Open AAAFX’s (ZuluTrade) copy trading account to invest in Cryptocurrency market today.

Cryptocurrency Copy Trading. Table of Contents

- Cryptocurrency Auto Trading on AAAFX × ZuluTrade

- ZuluTrade's Cryptocurrency Copy Trading

- What are Crypto Trading Bots?

- Cryptocurrency trading bot types

- What does a trading bot look like?

- How do trading bots work?

- When to use a cryptocurrency trading bot?

- Benefits of using a trading bot

- Are cryptocurrency trading bots profitable?

- Limitations of cryptocurrency trading bots

- Cryptocurrency Copy Trading with AAAFX × ZuluTrade

- Conclusion

Cryptocurrency Auto Trading on AAAFX × ZuluTrade

AAAFX × ZuluTrade launch auto-trading on BTC, LTC, ETH, BCH, and XRP. Join a rapidly rising market by following expert CryptoTraders from around the world. Copy your trading strategy and receive your trades in your investment account.

- To discover the new great talents, as part of the largest community of Traders in the world!

- To comment, evaluate, make use of AAAFX × ZuluTrade social tools and get the best out of the market using the wisdom of groups.

- To stay in control – AAAFX × ZuluTrade are the most advanced and component-rich platform to use for a tailor-made experience.

- It doesn’t matter if you are a newbie; Our CryptoTraders share their experience in a global market influenced by a diverse ecosystem of technology and innovation.

- We always put the accent on the customer: our Customer Support team is always available.

- AAAFX × ZuluTrade have a global presence, has millions of users, and is the only regulated service in the EU and Japan!

Go to AAAFx’s Official Website

ZuluTrade’s Cryptocurrency Copy Trading

There is a saying on Wall Street that “Money never sleeps”. It is also known as the title of a movie directed by Oliver Stone. People in the financial world can trade anytime, anywhere, and at least one market is open and trading takes place there, so money never goes to sleep. That said, most financial institutions and markets are closed on weekends and at night.

In contrast, cryptocurrencies are traded 24 hours a day, 365 days a year. It is biologically impossible for a trader to take advantage of every opportunity in the market. However, it is not technically impossible. In fact, algorithmic trading plays a large role in the global financial market, and the cryptocurrency market is no different.

Cryptocurrency training bots do most of the work, seizing opportunities that arise in the fast-evolving cryptocurrency market. Automated trading leaves no guesswork and uses fixed parameters to execute trades while minimizing execution risk. However, even inaccurate cryptocurrency trading bots can cause huge losses.

In today’s post, we will look at the types of cryptocurrency trading bots, their pros and cons, and dig into some of the many cryptocurrency trading bots in the market.

Start Cryptocurrency Copy Trading on AAAFx

What are Crypto Trading Bots?

A cryptocurrency trading bot is an automated software designed to monitor, analyze and execute trades made on numerous cryptocurrency exchanges using predetermined inputs.

In general, cryptocurrency trading bots use trading algorithm programs to automatically sell and buy cryptocurrencies according to their strategies. The most commonly used algorithms are market making, trend following, and mean regression programs.

- The market-making algorithm creates a consistent bid-ask spread, which allows you to buy at a lower price and sell at a higher price. This creates market liquidity.

- Trend-following algorithms analyze the momentum of cryptocurrencies and trade along these trends.

- The mean regression algorithm measures whether a cryptocurrency is likely to revert to its long-term average. For example, the algorithm can find a low price that is high but likely to pull back or rebalance to a higher level.

All transaction fees must be factored into the transaction calculation, and the best performing algorithms will choose the best exchange to gain an edge in transaction costs. Trading with cryptocurrency bots is very effective, eliminating the complexity and confusion that can arise from trading with different strategies at the same time on multiple cryptocurrency exchanges.

