What is Polkadot (DOT)? Why is it so popular in 2021? Table of Contents

- Polkadot - the next main Cryptocurrency

- Polkadot (DOT) token - what is it?

- What are the characteristics of Polkadot blockchain?

- Who is the founder of Polkadot?

- Origin of Polkadot (DOT) Coin

- How does Polkadot (DOT) staking work?

- Is Polkadot (DOT) a good investment?

- Is Polkadot (DOT) better than Bitcoin or Ethereum?

- Polkadot's Relay Chain vs. Ethereum beacon chain

- How is the value of Polkadot perceived?

- Polkadot (DOT) - Risks and Limitations

- Polkadot (DOT) coin price analysis

- Future Prospects of Polkadot (DOT)

- Conclusion

Polkadot – the next main Cryptocurrency

The environment surrounding the cryptocurrency industry is changing rapidly. First, we have witnessed a huge price surge for Bitcoin. Next, we saw the rapid growth of DeFi, decentralized finance that made Ethereum the center of the conversation. Ultimately, now experienced investors are looking for opportunities to diversify their investment portfolios through tokens that can leverage their market share on the Ethereum network. In the midst of this, the Polkadot token comes to mind. Since Polkadot (DOT) is still a relatively new token (DOT), we expect you to wonder what Polkadot is and what it is used for.

Polkadot (DOT) is an open-source project provided by the Web3 Foundation, which allows data transfer between different blockchains and supports multiple chains within one network. Polkadot (DOT) aims to eradicate slow communication between public and private blockchains and speed up the network without forking or compromising scalability.

As we know, the issue of interoperability remains unresolved in the current blockchain environment. Polkadot (DOT) is currently offering many technological innovations to overcome this problem. Interact with Ethereum applications and assets with plans to extend and integrate other blockchain platforms. The ultimate goal of the project is to add features that other blockchains such as Ethereum, Cardano, and EOS have not achieved. Allowing cross-blockchain transfer of tokens, data and assets here will set it apart from other cryptocurrencies. As such, Polkadot (DOT) is of great value and is actively rising in the cryptocurrency rankings. It has now become one of the top 10 cryptocurrencies with a market cap of over $7 billion.

Polkadot (DOT) token – what is it?

The Polkadot Token (DOT) is the native token of the network. In addition, Polkadot (DOT) is a blockchain protocol that encourages global computer networks to allow users to launch and operate blockchains.

Currently, the circulating supply of DOT is close to 900 million, while the maximum supply of Polkadot (DOT) Coin has not been determined in advance. These tokens are primarily intended to strengthen network cohesion and enable Polkadot (DOT) governance and upgrades.

See other Polkadot related articles

What are the characteristics of Polkadot blockchain?

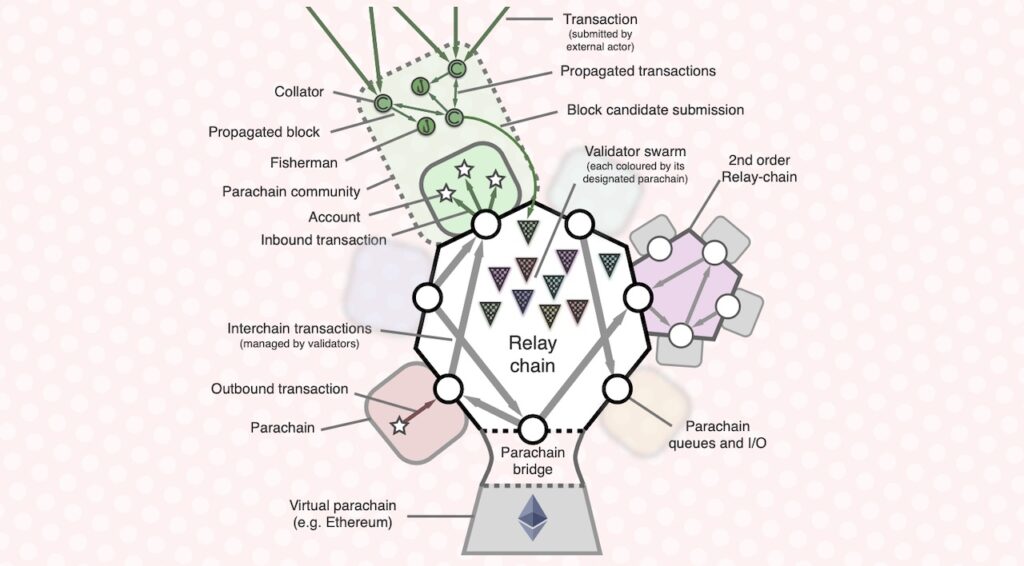

By design, Polkadot (DOT) operates two types of blockchain. These are the default network (relay chain) and user-created networks (parachain). The difference between them is that transactions on the relay chain are permanent. Conversely, parachains can be customized by users for a variety of uses and can be supplied as the main blockchain.

