Cryptocurrency Digest. Table of Contents

- 1. Celebrity "opinion leaders" dominate market sentiment

- 2. Many Latin American countries are willing to adopt Bitcoin

- 3. The Fed's stance turns to eagle

- 4. MicroStrategy buys Bitcoin with full position

- 5. Grayscale Bitcoin Trust (GBTC) discount rate shrinks

- 6. Decentralized finance (DeFi) is insufficiently motivated?

- 7. Back to futures

- 8. Options

The cryptocurrency market sentiment was generally optimistic in June. The market sentiment in May was pessimistic, full of fear, uncertainty and doubt (FUD). With the deregulation, major institutions accepted cryptocurrencies, and market sentiment improved. However, the price of Bitcoin has been maintained at 35,000-40,000 US dollars.

1. Celebrity “opinion leaders” dominate market sentiment

In the past few days, Bitcoin has performed strongly, with the price breaking through the key resistance level of around $40,000, and the extreme fear, uncertainty and suspicion in the market have faded. The first opinion leader to boost the market was Elon Musk. After returning to Twitter, he announced that if more than half of Bitcoin mining uses clean energy, Tesla may re-accept Bitcoin payments. In addition, Wall Street legend Paul Tudor Jones (Paul Tudor Jones) has once again expressed his bullishness for Bitcoin, and he has said so publicly for the first time since May 2020. This is the usual method of macro traders, they first establish a long position, and then find a way to get everyone to invest.

The bullish sentiment is high, and many traders have begun to pay attention to Bitcoin again. Bitcoin trading volume has rebounded slightly, and the dominant position has slightly recovered.

Start Investing in Crypto through Cryptoarmy.io

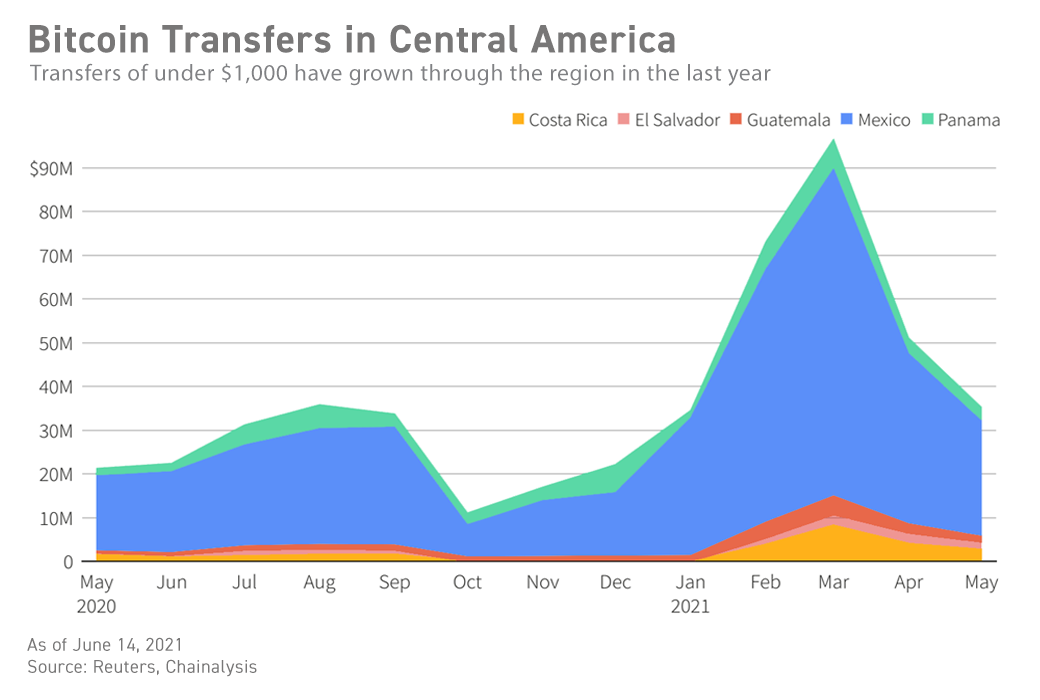

2. Many Latin American countries are willing to adopt Bitcoin

El Salvador uses Bitcoin as legal tender, but it is not enough to change market fundamentals. The dollarization of the Latin American economy at the beginning of the 21st century was to maintain economic stability. The current Bitcoinization boom is mostly a public relations gimmick with a little concealment, and its tangible economic benefits have not yet appeared. Salva’s legalization of Bitcoin can at best prompt similar economies with weaker power to consider adopting a multi-currency system and include virtual currencies. Since El Salvador’s announcement, Tanzania, Nigeria, Paraguay and Panama have expressed their intention to follow suit, but the response has been different.

