The best Cryptocurrency exchanges to trade during the news-time releases.

The Best Exchanges News Time trading

Do you want to buy and sell during the News Time? Now you are looking for an exchange that are ?

Check out the 3 best exchanges for News Time trading today.

| Best Exchanges for News Time trading | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

Trade during News-Time on Bybit

Cryptocurrency exchanges with Low latency

The cryptocurrency market is known to be extremely volatile. Therefore, the price (data) changes in fractions of a second. To keep up with this rapidly changing data, computer networks must be optimized for analyzing large amounts of data in a very short amount of time. In short, networks should operate as low-latency as possible.

The lower the latency or latency of a computer network, the more efficient the network.

Latency of cryptocurrency exchanges

Cryptocurrency Garaeso needs to communicate real-time prices for crypto assets it offers to its customers. Since the prices of these cryptocurrencies change every few thousandths of a second, exchanges must be able to process data quickly to update real-time prices and digest traders’ actions. In the case of a cryptocurrency exchange platform, especially if it is an exchange that deals with crypto derivatives, the success or failure of a trader can be determined by the degree of delay.

Trade during News-Time on Bybit

Why Low Latency is an Important Function in Cryptocurrency Exchanges?

As a trader, buying and closing at exactly what I expected is so exciting.

However, some exchanges that deal with highly volatile cryptocurrencies do not provide these features well. For example, let’s say a trader expects to be able to place a long-CFD trade on Bitcoin at $6,636.6. However, at the time of order, the price had already risen to $6,636.9. If the trader had contracted to liquidate at $6.637, the profit margin would have already been reduced.

Cryptocurrency exchanges with low latency give traders access to real market prices in real-time. Traders’ orders are also processed in milliseconds to ensure they are executed at the expected price level. At the same time, clearing orders are also efficient on these exchanges. Trades can usually be liquidated at exactly the price set by the trader. For example, suppose a trader buys a BTCUSD CFD pair at $6597 and sets a target of liquidation at $6597. After that, when the price reaches $6507.7, the trader places a liquidation order and the request is processed in 1 second. So at the moment of the liquidation order, the price changed to $6576.9. This is a loss when the order was closed, which was not at the time the trader requested the trade. Therefore, the lower the latency of a cryptocurrency exchange, the higher the transaction profit on the exchange. With low latency, traders can place orders exactly at the price they want. You can also liquidate at the exact price you want.

Trade with the low latency on Bybit

Trading with a low cost

Most traders can quickly estimate the required success rate, average expected return, risk, and position size needed for success. Each trader may have a different matrix of these metrics, but they need fine-tuning to ensure long-term success.

How you fine-tune these values will determine your success or failure. Performance comes from fine-tuning the balance.

Trade with a low cost on Bybit

Why are commissions and transaction costs important?

Some may say that trading is a skill, but the more you know about the factors to consider in trading, the more you start to think that trading is a science in itself.

If your performance isn’t good, you can keep a faithful record of it so you can easily spot the shortcomings of your trading and make changes to your approach, strategy, frequency, etc. to improve your results.

On the other hand, the problem I can’t figure out is the fixed costs, i.e. fees or spread costs. Of the two, the more difficult cost to reduce is the fee.

For example, let’s say you have contracts for difference (CFDs). The exchange may not announce the fee, but that’s because it’s already melted into the spread.

Traders can pay a commission of up to 1.5% for one set of buying and selling positions.

This means you are already losing money in and out of a trade before you even think about whether the trend is good or bad.

Another example. Consider a cryptocurrency trader trading on an exchange that charges both the taker and the maker.

This means that the trader has to pay a fee while providing atmospheric liquidity. Some exchanges offer up to 50 bp (basis point) or position entry or exit price.0.5% of the fee is set as a fee.

At first glance, this may seem like a small amount.

But let’s think about what compounding effect it will have, especially for active traders.

Even if you are not an investor, you will be sensitive to transaction costs, but if you are an active and experienced trader, you will be incredibly sensitive.

