Need to borrow some crypto funds? Binance Margin and Loans are two ways you can do so.

How To Borrow Crypto on Binance

- You can borrow cryptocurrencies on the Binance platform using Binance leverage and loan.

- Binance leverage provides a way to use funds provided by a third party for asset transactions.

- Binance loan is a financial service that allows users to meet their short-term liquidity needs by providing encrypted loans.

- Learn how to borrow cryptocurrencies through these Binance leverage and loan borrowed coins.

Need to borrow some encrypted funds? Binance Margin and Loan are two ways you can do this. In this article, use this step-by-step guide to learn why, when, and how to use Binance Margin and Loan. In this article, use this step-by-step guide to understand why, when, and how to use Binance leverage and staking coins.

Binance leverage allows traders to use leverage to amplify market volatility. Users can use leverage through automatic or manual borrowing. If the user decides to place an order in a full position or a position by position mode while borrowing, automatic borrowing will be a good choice. If not, you can consider borrowing manually.

Binance Leverage allows you to use your crypto assets as collateral to borrow money. You can borrow up to 10 times your assets, and assets worth more than 2 times your total debt can be transferred. Please note that at the same time, the probability of closing a position due to price fluctuations will increase accordingly.

With Binance loaned currency, users can borrow up to 65% of the value of their collateral, and the maximum loan period is 180 days.

In addition, the loan now provides Loans Staking to deduct part of the interest. The borrowed assets can be used for any type of transaction and can also be withdrawn from the platform. Binance loan is suitable for users who do not want to sell their existing assets but are looking for liquidity.

Go to Binance Official Website

How To Use Crypto Margins

How to borrow and transfer crypto on Margin via Binance Web.

![Transfer your chosen crypto collateral from [Fiat And Spot] to [Margin Cross].](https://mobie.io/wp-content/uploads/2021/11/Transfer-your-chosen-crypto-collateral-from-Fiat-And-Spot-to-Margin-Cross..png)

[Transaction]-[Margin Trading]-[Transfer], enter the amount of loan, and click [Confirm]

Click [Borrow] and select the digital currency you want to borrow, then click [Confirm Borrow]

![Click [Margin] and choose the crypto you want to borrow, then click [Confirm Borrow].](https://mobie.io/wp-content/uploads/2021/11/Click-Margin-and-choose-the-crypto-you-want-to-borrow-then-click-Confirm-Borrow..png)

Click [ Wallet ]-[Leverage]-[Transfer], now you can transfer the borrowed digital currency to the account you want to trade.

![Go to your [Wallet], click [Margin], and then [Transfer].](https://mobie.io/wp-content/uploads/2021/11/Go-to-your-Wallet-click-Margin-and-then-Transfer..png)

![binance Go to your [Wallet], click [Margin], and then [Transfer].](https://mobie.io/wp-content/uploads/2021/11/binance-Go-to-your-Wallet-click-Margin-and-then-Transfer..png)

Note: The part of the leveraged account that exceeds 2 times the liability valuation can be transferred out.

