Knowing the various situations in which positions may be forced to be liquidated, users can formulate better risk management strategies.

When trading on Binance Futures, liquidation is always executed at the mark price, not the last price.

In the cross-margin mode and the isolated-margin mode, the performance of the liquidation price is different.

Binance Futures allows users to trade with leverage, that is, users can establish positions by providing an initial margin.

While this feature is attractive, it also exposes users to the risk of forced liquidation.

In order to avoid losses, it is important to be aware of the various situations in which positions may be liquidated.

These situations are often misunderstood when trading cryptocurrency contracts. This article will explain three common misconceptions about forced liquidation.

Go to Binance’s Official Website

1. Execute forced liquidation at the mark price

When trading on Binance Futures, you may have come across two different prices: the last price and the mark price.

Last Price refers to the last traded price of the contract, while Mark Price refers to the contract’s estimated fair value.

Users should pay attention to the gap between the mark price and the liquidation price, because liquidation is always performed at the mark price. Executing forced liquidation at the mark price prevents price spikes and also combats market manipulation.

And if the forced liquidation is executed at the last price, even if the underlying asset has not yet reached the liquidation price, slight price fluctuations in Binance will lead to unnecessary forced liquidation.

Users with long positions must pay attention to whether the mark price of the contract is not lower than the liquidation price, otherwise their positions will be liquidated.

Users with short positions must pay attention to whether the mark price of the contract does not exceed the liquidation price, otherwise they will lose their margin.

Please switch from the last price to the mark price, or switch from the mark price to the last price through the Binance Mobile App as shown in the picture below.

If you are using the desktop version, please switch from last price to mark price or from mark price to last price as shown in the image below.

2. Liquidation price changes

Strictly speaking, the liquidation price of the position remains unchanged.

However, due to the dynamic change of the forced liquidation agreement, there are some exceptions to the forced liquidation price.

I. Cross Margin and Isolated Margin

The forced liquidation price of the contract is different in the cross-margin mode and the isolated-margin mode. Because these differences are often negligible in the contract market, users often find that the liquidation price has changed or that the stop-loss order has failed to protect the position from forced liquidation.

In cross-margin mode, all open positions share the full margin balance.

If you hold multiple positions, the liquidation price will change continuously with the performance of your positions.

In order to understand more thoroughly, let’s review the basic principles of the forced liquidation agreement, namely:

Maintenance Margin > Margin Balance

in

Margin balance = wallet balance + unrealized profit and loss

According to the above formula, when the margin balance is shared between multiple open positions in the cross-margin mode, the unrealized profit and loss will affect the margin balance.

Therefore, the forced liquidation price will continue to change with the performance of the position.

In the isolated margin mode, the liquidation price remains unchanged.

It is the margin balance allocated to a single position.

