Solana-Based Wallets Drained in Latest Exploit

The Solana network has been exploited and is under constant attack, and it appears that around 8,000 wallets have been looted. Wallets that have been idle for more than 6 months are among the hardest hit groups. Phantom and Slope wallet users appear to be among the main targets of the exploit. Solana’s audit firm, OtterSec, said on Twitter that their analysis showed that the transactions were signed by the actual owners, suggesting some form of private key compromise. At the same time, a Solana spokesperson emphasized that from the current investigation, there is “no evidence” that the vulnerability attack was caused by Solana’s fault.

The main cryptocurrency market recovered slightly in early Asian trade on Wednesday, despite the sudden geopolitical tension weighing on overall market sentiment. Key risk assets were lower after top Fed officials signaled that the central bank still intends to keep raising interest rates to curb inflation and refuted investors’ previous view of the Fed’s turn to a dovish stance on rate hikes. At the time of writing, BTC is up slightly over the past 24 hours and is currently trading just below the $23,000 mark. The largest cryptocurrency by market cap is facing major resistance near the $23,300 mark, and its current upward momentum is losing steam, with little hope of a sustained rebound.

ETH is back above the $1,600 mark after gaining 3% over the same period. However, a key bearish trend line is forming with resistance near $1,660 on the hourly chart of ETH. Failing to break this resistance, ETH is likely to fall and test support in the $1,500-1,550 range. Most major non-mainstream coins basically turned from losses to gains, with the exception of SOL, which fell 3.4% over the same period.

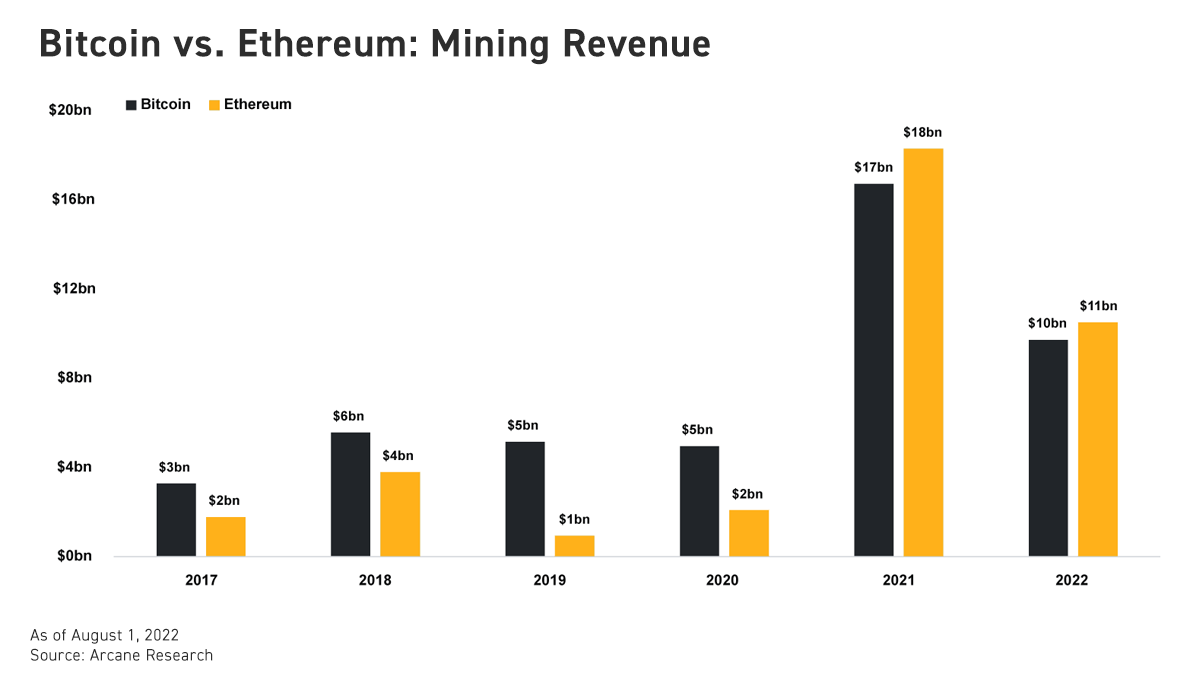

The topic of whether ethereum’s move to proof-of-stake consensus could lead to potential market disruption has sparked heated discussions in the crypto community, and the prospect of a rebound led by The Merge upgrade seems less certain. Ethereum mining is a multi-billion dollar industry that currently generates more revenue than Bitcoin mining. However, after The Merge upgrade, Ethereum miners will be replaced by staking validators and will need to switch to other GPU mineable coins, or ditch their GPU rigs, which will more or less disrupt the supply and demand dynamics of the market.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...