Aptos Labs, a blockchain company founded by former Meta employees, has raised $150 million in a new funding round led by FTX Ventures and Jump Crypto,

Aptos Labs, a blockchain company founded by former Meta employees, has raised $150 million in a new funding round led by FTX Ventures and Jump Crypto. Despite the current market downturn, the company has raised an astounding $350 million so far this year with this funding round. Aptos plans to use the proceeds from the financing to build “the world’s most robust security and production-ready blockchain.” The company will also focus on developing a blockchain that provides a “reliable foundation” for Web3 applications, ready to carry billions of users around the world in the future. For more news about Aptos, check out the ” New L1/L2 Opportunities ” section.

Losses in the main cryptocurrency market have been compounded by the ongoing debate over how weak economic indicators will affect the Federal Reserve’s inflation-fighting strategy. The largest cryptocurrency by market cap failed to hold onto last week’s gains, falling 7% as holders took profits near $23,000. At the time of writing, BTC’s market cap is consolidating in the lower part of the $21,000 range after losing 3.3% in the past 24 hours. A bearish trend line is forming with resistance near $21,900 on the hourly chart of BTC. If BTC fails to break above this level, a downside test of support near the $2-20,500 range is likely.

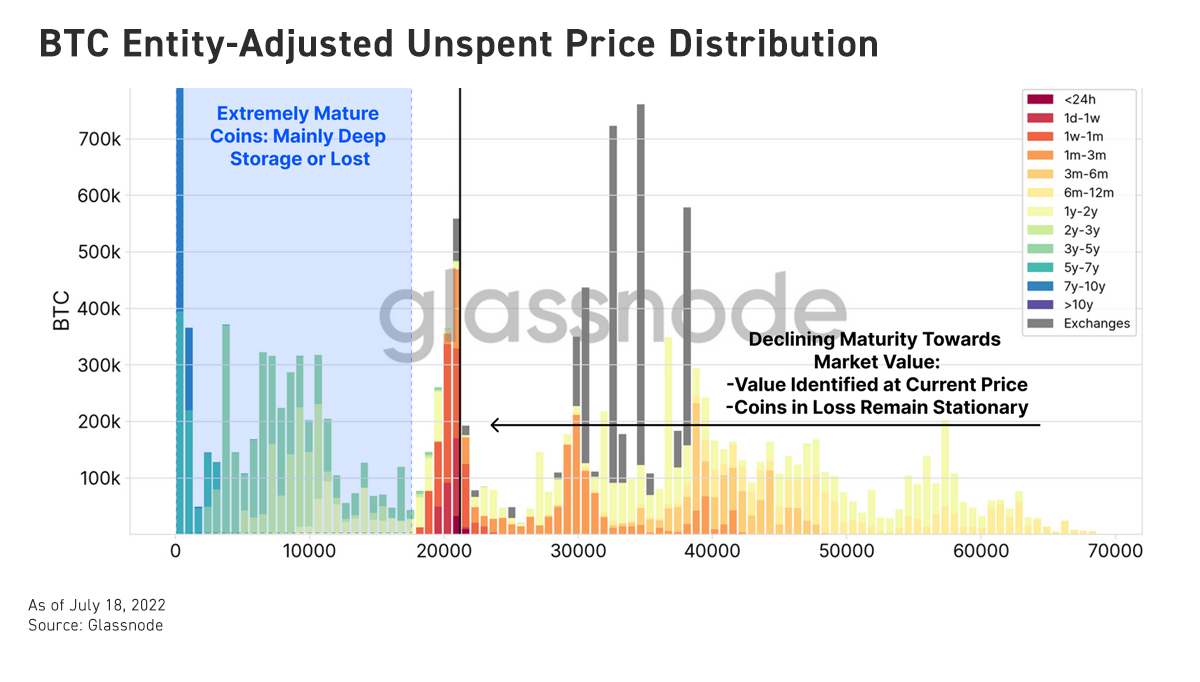

On-chain metrics show increased demand for transactions in the $20,000 range, with a high volume of transaction activity observed recently. Although holders face significant outstanding losses, “old coins” older than six months continue to appear in the recent reallocation of bitcoin. A node of concentrated supply near the psychological $20,000-$40,000 mark will act as solid price support once the market’s follow-up moves become clear.

On the other hand, ETH, the second-largest cryptocurrency by market capitalization, extended its losses further, falling 7% over the same period, and is now below $1,500. Most major altcoins are in the red, with NEAR and MATIC leading the downside correction with a drop of nearly 10% over the same period.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...