Thanks to Polkadot’s unique design, it is possible to keep transactions secure and accurate, using only the computing resources required to run the main chain. At the same time, it has the added benefit that users can customize many Parachains for different uses.

Here is an overview of the structure and components of Polkadot (DOT):

- Bridges

- A facilitator between parachains, parathreads, and other blockchains.

- Parachains

- Independent chains that can form their own tokens.

- Parathread

- Provides a flexible model for forming new tokens utilizing independent chains.

- Relay Chain

- It facilitates consensus between different chains.

Overall, the Polkadot (DOT) blockchain allows users to conduct transactions more privately and efficiently. This is because the blockchain they create does not expose user data to the public network. Gavin Wood said it could theoretically handle over 1 million transactions per second.

Invest in Polkadot with Bitlevex

Who is the founder of Polkadot?

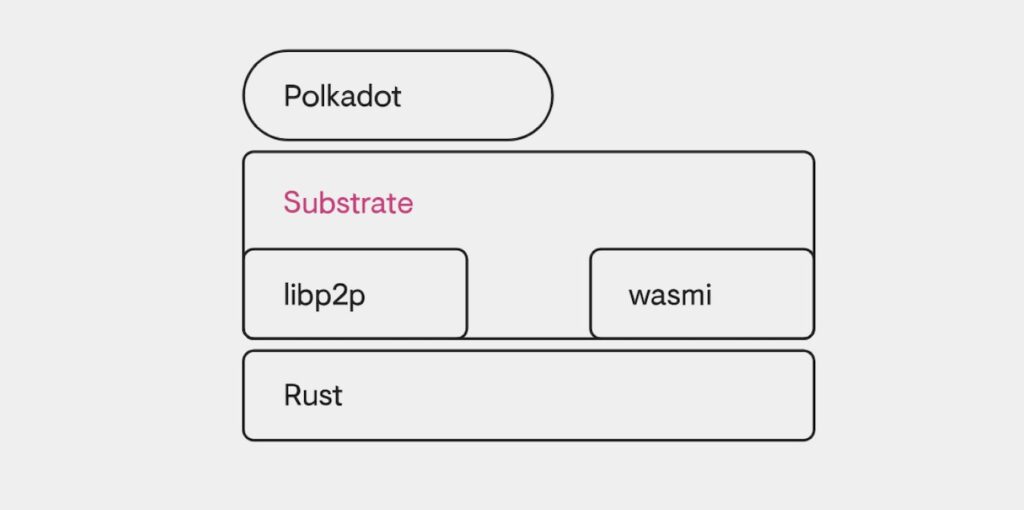

Polkadot (DOT) was developed by Parity Technologies in 2017. Parity Technology is a company co-founded by Dr. Gavin Wood and Jutta Steiner from Ethereum in 2018. This project is supported by funding, advocacy, research and collaboration from the Web3 Foundation.

Since its launch in 2015, Parity has focused on developing Polkadot (DOT) and related projects, Substrate, in developing node software for Ethereum called Parity Ethereum Client.

In 2018, the company launched two proofs-of-concept (PoC) on the market, and in July 2018 put Polkadot’s first Parachain into service. In September 2019, the network launched the Kusama network. After that, the beta version of Polkadot (DOT) was released in May 2020, and token transfer became possible in August 2020.

Origin of Polkadot (DOT) Coin

Polkadot (DOT) was first launched during the Initial Coin Offering (ICO) in 2017 when the project approached $140 million. It then proceeded with two private sales in 2019 and 2020, raising an additional $100 million. Although the main Polkadot (DOT) cryptocurrency is DOT tokens, Parachains can issue native tokens, transfer tokens, and use these tokens to make transactions.

However, Parity’s Ethereum wallet is weak, and there has been a hack involving about two-thirds of the previously frozen ICO tokens, and so far, the frozen tokens have not been recovered. Surprisingly, the team backing Polkadot (DOT) decided to go ahead with the project despite these losses.

