How does inflation affect Bitcoin?

Surprisingly, Bitcoin enthusiasts have found that Bitcoin moves in the same way as the stock market. We all know that Bitcoin is a concept of decentralized finance. In this regard, many people understand that the Bitcoin market will be isolated from traditional financial institutions. Many people are confused about the current market.

Buy and Sell Bitcoin on Paxful

What is inflation?

Before exploring the impact of inflation on the Bitcoin market, let’s first look at what inflation is. Inflation is what we call the rate at which prices rise over time. Generally speaking, discussions about inflation revolve around the rising cost of living, or the general rise in the prices of goods and items.

By itself, inflation is not necessarily a bad thing. To a certain extent, it can even be said that it is good for the economy. But the problem starts when inflation gets out of hand, potentially pushing the market into a hyperinflationary state.

Decentralized finance should be immune to these changes as it is based on a completely separate system concept. However, over the past few weeks, we have noticed a dramatic shift in Bitcoin’s value that coincides with the rapid inflation we are seeing in traditional financial institutions.

The effect of inflation on the price of Bitcoin

So, how does inflation affect the price of Bitcoin? On the surface, Bitcoin’s trend appears to be the same as current stock market conditions.

As bitcoin has grown in popularity over the past few years, hedge funds, banking institutions, and venture capitalists have bought a lot of bitcoin as an investment vehicle, believing they can make huge profits by hoarding it.

Be aware that since Bitcoin is a riskier asset than stocks or bonds, it is often one of the first assets to be sold in uncertain market conditions. At the end of 2021, many Bitcoin whales began to sell their hoarded assets due to concerns that excessive money printing by the quantitative easing (QE) policy would bring inflation. Bitcoin then flooded the market with fear and uncertainty in the community, causing others to panic and sell as well, and prices fell sharply. It’s a similar story on Wall Street, where high-to-moderate-risk stocks are being sold off by investors.

Go to Paxful’s Official Website

Implications for Bitcoin Speculators

In this case, Bitcoin speculators must be the most affected party. As the market shifted, speculators feared a crash and began to shift their funds to stablecoins.

This is similar to what we mentioned earlier in the Bitcoin price. With so much uncertainty about inflation, people started selling their bitcoins, and this had a snowball effect, and bitcoin’s price reflected those changes. Speculators are influential in the community, and their actions have the potential to influence the actions of others.

Impact on Bitcoin hardware wallets and mining GPUs

With prices rising, semiconductor shortages certainly aren’t helping the inflation we’re experiencing right now. The price of Bitcoin hardware wallets has risen due to limited supply.

In addition to the shortage of hardware wallets, components used by Bitcoin miners have likewise become more expensive and harder to obtain. The shortage of mining GPUs will certainly hinder the operations of Bitcoin miners, especially new miners that are not yet mature.

Buy and Sell Bitcoin on Paxful

Impact on actual users of Bitcoin

One thing that won’t change is that people will still use Bitcoin to send money. After all, the funds you send are the same after fees. For people who do not have a bank account but need to send money abroad, using Bitcoin to process money transfers is a better option.