11 Best Altcoins to invest in 2021

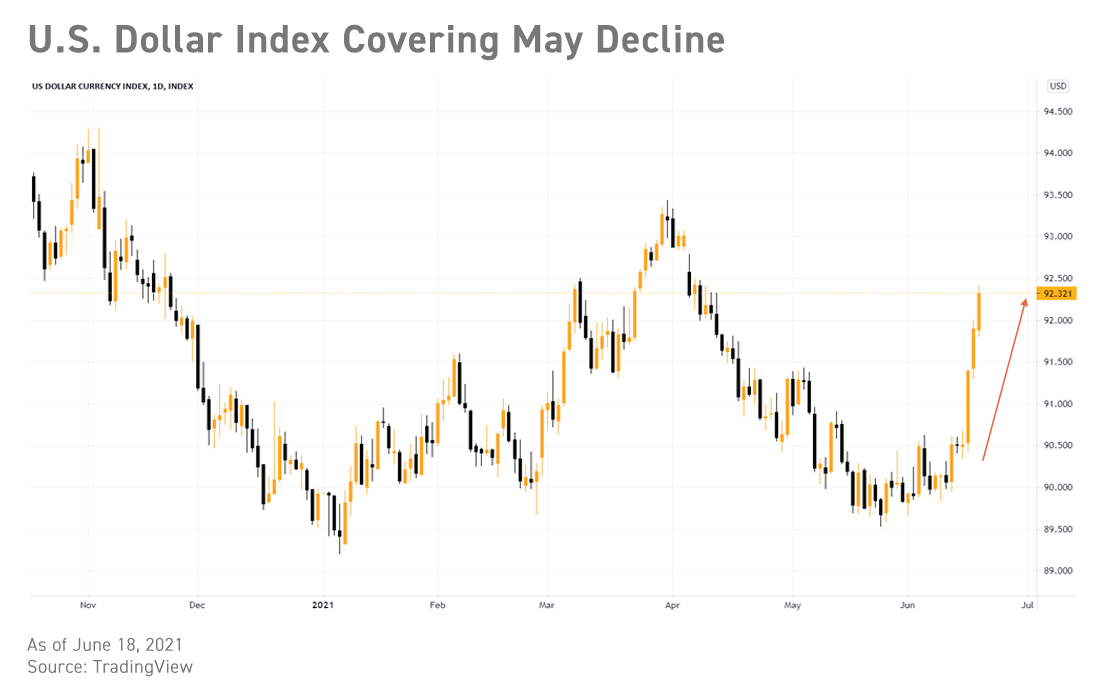

3. The Fed’s stance turns to eagle

The Fed’s impact on the macro market cannot be underestimated. Although the Fed did not take substantial measures to reduce its balance sheet this month, its dot matrix chart shows greater interest rate hikes. In addition, the Federal Open Market Committee (FOMC) meeting announced an increase in the interest rate on excess reserves (IOER). All the above helped the U.S. dollar rise, and the U.S. dollar index flattened the May decline in a few days. In the short term, the FOMC’s decision may weaken the market’s bullish sentiment for high-risk assets. Therefore, it is unlikely that the total market value of cryptocurrencies in the near future will exceed the all-time high (ATH). In addition, the Jackson Hole annual meeting of global central banks to be held in August will also be highly anticipated, when the Fed’s expected reduction of balance sheet will greatly affect market sentiment.