Let’s take a scalp trader, for example, who cuts the time unit and splits it according to the movement of the stock price.

Let’s assume with the belief that you will trade with positive expectations.

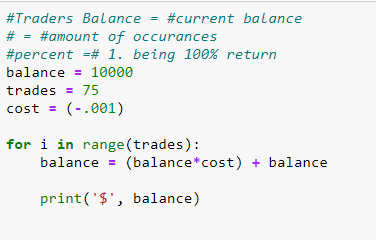

Imagine you are trading with ten thousand dollars in your account before figuring out the profit or loss of the strategy.

Since you trade with a short time unit, there is a high chance that you will buy and sell multiple times.

For simplicity, let’s assume that the trader is risking 1% of the account per trade, and the account is currently intact.

Scalping traders can trade from 50 to 300 trades per week.

Assuming a pilot number of trades is low, say 75 trades per week, that’s about 10.71 trades per day.

Round trip means about 37 rounds, that is, one set trade in which a position is opened with a buy, sold and closed, and vice versa.

In this case, let’s say the trader trades on a very famous exchange that charges 0.10% of the limit or 10bps (basis points) as a fee.

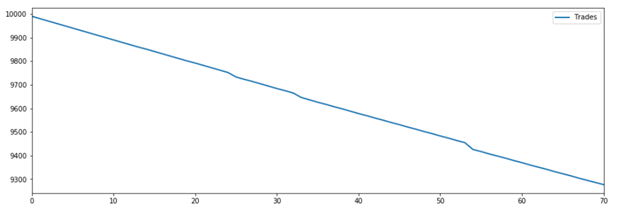

A simple look back in Python will give you an idea of how a trader will perform over time.

This is calculated assuming that all trades close at breakeven prior to breakeven, which in reality would never be the case.

In this example, the trader lost $722 in commissions alone.

Of course, again, this assumes that all trades are closed at the break-even point.

Now, if we put this situation into a loss-making system, consider how much more a fixed transaction tax alone would exacerbate the already negative situation.

It would be reasonable to infer that fees could completely swallow up profits, especially for traders who trade frequently.

It should now be pretty clear that the trader should focus on how to cut costs, among other things, to create lasting advantages.

Trade with a low cost on Bybit

Everything You Need to Know About Bitcoin Scalping Trading

Whether trading stocks, forex, or digital currencies , you should always have a plan. Traders cannot trade blindly without a strategy. If you trade without a strategy, you may lose your assets and be disappointed or have to bet a lot more.

Over the years, cryptocurrency traders and analysts have come up with numerous strategies.

Different approaches are available depending on whether you want to trade long-term or short-term. Scalping trading is one such strategy.

Today we will mainly focus on Bitcoin (BTC) scalping , especially given the recent sharp price movements . This volatility offers great opportunities for scalpers to trade.

What is Scalping?

Scalping is *one of the most common trading strategies among daily traders.

Scalping involves opening and closing trades in minutes.

(Day Trader: *Trader who trades dozens of times a day)

Scalping is much more like trading forex than trading stocks.

Forex traders start and end trades fairly quickly.

Similarly, scalpers aim to profit faster than volatility in low prices.

Conversely, if you decide to hold Bitcoin, you can keep the coin in your wallet for a long period of time.

When you say scalping BTC, you trade dozens of times a day and over time you can earn thousands of dollars even in small amounts.

What is the best trading indicator for scalping?

Given how quickly scalpers can apply, basic analysis usually doesn’t matter to them. Instead, technical analysis offers them much more value. It is much more accurate and relevant.

Technical analysis, which refers to the study of charts, patterns, and forecasts based on price movement, is sufficient to determine whether a price will rise or fall in the short term.

With sufficient experience and knowledge, you can create custom scalping indicators to gain significant advantages in the market. However, this can take years and is not suitable for beginners.

Of course, you don’t have to rely on all the indicators listed above.

Creating the right strategy involves a little research and a lot of trial and error.

