does not originate from Binance, but is provided by another trader.

And Bob, who is the counterparty, also has a short position of the same size.

Driven by 10x leverage, Alice now has a position size of 100 BNB (worth $20,000) with $2,000 in collateral.

However, if the price of BNB drops from $20 to $18, Alice could face automatic liquidation.

That means her assets will be liquidated, and her $2,000 balance will be lost.

If the system cannot close the position in time for some reason, and the market price falls further, the protection fund will be activated at this time to make up for the relevant losses.

Alice won’t make much difference here because her balance will be zeroed after the liquidation, but it will ensure that Bob gets the corresponding benefit.

If there is no protection fund, Alice’s $2000 will not only be lost, but the account balance will even become negative.

However, in actual trading, her maintenance margin will be lower than the minimum requirement, and her long positions may have been closed before that.

The forced liquidation fee is directly paid by the protection fund, and the remaining funds are returned to the user.

Therefore, the protection fund mechanism aims to effectively use the collateral paid by the traders who are forced to liquidate to make up for the loss of the zeroing account.

Under normal market conditions, the protection fund is expected to continue to grow as users are forced to liquidate their positions.

To sum up, the protection fund increases when users are forced to liquidate their positions before they reach breakeven or go negative.

In more extreme cases, the system may not be able to close all positions, in which case the protection fund will be used to cover potential losses.

This is uncommon, but it can happen when the market is volatile or extremely illiquid.

Open Binance’s Futures Account

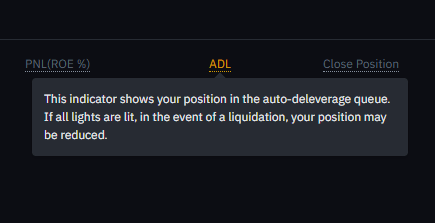

What is automatic reduction?

Auto-reduction is a method of forced liquidation of a position by a counterparty.

Automatic reduction of positions will only occur when the protection fund fails (in certain circumstances).

Although extremely rare, such events require profitable traders to take some of their gains to cover the losses of losing traders.

Unfortunately, the digital currency market fluctuates wildly, and the leverage ratio provided by perpetual futures is high, and automatic reduction of positions cannot be completely avoided, but we will make every effort to reduce this probability.

In other words, counterparty liquidation is the ultimate solution when the protection fund cannot fill all zeroed positions.

Generally speaking, the most profitable (and leveraged) positions also contribute the most to the auto-reduction.

Binance uses an indicator to inform users of its position in the auto-decreasing queue.

Binance’s futures market system takes all necessary measures to avoid automatic reductions and minimize its impact through a variety of features.

If an automatic reduction does occur, the counterparty liquidation will be executed with zero market fees.

Affected users will be notified immediately and can re-enter the market at any time.

Go to Binance’s Official Website

Binance Futures UI Guide

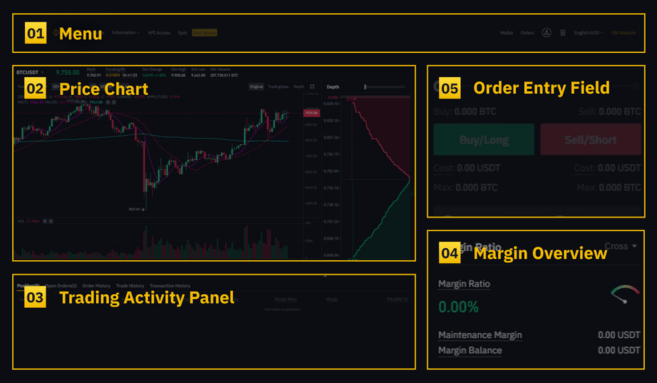

1. Within this area, you will also find links to other Binance pages, including coin-margined futures (quarterly contracts), API access, spot, and events.

Under the [Information] tab, links to Binance Futures FAQs, funding rates, index prices and other market data can be found.

On the right side of the top bar you can access your Binance account, including the dashboard.

You can easily view wallet balances and orders across the ecosystem.

Open Binance’s Futures Account

2. Here you can do the following:

- Hover over the contract type (default is BTCUSDT) and select the transaction you want to make.

- Check the mark price (liquidation will be based on the mark price, so keep an eye on that price).

- See expected funding rates, and the countdown to the next funding round.

- View current infographics. You can switch between the initial chart or the integrated TradingView chart. At the same time, you can click [Depth Chart] to view the real-time information of the current order book depth.