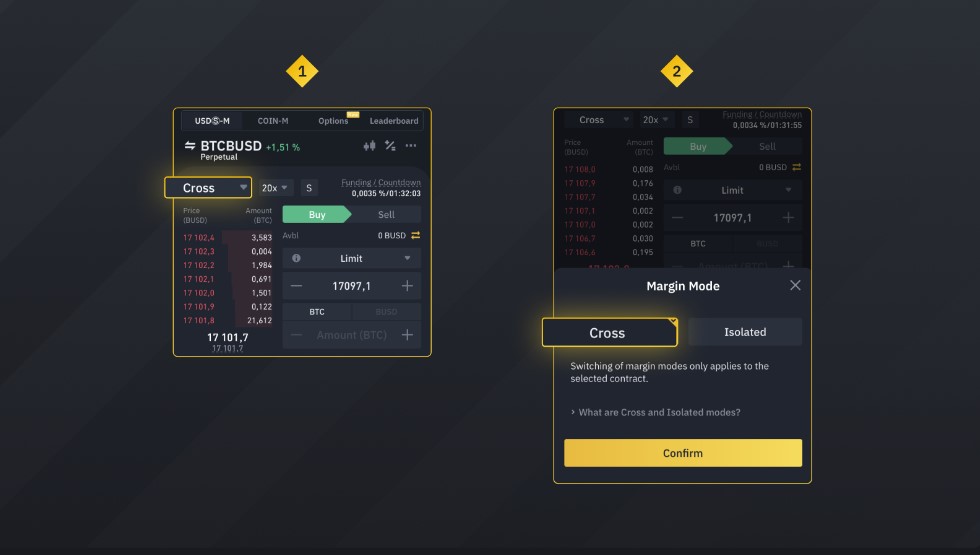

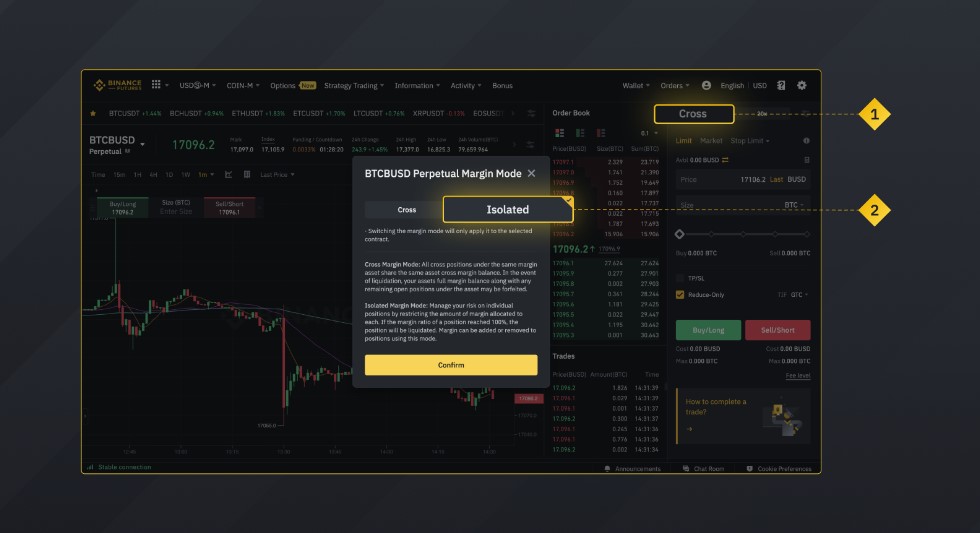

Please switch from the cross-margin mode to the isolated-margin mode through the Binance Mobile App as shown in the picture below.

Please switch from cross-margin mode to isolated-margin mode through Binance Desktop as shown in the picture below.

In the cross position mode, traders can avoid forced liquidation by paying close attention to the margin ratio.

When the margin ratio reaches 100%, it means that some positions you hold may be forced to liquidate because the wallet balance is less than the maintenance margin.

While cross-margin mode allows you to share the risk across all positions, cross-margin mode is usually more difficult to manage and the entire wallet funds will be at risk.

Go to Binance’s Official Website

II. Funding Rate

Liquidation prices may also vary due to funding rates.

According to the forced liquidation formula, if the wallet balance changes, the margin balance may also be affected.

Funding rates usually make up a small portion of a position, but can become larger in times of volatility.

Add it to the wallet balance or deduct it from the wallet balance, and the liquidation price will change.

Funding rate refers to the payment between users on each contract side (long and short) every 8 hours.

Funding rates help maintain a balance between contract market prices and spot market prices.

Binance does not make money from funding fees.

III. Changes in deposit amount

Also, if you increase or decrease your position by increasing or decreasing margin, the liquidation price may change.

In addition, if you increase or decrease positions to change the maintenance margin ratio, the liquidation price may also change.

Please note: In the cross-margin mode, when the available balance of the account changes, the liquidation price of the position will also change.

As long as you do not reduce your available balance, changing leverage will not affect the liquidation price of the contract.

In addition to the wallet balance, changing the position, position opening price or risk amount will also change the liquidation price.

Go to Binance’s Official Website

3. Insurance liquidation costs

Users often report that the loss exceeds expectations when the forced liquidation is executed.

This is because after the contract position is forced to close, the insurance liquidation fee will be charged and added to the insurance fund.

The insurance fund liquidates negative balances of wallets and guarantees investment profits for all users.

The calculation method of insurance liquidation fee is as follows:

Insurance liquidation fee = position nominal value x forced liquidation rate

Please note: Insurance clearing fees do not become revenue for Binance in any way. Binance only makes profits from transaction fees.

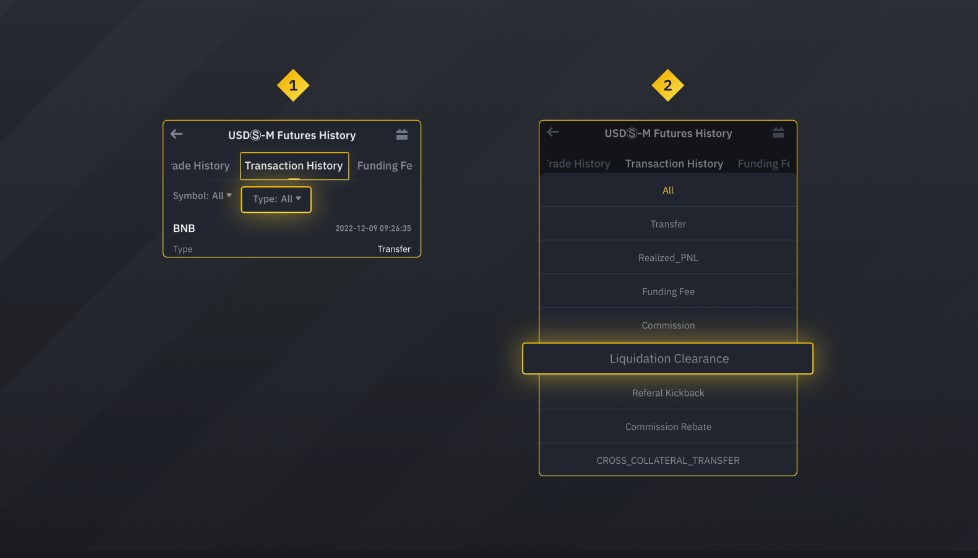

To see if you have paid the insurance liquidation fee, go to Contract Transaction History and click Forced Closeout Liquidation.

Users can reduce the chance of forced liquidation through various strategies, such as monitoring margin, using stop loss orders or reducing the amount of leverage.

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...