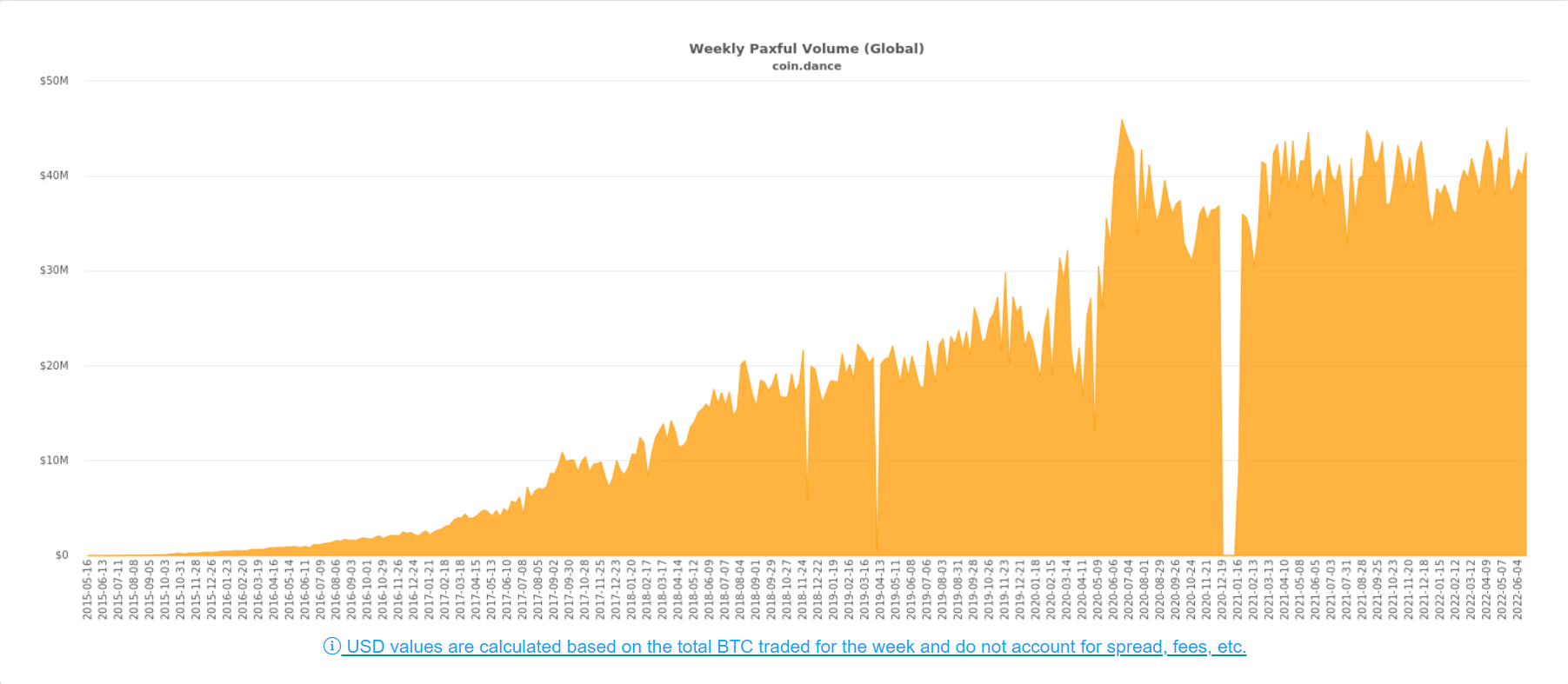

Don’t forget, there are still some people who still make a living trading Bitcoin. Paxful’s trading volume has not fluctuated dramatically at the moment, which shows that users are still actively participating in the market. This situation is the opposite of the predicted Bitcoin crash, after all, during a bear market, it is easy to spread fear and uncertainty.

It’s also worth pointing out that people are still using Bitcoin as a hedge against inflation. Despite the market shift, Bitcoin users still see the blockchain as a safer option for saving money. Inflation or not, in the hearts of true Bitcoin believers, 1 BTC is still equal to 1 BTC.

What are we missing?

Inflation may not be the only factor determining the current Bitcoin price. Instead, inflation can be combined with a number of other factors that work together.

Take, for example, a series of recent government policies aimed at regulating Bitcoin and other cryptocurrencies. For every announcement from a government agency, the market sees a flurry of activity amid concerns that the policies could have an impact on the blockchain.