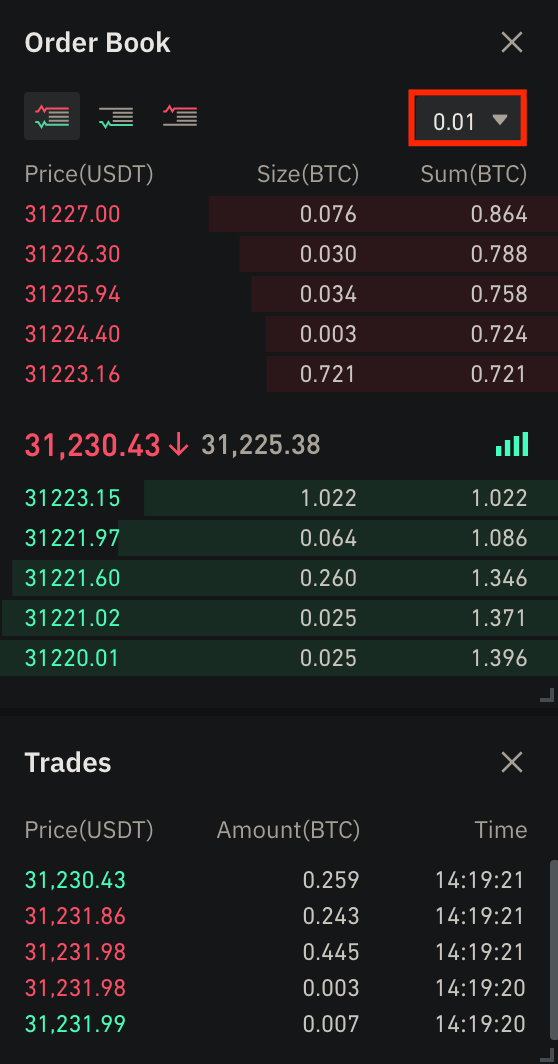

- View real-time order book data. The precision of the order book can be adjusted in the drop-down menu in the upper right corner of this area (default is 0.01).

- View previous transaction information in real time on the platform.

As long as you see an arrow in the small right corner of the module, you can move and resize the element.

This makes it easy to create custom interface layouts.

3. Here you can monitor personal trading activity. By switching between the different tabs, it is possible to check the current status of the position as well as the currently commissions and filled orders.

You can also find all trading activity and trading history within a specific time frame.

It is also possible to monitor positions located in the Auto-deleveraging queue under “Auto-deleveraging” (ADL) here (especially during periods of high volatility).

4. You can view available assets, deposit and buy more digital currencies here, and you can also view information about current futures and positions here. P\lease pay attention to the margin ratio to avoid forced liquidation.

Transfers between futures wallets and other Binance ecosystems can be performed by clicking on “Transfer”.

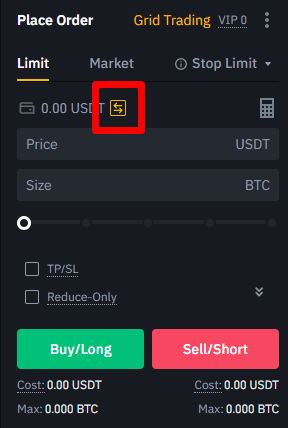

5. This is the order entry field. Please see below for a detailed description of the types of orders offered.

Here, it is also possible to switch between cross and isolated mode. Click the current leverage (20 times by default) to adjust the leverage.

Open Binance’s Futures Account

How to Adjust leverage on Binance’s Futures Account?

Binance Futures Trading allows manual adjustment of leverage for each contract.

When selecting a contract, you can move the mouse in the upper left corner of the page and hover over the current contract category (default is BTCUSDT).

To adjust the leverage, go to the order entry field and click on the current leverage (default is 20).

Adjust the slider or enter a value to set the leverage, then click [Confirm].

It is worth noting that the larger the position, the less leverage you can use.

Conversely, the smaller the position, the greater the leverage that can be used.

In addition, higher leverage will bring higher liquidation risk.

So new traders should carefully consider the leverage available to them.

Open Binance’s Futures Account

Difference between mark price and last price

To avoid price spikes and unnecessary liquidations during periods of high volatility, Binance Futures has introduced “Last Price” and “Mark Price”.

The last price is easy to understand, it represents the last transaction price of the contract.

In other words, the price of the most recent trade in the trade history is the “last price”.

It is used to calculate your realized profit and loss (PnL).

“Marking the price” is to avoid price manipulation.

It combines funding data with a basket of spot transaction data in its calculations.

The liquidation price and future profit and loss will be calculated based on the mark price.

Please note that mark price and last price may be different.

