Do you know what is APY?

Annual Percentage Yield (APY): How does APY apply to crypto?

In traditional finance, savings accounts usually provide both a simple interest rate and an Annual Percentage Yield (APY).

Annual rate of return (APY) is the annual return on an investment or deposit through principal and accrued interest.

The simple interest rate is the amount of interest earned based on the amount deposited. For example, suppose a bank offers an annual interest rate of 5% on an account. If a user deposits $1,000 (USD) into the account, the account will be worth $1050 (USD) after one year.

Interest rate vs APY

Simple interest rates do not take into account the effects of compounding, but APY is different. APY refers to the expected annual rate of return based on the deferred amount, including compounding interest. Compound interest refers to the interest earned on both the principal (the amount of the original investment in the asset) and the interest accrued on the initial principal deferral.

Real-life examples of APY

For example, let’s say the account mentioned above is an account that is compounded monthly. If a user deposits $1,000 (USD) into the account, after one year the account will be at $1050.16 (USD). In this example, the difference between simple interest (simple interest) and compound interest seems negligible, but the difference in returns becomes significant over time. Unfortunately, most traditional financial deposits have very low APY. The highest is 0.7% and the lowest is 0.06%. As a result, the interest income earned by depositing into a savings account is very low compared to the return on investment in the stock market.

Go to Phemex’s Official Website

How does APY apply to crypto?

In the cryptocurrency world, the principle of how APY works is the same. Users can earn compound interest by depositing cryptocurrency into a savings account. It provides liquidity to the liquidity pool through token staking and interest farms This interest activity can be done on cryptocurrency exchanges, decentralized finance (DeFi) protocols, and wallet apps. In general, users can earn interest depending on what they deposit in the same cryptocurrency. However, there are cases where you can earn interest in other cryptocurrencies.

What makes a good APY in crypto?

Typically, the APY earned by depositing in crypto is much higher than in traditional financial savings accounts. Most cryptocurrency projects offer more than 1% APY. For example, users depositing in Tether ( USDT ) on Phemex can get around 7% APY without having to lock them in the fund for a fixed period of time. If the user can lock it for 7 days, the APY rises to 10%. Some projects offer very high APY over 100%. These include Pancake Swap ( CAKE ), UNI Swap ( UNI ), and Sushi Swap ( SUSHI ), which are usually the DeFi platforms.

Different platforms offer very competitive APY rates. If transaction fees are low enough, interest farm users can maximize their profits by moving between liquidity pools across multiple platforms. However, since some projects may not be fundamentally sound, users should be aware of this and choose an investment location carefully.

Annual Return (APY) vs. Annual Interest Rate (APR): What’s the difference between the two?

APY and APR look very similar in that they both refer to interest. Some users even use these two terms interchangeably. However, APY and APR are not the same.

As mentioned earlier, APY is the annual return on investment or deposits through principal and cumulative interest. In contrast, APR is the annual interest on a particular debt.

If a user has a loan of any type, the loan execution abstention assigns a unique APR to it. APR can be fixed or variable, depending on the loan type and user’s requirements. The APR usually tends to be higher than the nominal interest rate of the loan. This is because it reflects all fees such as contract signing fee, insurance, and loan creation fee (new loan application process). However, unlike APY, APR is a simple interest rate that does not take compounding into account.

In the case of APY, the higher the percentage, the higher the return on the user’s deposit or investment. However, the higher the APR imposed on the debt, the higher the user’s interest rate. The APR a user has to pay is usually related to the party’s credit score. The higher the user’s credit score, the lower the APR can be applied. Conversely, the poorer the user’s credit score, the higher the APR will be assigned. In contrast, APY has nothing to do with a user’s credit score.

Since crypto loans are not related to credit score, APR is instead related to market volatility. Like APY, APR rises when demand is high and falls when the market is stable.

How is APY calculated?