Start Investing in Crypto through Cryptoarmy.io

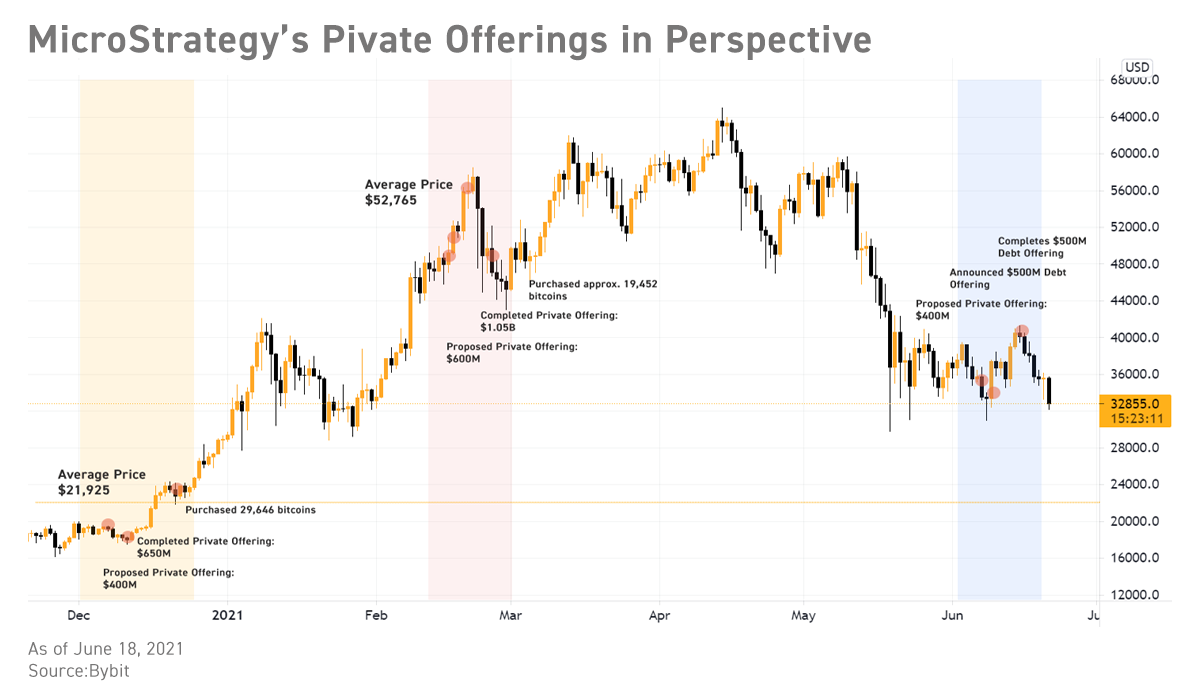

4. MicroStrategy buys Bitcoin with full position

Wei Strategy just issued 500 million US dollars of new debt, and within a few hours announced that it would sell 1 billion US dollars of stock on the open market to buy Bitcoin. This not only shows that the executive Saylor wants to buy bitcoins with full positions, but also allows micro-strategies to cash out their positions without having to sell his current holdings of $2 billion in bitcoins. This is good news for Bitcoin holders. Unlike before, the announcement of the purchase of the micro-strategy coincided with the high stage of Bitcoin and did not affect its trend, indicating that market changes are more advanced than Thaler’s judgment.

Buy Cryptocurrencies with Credit Card on StormGain

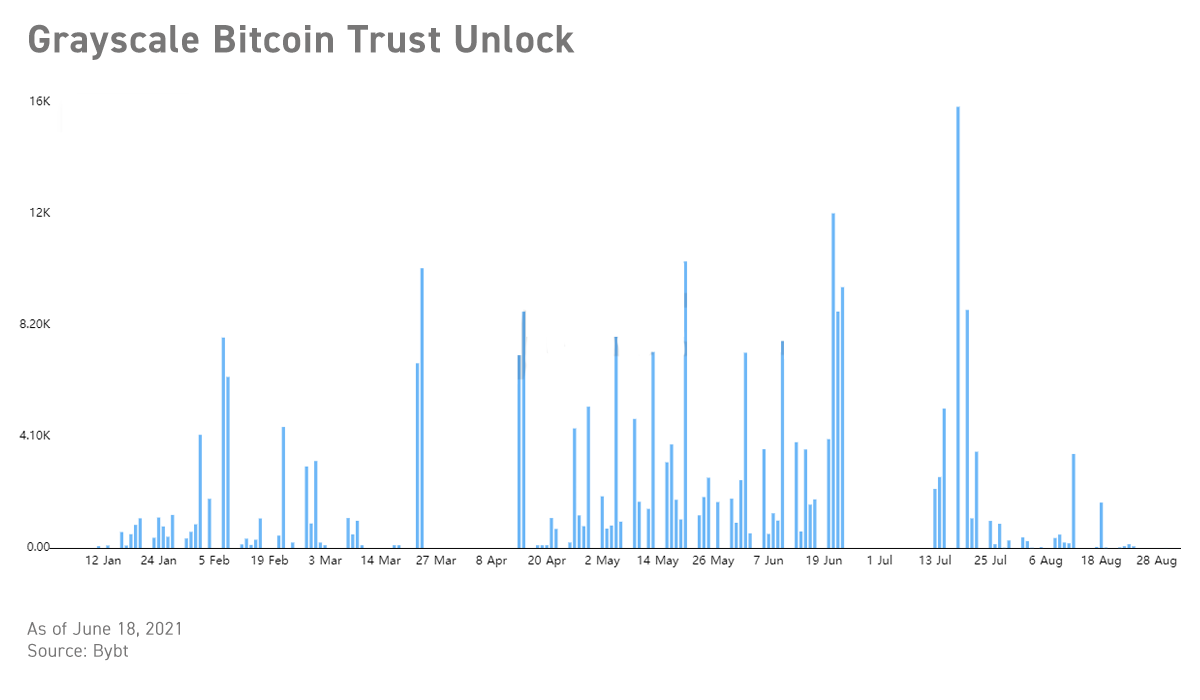

5. Grayscale Bitcoin Trust (GBTC) discount rate shrinks

From June 19th to 22nd, GBTC private equity shares worth approximately US$1.4 billion will be unlocked. If the Bitcoin short hedge has not closed, investors selling GBTC may put pressure on buyers.