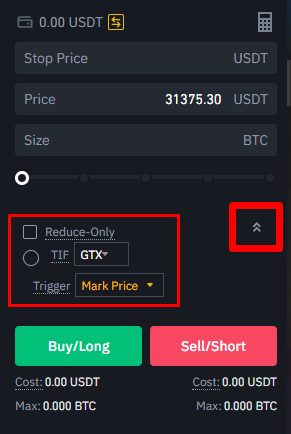

When setting up an order type that uses the stop price as the trigger condition, you can choose to use the last price or the mark price as the trigger condition.

To do this, select the price you wish to use in the “Trigger Condition” drop-down menu at the bottom of the order entry field.

Go to Binance’s Official Website

Type of order and how to use it

There are several order types available in Binance Futures:

Limit order

A limit order is an order placed in the order book at a specific limit price.

After placing a limit order, the trade is only filled when the market price reaches the limit price (or higher).

Therefore, a limit order can be used to buy at a lower price, or to sell at a price higher than the current market price.

Market order

A market order is an order to place a buy or sell transaction at the current best price. It is executed against a limit order previously posted on the order book.

When placing a market order, you will be charged a market order taker fee.

Stop Limit Order

The easiest way to understand what a stop-limit order is is to break it down to stop and limit.

The stop price is the price at which the limit order is triggered, and the limit price is the price after the limit order is triggered.

This means that a limit order will be posted in the order book as soon as the set stop price is reached.

Although the stop and limit prices can be the same, they do not have to be.

In fact, it is safer to set the stop price (trigger price) slightly higher than the limit price if it is a sell order and slightly lower than the current price if it is a buy order.

This increases the chance of a limit order being filled.

Market stop order

Similar to a stop-limit order, a stop-market order uses the stop price as a trigger.

However, when the stop price is reached, it triggers a market order.

Limit take profit order

If you already fully understand the definition of a stop-limit order, then a take-profit limit order is easy to understand.

Similar to a stop-limit order, it also contains a trigger price (the price at which the order was triggered) and a limit price (the price at which the limit order was added to the order book).

Take profit limit orders are great for managing risk and locking in profits at a specific price.

It can also be combined with other order types such as stop-limit orders for better position management.

Note that limit orders are not OCO orders.

For example, if your stop-limit order reaches the set amount and you also hold an active take-profit limit order, the take-profit limit order will remain in effect until you manually cancel it.

You can place a Take Profit Limit order under the “Take Profit Stop Limit” option in the order entry field.

Take Profit Order

Similar to a take profit limit order, a market take profit order uses the take profit price as the trigger condition.

A market order is triggered when the take profit price is reached.

You can place a Take Profit market order under the “Take Profit Stop Market” option in the order entry field.

Trailing stop order

Trailing stop orders help lock in gains while limiting potential losses on open positions.

For long positions, if the price goes up, the trailing stop will also go up.

Conversely, if the price falls, the trailing stop stops moving.

A sell order is placed if the price moves in the opposite direction by a specific percentage (called the retracement rate).

The same goes for short positions, but the opposite is true. Trailing stops move down with the market and stop when the market starts to rise. A buy order is placed if the price moves in the opposite direction by a specific percentage.

The activation price is the price that triggers the trailing stop order. If no activation price is specified, the current last price or mark price will default to the activation price. You can set at the bottom of the order entry field which price should be used as the trigger price.

The retracement rate determines the percentage of the price that the trailing stop “traces”. So, if the pullback is set at 1%, and the trade goes in the chosen direction, the trailing stop will always follow the price by 1%. If the price moves more than 1% in the opposite direction of the trade, place a buy or sell order (depending on the chosen trade direction).

Open Binance’s Futures Account

How to Use the Futures Trading Calculator?

You can see the calculator graph at the top of the order entry module.

It allows you to perform related numerical calculations before going long or short. You can adjust the lever sliders under each tab to use as a basis for calculations.

The calculator has three tabs:

- PNL

- Use this tab to calculate Initial Margin, Profit and Loss (PnL) and Return on Equity (ROE) based on target entry and exit prices and position size.

- Target Price

- Use this tab to calculate the price at which you need to exit your position to achieve your target rate of return.

- Closing Price

- Use this tab to calculate an estimated closing price based on personal wallet balance, expected entry price and position size.

