It is not easy for people to find the best time to buy cryptocurrencies. Due to the high volatility of these assets, large or small price changes may occur at any time. It is for this reason that some people experience FOMO, also known as the phobia of missing out.

FOMO refers to the feeling that people experience when the price of cryptocurrencies such as Bitcoin (BTC) fluctuates suddenly and extreme. When the price of cryptocurrencies falls, many people tend to go into panic selling out of fear of losing more money. This feeling is also very evident when the value of cryptocurrencies soars, and many people feel that they don’t have enough cryptocurrencies to hold or sell.

Finding the sweet spot to start is proving difficult in the cryptocurrency space. However, if you do not want to change every time the market worried, from the perspective of long-term finance to seize opportunities in the digital currency, you might want to consider trying Dollar Cost Averaging (DCA) strategy. But before we get started, what exactly is cost averaging? How exactly does it operate in the cryptocurrency space? Let’s dig deeper.

What is the average cost method?

Averaging, also known as a constant-amount plan, lets you invest the total amount in small increments over a specified period of time. This operation is the exact opposite of a one-time investment of the total amount. Following this approach, you will continue to buy regardless of asset prices or market movements.

This strategy is very popular for investors looking to invest in certain assets for the long term (e.g. commodity currencies, cryptocurrencies, stocks, etc.).

So, how does DCA in the cryptocurrency field work?

First, you need to decide how much cryptocurrency you want to invest in. In traditional investing, you put the total amount you want to invest in one lump sum. However, under the average cost method, you are in a specific time period, investment in fixed dollar (USD) amounts to Bitcoin encryption or any other currency. A simple example, such as buying $15 worth of bitcoins every week for a year.

It is important to note that choosing which cryptocurrency to use in DCA is critical. Currently, there are more than 12,000 cryptocurrencies on the market. The average cost method will last a long time, so choose a cryptocurrency that you think will appreciate in value later on, which will help you make the most of your time and money.

The following examples help you better understand how average costing works:

Suppose it is January 2020 and Claude decides to buy the Bitcoin equivalent of $1,020. At the time, each bitcoin sold for about $7,100. Instead of using the full amount to make a one-time purchase, Claude chose to try the average cost method, buying bitcoin over a 12-month period.

Every month from January 2020 to December 2020, Claude continued to buy the equivalent of $85 in BTC, regardless of market ups and downs. A year later, his earnings look like this:

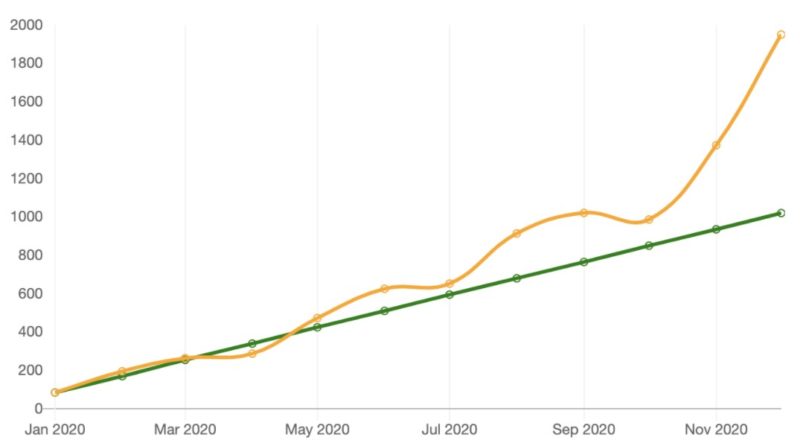

The green line in the graph above represents the total amount invested by Claude. And the orange line represents the change in BTC value over the 12-month investment period. At the beginning of Claude’s investment, the value of BTC was in the same range as the amount he invested, both at $85. However, after a few months, the price of Bitcoin began to move in a different direction.

At the end of the year, Claude’s $1,020 investment in BTC increased by an astonishing 91.19%, with a total value of $1,950 equivalent to BTC.

The tool used to calculate the value of Claude’s potential earnings uses the historical price of BTC as a reference. This helps determine how many satoshis (or BTC shares) he will get at that time.

You can also check out the DCA tool online to see how much you can earn after continuing to buy bitcoin for months. The dcaBTC tool, for example, allows you to customize your DCA settings, setting the amount you want to buy, the frequency of payments, and the investment period.

Advantages and disadvantages of the average cost method

As with anything new in the cryptocurrency space, there are advantages and disadvantages to the average cost approach. Here’s what you need to know before starting your DCA program.

Let’s start with the advantages of average costing. By choosing to make equal purchases over a certain period of time, you can avoid the potential risks of making a one-time investment without careful consideration. At the same time, due to the purchase on a regular basis, you can avoid FOMO state of mind, so as to avoid sudden price fluctuations due to concerns about conduct impulses investment.

Cryptocurrency exchanges and marketplace platforms charge a fee for every transaction you make. Although it may seem that you will pay more in transaction fees in cost-averaging, keep in mind that cost-averaging is a long-term plan. The fees you pay relative to the potential benefits you may earn in a few years can be ignored.

In addition to this, you don’t have to have a large amount of capital to start investing if you choose the average cost method. . Since this method is an ongoing small purchase, you don’t have to invest a lot of money all at once. If the market fall or collapses when you buy, you can also hold encryption currency at a lower price.

But on the other hand, if the price spikes on your planned purchase date, you may also buy the cryptocurrency at a higher price. This is especially true when BTC or your cryptocurrency of choice is in a strong bull market. Many cryptocurrency enthusiasts and investors are concerned that prices will be higher in the hours, days, weeks or even months ahead, and so often opt to make large one-time purchases.

We’ve also mentioned before that in a DCA strategy, you make small purchases at predetermined times within a certain period. This means that whether the market is stable, rising or falling, you will be buying a portion of the cryptocurrency.

Is cost-averaging worth trying?

The goal of DCA is to help you get the most out of cryptocurrencies in a fixed amount of time without taking too much risk. While there are some drawbacks to this approach, you can also reap many benefits from it.

So, is the average-cost approach to cryptocurrency worth your time and money? As always, please do your own research and get the relevant information first before you start. You can also bookmark this article on your browser and use the information in this article whenever you need it. Good luck!

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...