Animoca Brand has recently secured another $100 million in funding with Singapore state investor Temasek leading the round.

Temasek Leads Animoca’s $100M Funding Round

Headquartered in Hong Kong, Web3 gaming pioneer Animoca Brands has built a financial, gaming and social media group with 240 companies in just five years, making it a force to be reckoned with in the industry. Recently, the company will usher in a new round of financing of 100 million US dollars, led by Temasek, a state-owned investment company in Singapore. The Hong Kong startup is currently valued at $6 billion. This comes after Animoca Brands had raised $359 million from VCs including George Soros and the Winklevoss brothers, and another $75 million in the same round earlier this summer U.S. dollar, and it was the crypto winter when the market value evaporated by $2 trillion. The company hopes to challenge the market dominance of big tech companies by creating decentralized, blockchain-powered virtual worlds.

Another 75 basis points of interest rate hikes in September may be on the horizon. After the stock market fell for three consecutive days, the main cryptocurrency market remained in a range-bound state. The outlook for Asian markets appears to be slightly better in contrast to the risk-off mode in full swing, which also led to a small rebound in Asian trading hours. At the time of writing, BTC is currently trading above the $20,000 mark and the 100 hourly simple moving average after experiencing a small decline over the past 24 hours. A bearish trend line is forming with resistance near $20,300 on the hourly chart of BTC. The largest cryptocurrency by market cap will only open the door for further gains if it clears hurdles in the $20,300-$20,500 range.

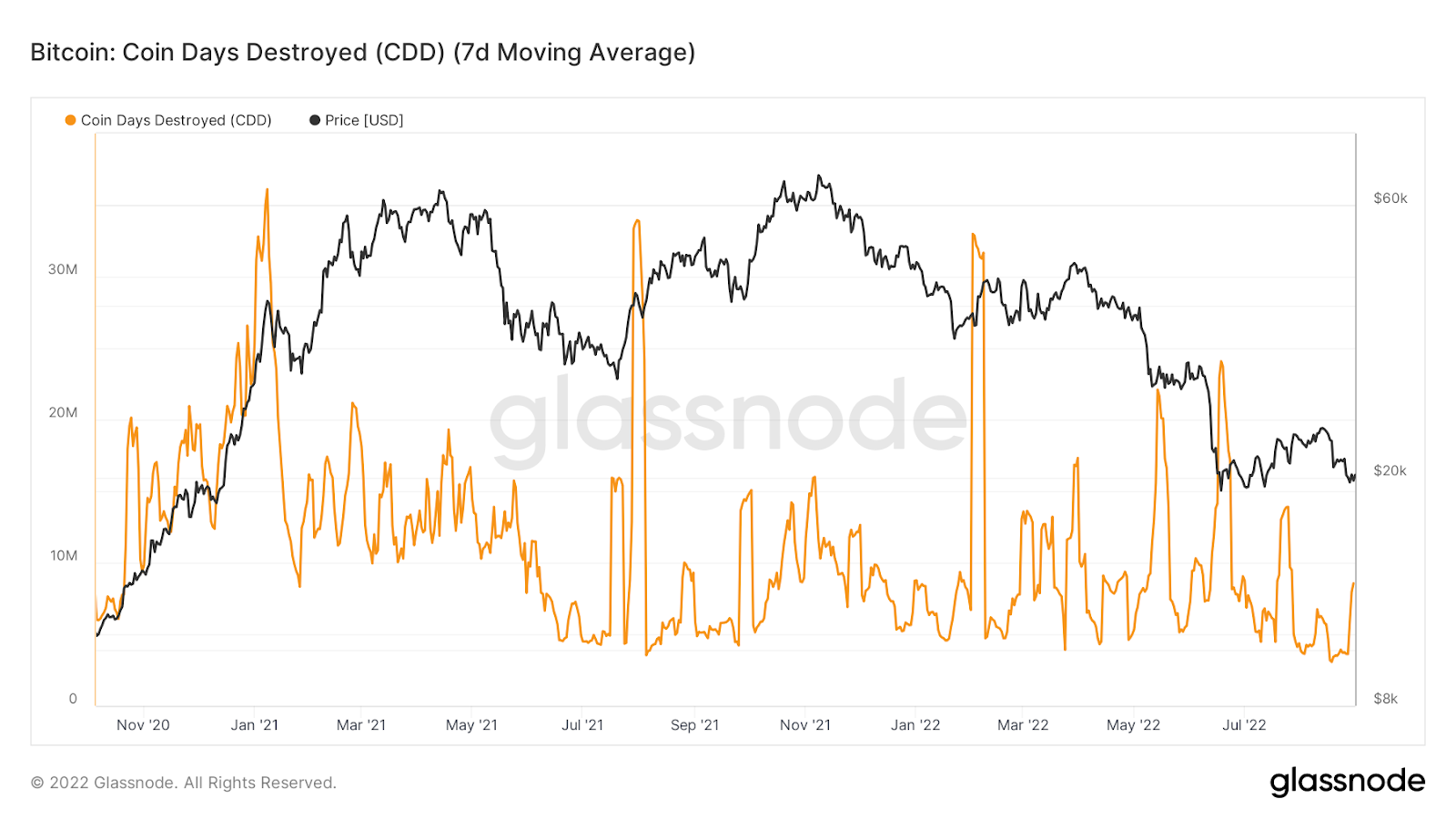

In the derivatives market, the BTC-weighted funding rate has returned to the middle zone. However, the long-term outlook is bleak as the BTC forward month futures premium continues to fall. On-chain metrics show that over the past few days, about 10,000 dormant BTCs between 7-10 years of age have re-engaged in trading activities. As Mt.Gox’s process of repaying its creditors slowly progresses, the impact of the event on the main market is unknown, and monitoring this data point may be helpful.

ETH accelerated its gains during the Asian session, returning to the $1,600 mark after closing up 1.8% over the past 24 hours. On the hourly chart of ETH, a key ascending channel is forming with support near $1,510. If the momentum continues, the second-largest cryptocurrency by market cap could soon break above $1,625. Most major non-mainstream coins have mixed performance, with NEAR topping the list of gainers, while other non-mainstream coins have lost an average of 1%-2% over the same period.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...