Go to Binance’s Official Website

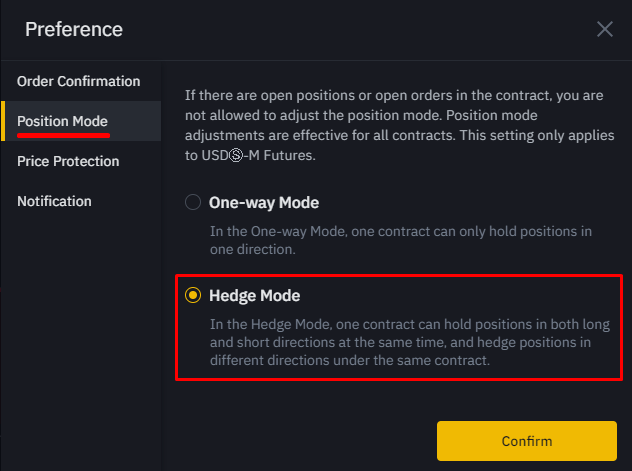

How to use the Hedge mode?

In the hedge mode, it is possible to hold both long and short positions in the same contract.

What’s the benefit of doing this? Suppose you have an open long position because you are bullish on the long-term rise in the price of Bitcoin, at the same time, you may want to short quickly on a shorter time frame.

Two-way mode supports this operation – in this case, a quick short will not affect a long position.

The default position mode is one-way position.

This means that for a single contract you cannot hold positions in both directions at the same time.

If you do this, the positions in both directions will cancel each other out.

Therefore, manual activation is required when using the hedge mode.

Here’s what you need to do.

1. Go to the top right of the screen and select [Preferences].

Access the [Position Mode] tab and select [Hedge Mode].

Open Binance’s Futures Account

What decides the funding rate and how to check it?

Funding rates ensure that the price of the perpetual futures contract is as close as possible to the (spot) price of the underlying asset.

In essence, traders will “pay each other” based on their positions, and the difference between the price of the perpetual futures contract and the spot price will determine which side wins.

When the funding rate is positive, longs are paid to shorts.

When the funding rate is negative, shorts are paid to longs.

This means that depending on the funding rate and your open positions, you end up either on the side paying or on the side receiving it.

On Binance Futures, funds are paid out every 8 hours.

You can see the time remaining for the next funding cycle and the estimated funding rate next to the mark price at the top of the page.

If you want to view the previous funding rate of each contract, you can hover the mouse over [Contract Information] and click [Funding Rate History].

Open Binance’s Futures Account

Pending orders only, valid time and close positions only

When using limit orders, you can place additional orders at the same time as the order is posted.

In Binance Futures, such orders can be “pending orders only” or “time in force (TIF)” orders, which determine the additional characteristics of limit orders.

You can find it at the bottom of the order entry field.

“Pending orders only” means that your order will always be added to the order book first, but will never be filled with an existing order in it.

If you only want to pay for pending orders, you can do this.

TIF orders mean that you can set how long the orders are valid (before they are filled or expired).

The TIF instruction has the following three options:

- GTC (Good Till Cancelled):

- The order will remain active until it is filled or cancelled.

- IOC (Immediate Fill or Cancel):

- The order will be executed immediately (full or partial). If only partially executed, the unfilled portion of the order will be cancelled.

- FOK (Full Fill or Kill):

- The order must be fully filled immediately. Otherwise, the order will not be executed at all.

When you are in one-way position mode, checking “Reduce-Only” will ensure that new orders will only reduce the position and never increase the existing position.

Open Binance’s Futures Account

Under what circumstances will the position be liquidated?

If the margin balance falls below the required amount, a liquidation will occur.

Margin balance is the Binance Futures account balance, including unrealized profit and loss.

That is, your profit or loss will cause the margin balance to change.

If using the cross-position mode, the balance will be used as margin for all positions.

If using the isolated position mode, the balance can be allocated to each position.

“Maintenance Margin” means the minimum margin required to maintain a position.

The amount depends on the size of the open interest. The larger the position, the more maintenance margin is required.

You can view the current margin ratio in the lower right corner. If the margin ratio reaches 100%, the open position will be closed.

When a liquidation occurs, all your open orders will be cancelled.

The most reasonable action is to avoid automatic closing by tracking the position, as automatic closing will incur additional fees.

If your position is about to be liquidated, manual closing will be preferable to automatic closing.

Go to Binance Official Website

Automatic Lightweighting and Its Impact

When a trader’s account size falls below 0, losses are covered with insurance funds.

However, in some unusually volatile market environments, insurance funds may not be sufficient to cover these losses and must be filled by closing open positions.

In this case, your open positions are also at risk of being closed.

The closing of positions is carried out in a specific queue order, and the traders with the highest profitability and the highest leverage will be at the forefront.

Hover over the [Positions] tab and click on the [Auto Decreases] (ADL) on the right to view the current position of the position in the queue.

Open Binance’s Futures Account

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...