Binance has launched an Options Platform offering two primary types of options, Call and Put, providing traders with a versatile, cost-effective tool to hedge against market risks, capitalize on market views at a fixed cost, and enhance overall portfolio performance.

As we tread further into the constantly evolving landscape of cryptocurrency trading, there has been a substantial growth in demand for advanced financial instruments. This increased demand, driven by both retail and institutional interest, has led Binance, a global leader in digital asset exchanges, to launch a groundbreaking Options Platform. This new platform offers a cost-effective product designed to empower traders who wish to protect their portfolios against market volatility, or express their market views at a fixed cost, the latter being limited to the Options Premium. In this comprehensive guide, we unravel the world of Binance Options, delve into their numerous benefits, and provide a step-by-step guide on how to trade them.

Go to Binance’s Official Website

Demystifying Binance Options

Binance Options represent the latest addition to the exchange’s robust roster of financial instruments. These options contracts offer traders the right, without the obligation, to buy or sell the underlying digital asset at a predetermined price on a specified future date. This unique characteristic of options trading allows traders to gain controlled exposure to market movements at a fixed premium, transforming them into an ideal tool for hedging against market risks and enhancing overall portfolio performance.

The newly launched Binance Options Platform is designed to enable trading of two primary types of options: Call Options, which grant traders the right to buy the underlying cryptocurrency, and Put Options, which provide traders the right to sell the underlying cryptocurrency.

Deciphering Call Options

Call Options, one of the two primary types of options contracts, are typically used by traders who are bullish, that is, those who anticipate a surge in the price of the underlying cryptocurrency. For a trader to profit from a Call Option, at the time of expiration, the price of the underlying cryptocurrency must be trading significantly above the Strike Price, enough to cover the Options Premium paid.

For example, if a trader is expecting a price rise in Ethereum (ETH) following a significant market event next week, the trader can lock in a purchase price by buying a weekly ETHUSDT Call Option. If, upon expiration, ETHUSDT settles at a price above the Strike Price, the trader will earn the difference between the Strike Price and the Settlement Price of ETHUSDT. Moreover, the trader has the alternative option to sell the ETHUSDT Call Option back to the market before expiry, securing a profit without having to wait for the contract to expire.

Go to Binance’s Official Website

Interpreting Put Options

Conversely, Put Options give traders the right, but not the obligation, to sell the underlying asset at the expiry. Traders can profit from a Put Option when the price of the underlying cryptocurrency falls significantly below the Strike Price, enough to cover the Options Premium.

Consider a scenario where a trader anticipates a fall in the price of ETH following a certain market event. To secure a selling price, the trader can purchase a weekly ETHUSDT Put Option. If ETHUSDT settles below the Strike Price on expiry, the trader will earn the difference between the Strike Price and the Settlement Price of ETHUSDT. The trader also has the flexibility to sell the ETHUSDT Put Option back to the market before expiry, allowing the trader to lock in a profit without waiting for the contract to expire.

The Multifaceted Benefits of Trading Binance Options

Binance Options serve as one of the most flexible and diverse financial instruments in the current market, providing additional trading and strategic opportunities while offering cost efficiencies that can significantly enhance your trading strategies. Here are the key advantages:

- Competitive Fees:

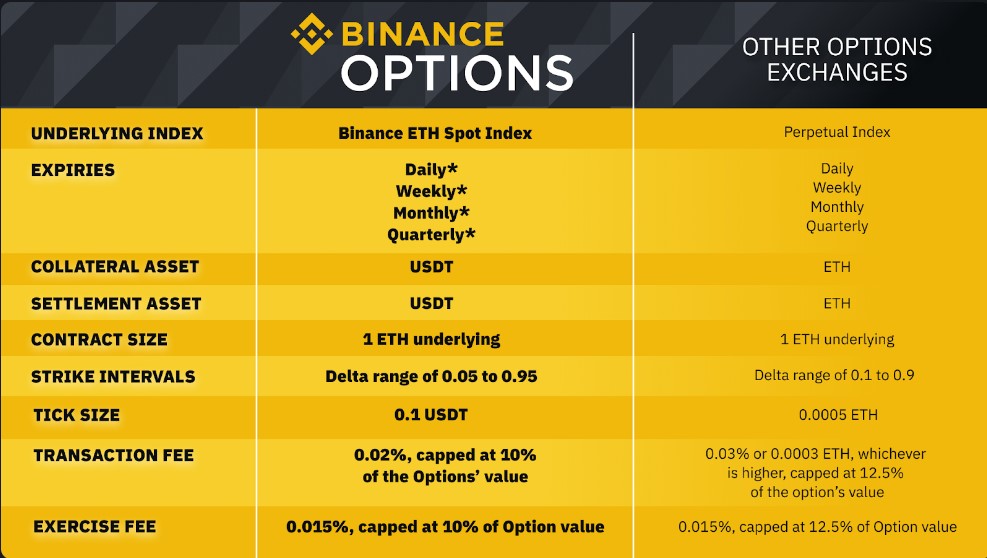

- Binance is committed to ensuring affordability in trading by offering one of the lowest options transaction fees in the market, making options trading not just cost-effective but accessible to a wider audience.

- User-Focused Experience:

- Binance Options boasts a user-centric interface, offering API connectivity, and seamless ways to switch assets across multiple trading products, providing traders with a truly efficient and versatile trading experience.

Go to Binance’s Official Website

Why You Should Trade Binance Options

Binance Options offer multiple strategic advantages that can significantly enhance the performance of your trading portfolio:

- Portfolio Protection:

- Binance Options can be used as a tool to hedge your risk. If you are a long-term investor and are apprehensive about market volatility, you can purchase Put Options to protect your portfolio against potential market downturns and offset potential losses.

- Tailored Strategies:

- With Binance Options, you can employ a combination of different Strike Prices, Expiry Dates, and types of Options to create tailored directional or neutral trading strategies, allowing you to profit irrespective of the direction of the underlying asset’s price.

- Limited Risk with Unlimited Potential:

- The maximum loss you can incur with Binance Options is capped at the Options Premium. However, the upside potential, especially for Call Options, is unlimited.

- Diverse Trading Opportunities:

- Options prices are influenced not just by the underlying asset’s price movements, but also by volatility and time value, allowing you to speculate not just on price directions, but also on volatility trends.

- Low Capital Requirement:

- With Binance Options, you need to pay only the required Options Premium to get the same exposure as holding an equivalent Futures or Spot position. This lower capital requirement amplifies your trading results.

Trading Binance Options: A Step-By-Step Guide

Trading Binance Options is a simple and intuitive process:

- Visit the Binance Options page and click [Register Now] to open an Options account.

- [Transfer] funds to your Options Wallet.

- Select the underlying asset you would like to trade.

- Choose between [Call] and [Put] Options to open a position.

- Input [Price], [Amount], select [Order Type], and click [Buy].

- And voilà, you’re trading Binance Options!

Conclusion

Binance Options aims to simplify options trading with its intuitive design. High liquidity, characteristic of Binance, is also reflected in the new Options Platform, ensuring buy and sell orders are executed swiftly without slippage. By reducing transaction costs, Binance offers one of the lowest options trading fees in the market, making it more accessible for both retail and institutional investors. Whether you’re speculating on short-term price movements or hedging to reduce risk exposure in underlying assets, Binance Options is the platform for you.

Go to Binance’s Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...