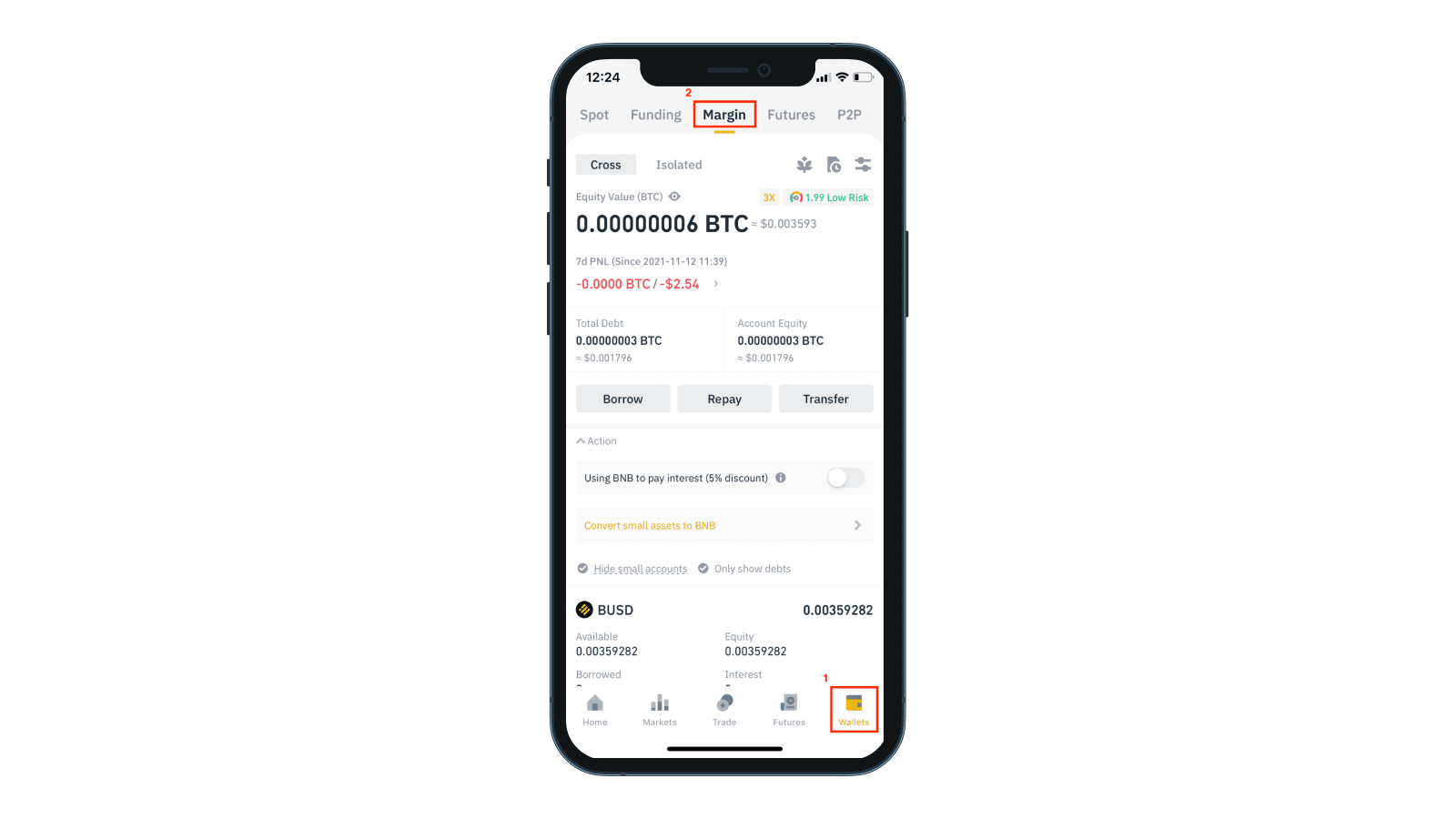

How to borrow and transfer crypto on Margin via the Binance app

【Wallet】-【Leverage】

Step 1: Click [Transfer] to transfer your collateral to a margin account.

Step 2: Click [Borrow] and select the amount you want to borrow.

![Click [Borrow], choose the amount you would like to borrow, and click [Confirm].](https://mobie.io/wp-content/uploads/2021/11/Click-Borrow-choose-the-amount-you-would-like-to-borrow-and-click-Confirm..png)

Step 3: Click [Transfer], select the account you want to transfer, and click [Confirm].

![Click [Transfer], choose the account you want to transfer the asset to, and click [Confirm].](https://mobie.io/wp-content/uploads/2021/11/Click-Transfer-choose-the-account-you-want-to-transfer-the-asset-to-and-click-Confirm..png)

Note: You can transfer assets with a value beyond 2 times your total debt from your leveraged account.

