What is Crypto Fear and Greed Index and what can you learn from this data?

What is the Crypto Fear and Greed Index?

To many, the price of a cryptocurrency doesn’t matter because its success is not determined by value, but by its impact on the lives of people around the world. However, for traders, cryptocurrencies may be seen as a good investment. The trick is knowing what to choose when there is uncertainty around you. Whether prices are rising or falling, the volatility of cryptocurrencies can make it difficult for newbies to make informed decisions.

Luckily there are now some tools to help you decide, one of which is the Crypto Fear and Greed Index.

Open a Crypto Wallet on Paxful

Fundamentals of the Crypto Fear and Greed Index

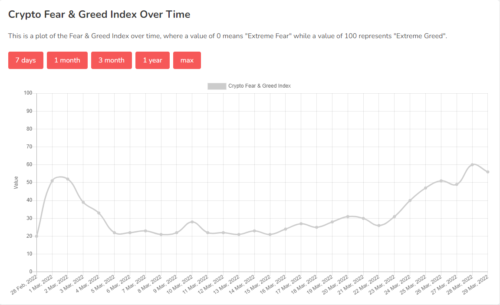

The Crypto Fear and Greed Index is a scale that reflects people’s current sentiment toward the cryptocurrency market. The highs and lows of an asset’s value can be described as the effect of increased fear or greed in the market . Increased greed will mean increased demand, which in turn will increase the price of Bitcoin. Alternatively, an increase in fear could manifest as a decrease in demand and value, which could be the best time to buy Bitcoin.

The Crypto Fear and Greed Index is very simple to read. If the index reaches 80 or higher (extreme greed), it means that people are positive towards cryptocurrencies, there is a lot of greedy buying in the market, and this is the best time to sell. If the number falls, closer to zero, it means fear has increased. During times of extreme fear, the market sees low demand and low prices, and many see this as an ideal time to buy BTC.

Go to Paxful’s Official Website

What is the formula for calculating the index?

Calculating the Crypto Fear and Greed Index involves factors such as surveys, social media content, and trends, resulting in a temperature index for the market. Each factor is assigned a corresponding weight to accurately describe the current state of affairs.

Let’s look at these factors:

Volatility (25%)

Volatility measures the price change of a cryptocurrency over time, taking a 30-day and 90-day average. These averages are used to give users a detailed understanding of the current volatility of the market, as well as maximum drawdowns and behavior relative to the averages. The increase in volatility has been linked to increased fear in the cryptocurrency market.

Market capacity (25%)

Again, this factor uses the 30-day and 90-day averages to measure market momentum. Here, market momentum is combined with market volume to describe how bullish or greedy the market is at the time. An increase in this value represents an increase in volatility in a bullish market.

Social media (15%)

This section primarily measures the number of posts and hashtags about Bitcoin and other cryptocurrencies, backed by data from Twitter posts and forum sites like Reddit. The engagement of the post is also taken into account, as this shows how “fast” the community is digesting and disseminating this information. Increased posting and engagement represent increased market greed.

Research (15%)

Weekly research helps analysts observe and understand the market. This approach combines traders’ first-hand experience with their insights, giving analysts exactly how the community perceives the market. Of course, accuracy improves as more respondents participate in the survey.

Dominance Index (10%)

The Dominance Index of a cryptocurrency (in our case Bitcoin) is measured by market capitalization compared to other coins. Here, we have to take into account that Bitcoin is seen as a safe investment in the community.

This part of the analysis has two sides. A rise in the Bitcoin Dominance Index could represent a market panic as less and less money is circulating in other tokens. Alternatively, a drop in the dominance index could indicate greed in the market, as people are willing to take more risk in other tokens.

Trend (10%)

Of course, trends also play a role in indices. Google Trends is a great tool that shows search volume for queries related to Bitcoin or other cryptocurrencies. To be clear here, refine your search terms to queries like “bitcoin price increase”, “ethereum price prediction”, etc. You can judge cryptocurrency fear and greed based on the increase in the corresponding search terms.

Open a Crypto Wallet on Paxful

The case for extreme fear and greed in the cryptocurrency industry

Now that we’ve broken down the components of the index, let’s look at some real-world examples of how the extreme fear or greed index actually behaves in the market. In several of the following cases, we see dramatic changes in the value of BTC following events that lead to a surge in fear or greed.

Extreme fear

August 22, 2019 – 5/100

Bitcoin price: $10,127.53 Average

Bitcoin price over the period: $10,000

After several months of steady appreciation, the price of BTC crossed the $12,000 mark as the US imposed a 10% tariff on Chinese goods sparking trade concerns, but this didn’t last long and BTC value plummeted shortly thereafter.

