Aave’s governance body, the Aave DAO, voted to approve the proposal to create a new stablecoin protocol, with a 99.9 percent support turnout. This means that more than 500,000 DAO members corresponding to AAVE support the proposal to create GHO. GHO is a collateral-backed stablecoin consisting of multiple cryptocurrencies. Users who want to mint GHO will need to deposit Aave-licensed cryptocurrency while still earning interest on the underlying collateral. The recharge amount must be greater than the GHO borrowed amount, and after the user repays the loan or is liquidated, these borrowed GHO will be completely destroyed. While the GHO proposal passed overwhelmingly, its rollout will take some time.

The main cryptocurrency market rose in tandem with major stock indexes on Friday as investors braced for disappointing corporate earnings and signs of an economic pullback. BTC briefly surged on Saturday but failed to stabilize above $25,000 before falling below the $24,000 mark. At the time of writing, the largest cryptocurrency by market capitalization has lost 1.7% in the past 24 hours and is now in the lower $23,000 range. On the hourly chart, BTC has moved below a key bullish trend line with support near $23,700. BTC would have to break the $24,000 mark before it could open the door for further gains.

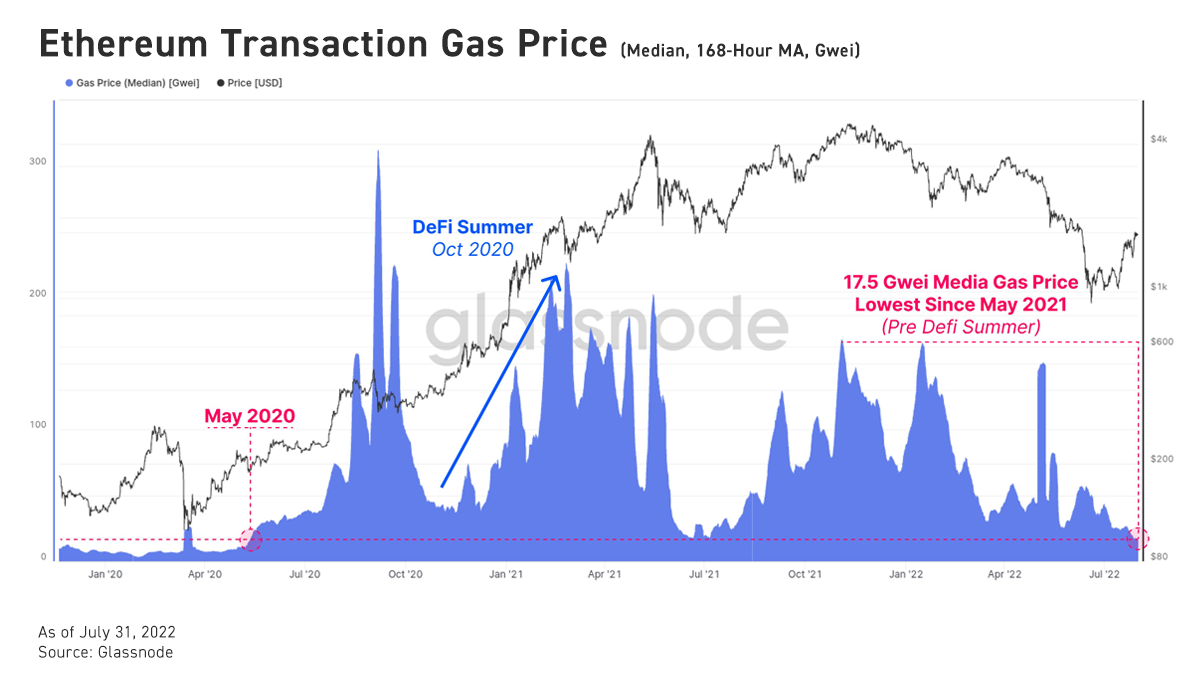

Last week, ETH outperformed BTC by a wide margin, rising 75% from local lows. Despite a slight loss over the same period, the second-largest cryptocurrency is poised to hit the $1,700 mark again. However, the current ETH-led rally is picking up, and the main driver appears to be speculative trading. On-chain metrics show that Ethereum’s median gas fee has fallen to levels seen in May 2020, when ETH spot prices were as low as $220. For now, however, plunging gas fees have not given traders more confidence in the continued demand for ETH.

Most major altcoins had mixed performances over the weekend. Many currencies have turned from rising to falling, with an average decline of about 2%, while the price of FIL has risen sharply in the past 24 hours, with an increase of more than 20%. At the same time, NFT trading volumes continued to decline. Leading NFT platform OpenSea saw a slight increase in total NFT sales and the number of unique users from the previous month, but total dollar-denominated sales fell. Additionally, NFT transactions on the Solana platform also cooled in July.

The market rally appears to have extended to most sectors of the cryptocurrency market, with many L1 protocols and Merge-related protocols surging sharply over the past week. In the derivatives market, the funding rate of BTC on major centralized exchanges has basically left the negative territory. Although ETH is leading the market rally due to the upcoming Merge upgrade, the futures premium of ETH is quite low compared to BTC, and the contract for delivery on December 22 is at a discount, while the contract for delivery on March 23 and June 23 is at a discount. The contract is close to the horizontal state. In the options market, both ETH open interest and volume flipped, with investors betting that ETH would return to the $2,500 range in the near term.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...