Go to Binance Official Website

How To Use Binance Loans

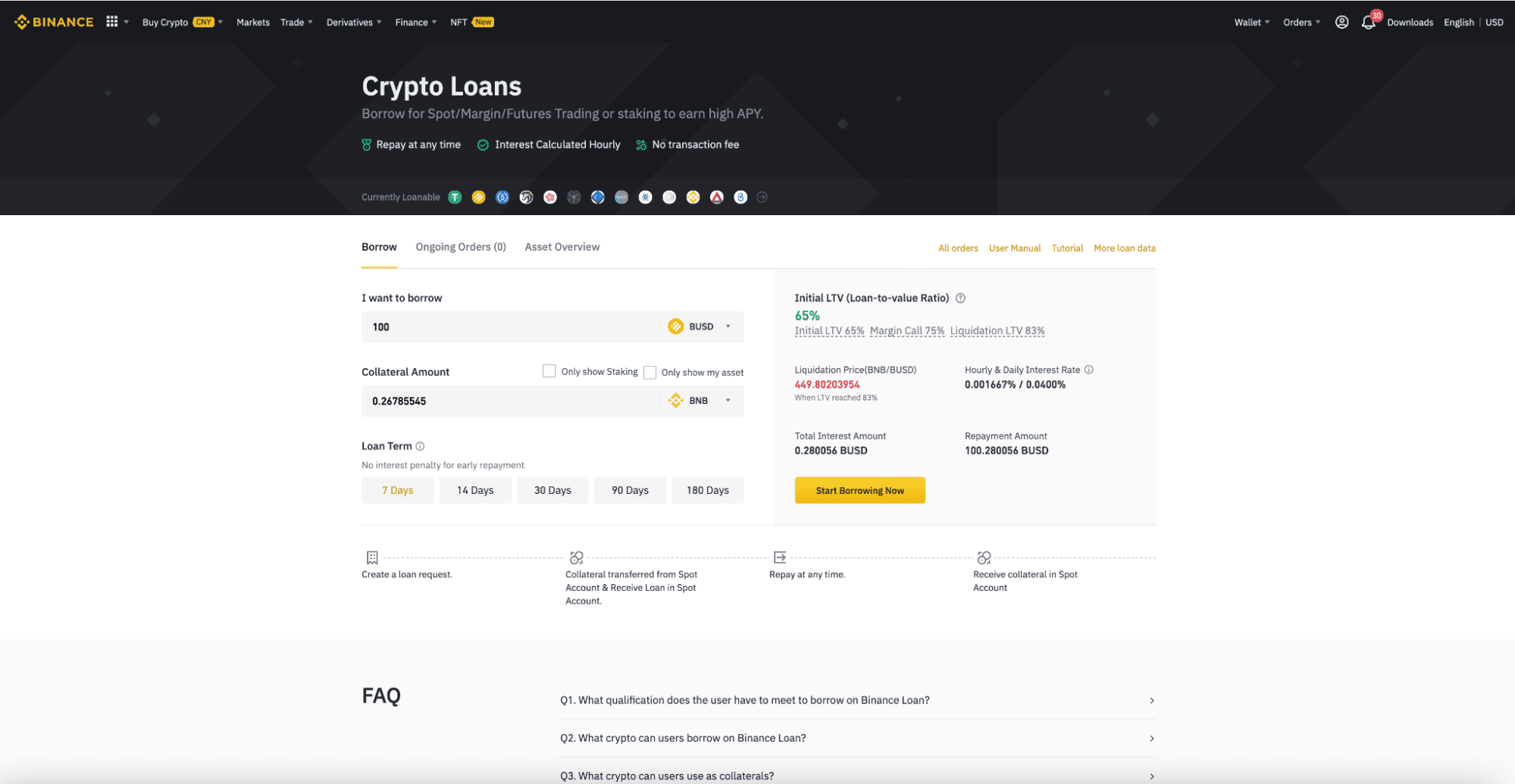

How to use Binance to loan borrowed coins to lend digital assets (Web).

【Financial Business】-【Loan Coin】

Step 1: Select by number and corresponding assets into collateral.

Step 2: Choose the loan term.

Step 3: Check the order details, click [Start Borrowing Now], and then click [Confirm].

![Step 3 Check the order details and click [Start Borrowing Now] and then click [Confirm].](https://mobie.io/wp-content/uploads/2021/11/Step-3-Check-the-order-details-and-click-Start-Borrowing-Now-and-then-click-Confirm..png)

