Cross Markets Arbitrage is a commonly used method to absorb profit in the cryptocurrency market.

What is cross-market arbitrage?

Cross-market arbitrage is a common method of earning profits in the cryptocurrency market, and when there is a price difference between different exchanges for the same type of coin, users can obtain price difference profits by buying low and selling high.

Yes. At any given time, the BTC price is $35200 on exchange A and $35380 on exchange B. If you buy 1 BTC through exchange A, transfer it to exchange B, and sell, you can immediately earn $180. Both selling and selling incur a certain fee. The price difference between exchanges must be greater than the sum of the two-party fees in order for users to make a profit.

Bibox supports the creation of AI trading bots and automatically uses cross-market arbitrage. After the user enters the API information, the procedure automatically determines the available coins and corresponding trading pairs for arbitrage according to the asset situation, so that they can earn profits through the price difference. Bibox cross-market arbitrage is It automatically determines if it is greater than the sum of the two-party fees and only executes the strategy if the net interest rate is above zero.

Go to Bibox’s Official Website

How to use cross market arbitrage

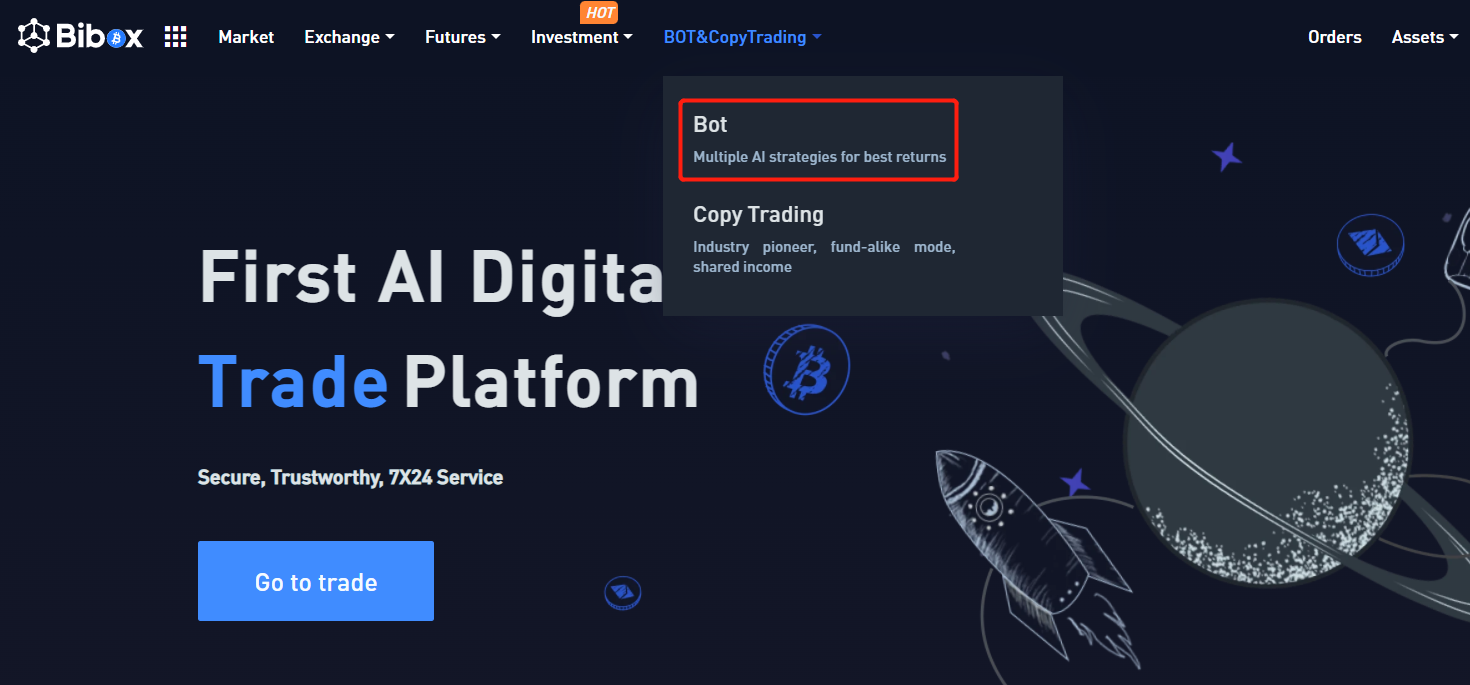

1. Go to the Bibox official website and click the “Quant & Copy Trading—Quant” entry in the navigation bar at the top.

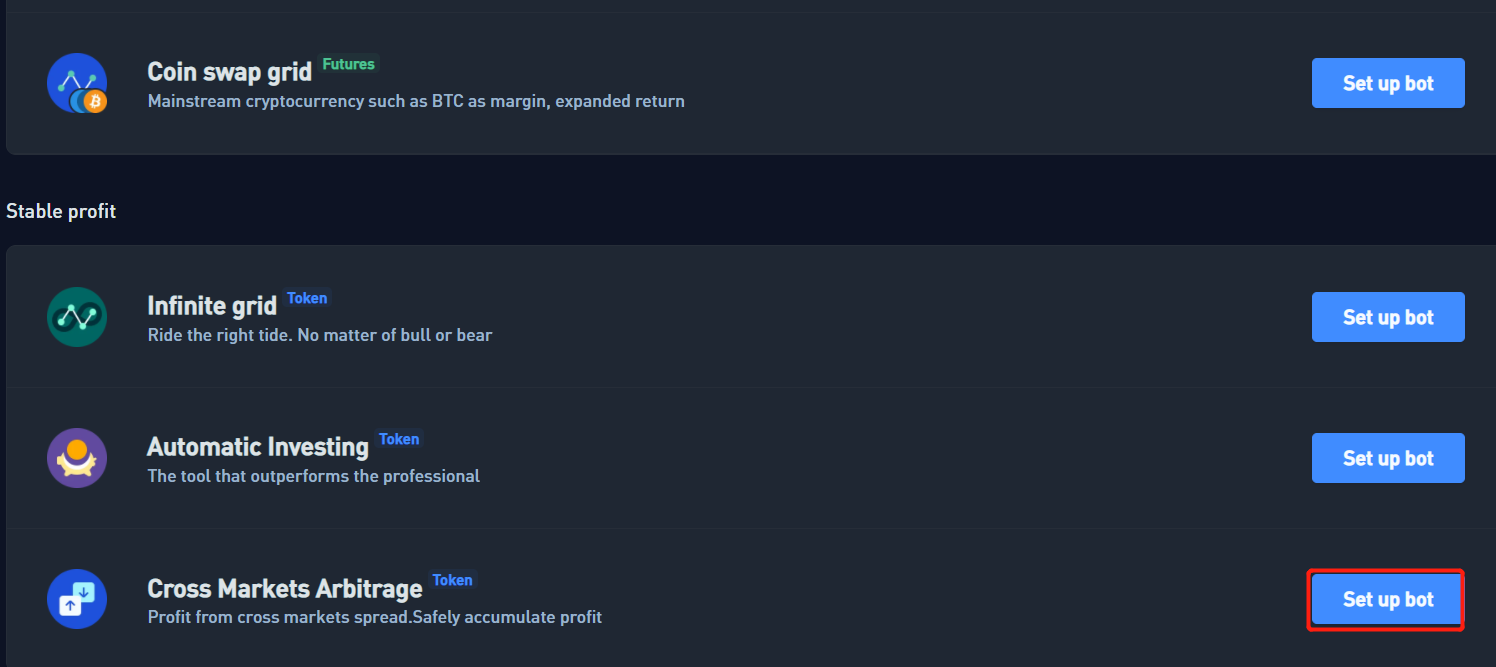

2. Select “Cross Market Arbitrage” from the list of strategies and hit “Create Bot”.

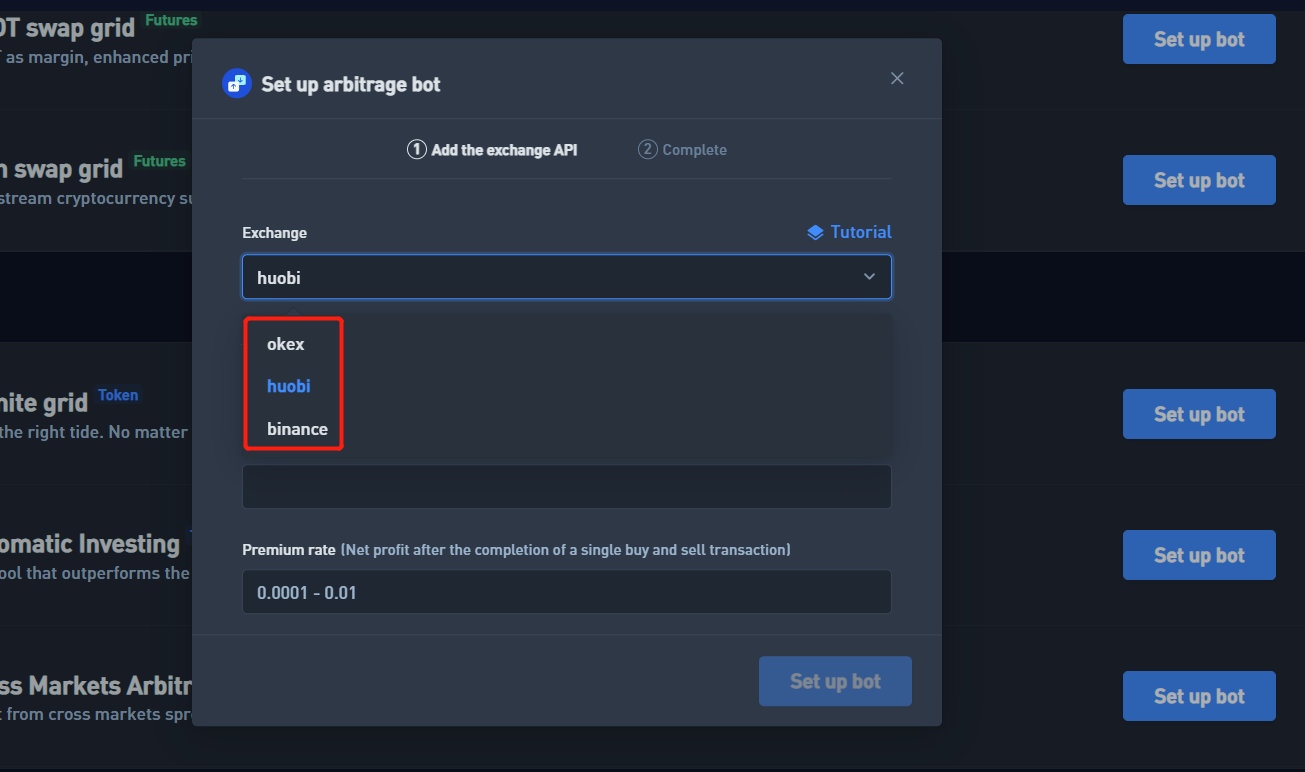

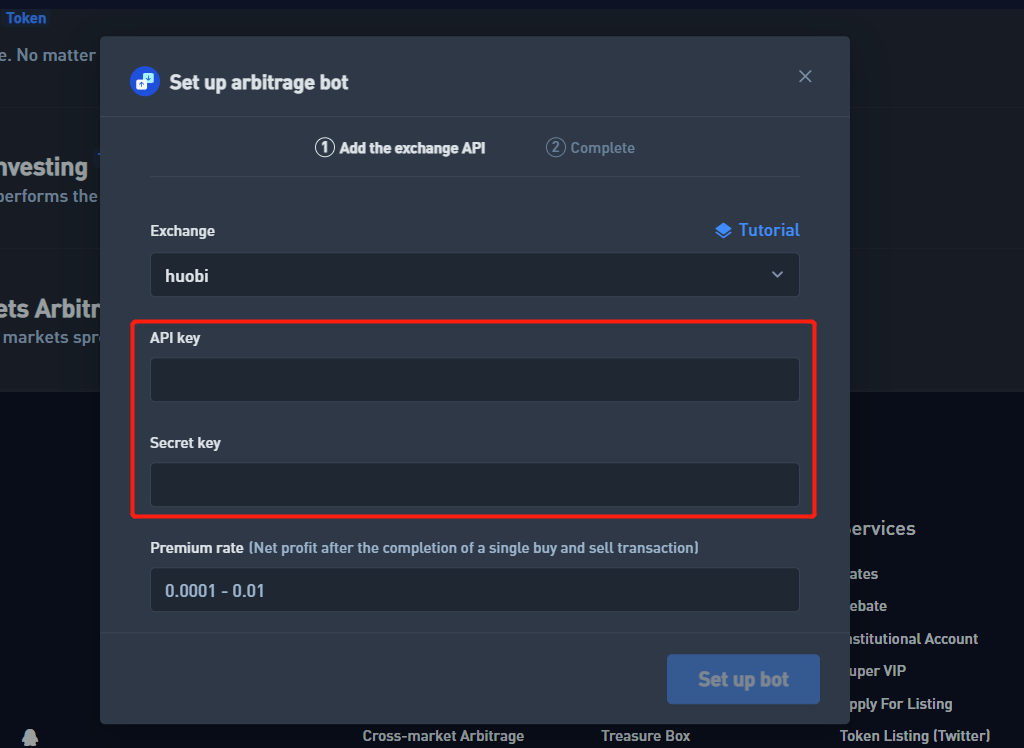

3. Select the target exchange in the pop-up window to perform cross-market arbitrage with Bibox.

4. Deposit a certain amount of funds in Bibox and the target exchange (requires simultaneous listing)

Example: For BTC/USDT, funds must satisfy either of the following conditions:

- There is an equivalent BTC of 200 USDT or more in the Bibox account and 200 USDT or more in the Huobi account.

- There is an equivalent BTC of 200 USDT or more in the Huobi account and 200 USDT or more in the Bibox account.

- Bibox and Huobi accounts must have at least 100 USDT and 100 USDT equivalent BTC at the same time.

