BlockFi platform does not require collateral from all borrowers.

Over the past weekend, the main cryptocurrency market has seen wild swings. The top digital asset tumbled on Saturday, then briefly recovered on Sunday before diving again. At the time of writing, BTC is down 3.6% over the past 24 hours and is currently below the $22,000 mark and the 100 hourly moving average. Additionally, BTC broke below a key bullish trend line with support near $22,700 on the hourly chart. The largest cryptocurrency by market cap could fall further if support near $21,400 falls.

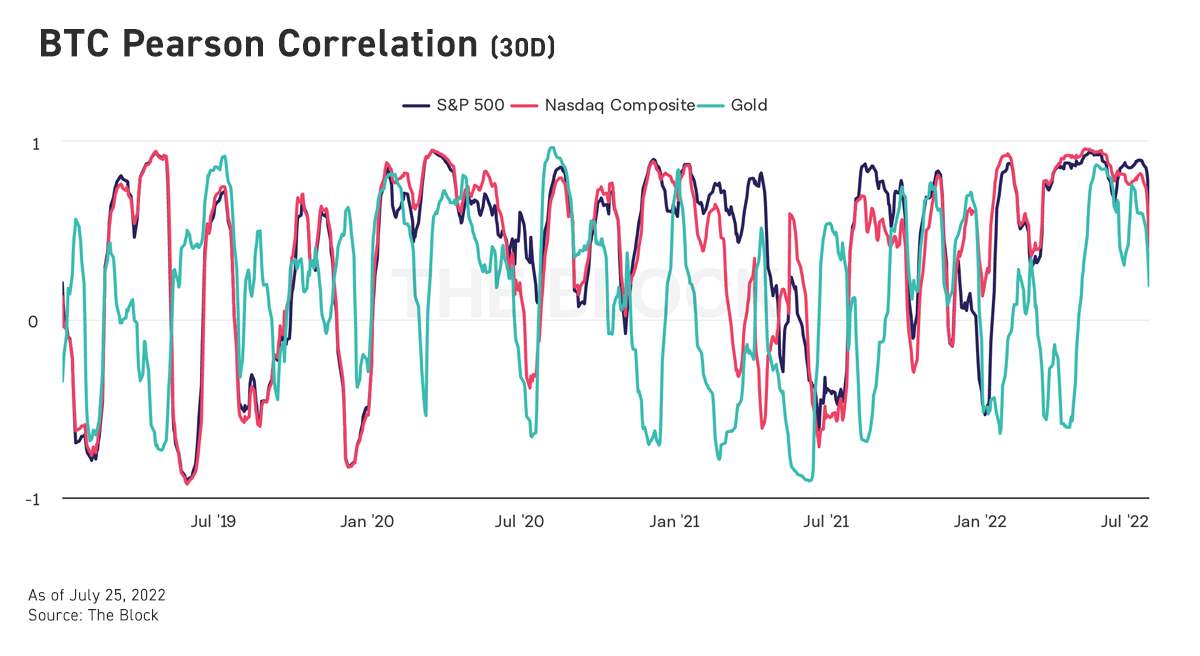

At the same time, BTC’s correlation with traditional financial markets has fallen sharply after reaching local highs last week. BTC’s Pearson 30-day correlation with the S&P 500 fell to 0.7, while its correlation with the Nasdaq Composite fell below 0.5. Having said that, this week is still important for major digital assets as upcoming events may provide some guidance on the subsequent market direction. Especially with the upcoming Fed rate decision, this variable is likely to be the dominant factor influencing trading trends in the coming days. The latest forecast from CME Group’s Fed Watch tool puts the odds of a 75 basis point hike above 80%.

Similar to BTC, ETH has lost 5.5% of its market cap over the same period, with the current price falling back to $1,520. Although the positive news of the Merge upgrade has played a decisive role in the recently higher ETH spot market, Ethereum’s miner fees have not risen, and remain low. On the other hand, the major non-mainstream coins turned from rising to falling, among which AVAX and ATOM led the downward correction with a 7% decline in the same period.

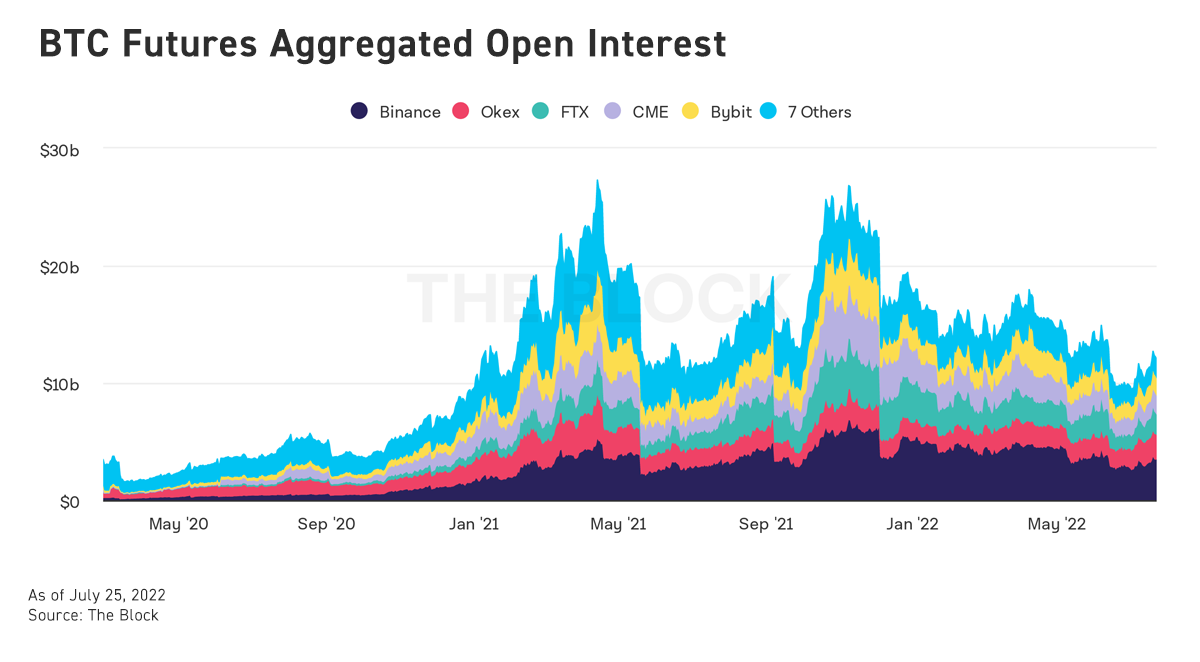

In derivatives markets, while spot prices have rebounded from recent bottoms, total open interest has declined. Although the BTC perpetual funding rate has dropped slightly from a local high recently, it is still at a high level. In the options market, the BTC gamma exposure indicator also fluctuated over the weekend. BTC’s implied volatility spiked on July 29, but the implied volatility curve could slow if expectations of a one-percentage-point hike don’t materialize. The rally driven by the positive news on the ETH development side is also reflected in the capital flow of the options market.

Centralized cryptocurrency lending company BlockFi has released its second-quarter transparency report. The report shows that the company holds $1.8 billion in outstanding loans from customers, of which about $600 million is unsecured because the BlockFi platform does not require collateral from all borrowers. BlockFi has developed a set of guidelines for this purpose to address liquidity risks and fulfill the platform’s obligations to institutional and individual investors.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...