Dual-Price Mechanism in Bybit: Protecting Traders from Market Manipulations

Market manipulations, which cause the market price on a futures exchange to significantly deviate from the Spot price, can lead to mass liquidation of traders’ positions. This not only costs traders considerable amounts of their hard-earned money but also undermines public confidence in the entire crypto exchange industry. To counteract such occurrences and ensure a fair trading environment, Bybit has implemented a Dual-Price mechanism. This FAQ will provide a comprehensive understanding of this mechanism, breaking down the technicalities into simple language.

Go to Bybit’s Official Website

Understanding the Dual-Price Mechanism

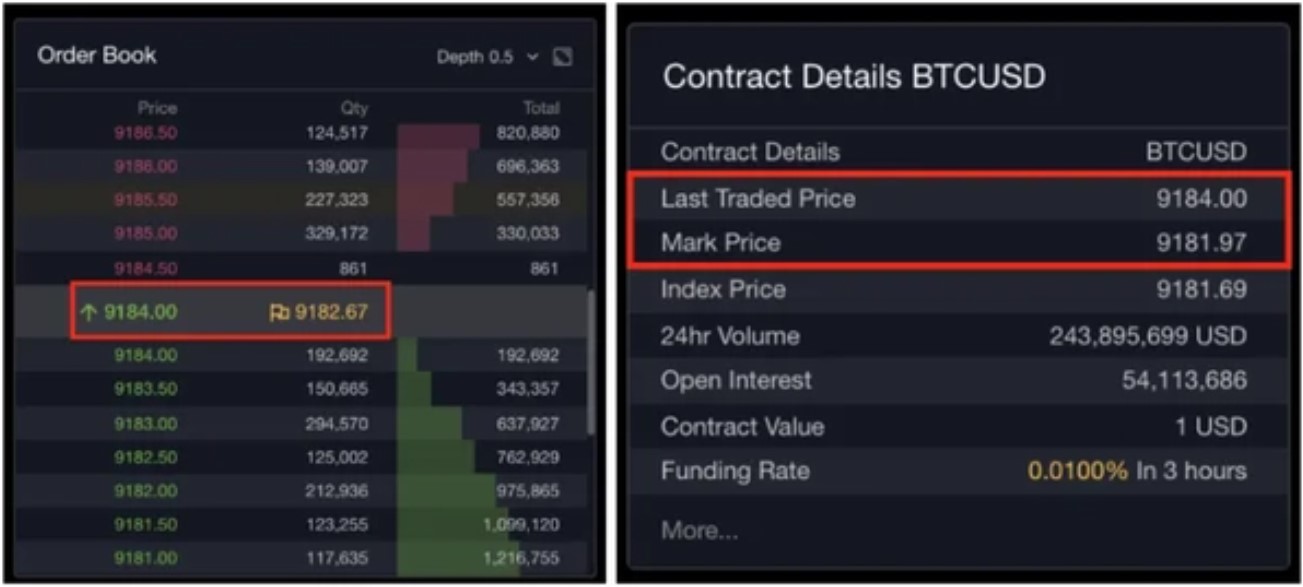

The Dual-Price Mechanism in Bybit involves two primary elements: the Mark Price and the Last Traded Price. The goal of this mechanism is to prevent market manipulations that might lead to unnecessary liquidations and to ensure a more reliable and secure trading environment.

Mark Price

In the context of perpetual contracts, the Mark Price corresponds to a global Spot price index plus a decaying funding basis rate. It can be seen as reflecting the real-time Spot price on the major exchanges. The Mark Price in Bybit is used to trigger liquidation and measure unrealized profit and loss, though it doesn’t affect a trader’s actual profit and loss. A trader’s position is only liquidated when the Mark Price reaches their liquidation price.

The calculation of the Mark Price is somewhat complex, and it involves factors such as an Index Price, Last Funding Rate, Time Until Funding, and a Moving Average. There are specific circumstances where Bybit adjusts the criteria for choosing the mark price, for example when there is abnormal index price or when there is insufficient data to calculate the 30-minute moving average.

Go to Bybit’s Official Website

Last Traded Price

The Last Traded Price refers to Bybit’s current market price, which is always anchored to the Spot price using the funding mechanism. This characteristic makes it unlikely for the price on Bybit to significantly deviate from the Spot market price.

Breaking It Down: The Dual-Price Mechanism in Layman’s Terms

The dual-price mechanism is essentially a measure employed by cryptocurrency exchange platforms to mitigate any potential liquidations as a result of uncontrollable drastic price fluctuations instigated by market manipulations.

The nature of cryptocurrency trading, being decentralized and operating 24/7, makes it vulnerable to market manipulations, particularly when the market depth is poor. These manipulations could lead to substantial price deviations between platforms.

The dual-price mechanism, however, uses a fair price or the “mark price” instead of the last traded price to trigger liquidation. The mark price is an external price derived from the average spot price. As long as the mark price doesn’t reach the liquidation level, the position won’t be liquidated. The dual-price consists of the last traded price and the mark price.

The Last Traded Price is the last traded price on Bybit. While this is usually close to the spot index price, it can deviate significantly in situations of high volatility or malicious manipulation.

The Mark Price, for a Bybit perpetual contract, is derived from the spot index price and a decaying funding rate. The index price of BTCUSD is the real-time weighted average price of five major spot exchanges (Coinbase, Bitstamp, Kraken, Gemini, Bittrex), and the index price of BTCUSDT is the real-time weighted average price of four major spot exchanges (Poloniex, OkEx, Huobi, Binance).

Therefore, by using the dual-price mechanism, Bybit effectively shields traders’ positions from unnecessary liquidation in the event of abnormal price fluctuations. This not only makes trading more secure but also enables traders to make more informed decisions.

Go to Bybit’s Official Website

Conclusion

Bybit’s Dual-Price Mechanism is a robust tool in the fight against market manipulations. By utilizing the Mark Price and the Last Traded Price, Bybit ensures a fairer trading environment, reducing the risk of unwarranted liquidations and creating a more reliable platform for traders. This empowers traders to participate with more confidence and stability, helping to foster trust and growth in the cryptocurrency industry.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...