Do you know which Cryptocurrency Exchange is the best? We are here to find out.

Best Crypto Exchange. Table of Contents

Comparison of major Cryptocurrency Exchanges

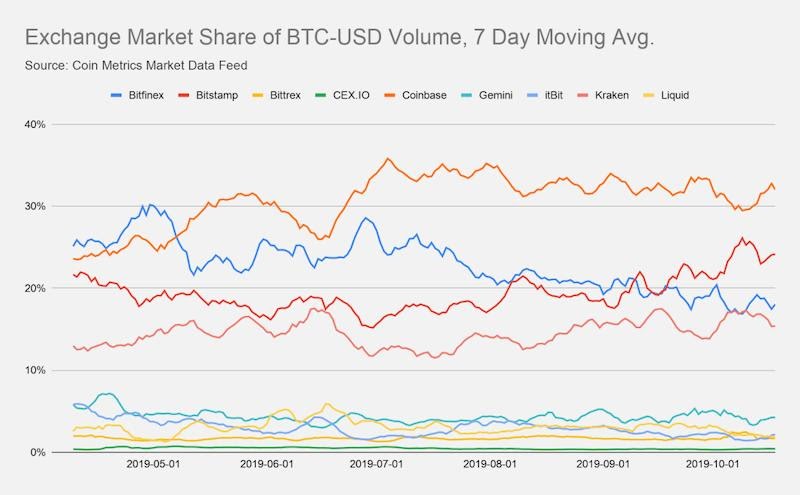

The exchange pattern of the spot market may have been determined. Coin Metrics has studied the data of the last five months. In the BTC-USD (fiat currency entry) trading market, the market share of Coinbase is close to 35%, Bitstamp is close to 25%, and Bitfinex is approximately 18%, Kraken is close to 15%, and only 7% of the market share is left for Gemini, CEX IO, itBit, Bittrex, etc.

The main players in the currency market are Binance, Huobi, OKEx, Poloniex, Gate, KuCoin, Bitfinex, Bittrex, etc.

Affected by factors such as the failure of public chain stories and the inability of a large number of altcoin projects to fulfill the expected product progress, the willingness of spot transactions is sluggish and lacks liquidity, and derivatives such as futures magnify volatility, and exchanges are competing for this market.

The team of Satoshi Mamoto has conducted research on the leading derivatives exchanges in the existing market, and hope that this article can help you understand the current status of the entire derivatives market.

There are many derivatives exchanges in the market, which cannot be included in one article. We have selected the 7 most influential companies in the market based on factors such as trading volume, existence time, growth rate, and product type: BitMEX, OKEx, Huobi, Deribit, Bybit, Binance and FTX.

What is Bybit? How to open a Crypto currency account?

1. Product type

Among them, the trading currencies provided by BitMEX, OKEx Futures, Huobi DM, and Bybit are all major mainstream currencies, and the market value of these currencies is almost in the top 20.

Binance Futures currently only has BTC perpetual contracts, and the leverage is also the highest, reaching 125 times. Deribit only trades BTC and ETH, after providing perpetual/expiring contracts, there are options.

FTX is the most innovative derivatives platform. The team has an extremely sensitive market sense, providing 51 trading pairs in 20 mainstream large currencies and mid-market value assets, as well as many innovative index-based products, such as mainstream altcoins. Index ALT, medium market capitalization altcoin index MID, and mainstream platform currency index EXCH, etc.

This also brings about another problem. The liquidity of these assets is a little bit worse, and the audience user threshold may be a little bit higher. Compared with mainstream assets, malicious incidents are more likely to occur.

List of Cryptocurrency Exchanges

2. Exchange Volume

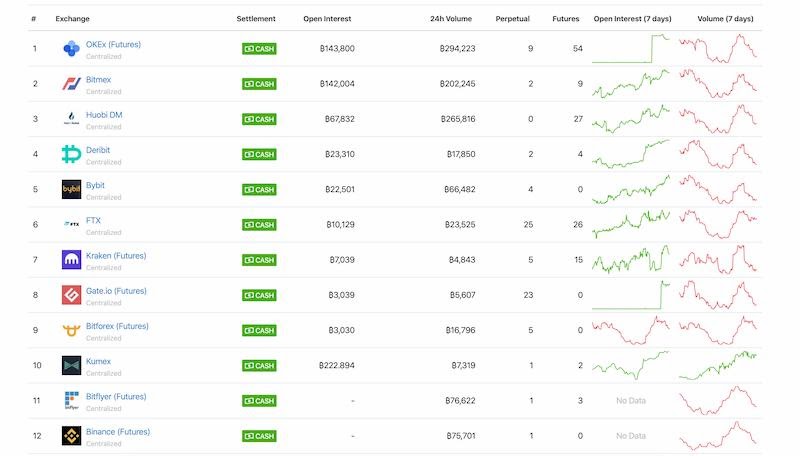

Trading volume is a relatively controversial data. The statistical methods of various data platforms are not the same as the product types of derivatives platforms, and this often triggers a war of words between derivatives exchanges. In this article, the November 6th Coingecko is selected. The data of Skew and Skew are for reference only.

