How does leveraged Cryptocurrency trading work on PrimeXBT?

Leveraged Cryptocurrency Trading. Table of Contents

Leveraged Bitcoin Trading

Leverage allows you to gain much more exposure to the market you are trading in than the amount you deposited to open the trade.

How does leverage work?

Leverage is a key feature of the PrimeXBT trading platform and can be a powerful tool for the trader. You can use it to take advantage of relatively small price movements, leverage your portfolio to increase position size, and get your capital to grow faster.

Leverage uses a deposit, known as margin, to provide you with more exposure. Basically, you put in a fraction of the total value of your trade and PrimeXBT provides you with the rest. PrimeXBT’s products allow traders to gain exposure to major cryptocurrencies, such as bitcoin, Ethereum, and others, without investing a lot of capital.

PrimeXBT is an advanced and award-winning margin trading platform that offers a wide variety of Bitcoin-based CFDs with additional leverage and long and short positions on stock indices, commodities, forex, and cryptocurrencies.

PrimeXBT’s products allow traders to access a wide range of trading instruments and build a diverse trading portfolio, without tying up a lot of capital.

Try Leveraged Cryptocurrency Trading on PrimeXBT

Example of trading BTC/USD

For example, you want to buy 10 bitcoins at a price of $ 10,000.

To open this trade with a traditional trading platform, you would have to pay $ 10 × 10,000 for a $ 100,000 position (excluding commissions and other fees). If the price of bitcoin increases by 5%, each of your 10 bitcoins will be worth $ 10,500.

If you decide to sell, then you would have made a profit of $ 5,000 on your original investment of $ 100,000.

Trade with 1: 100 leverage on PrimeXBT.

This way, you will only have to pay 1% of your $ 100,000 or $ 1,000 position to open the trade. If the price of bitcoin increases by 5%, you will make the same profit of $ 5,000, but for a considerably lower cost.

That means that the benefits can be multiplied enormously.

Go to PrimeXBT Official Website

What are the benefits of using leverage?

- More benefits

- You only have to put a fraction of the value of your trade to receive the same profit as in a conventional trade with any other exchange platform.

- Leverage opportunities

- Leverage frees up capital that can be used for other investments. The ability to increase the amount available to invest is known as leverage.

- Profit from the market crash

- Using leveraged products to trade on market movements allows you to benefit from falling markets as well as rising markets.

Open PrimeXBT Account for Free

Profit from the ups and downs of the market

PrimeXBT allows traders to take advantage of both rising and falling prices.

If you want to buy a bitcoin, for example, the value of your account will increase as the price of bitcoin increases. If the price of bitcoin decreases, your account will lose value. In addition to performing standard operations (purchases), the PrimeXBT platform allows you to open a position whose value will increase as the price of the cryptocurrency decreases. This is called a sell or short position, as opposed to a sell or long position.

Go to PrimeXBT Official Website

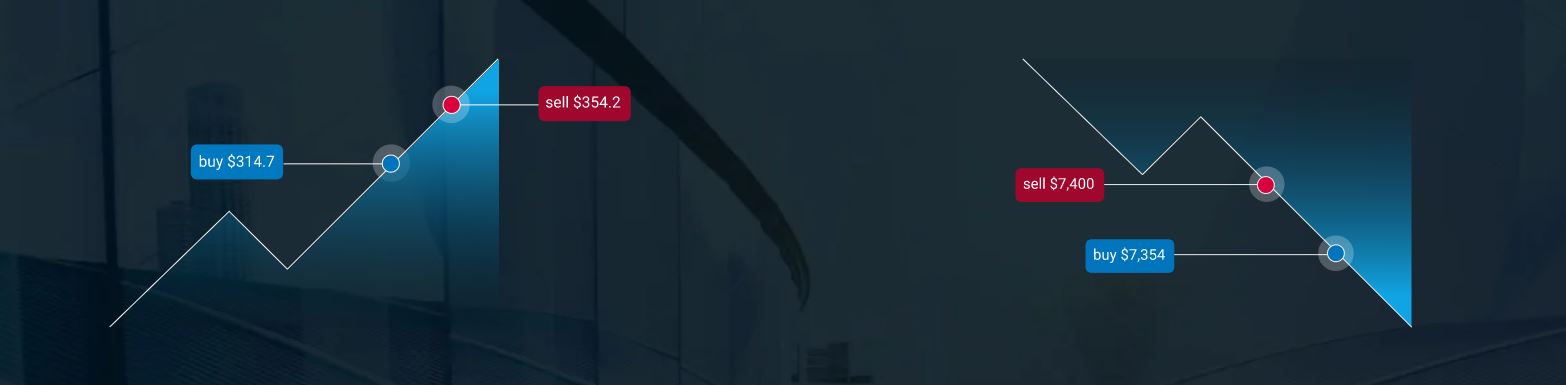

Example of Long Position in the Cryptocurrency market

Suppose the market price of Ethereum is $ 314.7. You think the price of Ethereum will increase, so buy 200 ETH at $ 314.7. This equates to a position value of $ 62,940.

Since PrimeXBT offers leveraged trading, you don’t have to put all the value of this trade. You just have to cover the margin, which is equal to 1% of the size of a total position or $ 629.40.

If your forecast is correct and the price of ETH rises, you can decide to lock in the profit. The price of Ethereum is $ 354.2 and you close your position.

To calculate your profit, you have to multiply the difference between the closing price and the opening price of your position by its size.

354.2-314.7 = 39.5, which multiplies by 200 and makes a profit of $ 7,900 because you had a “long” position.

Learn How to Trade Crypto on PrimeXBT

Example of Short Position in the Cryptocurrency market

Bitcoin is trading at around $ 7,400. He anticipates negative news about the cryptocurrency market that will negatively affect the price of BTC, so he decides to sell 10 bitcoins at $ 7,400 for a total short position worth $ 74,000.

Bitcoin has a 1% margin requirement (1: 100 leverage), so you have to deposit 74,000 × 1% = $ 740 as margin guarantee.

The news is bad and bitcoin falls to $ 7,354. You want to secure the profit, so you buy back 10 BTC at $ 7,354.

Since this is a short position, subtract the closing price ($ 7,354) from the opening price ($ 7,400) of your position to calculate profit before multiplying by its size of 10.

7,400-7,354 = 46, which you multiply by 10 and you make a profit of $ 460 because you were “short”.

Register with PrimeXBT for free

How to calculate profits and losses?

To calculate the profit or loss on a long or short sale, multiply your position size by the difference in points between the opening price and the closing price. In both long and short sales, profits and losses are effective once the position is closed.

You can also use leverage to gain exposure to a much higher position than a standard trade (both long and short) if you are confident that the market will go up or down.

You are one step away from leveraged cryptocurrency trading.

Open an account to start trading now – it’s free and easy, and no personal information is required.

Please check PrimeXBT official website or contact the customer support with regard to the latest information and more accurate details.

PrimeXBT official website is here.

Please click "Introduction of PrimeXBT", if you want to know the details and the company information of PrimeXBT.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...