Explore the differences between crypto trading and long-term holding (HODLing), the advantages and disadvantages of each strategy.

Crypto Trading versus Long-term Holding

Choosing between making quick profits through trading or holding onto your investments for the long term can be a challenging decision; in this article, we will delve deeper into the differences between these two strategies, offering you comprehensive information to help you determine the best approach for your unique situation.

In the world of cryptocurrencies, there are generally two primary types of enthusiasts: active crypto traders and long-term holders, often referred to as HODLers. The burning question is, what truly distinguishes these groups, and what unique advantages does each strategy provide?

HODLing, a term derived from a misspelling of “hold,” refers to retaining your crypto assets for an extended period. The duration of holding varies among individuals; most HODLers keep their crypto for at least a year before considering selling. However, others hold onto their investments for much longer or even indefinitely, waiting for the ideal price before selling or never selling at all.

Go to CoinField’s Official Website

One might wonder, what drives people to choose HODLing over trading?

While trading offers the potential for immediate and consistent profits, HODLing is based on the belief that, over an extended period, the value of one’s chosen cryptocurrency will rise significantly. This increased valuation could lead to substantial returns if the HODLer eventually decides to sell their assets.

HODLers often patiently wait for their preferred coin to reach a specific value before selling, but the timeline for this value increase remains uncertain. For instance, if someone had purchased bitcoin back in 2010 and held onto it until 2017, when it reached its all-time high of $20,000, they would have yielded massive profits for those who decided to sell at that precise time.

Advantages of HODLing include:

- A hands-off, less time-consuming approach to investing

- Reduced taxes and paperwork due to long-term capital gains, which are typically taxed at a lower rate

- Allows for cost averaging, making it easier to manage market volatility

Disadvantages of HODLing involve:

- A less thrilling investment experience compared to day trading

- No opportunity for short-term gains or immediate income

Crypto Trading

In contrast, crypto traders typically trade daily or whenever significant price fluctuations occur. The volatile nature of cryptocurrencies enables traders to potentially make short-term gains and immediate profits by taking advantage of these price swings.

However, trading carries its own set of risks, including selling too early and missing out on additional profits, or misjudging market movements and incurring losses. The non-stop, 24/7 nature of crypto markets can also lead to mental strain, as traders may become consumed by the process, often staying up all night trading to maximize their opportunities. While trading provides instant gratification, it can also cause immediate disappointment and stress.

Advantages of Crypto Trading encompass:

- The potential for immediate profit if trades are executed strategically

- A more exciting and engaging experience compared to long-term holding

- The possibility of establishing a consistent income stream through successful trading

Disadvantages of Crypto Trading include:

- A higher risk associated with the unpredictable nature of market fluctuations

- Increased taxes with short-term capital gains, which are usually taxed at a higher rate than long-term gains

- More complex tax paperwork due to the frequency of trades

- Potential for sleep deprivation and stress resulting from constant market monitoring

Start Crypto Trading with CoinField

Can I Combine Both Approaches?

Some investors choose to adopt a hybrid strategy, splitting their holdings between trading and HODLing. They may allocate a portion of their assets for long-term holding while actively trading the rest daily or during significant price swings. This combined strategy can potentially maximize gains by taking advantage of both short-term and long-term market movements.

When adopting this approach, it’s crucial to conduct thorough research and set personal goals for each aspect of your investment strategy. For instance, you may identify specific coins that are likely to appreciate in value over time but do not exhibit significant day-to-day fluctuations, making them ideal candidates for long-term holding. On the other hand, some coins may experience considerable price swings on a daily or weekly basis, making them better suited for trading.

Regardless of your chosen approach, whether it’s short-term trading, long-term holding, or a combination of both, it’s essential to perform in-depth research and analysis of your selected cryptocurrencies. For HODLers, this means identifying coins with strong potential for long-term growth and avoiding those that may lose value over time.

When it comes to trading, you’ll need to learn the intricacies of trading strategies and techniques, as it is a challenging endeavor that carries significant risks. Educating yourself on various trading methods, market analysis, and risk management strategies can greatly improve your chances of success.

Most importantly, in both HODLing and trading, you must understand and accept the inherent risks associated with cryptocurrency investments. Regardless of the strategy you choose, there’s always the possibility of losing your entire investment. Therefore, it’s crucial to assess your risk tolerance and make informed decisions based on your financial goals and comfort level.

Go to CoinField’s Official Website

Start Trading and HODLing Today

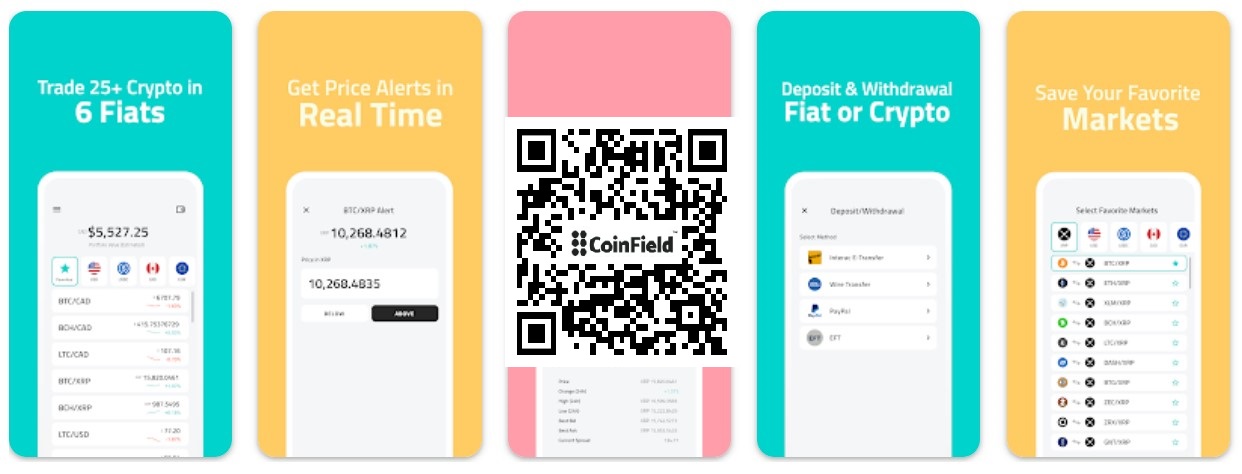

If you’re ready to embark on your cryptocurrency journey, consider opening an account on a reputable exchange platform like CoinField. This user-friendly platform allows you to begin trading and holding your chosen cryptocurrencies with ease, providing you with the necessary tools and resources to manage your investments effectively. So, whether you’re an experienced trader or a newcomer to the world of digital assets, CoinField can help you navigate the exciting realm of cryptocurrencies and achieve your financial goals.

Please check CoinField official website or contact the customer support with regard to the latest information and more accurate details.

CoinField official website is here.

Please click "Introduction of CoinField", if you want to know the details and the company information of CoinField.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...