Given the extreme volatility of the cryptocurrency market, cryptocurrency trading bots can provide both novice and experienced traders alike with greater flexibility and discipline while managing cryptocurrency-related risks more easily. Automated cryptocurrency trading bots can prevent human error and easily trade cryptocurrencies in the market faster than humans can.

Find out more about AAAFx’s Copy Trading

Cryptocurrency trading bot types

Cryptocurrency trading bots use strategies that have been endorsed by successful traders for years. From arbitrage to technical analysis, bots can specialize in specific types of trading. Now let’s take a look at some of the main automated cryptocurrency trading software.

1. Arbitrage Bots

Arbitrage trading is a trading strategy that takes advantage of price differences between exchanges to take advantage of market inefficiencies. Cryptocurrency trading bots compare cryptocurrency coin and token prices across different exchanges.

Every cryptocurrency exchange will have some differences between cryptocurrency prices. This is because the price is determined by the participants of that exchange. The only way to quickly capture this price gap and make money is to use an arbitrage bot.

If there is a price difference, the arbitrage bot will move quickly and make money.

Go to AAAFx’s Official Website

2. Market Maker Cryptocurrency Trading Bot

On the other hand, market-making cryptocurrency trading bots create a bid-ask spread in the market, which indicates that the difference between the asking price and the buying price is positive. The main purpose of a market-making bot is to fill the order book with buy and sell orders so that other market participants can execute orders against the order book.

To keep sell and buy orders possible, investment specialists also need to make money. Automated trading bots allow you to sell and buy multiple orders at the same time to generate margin. For example, a market-making cryptocurrency trading bot places a buy order for $0.49 and sells the same token for $0.51. If both orders are fulfilled, you will have a net profit of $0.02.

3. Technical Cryptocurrency Trading Bot

Technical cryptocurrency trading bots trade using pre-configured technical indicators to seize opportunities . Technical analysis of the current market can be done daily or over an extended period of time.

Most of the technical cryptocurrency trading bots offer both customizable signal trading and social trading, allowing you to follow and copy the metrics of successful traders.

Go to AAAFx’s Official Website

4. Portfolio Automation Crypto Trading Bot

Portfolio Automation Crypto trading bots automatically execute trades to rebalance your portfolio on a pre-set schedule.

You can preset the frequency you want to recalibrate, such as every 30 minutes, every hour, or every few hours. Streamlined portfolio management saves time and ensures you have a disciplined portfolio.

5. Coin landing bot

Coin landing bots automate the cryptocurrency lending process with risk-limited yield rates. Landing bots run complex algorithms to continuously monitor digital asset markets, manage and renew loans.

The coin landing bot manages the supply and demand of loans and creates the optimal interest rates for all supported coins.

