BarrelDAO Sells Out NFT-Linked Solana-Themed Beer

Recently, beer-themed BarrelDAO launched a new NFT collection that can be redeemed for limited-edition Solana-themed beers. The 333 NFT collections that BarrelDAO released last Friday have sold out at a unit price of 1.35 SOL. At the time of writing, several of these NFTs have a floor price of 2.49 SOL in the secondary market. Each NFT holder can redeem a case (16 cans) of Solana Summer Shandy beer printed with NFT artwork including DeGods, Degenate Ape Academy and more.

Risk assets fell sharply after Federal Reserve Chairman Jerome Powell reiterated his firm stance against inflation. The prospect of the Federal Reserve likely to maintain high interest rates for an extended period has sent investors into panic and dumped top cryptocurrencies, further dampening sentiment.

Just this past weekend, BTC struggled to hold support above $20,000, on the other hand, ETH prices were still lower despite The Merge upgrade. At the time of writing, the largest cryptocurrency by market capitalization is now slowly making its way towards the $20,000 mark after experiencing a small drop over the past 24 hours. Looking up, BTC faces strong resistance in the $2-20,200 range. Failure to close above this resistance zone could see BTC accelerate a downside correction and test support in the $18,500-$19,500 range.

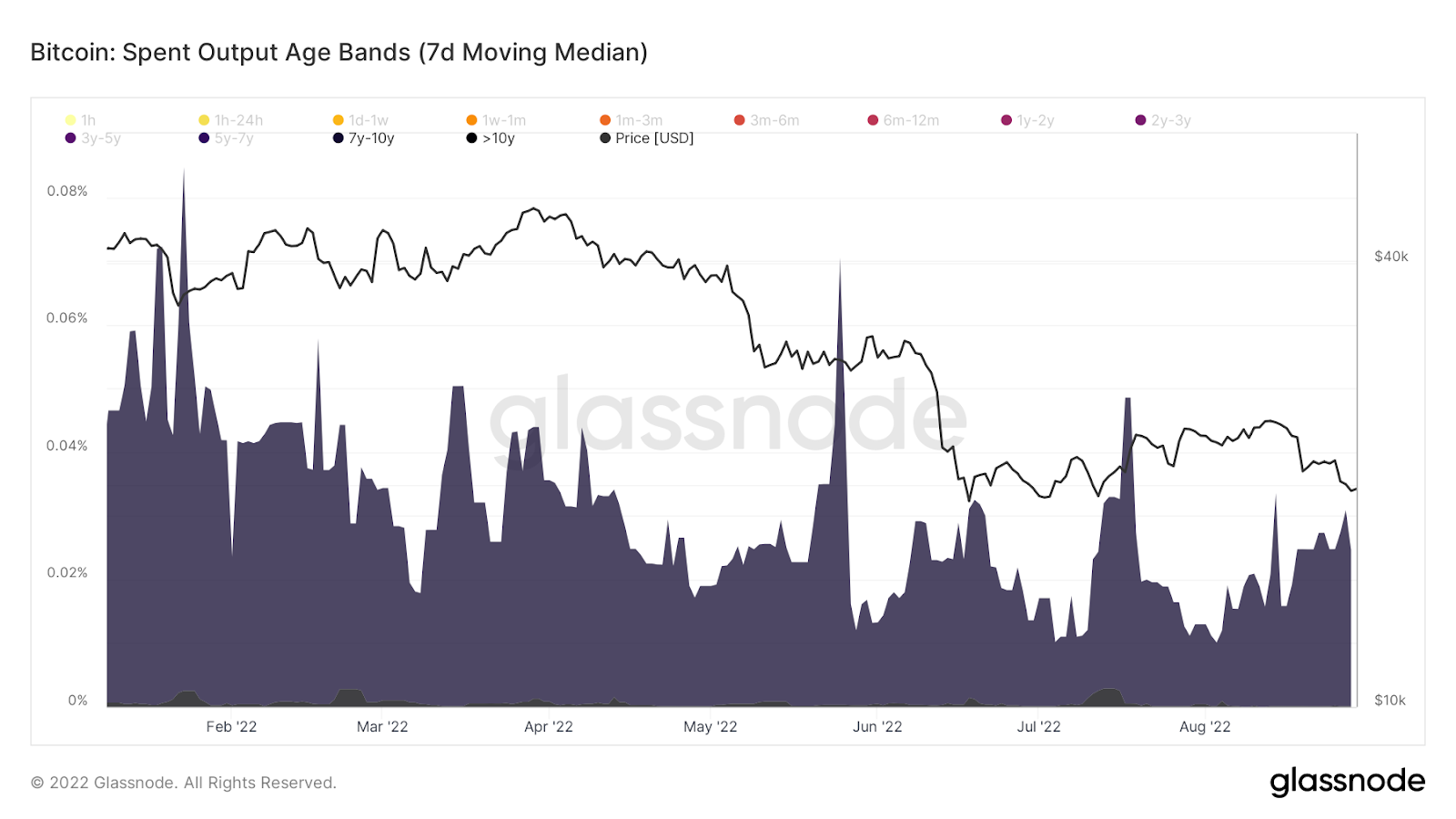

At the same time, there has been a sharp spike in 7-10 years old BTC sold, suggesting that these older BTC have been moved during the recent price crash. This surge is quite similar to the May 13th trading situation, when large amounts of old coins were moved in a capitulation sell-off, followed by a month-long consolidation and further price declines. The 7-day moving average of trading volume also indicates an uptrend in older coins trading, which usually coincides with a price downside discovery period.

Similar to BTC, ETH’s market cap has shrunk by 2.7% over the same period and is now below the $1,500 mark. The performance of most major altcoins was mixed, with AVAX leading the downside correction with a 7% loss over the same period. The bear market changes following Friday’s speech by Fed officials should be the focus of attention. The main cryptocurrency market is likely to enter September with weak token performance against the backdrop of increased liquidity pressures.

There has been a marked shift in market sentiment and expectations in the derivatives space. BTC perpetual contract funding rates on major exchanges have plunged into negative territory following Friday’s market turmoil. This suggests that bearish sentiment has peaked since July, with investors trying to get out of the market after a string of bad implosions. Long-term expectations fell: The basis for BTC futures expiring in June 2023 fell below 0.25%, while the basis for ETH futures expiring in the same period was close to -2%. In the options market, weakness in spot prices has had little effect on Realized Volatilty, suggesting that options traders may have factored in the Jackson Hole symposium when pricing.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...