March 28, 2020 – 8/100

Bitcoin Price: $6,208.81

March 10-April 17 Index Range – 9-16/100

Average Bitcoin Price During This Period: $6,000-$7,000

The global pandemic in 2020 has had a huge impact on the value of BTC. At the time, BTC fell below $4,000 , halving its value in just two days. The ensuing slump in oil prices spooked many investors into risk-reducing decisions that further exacerbated the situation.

June 22, 2021 – 10/100

BTC Price: $31,655.20

May 22nd – July 18th Index Range: 10-19/100

After the massive crash that began on May 12, the Chinese government decided to ban Bitcoin — mining, holding, and trading it all became illegal. This caused panic in the BTC international market, and investors sold their assets, causing the value of BTC to plummet from an all-time high of $ 63,569.81 on April 14 to $29,789.94 on July 21

Elon Musk also reversed his initial support for Bitcoin by announcing that Tesla would no longer accept Bitcoin. This further complicates the form, thereby reducing the value of BTC.

January 8, 2022 – 10/100

BTC price: $41,534.35

Bitcoin price crashed from $50,792.04 on December 7 last year , and earlier this year saw a brief dip in BTC amid fears of a “crypto winter.” Such concerns have prompted many investors to pull out of riskier investments to maintain stability. Next on January 23, the price fell to $35,071.80.

Extreme greed

July 9, 2019 – 84/100

BTC price: $12,304.35

At this time, Bitcoin is becoming more and more popular and the application rate is getting higher and higher, and the price has broken through record highs several times within a few months, reaching a record high since 2017. This extreme greed caused BTC to reach its then all-time high of $12,000 .

August 11, 2020 – 84/100

BTC Price: $11,391.01

July 31st to September 3rd Index Range – 75-84/100

Before the bull market from October 2020 to January 2021, fiat currencies weakened and Bitcoin entered the mainstream market and began to rise rapidly, and this trend continued from October to January. As the value of BTC climbed, the greed of the market made it difficult for newbies to invest.

December 8, 2020 – 95/100

BTC price: $18,549.09

In the middle of the 2020 bull market, calls from institutional investors have helped BTC regain the spotlight of market greed. From $11,000 in August to $18,000 by the end of the year . Increased purchasing power and inflation are important factors in this increase in greed.

December 31, 2020 – 95/100

BTC Price: $28,890.12

November 17th to January 9th Index Range: 86-95/100

Average Bitcoin Price During This Period: $16,000-$40,000

First all-time high reached on January 10, 2021 at $40,256.35

February 9, 2021 – 95/100

BTC price: $46,527

This coincides with the start of another bull market that began on February 7, 2021, just two months before the Bitcoin halving .

February 14, 2021 – 95/100

BTC Price: $47,215.52

Index Range Feb 7-22: 86-95/100

Price Range Feb 7-22: $39,000-$56,000

More and more people will start investing and trading BTC at this time. The greed in the market at this time pushed BTC above $50,000 and gradually stabilized at $47,000 .

October 20, 2021 – 84/100

BTC price: $64,276.54

The growing popularity of NFTs has led to a greater understanding of the cryptocurrency space, focusing on the first cryptocurrency, Bitcoin. It hit an all-time high of $66,008.47 the next day . Later, BTC hit an all-time high of $67,553.95 on November 9, 2021

Go to Paxful’s Official Website

How to Invest with the Fear and Greed Index

Imagine this: one day you go online and see that a lot of your friends on social media are buying bitcoin at an astonishing rate. Therefore, you also feel the need to buy Bitcoin. After all, you don’t want to miss out on a good opportunity, right? Next, the market then corrected itself and the demand for Bitcoin dropped along with its value.

This is just a simple example of emotional buying, and you may find that impulse trading is not the best option.

Trading Bitcoin with the Fear and Greed Index is actually quite simple, you know what options you have when faced with certain conditions. When greed is running high, prices can drop quickly, so selling BTC may be the best option. Vice versa, high fear is a good time to buy.

Open a Crypto Wallet on Paxful

What can we learn from this?

The most basic lesson we can learn from this is how much public sentiment can affect the value of cryptocurrencies. It’s the same lesson we’ve learned from economic crises over the past few decades: Fear can force people to stop spending, causing stocks to fall in value, while extreme greed can lead to economic bubbles.

The Crypto Fear and Greed Index is a practical tool to understand public sentiment and help you avoid impulse trades. In a market environment where veteran traders can also be confused, being well-informed is the best option.

Start investing in Crypto with Paxful

Please click "Introduction of Paxful", if you want to know the details and the company information of Paxful.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...