In August 2020, Polkadot (DOT) allowed investors to trade the rest of the tokens. As a result, DOT has been listed on many major exchanges, including Binance, Huobi, and Kraken. And, driven by high trading volume, DOT’s market capitalization soared. Currently, Polkadot (DOT) has surpassed $7 billion in market capitalization and ranks 7th in cryptocurrency market capitalization.

An interesting and somewhat unusual thing about DOT tokens is that the face designation of the tokens has been “revised” with a 100x acquisition after the start of the transaction. This means that the total number of Polkadot (DOT) coins has increased 100 times, which means that it has increased from 10 million to 1 billion. As a result, all DOT holders will get 100 coins for each existing coin they previously held. Since the new coin is equivalent to about 1/100 of the value of the existing coin, the market capitalization was not affected, and the number of coins was improved to be more legible.

Start Investing in Cryptocurrencies

How does Polkadot (DOT) staking work?

To properly understand what Polkadot (DOT) Coin is, you must first understand its purpose and function. The DOT cryptocurrency plays a decisive role in maintaining and operating the Polkadot (DOT) blockchain.

Users who own and hold stakes in DOT can vote for network upgrades. Each vote is proportional to the amount the user has staked DOT cryptocurrency. As of 2020, DOT is yielding staking returns of 10% to 15% per annum on exchanges such as Kraken and Bitfinex.

To encourage staking, Polkadot (DOT) will reward users with newly minted DOT based on how many tokens they have staked. The Polkadot (DOT) blockchain has 4 main consensus roles, all of which can be rewarded.

Each consensus role is as follows:

- Validators

- People who maintain the relay chain by staking DOT or validating proofs.

- Nominators

- Secure the chain by staking DOT for a short list of validators and the reliability of the operation.

- Collectors

- Keeps most of the shards. They collect shard transactions from users and then create proofs for validators.

- Fishermen

- These monitor the behavior of the network and report suspicious activity to Validators.

Apart from basic financial transactions for governance and bonding, staking is one of the three main uses of DOT tokens. Parachains within the Polkadot (DOT) network are public blockchains, private blockchains, or other data sources. Data on Parachain is accessed through special nodes and sent to Polkadot (DOT), similar to how decentralized oracles work. Parachain is activated by staking DOT tokens and removed from Polkadot (DOT) by unstaking.

Is Polkadot (DOT) a good investment?

Typically, DOT’s average staking profit is around 10-15% per year. However, returns will vary depending on stake pool performance, network changes, the amount of tokens staked, and demand. Conversely, DOT staking is less complex than cryptocurrency mining. This means that staking is more suitable for beginners, and the return on staking is less dependent on user supply (in terms of validating transactions).

Consequently, whether staking Polkadot (DOT) coin is a good investment depends on how much profit you are trying to generate and how many stakes you are willing to hold.

Should you invest in Bitcoin or Altcoins?

Is Polkadot (DOT) better than Bitcoin or Ethereum?

Although they did not deliberately set up Ethereum as a competitor, Polkadot (DOT) is often referred to as an ‘Ethereum Killer’. Even after the infamous Ethereum 2.0 upgrade, the Polkadot (DOT) blockchain is considered an improved version of the existing Ethereum infrastructure because both Ethereum and Polkadot (DOT) utilize sharding to avoid scalability and transaction problems. However, Polkadot (DOT) and Bitcoin have very different designs, functions, and purposes, making it rather difficult to compare them to Bitcoin.

Many experts see cross-chain networks as important for the development of DeFi and decentralized applications. In this sense, the structure of Polkadot (DOT), which consists of a relay chain and unlimited parachains, is superior to Bitcoin, which uses a relatively rigid model of Proof of Work (PoW) consensus and immutable decentralization.

Another difference comes from the way the two networks reward users to incentivize participation and adoption. In the past, Bitcoin has always rewarded miners despite the difficulty of computational work. In recent years, bitcoin mining (and then earning rewards) has been monopolized by really wealthy individuals or companies that can afford the equipment, utility bills, and bandwidth.

However, since Polkadot (DOT) is decentralized, there are validators who can receive tasks in different roles by staking Polkadot (DOT) tokens. Depending on the amount of DOT staked, users will be rewarded with more DOT tokens, which may also influence project development. On the other hand, these benefits do not apply to Bitcoin holders.

