Cryptocurrency Analysis. Table of Contents

Know the Fundamentals and Trade to Earn

Do you like following financial news?

Or even getting updates on product launches of certain companies like Apple, Nike or Nintendo?

If the answer is yes, you may have a natural knack to trade using a theory investors call ‘fundamental analysis’.

Simply put, unlike its counterpart technical analysis, fundamental analysis seeks to understand market sentiment based on what happens outside of all the financial charts.

Fundamental analysis can be applied to any financial markets including Cryptocurrency market.

List of Cryptocurrency Brokers

What are the “fundamentals”?

In CFD (which includes Cryptocurrency, Commodity, Metal, Stock, Oil etc…) and Forex trading, fundamental analysis earned its name because its patrons analyze the fundamentals affecting the currency of a given economy.

The main factors that traders using fundamental analysis look at are economic, political or environmental events or earnings reports.

It can also be based on economic data, announcements or events.

In other words, any time there’s an indication of economic growth, strength or weakness, analysts will use this fundamental data to better predict the price movement of a currency – in theory of course.

Examples of fundamental analysis

For example, once a month, the US government releases a report called the Non-Farm Payroll (NFP).

This NFP (also referred to as the ‘jobs report’), reveals the latest unemployment statistics in the United States.

Speculators will often use this report to determine the health of the US economy.

That’s because if more jobs are created than expected, some economists will perceive this as a possible indication of a healthier US economy driving the value of the US dollar up.

On the other hand, if this month’s unemployment rate is higher than expected, it could cause the US dollar to drop.

Another example is if the Federal Reserve, United States’ central bank, makes an announcement that they will raise interest rates.

Traders who implement fundamental analysis in their trading strategy, could potentially use this development as an indication of a rising US Dollar.

Will the currency actually rise? We hope we don’t need to tell you that this is only a theory – some people choose to follow it while other don’t.

Interestingly enough, changes in currency values could also take place just from the build-up to an economic event.

So, if the European central bank is preparing to announce a policy change later on today, people might decide to buy or sell Euros in anticipation of a potential change in monetary policy.

Why? Because they try to “stay ahead of the market”.

If enough traders choose to act before an event takes place, the change in price could come into effect before the announcement is released.

In case of Cryptocurrency markets, you can start from searching for the correlated economic announcements as it is new and particular markets.

List of Cryptocurrency Brokers

Find the Fundamentals of your Cryptocurrency

Fundamental analysis is a theory whereby traders trade on market sentiment.

This means that people will look for indications regarding the direction of a specific asset price based on events one may read or hear about in the news.

In fundamental analysis, traders attempt to assess the state of the economy, while trying to figure out how the market will react to certain economic events.

If you can successfully predict how the markets will react to a homeownership report in Australia, a new acquisition of a company by Google or a GDP report in the UK, you could potentially find remarkable trading opportunities.

At the same time, if you can find the correlated information to the Crypto markets you are investing, then you could potentially find remarkable trading opportunities.

Check the Economic Calendar

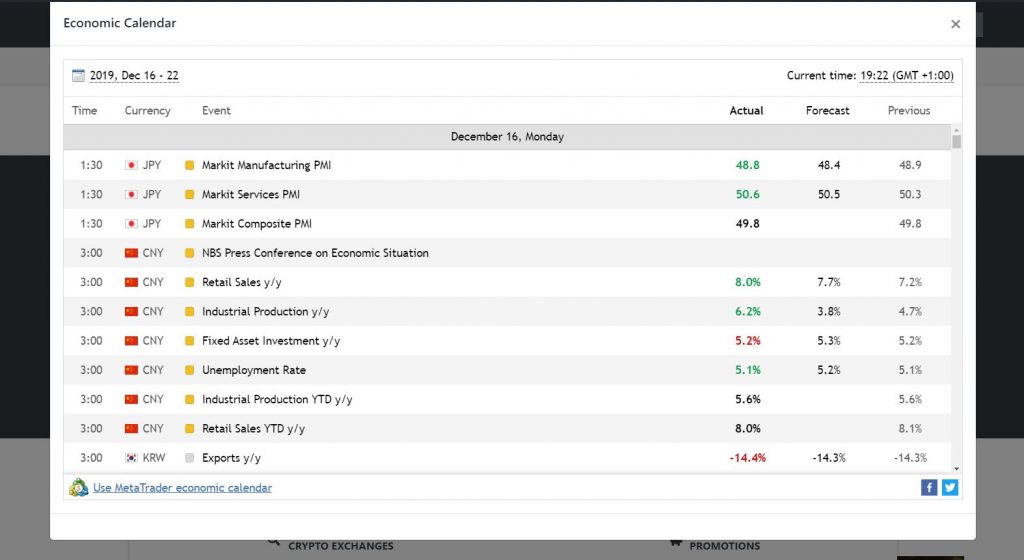

On our website, we have recently added a new tool for investors, “Economic Calendar”.

Click on “Economic Calendar” on the right up side of the website.

Then, in the pop-up screen, you can view the upcoming events with “The most affected currency”, “Actual”, “Forecast” and “Previous”.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...