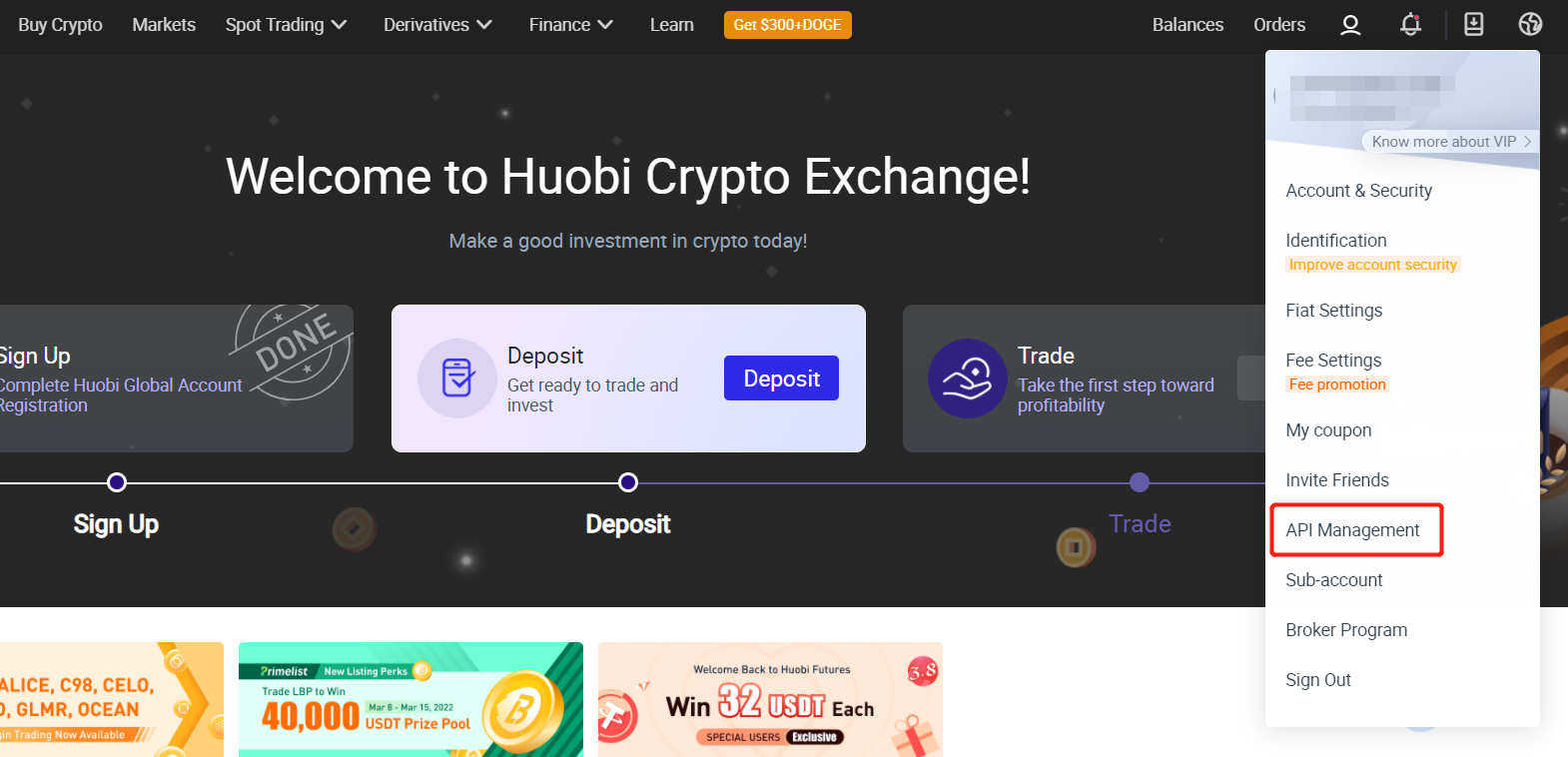

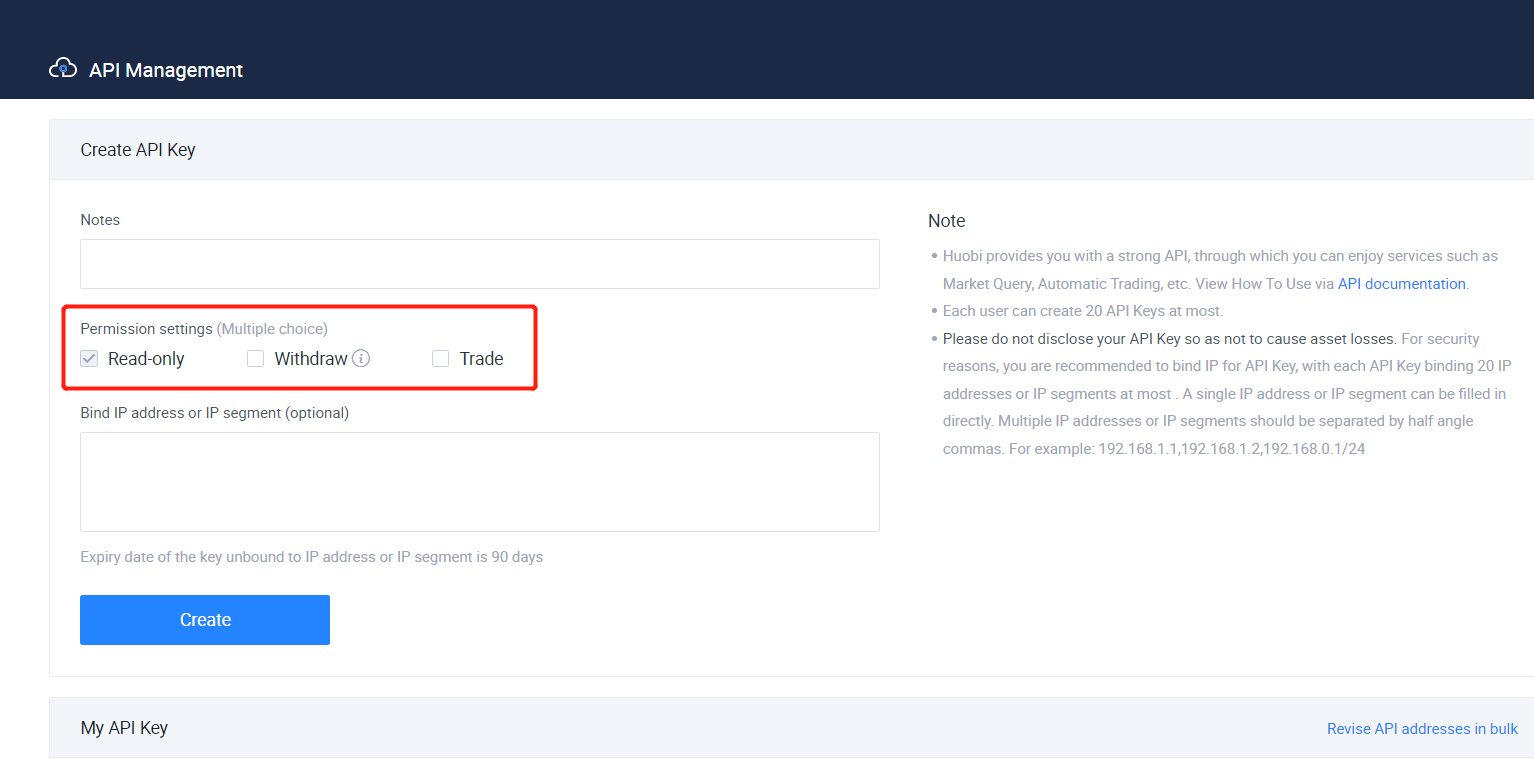

5. Go to the target exchange and generate an API Key and Secret Key (for Huobi).

1) Find ‘API Management’ on the target exchange.