Start Investing in Crypto through Cryptoarmy.io

6. Decentralized finance (DeFi) is insufficiently motivated?

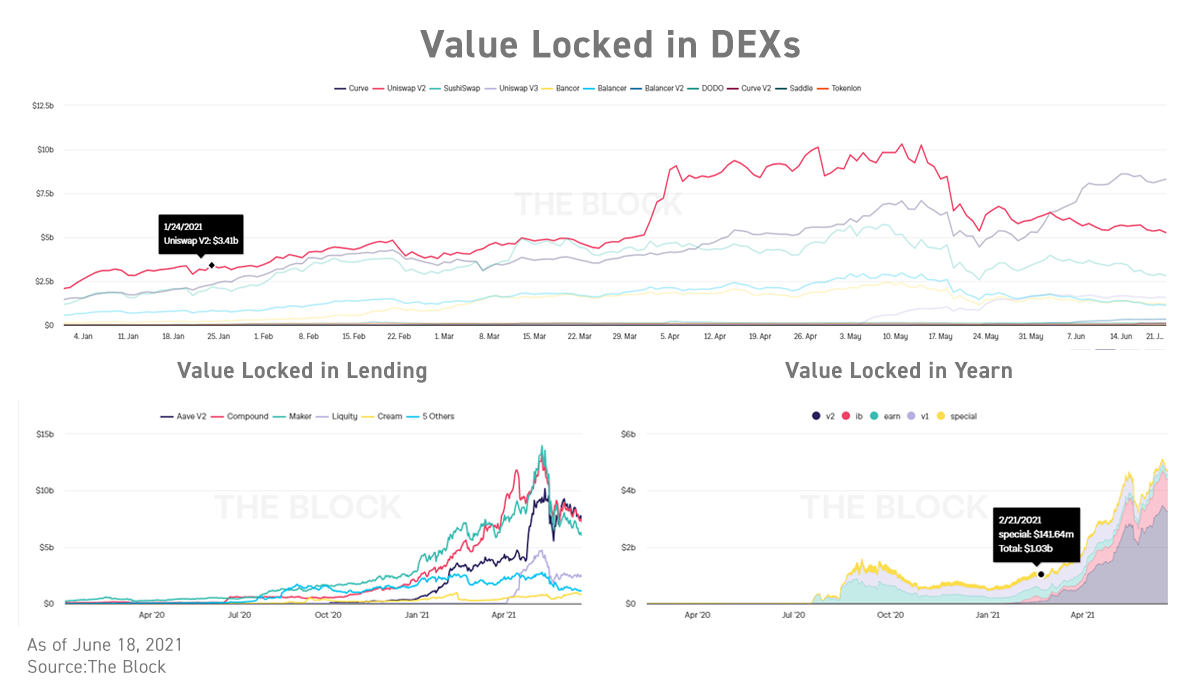

This argument is not uncommon. Does the lower fuel price in the Ethereum zone indicate long-term structural bearishness? It may also be that the market has entered a new cycle, shifting from speculative behavior to a defensive trading strategy. For example, investors have begun to favor interest-bearing agreements. Although the total lock-up value (TVL) of decentralized exchanges (DEX) dominated by non-stable currencies has not risen, the TVL of the lending sector has shown an upward trend.

What is DeFi (Decentralized Finance)?

7. Back to futures

Although the spot price of Bitcoin rose to $40,000 this week, according to the open interest indicator and Oi/funding chart, the perpetual contracts and futures contracts in the futures market are still in a serious net short state. Due to a small number of short positions, the annualized increase of the 3-month basis contract was 10%, but it was not enough to close all existing short positions. Therefore, the Bitcoin price will still be affected by short positions, but it depends on whether there will be unexpected bullish factors.

Which is the Best Cryptocurrency to buy in 2021?

8. Options

With the addition of US$2 billion in new options contracts last week, the options market is showing signs of activity, but the trading volume is still much lower than in April and May. The Bitcoin price is consistent with the max pain point and the Gamma value of the market maker’s position, hovering at $40,000. The high volume this week has brought much-needed symmetry to the “smile” curve of implied volatility (IV). Bitcoin IV was at a low point in May, and there was a certain discount relative to the actual volatility (RV). After assessing the risk return, investors will tend to increase Vega’s risk exposure.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...