How should we pick a cryptocurrency with a high safety margin? A proven strategy is to select the leading projects.

A must-know monopoly leader on the NFT track-OpenSea

In the cryptocurrency industry, how to choose a currency with a high margin of safety? One of the high winning strategies is to “pick the leader.

“The growth rates of the segmented track leaders vary, but basically the hot ones we have seen, such as value storage -Bitcoin; infrastructure platform-Ethereum, exchange platform currency leader – Binance Coin…… performance is very good, many of them hundreds of times coins, a thousand coins, even coins a million times.

What about the popular NFT track? You must understand that its leading project is OpenSea.

Not only because it is absolutely the leading boss, focus on it has not issued tokens, ahead of the layout, might be able to in its dropping a small fortune on.

What does OpenSea do?

OpenSea is the world’s largest decentralized NFT trading platform, which can be understood as Uniswap in the NFT world.

OpenSea was established in February 2017 and is a company supported by Y Combinator for incubation.

Before 2020, OpenSea was a small company, and even the initial business was not an NFT trading platform.

It was not until the CryptoKitties fire that it turned to the NFT market. After the transformation, it has been unknown for a long time.

With the outbreak of NFT in the second half of 2020, OpenSea has only begun to emerge.

Why is OpenSea the absolute monopoly leader in the NFT track? Let’s look at the data.