Go to AAAFx’s Official Website

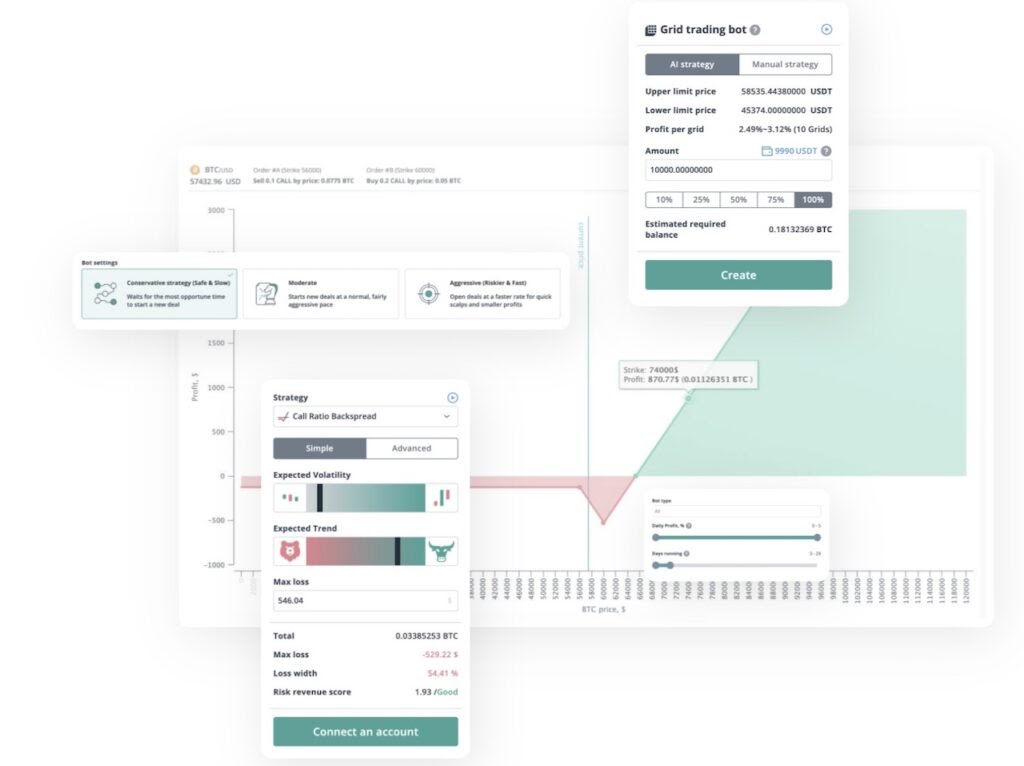

What does a trading bot look like?

All bots have different interfaces, but most of them are similar to the trading screens of typical cryptocurrency exchanges. You can choose from charting, orderbooking, and automatic trading strategies.

Here are the interfaces of some of the major cryptocurrency trading bots available.

How do trading bots work?

Cryptocurrency trading bots communicate with cryptocurrency exchanges and place orders according to preset instructions. This is typically done by giving the bot permission to an exchange account on a cryptocurrency exchange through an application programming interface (API) key.

After setting permissions, the bot immediately pulls and analyzes market data and automatically starts trading according to the configuration you set. Bots are usually granted two core permissions: the ability to read and display balances, and the ability to trade. To stop using the bot, simply revoke your permission to use the cryptocurrency exchange.

For example, you can start using a cryptocurrency trading bot by linking your Bybit account to 3Commas via the Bybit API key provided . Trading bots allow the bot’s artificial intelligence (AI) to perform trade analysis.

In general, the best cryptocurrency trading bots have to go through three steps:

- The signal generator stage identifies possible trades based on market movements and technical indicators.

- The risk allocation phase is the phase in which the cryptocurrency trading bot distributes the risk according to the parameters set by the user. These pre-set parameters determine the amount of capital that must be allocated in each trade.

- The execution stage is the stage in which buying and selling of cryptocurrency actually takes place.

Go to AAAFx’s Official Website

When to use a cryptocurrency trading bot?

Trading bots save you time by doing a lot of work such as portfolio diversification and management, rebalancing, market analysis, smart order routing, and more.

The best part is that customization allows you to make them do specific things. If you have a task to repeat according to certain guidelines, the cryptocurrency trading bot will do it for you. For example, cryptocurrency trading bots can perform portfolio rebalancing, a tedious, time-consuming, and periodic task.

Similarly, you can assign tasks that need to be performed with high accuracy to your cryptocurrency trading bot. Selling an asset at a specific price can change so quickly that it can be impossible for humans to track. The bot monitors cryptocurrency exchanges based on specific conditions and executes trades at the exact moment.

Cryptocurrency trading bots also perform complex trades. For example, smart order routing needs to monitor trading pairs on numerous exchanges in order to determine when, how much, and at what price to proceed with a trade. This must be done quickly before market conditions change. A complex strategy like this is difficult to do manually, but can be executed using a cryptocurrency trading bot.

If you are spending more and more time managing your portfolio, a cryptocurrency trading bot may be for you. Bots enable cost-effective and cost-effective trading. They usually pay a monthly subscription fee and hire a developer to fine-tune their trading strategy.