Speaking of transaction processing times, Polkadot (DOT) represents a significant step forward with linear processing transactions reaching a volume of 1000 transactions per second. As data travels on Polkadot’s parachains and back to the main chain via bridges, this number grows exponentially. Here, the scalability and technological edge of the project is once again emphasized.

What is DeFi (Decentralized Finance)? How to make profits with DeFi?

Polkadot’s Relay Chain vs. Ethereum beacon chain

As you know, Polkadot (DOT) and Ethereum 2.0 share a shared network similarity. But there is still a difference. The unique difference is that the Beacon Chain is used on different parallel shard plugs to share information on the condition that it can only be chained incompatible structures.

However, relay chains are more flexible as they allow different shards to operate independently. Using standard Web assembly, validators on relay chains can accept other Parachains that are much more interoperable. Additionally, external chains can be connected to the Polkadot ecosystem using bridges.

For example, decentralized applications on Ethereum 2.0 (ETH 2.0) can connect to the Polkadot ecosystem, whereas Ethereum 2.0 (ETH 2.0) cannot connect to apps developed outside the Ethereum network.

After all, the high interoperability of Polkadot (DOT) makes it more attractive to users and effectively solves the scalability problem. In other words, Polkadot (DOT) can communicate and develop without intermediaries without compromising security, much cheaper and faster.

How is the value of Polkadot perceived?

Polkadot (DOT) has many advantages over many existing blockchains. Ethereum 2.0 is already functionally integrated, and there is a special structure for distributing Parachain, a blockchain within a blockchain, also known as a shard. In the Polkadot (DOT) blockchain, shards send asynchronous messages between shards, and each shard has a special State Transition Function (STF).

These para chains collect and process data, then ‘feed’ the processed data to a relay chain that transmits it to other chains. The fourth component, the ‘bridge’, relays data back to the main chain, such as Ethereum, Bitcoin, Tron, or other platforms.

The value of Polkadot (DOT) is enormous as it basically creates what is known as a heterogeneous blockchain. Connecting multiple chains in a single network allows for parallel processing of transactions and secure cross-chain data exchange.

This allows arbitrary data such as real-world assets and tokens to move across Polkadot’s multi-chain application environment. Any blockchain can join the Polkadot (DOT) infrastructure. It is essentially a set of grouped validators that utilize heterogeneous shards.

This means that the use cases for Polkadot (DOT) are far more important than those for other blockchains. These include transaction chains, oracle chains, identity chains, file storage chains, data curation chains, IoT chains, financial chains and personal information chains.

Start Investing in Cryptocurrencies

Polkadot (DOT) – Risks and Limitations

Polkadot (DOT) is a fairly safe project that overcame great challenges in a short period of time. It truly demonstrates the value of that team and the community behind it.

There are still some risks associated with Polkadot (DOT) Coin. It is associated with a sharp rise in cryptocurrencies. The Polkadot (DOT) blockchain appears to be less focused on the user experience and has become a bit too complicated for the benefits Polkadot (DOT) brings.

Community-led hybrid consensus is another potential weakness. While this makes good sense, Polkadot (DOT) cryptocurrency holders don’t always know what’s best for a typical network.

The second risk has to do with money. In particular, it relates to Polkadot’s allocation of DOT tokens. A significant portion of the investment in this project comes from China, especially ordinary miners. Many cryptocurrency enthusiasts are wondering what this means for the future of Polkadot (DOT), and how it will affect inactive DOT holders with incredibly high inflation.