APY is determined by a unique formula. This formula is usually used in traditional finance because of this, the nominal interest over the long term is about the same. It is calculated by considering the number between the nominal interest rate value and the compounding calculator. These two definitions are:

The nominal interest rate is the interest rate before inflation is taken into account.

The compounding period is the period from the last time the interest is compounded to the time it is compounded again. For example, monthly compound interest means that interest is compounded monthly. You can set different compounding periods for different cycles, such as monthly compound interest, daily compound interest, and annual compound interest.

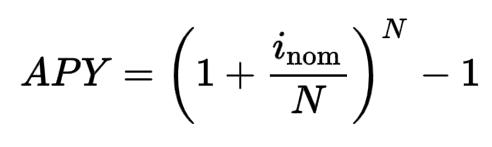

The APY calculation formula is as follows:

Why is APY high in cryptocurrency?

In the cryptocurrency world, APY is constantly changing. As a result, the APY shown by cryptocurrency exchanges, liquidity pools and staking pools is often just an estimate. Volatility is caused by changes in the supply and demand of certain crypto assets. When the demand for a crypto asset is high, the interest rate and APY usually rise together.

The detailed blockchain protocol of the project is also reflected in APY calculation. This is because the compounding period may vary from project to project. For example, some projects compound interest based on blocks mined per block cycle, while others apply terms based on different criteria. The longer the number of compounding periods, the higher the APY. However, the difference is relatively insignificant.

For example, suppose a user deposits $100,000 USD into an account with an interest rate of 5%, compounded monthly. APY equals 5.116%, or $105,116 USD after one year. If it is an account with daily compounding applied, the APY is 5.126%, and the account amount after one year is about $105,126. The difference between daily APY and monthly APY is about 0.01%.

As mentioned earlier, the APY of a crypto project will depend on the supply and demand of the project’s assets. High demand translates to high APY. A really high APY is offered by interest farms or liquidity mining projects. Users provide liquidity to the liquidity pool or lend their tokens to others to earn interest or rewards.

Go to Phemex’s Official Website

Crypto loan

If a user earns more than 1% on their loans, that means that other users are willing to pay more than 1% interest on borrowing crypto assets. In general, crypto loans allow users to profit from interest rates, short-term sales, etc.

Interest rate arbitrage benefits from the difference by borrowing crypto assets from low interest pools and lending them to high interest pools.

Short selling refers to borrowing crypto assets at a certain price and then selling the borrowed funds at a higher price in anticipation of a future price decline. In this way, if the price really drops, the user buys the same amount of crypto assets at a lower price than the borrowed price, and the difference is theirs.

Projects that offer very high APYs of 100% or more often try to counteract non-permanent losses. Non-permanent loss occurs when the token ratio of a specific pool is unbalanced. High APYs are common, especially for new projects launched on decentralized exchanges ( DEXs ). This is because at the beginning of the coin’s life cycle, the price volatility is very high, which increases the possibility of dumping. By offering high APY at this time, these projects offset semi-permanent losses and entice users to choose to provide continuous liquidity rather than sell. After a period of time, it is not uncommon to see APY decline as the number of liquidity providers increases and projects stabilize.

Conclusion

Annual Percentage Yield (APY) is the return on an investment that reflects principal and compound interest. A high APY means that users can earn more based on the assets they hold. Therefore, users considering crypto deferrals should also keep APY in mind when comparing platforms. However, it is important to keep in mind that APY is volatile.

Most crypto deposit options and liquidity pools offer more than 1% APY. Some new projects try to address semi-permanent losses and price volatility by offering APY of 100% or more. As a result, users can leverage these pools to make good profits. However, there is always the possibility of rugging, which is called fraud or cheating, so we recommend that you thoroughly conduct your own investigation before proceeding.

Please check Phemex official website or contact the customer support with regard to the latest information and more accurate details.

Phemex official website is here.

Please click "Introduction of Phemex", if you want to know the details and the company information of Phemex.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...