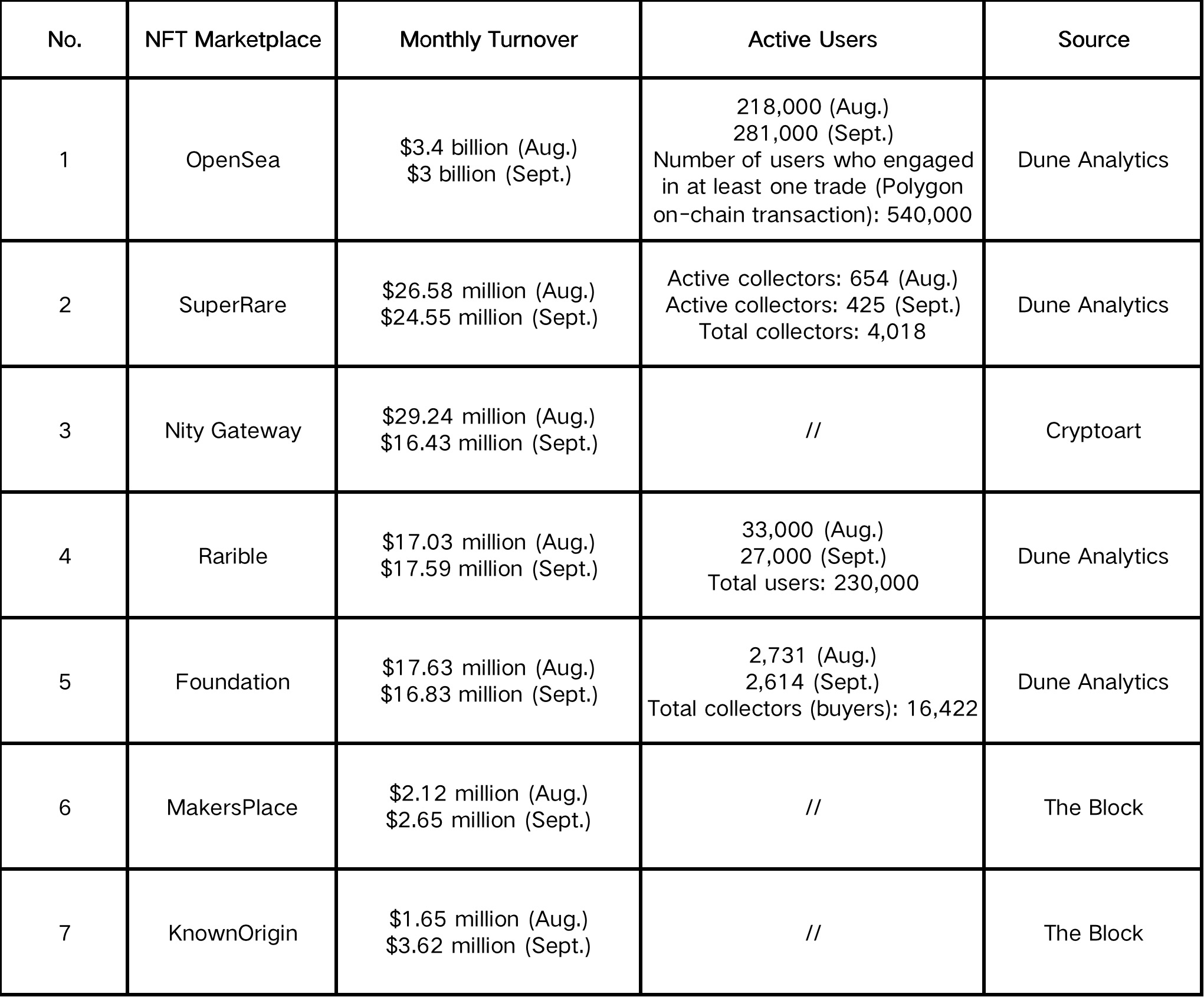

Summary NFT trading platform, in addition to OpenSea, little-knowns are SuperRare, Rarible, Foundation, Nity Gateway, and MakersPlace

Take the transaction data of the past two months as an example:

In August and September, the total NFT trading volume of the seven marketplaces stood at approximately $3.5 billion and $3.08 billion.

However, OpenSea alone contributed an excess of $3.4 billion (August) and $3 billion (September), with a market share of over 97%.

It is even more monopolistic than the search engine giant Google (Google owns 92% of the search market).

In terms of the number of users, OpenSea also boasts an overwhelming advantage.

In September, OpenSea had 281,000 active users, while its peers only had much fewer active users, ranging from a few thousand to only a few hundred.