Benefits of using a trading bot

From reaction time to processing power of machines, cryptocurrency trading bots have many advantages. Now let’s see why you should set up an automated trading platform.

1. Transaction without emotion

No matter which automated trading bot you work with, emotions are not involved in any trade. Cryptocurrency trading bots are rational, immediate, and trade based on a clear strategy.

You can trade with much more restraint, excluding the fear of loss, the greed for profit, and the human nature of being afraid of the uncertain.

Go to AAAFx’s Official Website

2. High efficiency

Trading bots trade in an instant within a set range. Combining immediate decision-making with the ability to quickly process market intelligence, trading patterns, and risk assessments, trading bots deliver unmatched efficiencies.

Cryptocurrency trading bots prevent human error, while minimizing delays that can occur in manually processing and analyzing large volumes of data.

3. Disciplined trading

In volatile markets like cryptocurrencies, there is no single formula for success, but using bots to automate the trading process ensures consistency and discipline in trading. Operating with preset trading conditions, the bot consistently analyzes the market to maximize long-term performance.

Go to AAAFx’s Official Website

4. Ongoing transaction

The cryptocurrency market never closes. Trading bots are the only viable solution for anyone who wants to maximize their profits around the clock.

Are cryptocurrency trading bots profitable?

Algorithmic trading can be profitable. Only when you know what you are doing is it possible to make a profit. Unfortunately, as with any trading strategy, trading cryptocurrencies using bots can be risky.

The main issue lies between the algorithms built into the bots and how well novice traders understand them. Algorithmic trading bots are built for the needs of professionals, so there is no guarantee that a bot that works well for the people who made it will be good for you.

On the other hand, cryptocurrency trading bots do their job well by eliminating emotion and increasing trading accuracy. However, not all trading bots are effective or sophisticated. This is especially true for free cryptocurrency trading bots that are available to the general public. These bots are usually flawed and may also contain algorithms that can infiltrate funds.

Go to AAAFx’s Official Website

Limitations of cryptocurrency trading bots

No matter how advanced cryptocurrency trading bots have been, every cryptocurrency trading bot has its limits. Keep in mind that not all bots have the same limitations. A steep learning curve may follow the bot.

If you start trading with the default settings of the bot, you may not be able to earn money. Also, if you want to use a bot effectively, you need to test iteratively. If your current trading algorithms, trading strategies, and trading signals are widely used, your ability to make money quickly decreases. Each bot needs new algorithms, custom strategies, and new trade structures to hit the market.

Also, you must be proficient in using cryptocurrency trading bots. Poorly designed, poorly-accurate trading bots can cause huge losses. The loss will be even greater, especially if you can make many trades at a fast pace. Even a single bug in the source code can make a user painful.

Cryptocurrency Copy Trading with AAAFX × ZuluTrade

ZuluTrade is one of the more advanced automated cryptocurrency trading bots providers.

ZuluTrade’s platform focuses on transparency and has a lot of community support for Discord. This platform also has a learning curve, but once you get used to it, it’s easy and intuitive to use.

ZuluTrade is an easy-to-use no-code platform for beginners.

With ZuluTrade, it takes only a few minutes to develop a long-term strategy, so you can regularly buy and sell orders without keeping an eye on the market.

ZuluTrade is a low-fee directional trading platform that automatically trades using given market analysis.

The built-in trading algorithm trades cryptocurrency pairs from popular cryptocurrency exchanges.

Go to AAAFx’s Official Website

Conclusion

Humans need to sleep, but bots don’t have to. As the number of cryptocurrencies increases and their value increases, it becomes difficult to spot opportunities. Whether you are an experienced trader or a beginner looking to make money, cryptocurrency trading bots provide reliability and stability in volatile markets. Set up a cryptocurrency trading bot today and turn the insights you gain into revenue.

Start Cryptocurrency Copy Trading with AAAFx

Please click "Introduction of AAAFx", if you want to know the details and the company information of AAAFx.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...