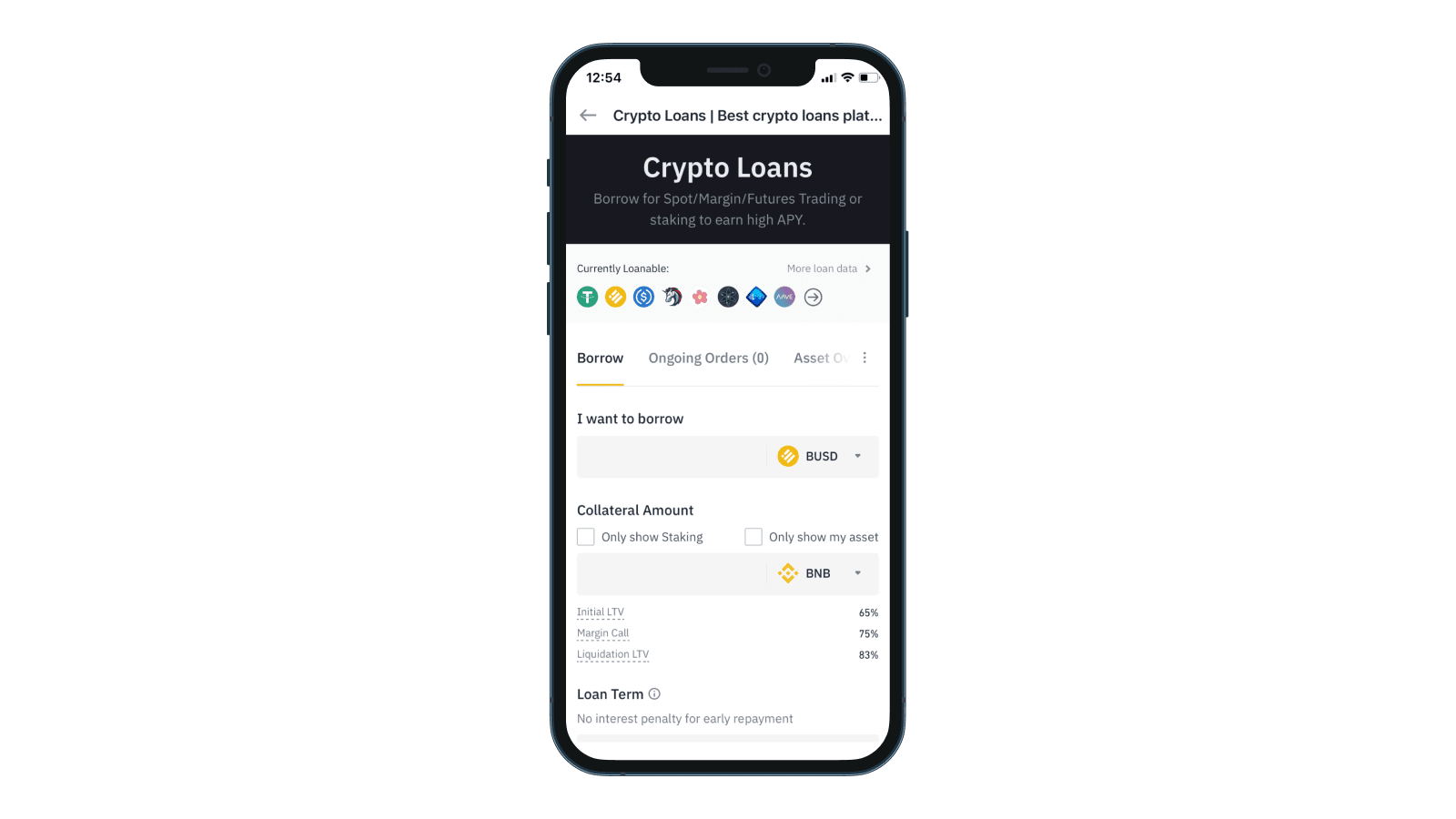

How to use Binance loaned currency to lend digital assets (App)

The first step: [More]-[loan to borrow coins]

![On your app, click [More], and select [Crypto Loans].](https://mobie.io/wp-content/uploads/2021/11/On-your-app-click-More-and-select-Crypto-Loans..png)

The second step: select the amount and period of borrowing, and select the loan.

Step 3: Check the order information and click [Start Borrowing], then select [Confirm]

![Check the order details, click [Start Borrowing Now] and then click [Confirm].](https://mobie.io/wp-content/uploads/2021/11/Check-the-order-details-click-Start-Borrowing-Now-and-then-click-Confirm..png)

Leverage and borrowed money is borrowed two simple encryption methods into more money. Start using them to make the most of your assets.

Go to Binance Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...