2) The ‘Read’ and ‘Transaction’ permissions must be opened, the ‘Withdrawal’ permission must not be opened, and the IP address is not bound. must be reopened.)

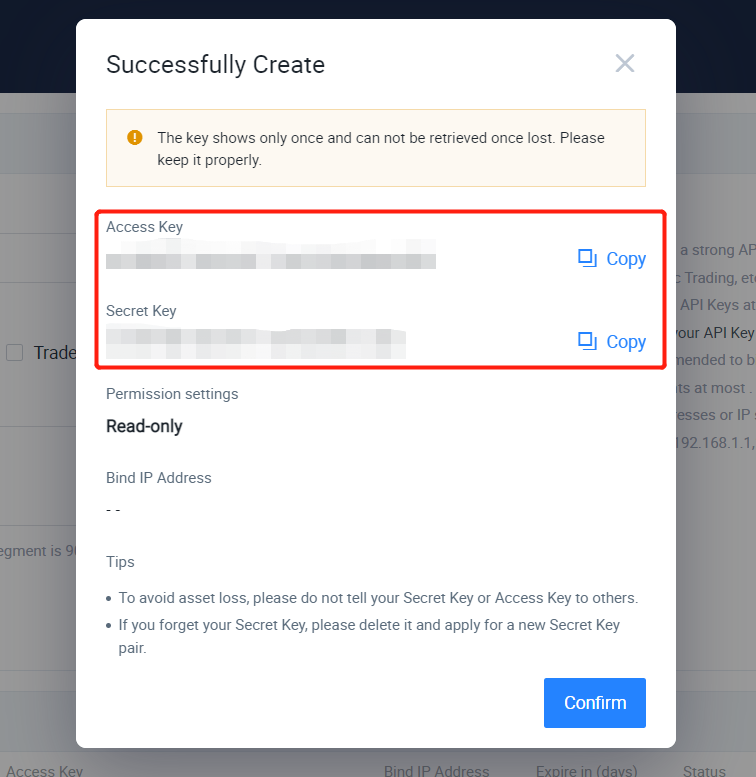

3) Record the Access Key and Secret Key respectively.