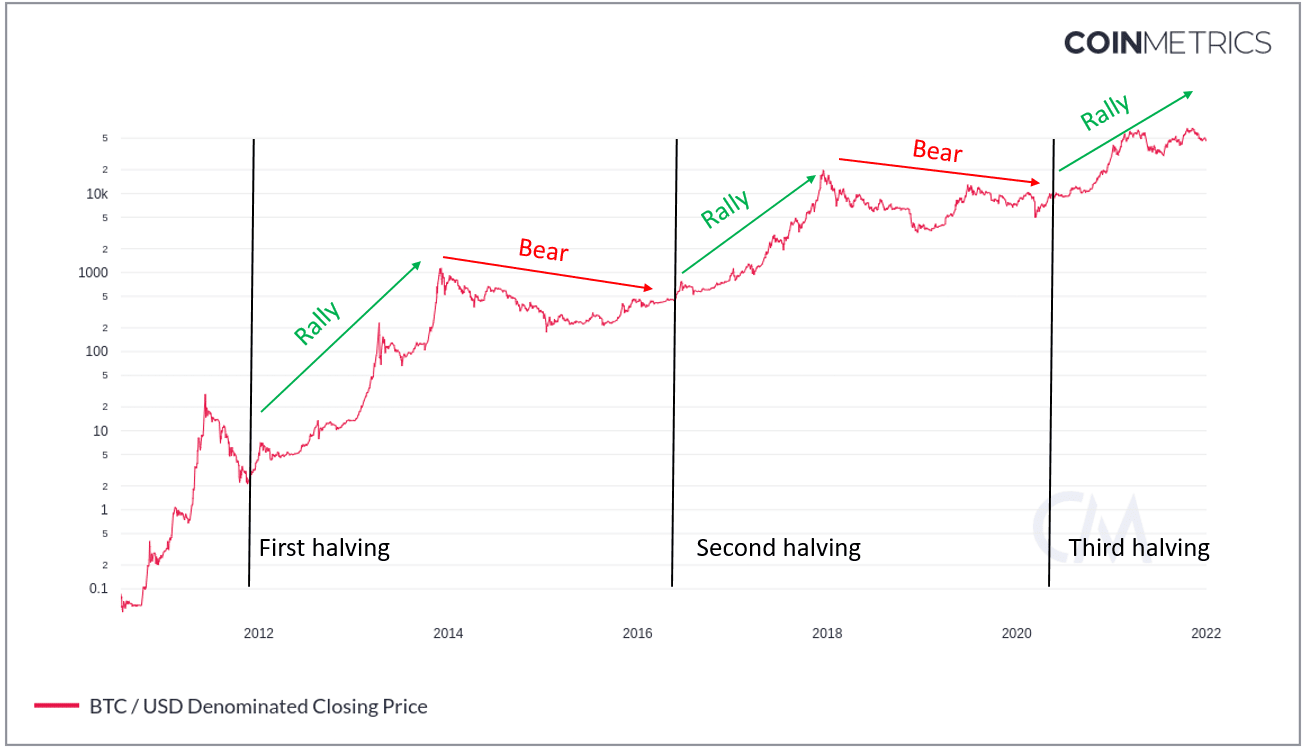

Another potential reason is the Bitcoin halving cycle – which we are currently in. Historically, there has been a bear market that lasts up to two years between Bitcoin halving cycles. During this period, there has been little public interest in Bitcoin and the price tends to trade sideways.

Another possible factor is tax season. Some people have noticed that Bitcoin’s value tends to underperform at the beginning of the year (i.e. tax season). One explanation might be that during tax season, some users sell their assets to pay their taxes.

The point is, it’s hard to be 100% sure right now. After all, Bitcoin itself is an emerging currency. The best way to do this is to understand and engage with the community as fully as possible, taking care to do your own research.

Buy and Sell Bitcoin on Paxful

Bitcoin is here to stay

It’s been a while since Bitcoin first came out, and the market lows we’re seeing now are well above those seen in the past. In fact, you’ll even see Bitcoin’s all-time low (the lowest price it could ever reach) still rising. This shows that Bitcoin is not dead.

Still, it’s not easy to stay calm in the face of various situations. At the end of the day, your main concern is keeping your funds safe and not depreciating. Inflation is inevitable, at least for now, and all we can do is prevent it from happening. Decentralized finance may not be as mature as we expected, but it has already shown us what is possible to empower users around the world.

Please click "Introduction of Paxful", if you want to know the details and the company information of Paxful.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...