The 5 Best Cryptocurrency Exchanges in 2021

Polkadot (DOT) coin price analysis

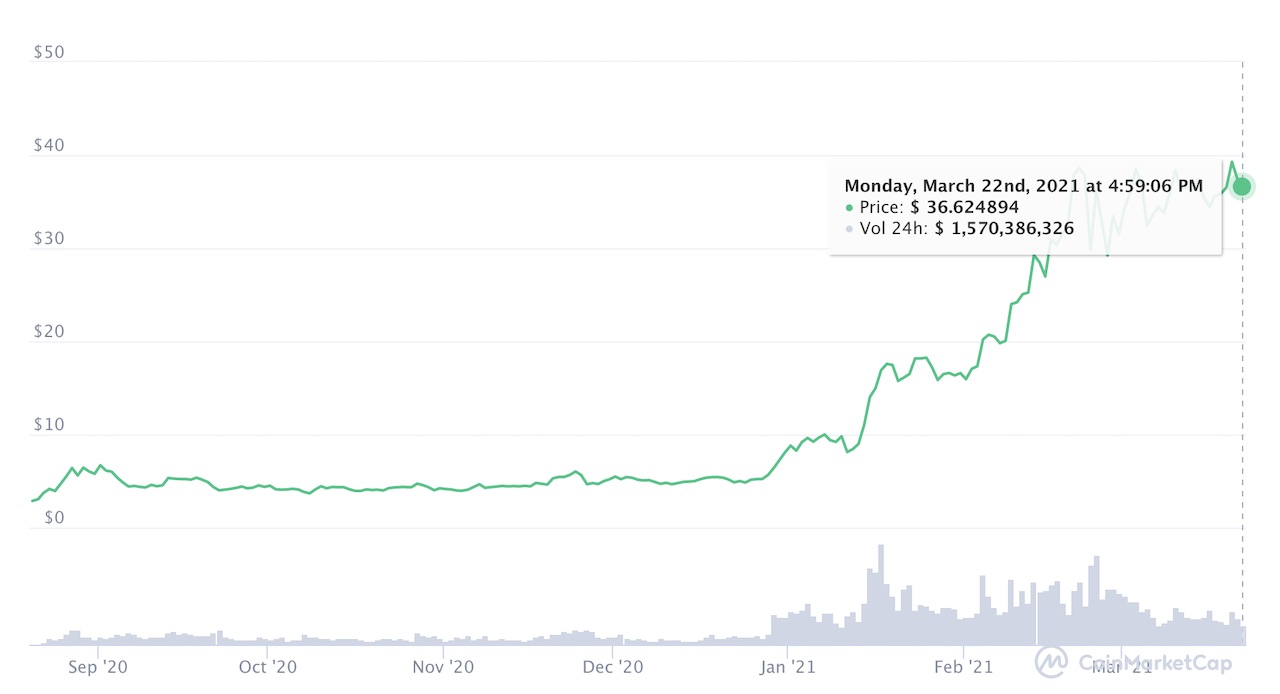

Polkadot (DOT) hit an all-time high of $368.05 in August 2020, right after the project started. However, the price of DOT fell sharply at the end of August, reaching its lowest price of $2.69. Since then, the price of DOT has averaged between $3 and $8 per year. However, on January 7, 2021, Polkadot, on an uptrend, broke the average trading price of $10.63. Then the bearish correction began, but a week later the DOT rebounded to $8.78.

Analyzing the moving average and the RSI indicator, we see a bullish look. And if DOTUSD rises again and crosses the resistance level, it could again surpass the $10 level. Conversely, a stronger correction may occur if the DOT price moves downward and breaks above resistance. Currently, DOT is trading at $36.65 and is again reaching all-time highs.

Start Investing in Cryptocurrencies

Future Prospects of Polkadot (DOT)

Many experts are watching Polkadot (DOT) trading volume increase to decide whether to hold Polkadot (DOT) coin in the future. At the same time, many projects are working to be integrated into Polkadot’s Para chain.

In 2020, we saw the Polkadot blockchain achieve an important milestone by launching the multi-chain network Kusama for early-stage deployment. The new network increased the number of validators from 700 to 900. Many expect Polkadot (DOT) to go into the same orbit. The network then needs to be run by at least 1,000 validators.

This is because a large number of validators are likely to attract new users to the platform. Here we can understand why Polkadot wants to build a bridge between different blockchains in the coming months.

One promising project integrated with Polkadot (DOT) is Edgeware, which is believed to provide a sustainable ecosystem. It mainly relies on a few pieces of code held by separate modules within different parts of the blockchain. WASM smart contracts can use different architectures with more flexible and smooth execution. In 2021, Edgeware looks like a breakthrough, and Edgeware itself is already in the spotlight, so the future for Polkadot (DOT) is bright.

Invest in Polkadot (DOT) with AltumBrokers

Conclusion

Polkadot (DOT) is an ecosystem with undiscovered potential. There may be shortcomings, but only the future can tell if they are true. However, in terms of competition, Polkadot (DOT) Coin is currently in competition with Cosmos, which is similar in concept to Polkadot (DOT) Coin, but uses a simpler protocol. While other projects are also working on cross-blockchain communication, Polkadot (DOT) is leading the way in many ways.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...