Aave Companies, the centralized group behind the Aave lending protocol, proposed the launch of a new stablecoin pegged to the U.S. dollar.

On Thursday, the Aave Companies, the centralized group behind the Aave lending protocol, proposed the launch of a new stablecoin pegged to the U.S. dollar. At this time, the aftermath of Terra’s UST crash in May still lingered, and stablecoin scrutiny continued to tighten. Traders will be able to mint GHO stablecoins by staking their locked assets on Aave. According to the governance proposal, GHO will be “backed by a user-selected diverse set of cryptocurrency assets.” At the same time, borrowers can still earn income from the assets they deposit. GHO aims to release more liquidity for decentralized stablecoins in the market, driving the Aave and Curve platforms to generate more transaction volume and transaction fees, thus making DeFi more attractive than CeFi. The Aave DAO, consisting of all AAVE token holders, will vote on the proposal after the feedback submission period closes.

The main cryptocurrency market and major stock indexes rose in unison on Thursday following the release of the minutes of the Federal Open Market Committee (FOMC) meeting. BTC breached the $21,000 resistance level within hours and briefly charged above the $22,000 resistance level before retracing to correct. The largest cryptocurrency by market cap is currently holding a high in the $21,000 range after gaining 7.5% over the past 24 hours. The next major hurdle for BTC is around the $22,500-$22,800 range. A close above this range could open the door to further gains.

Similar to BTC, ETH has gained more than 6% in the past 24 hours. At the time of writing, the second-largest cryptocurrency by market capitalization is consolidating above the $1,200 mark and the 100 hourly moving average. Most major altcoins also rose further, with MATIC leading the pack with double-digit percentage gains over the same period.

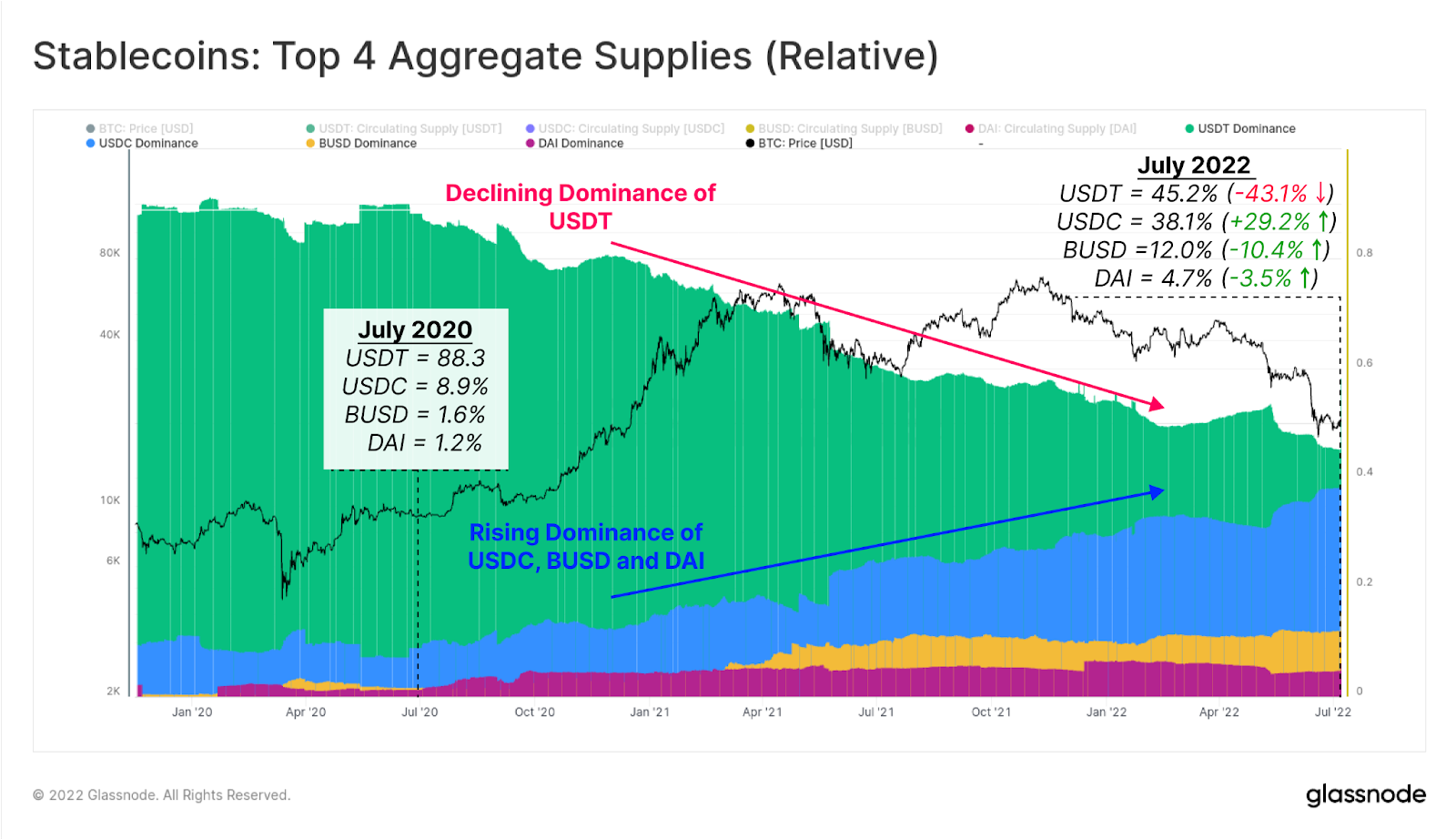

The stablecoin market is still recovering from the aftermath of Terra’s UST crash. However, the general trend has seen USDT’s market cap dominance go downhill since the beginning of 2020. Recent events have only accelerated this process, with USDT already accounting for less than half of the stablecoin market. Meanwhile, the market cap dominance of USDC and DAI has quadrupled over the same period.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...