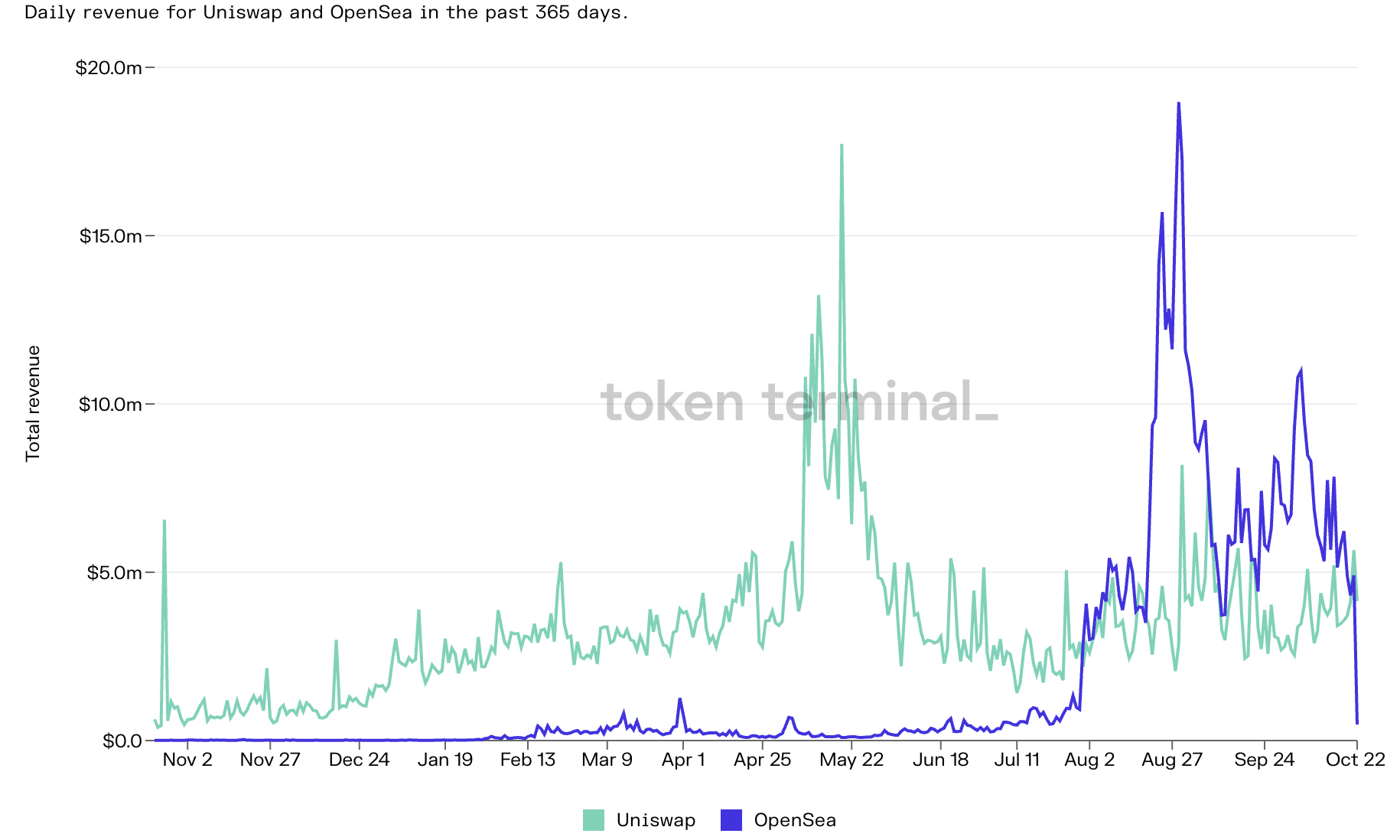

So based on these data, other platforms can’t even talk about revenue, but OpenSea ‘s revenue in August and September of this year has surpassed Uniswap, the leader of DEX.

How did OpenSea build such a monopoly?

So why OpenSea can form such a monopoly situation?

Because it has many advantages :

1) Low handling fee

OpenSea only charges a 2.5% fee to sellers.

Although this fee is much more expensive than cryptocurrency exchanges, it is 15%-30% more often than traditional auction houses (such as Sotheby’s) and other NFT trading platforms. Its cost is simply not too cheap.

2) Low threshold

OpenSea does not set thresholds for artists and NFT works, does not review works, and does not need to spend gas fees to cast NFT works.

Only when users sell NFT works will they be charged on the chain.

Therefore, after the NFT fire, the number of OpenSea NFT collections has grown very rapidly. As of writing (October 22), the number of NFTs sold online has exceeded 20 million.

3) Decentralized network storage

As to the center of the NFT trading platform, OpenSea protects the persistent data and can not be tampered with, but you know in the trading platform, wants to NFT assets content fully wound Ethernet Square, the difficulty is very large ( high fees, high technical difficulty )

Therefore, OpenSea uses the method of storing documents with hash values offline to forge NFT tokens, which not only guarantees the security of data that cannot be tampered with but also realizes the large-scale storage of NFT asset content.

4) Multi-chain, multi-category, and multi-project gathering to form a one-stop NFT transaction service.

OpenSea NFT has a large number and a wide variety of categories, covering fields such as painting, music, domain names, virtual worlds, games, sports star cards, and utilities. The coverage is very wide.

Almost no matter which NFT users want to buy or browse, they can find Found on OpenSea, this has a very large aggregation effect on the flow of buyers and sellers.

Not only that, OpenSea supports multi-chain transactions ( Ethereum is expensive, so users can also choose Polygon chain transactions with ultra-low Gas fees).

How can the OpenSea one-stop NFT transaction service formed in this way not be favored by the market?

How should we make to profit from OpenSea?

So, faced with such prospects, comparable Uniswap ( Uniswap current market value of $15.9 billion, came in the encryption market capitalization rankings single currency on 12th ) project, we lurk in the end how to get a share of it?

The most definite answer is probably: airdrop.

Nowadays, there are already a lot of smart little partners who buy and sell NFTs on OpenSea to brush transaction orders, hoping to get OpenSea airdrops in the future.

After all, as a leader, coveted dropped its dividend inevitable lot of people, it also inevitably require users to OpenSea income contributes only better access to airdrop.

This may also be one of the reasons why OpenSea transaction volume has soared.

Of course, for the specific NFT collection investment, the uncertain factors are much greater.

Therefore, it is not recommended for novices to buy large amounts of NFT to make airdrop transactions.

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...