The main cryptocurrency market fell further on Tuesday after fears of a looming recession led to a massive sell-off in traditional financial markets, coupled with aggressive monetary tightening by the Federal Reserve. The emergence of this bearish momentum took BTC below the key support level of $30,000 for the first time since July 2021. After the recent drop, BTC is now down more than 55% from its all-time high of $69,000. At the time of writing, BTC is currently consolidating losses above $31,000 after losing 5.8% of its market cap over the past 24 hours. A major bearish trend line has also formed on the hourly chart of BTC with a ceiling near $32,000. The good news is that if the price of BTC can break above the aforementioned resistance level, it could start a short-term recovery. But on the flip side, the existing bearish momentum could also see BTC fall further and test support in the $28,000-$29,500 area.

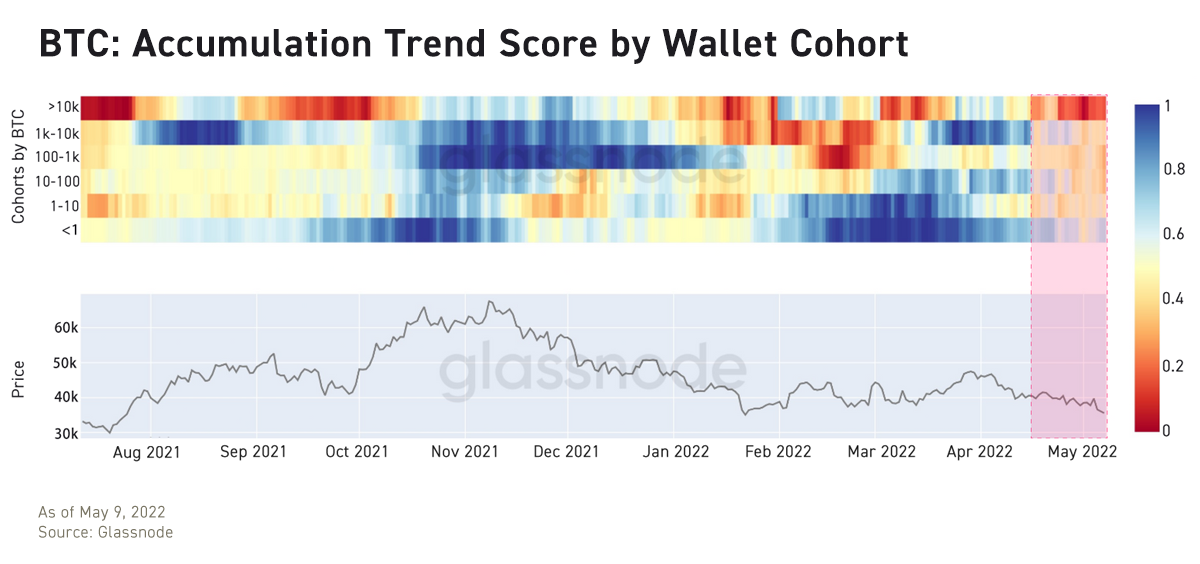

On-chain accumulation scores show that wallets of all groups, from small fish to giant whales, appear to be slowing their BTC accumulation behavior. Addresses with account balances above 10,000 have significantly reduced their purchases, and in fact this group has even become a major selling force over the past few weeks. Compared with some of the more experienced players in the space, Xiaosan has shown more confidence, but its holdings have also decreased significantly compared to the first quarter of this year.

While fear continues to plague BTC holders, ETH and other major altcoins also suffer. ETH is currently struggling to hold above $2,400 after falling 3% overnight. Most major altcoins also experienced double-digit percentage declines compared to 24 hours ago. LUNA’s stablecoin UST de-pegged from the U.S. dollar twice within 48 hours, causing its market cap to shrink by more than 50%.

Azuki Collection Crashes after a Blog Post

While everyone else was busy lamenting BTC’s fall and UST’s decoupling, a group of NFT enthusiasts were hosting a controversial conversation in the Twitter Space, ironically titled “The Death of Azuki” “. The bold assertion follows a blog post by Azuki’s anonymous founder, Zagabond. The reason is that Zagabond shared in the article that he had previously participated in several mediocre NFT projects, and many “on-chain detectives” believed that these projects were “rug-pull” behaviors to defraud money. Although Zagabond has since denied all allegations that his past projects were “rug-pull”, the Azuki line’s reserve price still plummeted 48% in the mere hours after the blog post.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...