Among them, Coingecko ranks based on 24-hour trading volume and open interest. Among them, OKEx is ranked first, BitMEX is second, Huobi contract is third, Deribit is fourth, Bybit is fifth, and Binance data is incomplete.

Skew does not include OKEx and Bybit data. BitMEX ranks first in volume and open interest, Huobi is second, and Binance is fourth.

Go to Bybit’s Official Website

3. Handling fee & bonus

BitMEX, Deribit, and Bybit reward liquidity providers with fees, and at the same time, long and short parties pay each other’s funds rate to achieve the rivet between the perpetual contract price and spot price.

The delivery contract of OKEx futures and Huobi DM requires additional fees; if you do not hold the FTX platform currency FTT, the FTX fee is relatively the highest; Binance Futures, which has just been launched for more than a month, is discounting the fee and discount The latter handling fee is the lowest among all platforms.

Almost all derivatives exchanges that have issued platform currencies are adding value to platform currencies. The more platform currencies you hold, the lower the commission you can enjoy.

Note: Each platform provides different rate standards for users and market makers with different trading volumes (the rate standards selected in this article are the lowest level applicable to ordinary users). The greater the trading volume, the lower the rate.

List of Cryptocurrency Exchanges

4. Marked Price

The marked price determines when the forced liquidation of the contract occurs. All exchanges use the spot prices of multiple exchanges to jointly calculate the marked price, so as to avoid vicious events when a single exchange fails.

The relevant indexes basically use the data of Coinbase, Kraken, Bitstamp, Gemini and other exchanges that have legal currency deposit channels.

BitMEX, OKEx Futures, Huobi DM, Deribit, and Binance Futures use the weights of different exchanges to calculate index prices. Bybit takes one more step to measure the validity of the data, eliminates abnormal quotes or automatically reduces the weight of abnormal data exchanges, in an attempt Ensure that Bybit‘s index calculation method is more stable.

Go to Bybit’s Official Website

5. Rebate mechanism

All derivatives platforms use a rebate mechanism to motivate users to invite newcomers. Among them, Bybit does the best, with higher commission rebates.

At the same time, there are sub-agent commission rewards and a professional login agent system, and multi-dimensional reports are provided to help recommenders understand the details of commissions. In general, Bybit‘s commission ratio is more than twice the industry standard.

6. Platform currency & market value

Among these seven platforms, OKEx, Huobi, Binance, and FTX have all issued platform coins. Among them, Binance platform coin BNB has the highest market value, close to 3.2 billion U.S. dollars. The high market value of platform coins may bring Binance an advantage.

The trading platform has a strong network effect, that is, the more users, the better the liquidity and the depth, and the users are more likely to trade here. The transaction, which itself creates value and liquidity, is combined with tokens. BNB enables users to become shareholders and enjoy the beneficiaries of platform growth.

BNB, which has the seventh market value, maybe Binance’s secret weapon, and other derivatives platforms must consider whether to add BNB. BitMEX, Huobi DM, and OKEx futures all added assets with a smaller market value than BNB, but did not add BNB, which may be considered by competitors.

Not adding will lose some users, while adding may bring traffic to Binance‘s spot and derivatives platform.

Note: The information in the above picture comes from CMC, non-small numbers and public information on the market

List of Cryptocurrency Exchanges

Conclusion

At present, these seven platforms form the basic structure of the derivatives market. Among them, BitMEX and OKEx futures have existed for the longest time and have the highest trading volume.

Bybit and Binance Futures are the fastest growing. The rapid growth of Binance Futures comes from Binance‘s huge brand influence and the introduction of massive users on the spot station.

The growth of Bybit is attributed to its good product experience. For example, when the market fluctuated sharply on October 26, many exchanges experienced delays or downtime, Binance experienced a short period of time, and the BTC spot price dropped to $7,361; FTX was down for nearly 30 minutes; Bybit‘s trading system was in a stable operating state, setting a trading record in the 10 months since the platform was launched that day, and the 24-hour trading volume exceeded US$4 billion.

Like the spot market, over time, the derivatives market may also move towards a winner-takes-all market-the top exchange will grab most of the market share and profits, provide good services to users, and meet multiple transaction needs. Only if there is no malicious incident when the pin is down, can you live to the end.

Go to Bybit’s Official Website

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...