Nevertheless, learning to read basic charts is an essential skill to master. This allows you to track price movements in real time while discovering striking patterns. Most scalpers focus on 1-hour to 1-minute charts.

However, signals from the higher timeframe charts will help you determine bearish and bullish overall and also give the general feeling of the market.

Considering the high volatility of the BTC price, which is constantly rising and falling,

can be interpreted as a less reliable signal in the lower times. Scalpers usually need to look for multiple indicators and use special combinations to be confident in predicting their price on indicators. Once again, by taking the lead with sufficient experience and optimal strategy, scalpers are able to find signals that can be dealt with in multiple time frames.

Go to Bybit’s Official Website

What are some scalping strategies you can use?

Scalping Bitcoin is already a trading strategy in its own right, but there are several ways to approach it.

Basically, scaling also has its own sub-strategy.

First, let’s take a look at the two types of scalpers.

There are improvised scalpers and systematic scalpers.

- Systematic scalper

- As the name suggests, systematic scalpers tend to follow meticulously defined trading structures. They usually do thorough scrutiny and set benchmarks for when trades start and end. With stringent conditions in place, scalpers must use the tool to its full potential. Profits from the systems they create depend on how well they can follow their rules without being swayed by emotions. After all, numbers are unique to them.

- Improvised scalpel

- On the other hand, improvised scalpers tend to make decisions on the fly. They improvise and react to market movements. While some of these may have requirements in terms of when they enter or exit the market, they do not follow many strict rules and simply react and react to the changes they actually see.

Now that we’ve covered the two main types of scalpers,

let’s dive deeper into their strategies.

- Pure trend scalping

- This strategy involves relying on trends and trend-following indicators that are applied over multiple time periods. Most scalpers tend to start with a trending indicator called the MESA Adaptive Moving Average. This allows you to track trends in higher timeframes such as 1 hour, 4 hours or even 1 day. To do this, it monitors and displays the change in the ratio over the steps, called the Hilbert Transform Differentiator. Basically, this graph represents change much better by showing a complex trendline based on fast and slow moving averages. The Coomon Pure Trend Scalping strategy approach involves examining MESA indicators on daily and 4-hour charts to determine whether the overall trend of the market is favorable. One trader then switches every 5 minutes to find the intersection of the 5 Exponential Moving Average (EMA) and the 25 EMA.

- Range trading

- Another common scalping strategy is range trading. This strategy requires waiting for a specific price range (a price rebound, such as a pattern between support and resistance) to appear. Traders can trade within the range as long as it is not broken. The lower end of the range acts as supported, while at the upper end it acts as resisted. In addition, it is highly profitable for very experienced scalpers. However, it does not work for everyone. This scalping strategy is advantageous for those who know the market well and quickly recognize short-term patterns.

A few tips to keep in mind

Finally, here are some tips and things to remember. I think perhaps the most important concept is patience. Scalping can be quite intense if you want to be a capable scalper. It also requires patience and concentration and, above all, you should never allow yourself to trade emotionally.

Separately, we encourage you to follow a few tips:

- Scalping trading is not for everyone. If your daily trading volume is too overwhelming, there’s nothing wrong with investing in the long term.

- In order to get enough profit, if the trading volume is low, avoid altcoins with low trading volume because only a small amount of altcoins can be traded.

- You should always have an effective exit strategy in place.

- Always have a plan in trading and stick to it no matter what happens.

- However, you must respond with room and flexibility to adapt to any scenario.

- No matter how confident you are about the direction of the price, you should not risk investing all in a single trade.

- Do not ignore the technical indicators, you need to find the right combination for you.

- Be aware of all transactions and transaction fees.

Scalping Bitcoin can be a great way to profit from the small volatility in the price of an asset.

However, this trading method has to be learned hard and followed by its own rules.

You must choose or develop and stick to your own best scalping strategy.

Some of this has to do with finding the indicators that best suit your scalping style.

Finally, be aware of any dangers and pitfalls along the way.

With a little practice, you can quickly master the trick and start earning money.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...