4) Just put your Access Key and Secret Key into the Bibox cross-market arbitrage counterpart and click “Create Bot”.

*Premium ratio refers to the net rate of return (after deducting fees from both sides) for arbitrage transactions through both exchanges. If the price difference between the two exchanges meets the yield condition, the bot will immediately and automatically execute arbitrage.

The recommended premium percentage setting is 0.001 – 0.005.

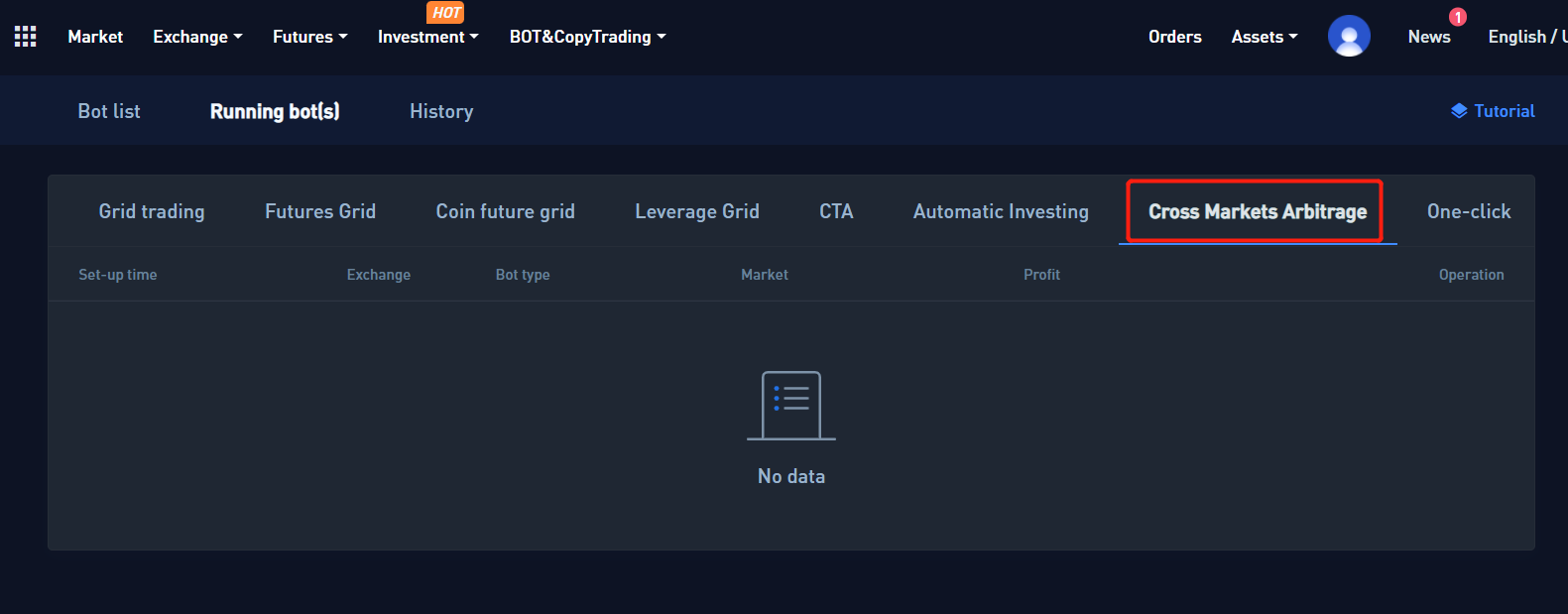

6. When cross-market arbitrage is executed, you can see information about currently running cross-market arbitrage in “Running Bot”-“Cross-Market Arbitrage”.

Features of cross market arbitrage:

- Low-risk buying and high-priced selling are carried out at the same time.

- Autocomplete procedures can save you a lot of time.

- In order to be able to execute immediately when there is a price difference, both USDT or BTC deposits are required at the same time.

- Yields are stable and fall short of CTA strategies.

Go to Bibox’s Official Website

Please click "Introduction of Bibox", if you want to know the details and the company information of Bibox.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...